College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 2E

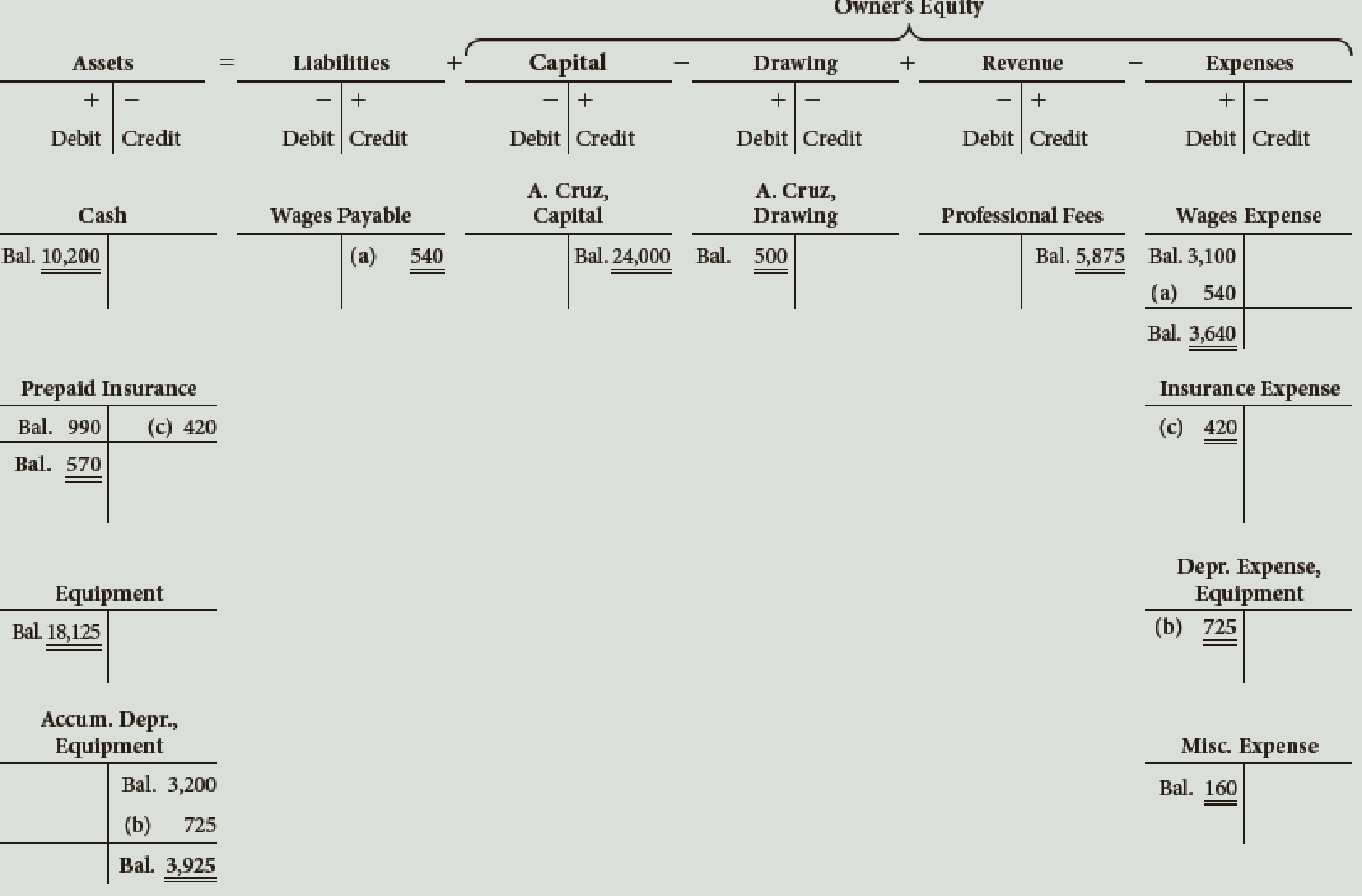

The ledger accounts after

- a. Journalize the following closing entries and number as steps 1 through 4.

- b. What is the new balance of A. Cruz, Capital after closing? Show your calculations.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Considering the following events, determine which...Ch. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - The partial work sheet for Emil Consulting for...Ch. 5 - The account balances of Miss Beverlys Tutoring...Ch. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - After the adjusting entries are recorded and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals Of Financial Accounting

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting: Tools for Business Decision Making, 8th Edition

What are assets limited as to use and how do they differ from restricted assets?

