Concept explainers

Interpretation of Regression Results: Multiple Choice

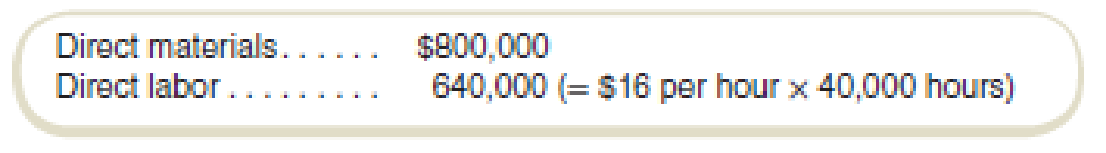

Cortez Company is planning to introduce a new product that will sell for $96 per unit. The following

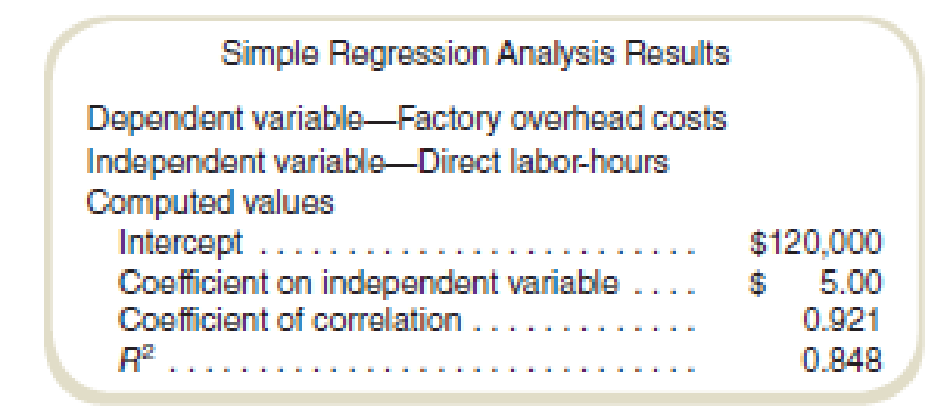

Manufacturing overhead costs have not yet been estimated for the new product, but monthly data on total production and overhead costs for the past 24 months have been analyzed using simple linear regression. The following results were derived from the simple regression and provide the basis for overhead cost estimates for the new product:

Required

- a. What percentage of the variation in overhead costs is explained by the independent variable?

- (1) 84.8%.

- (2) 45.0%.

- (3) 92.1%.

- (4) 8.48%.

- (5) Some other amount.

- b. What is the total overhead cost for an estimated activity level of 50,000 direct labor-hours?

- (1) $120,000.

- (2) $370,000.

- (3) $250,000.

- (4) $320,000.

- (5) Some other amount.

- c. How much is the variable manufacturing cost per unit, using the variable overhead estimated by the regression (assuming that direct materials and direct labor are variable costs)?

- (1) $88.00.

- (2) $82.00.

- (3) $86.80.

- (4) $72.00.

- (5) Some other amount.

- d. What is the expected contribution margin per unit to be earned during the first year on 20,000 units of the new product? (Assume that all marketing and administrative costs are fixed.)

- (1) $96.00

- (2) $24.00

- (3) $56.00

- (4) $14.00

- (5) Some other amount.

- e. What is the manufacturing cost equation implied by these results?

- (1) Total cost = $640,000 + ($5.00 × Number of units).

- (2) Total cost = $120,000 + ($86.80 × Number of units).

- (3) Total cost = $120,000 + ($72.00 × Number of units).

- (4) Some other equation.

a.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 45E

Option (1) The percentage of the variation in overhead costs is 84.8%.

Explanation of Solution

Regression analysis:

Regression analysis is used to show the relationship between the cost and the activity. It is used to estimate the cost at various level of activity.

The most important step in the calculation of regression analysis is to establish a logical relationship between the cost and the activity. The activity (independent variable) is placed on the right-hand side and the cost (dependent variable) is placed on the left-hand side of the graph.

Percentage of the variation in overhead costs is explained by the independent variable:

The percentage of the variation in overhead costs is 84.8% as per the value of R2.

Justification for the correct and incorrect answer:

(1)

84.8%: This is the correct figure as the value is equal to the value of R2.

(2)

45.0%: This is an incorrect figure as the value is not matching with the value of R2.

(3)

92.1%: This is an incorrect figure as the value is not matching with the correct value of 84.8%.

(4)

$14.00: This is an incorrect figure as the value is not matching with the value of R2.