Accounting For Governmental & Nonprofit Entities

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The ledger accounts after adjusting entries for Cortez Services are presented below. a. Journalize the following closing entries and number as steps 1 through 4. b. What is the new balance of J. Cortez, Capital after closing? Show your calculations.arrow_forwardThe partial work sheet for Ho Consulting for May follows: Required 1. Write the owners name on the Capital and Drawing T accounts. 2. Record the account balances in the T accounts for owners equity, revenue, and expenses. 3. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 4. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 5,840arrow_forwardAfter the adjusting entries are recorded and posted and the financial statements have been prepared, you are ready to record the closing entries. Closing entries zero out the temporary owners equity accounts (revenue(s), expenses(s), and Drawing). This process transfers the net income or net loss and the withdrawals to the Capital account. In addition, the closing process prepares the records for the new fiscal period. Required 1. Journalize the dosing entries in the general journal. (If you are using Working Papers to prepare the closing entries, enter your transactions beginning on page 5.) 2. Post the closing entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a post-dosing trial balance as of October 31, 20--. Check Figures 1. Debit to Income Summary second entry, 12,023.25 2. Post-closing trial balance total, 37,420.00arrow_forward

- The partial work sheet for Ho Consulting for May follows: Required If you are using working papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 5,840arrow_forwardThe post-closing trial balance submitted to you by the bookkeeper of Tafoya Consulting Company is shown below. Assume that the debit total (41,048) is correct. a. Analyze the work and prepare a response to what you have reviewed. b. Journalize the closing entries. c. What is the net income or net loss? d. Is there an increase or a decrease in Capital? e. What would be the ending amount of Capital? f. What is the new balance of the post-closing trial balance?arrow_forwardThe partial work sheet for Emil Consulting for June is as follows: Required If you are using Working Papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 4,930arrow_forward

- Assume that the first two closing entries have been made and posted. Use the T-accounts provided as follows to: A. complete the closing entries B. determine the ending balance in the Retained Earnings accountarrow_forwardAssume that the first two closing entries have been made and posted. Use the T-accounts provided below to: A. complete the closing entries B. determine the ending balance in the Retained Earnings accountarrow_forwardIdentify which of the following accounts would be listed on the companys Post-Closing Trial Balance. A. Accounts Receivable B. Accumulated Depreciation C. Cash D. Office Expense E. Note Payable F. Rent Revenue G. Retained Earnings H. Unearned Rent Revenuearrow_forward

- What critical purpose does the adjusted trial balance serve? A. It proves that transactions have been posted correctly B. It is the source document from which to prepare the financial statements C. It shows the beginning balances of every account, to be used to start the new years records D. It proves that all journal entries have been made correctly.arrow_forwardRead each definition below and write the number of the definition in the blank beside the appropriate term. The quiz solutions appear at the end of the chapter. Recognition Historical cost Current value Cash basis Accrual basis Revenues Revenue recognition principle Matching principle Expenses Adjusting entries Straight-line method Contra account Deferral Deferred expense Deferred revenue Accrual Accrued liability Accrued asset Accounting cycle Work sheet Real accounts Nominal accounts Closing entries Interim statements A device used at the end of the period to gather the information needed to prepare financial statements without actually recording and posting adjusting entries. Inflows of assets or settlements of liabilities from delivering or producing goods, rendering services, or conducting other activities. Journal entries made at the end of a period by a company using the accrual basis of accounting. Journal entries made at the end of the period to return the balance in all nominal accounts to zero and transfer the net income or loss and the dividends to Retained Earnings. A liability resulting from the receipt of cash before the recognition of revenue. The name given to balance sheet accounts because they are permanent and are not closed at the end of the period. An asset resulting from the recognition of a revenue before the receipt of cash. The amount of cash or its equivalent that could be received by selling an asset currently. The assignment of an equal amount of depreciation to each period. Cash has been paid or received but expense or revenue has not yet been recognized. A system of accounting in which revenues are recognized when a performance obligation is satisfied and expenses are recognized when incurred. Cash has not yet been paid or received but expense has been incurred or revenue recognized. Financial statements prepared monthly, quarterly, or at other intervals less than a year in duration. Revenues are recognized in the income statement when a performance obligation is satisfied. The process of recording an item in the financial statements as an asset, a liability, a revenue, an expense, or the like. An asset resulting from the payment of cash before the incurrence of expense. The name given to revenue, expense, and dividend accounts because they are temporary and are closed at the end of the period. A system of accounting in which revenues are recognized when cash is received and expenses are recognized when cash is paid. A liability resulting from the recognition of an expense before the payment of cash. The association of revenue of a period with all of the costs necessary to generate that revenue. An account with a balance that is opposite that of a related account. The amount paid for an asset and used as a basis for recognizing it on the balance sheet and carrying it on later balance sheets. Outflows of assets or incurrences of liabilities resulting from delivering goods, rendering services, or carrying out other activities. A series of steps performed each period and culminating with the preparation of a set of financial statements.arrow_forwardFor each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement). A. Accounts Payable B. Accounts Receivable C. Cash D. Dividends E. Fees Earned Revenue F. Insurance Expense G. Prepaid Insurance H. Suppliesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License