(5)

Some other amount: This is an incorrect option as the value is 84.8% is given above in the option.

b.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 45E

Option (2) The total overhead cost is $370,000.

Explanation of Solution

Total overhead cost:

Total overhead cost is the total cost of the given overhead. It consists of fixed cost and variable cost.

Calculate the total overhead cost:

Thus, the total overhead cost is $370,000.

Justification for the correct and incorrect answer:

(1)

$120,000: This is an incorrect figure as it is not matching with the total overhead cost of $370,000.

(2)

$370,000: This is the correct figure as the total overhead cost is $370,000.

(3)

$250,000: This is an incorrect figure as the value is not matching with the correct value of $370,000.

(4)

$320,000: This is an incorrect figure as the value of total overhead cost is $370,000

(5)

Some other amount: This is an incorrect option as the value is $370,000 is given in the above options.

c.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 45E

Option (2) The variable manufacturing cost per unit is $82.

Explanation of Solution

Variable manufacturing cost:

Variable manufacturing cost is the cost of production that varies with the change in the volume of the production.

Calculate the variable manufacturing cost per unit:

Thus, the variable manufacturing cost is $82.

Working note 1:

Calculate the labor cost per unit:

Working note 2:

Calculate the total labor hours:

Justification for the correct and incorrect answer:

(1)

$88.00: This is incorrect figure is not as per the above calculation of 40,000 direct hours.

(2)

$82.00: This is the correct figure as the figure is matching with the calculated figure of $82

(3)

$86.60: This is an incorrect figure as the value is not matching with the correct value of $82.

(4)

$72.00: This is an incorrect figure as the value is $82.00.

(5)

Some other amount: This is an incorrect option as the value is $82.00 is given above option.

d.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 45E

Option (4). The expected contribution margin is $14.00.

Explanation of Solution

Contribution margin:

The surplus of sales price over the variable expenses is known as the contribution margin. It is computed by deducting the variable expenses from the sales revenue. The contribution margin income statement is made to record the contribution margin.

Calculate the estimated contribution margin:

Thus, the estimated contribution margin is $14.

Justification for the correct and incorrect answer:

(1)

$96.00: This is an incorrect figure as it is not as per the above-calculated value of $14.

(2)

$24.00: This is an incorrect figure as per the figure is not matching the calculated figure of $14.

(3)

$56.00: This is an incorrect figure as the value is not matching with the correct value of above-calculated figure $56.

(4)

$14.00: This is the correct figure as per the above calculation.

(5)

Some other amount: This is an incorrect option as the value is $14 is given in the above options.

e.

Identify the appropriate answer for the given statement from the given choices.

Answer to Problem 45E

Option (4) The manufacturing cost equation is:

Explanation of Solution

Cost equation:

Cost equation is a mathematical representation of the cost estimation at various level of activity. It is used by defining the fixed cost, and variable cost per unit. The variable cost per unit is multiplied by the given variable to calculate the relative cost.

Calculate the manufacturing cost equation:

Thus, the manufacturing cost equation is:

Justification for the correct and incorrect answer:

(1)

(2)

(3)

(4)

Some other equation: This is the correct figure as the correct answer is not given in any of the above options.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Bolger and Co. manufactures large gaskets for the turbine industry. Bolgers per-unit sales price and variable costs for the current year are as follows: Bolgers total fixed costs aggregate to 360,000. Bolgers labor agreement is expiring at the end of the year, and management is concerned about the effects of a new labor agreement on its break-even point in units. The controller performed a sensitivity analysis to ascertain the estimated effect of a 10-per-unit direct labor increase and a 10,000 reduction in fixed costs. Based on these data, the break-even point would: a. decrease by 1,000 units. b. decrease by 125 units. c. increase by 375 units. d. increase by 500 units.arrow_forwardIncome Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardKatayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forward

- The president of a small manufacturing firm is concerned about the continual increase in manufacturing costs over the past several years. The following figures provide a time series of the cost per unit for the firms leading product over the past eight years: a. Construct a time series plot. What type of pattern exists in the data? b. Use simple linear regression analysis to find the parameters for the line that minimizes MSE for this time series. c. What is the average cost increase that the firm has been realizing per year? d. Compute an estimate of the cost/unit for next year.arrow_forwardRefer to Cornerstone Exercise 3.4 for data on Dohini Manufacturing Companys purchasing cost and number of purchase orders. The controller for Dohini Manufacturing ran regression on the data, and the coefficients shown by the regression program are: Required: 1. Construct the cost formula for the purchasing activity showing the fixed cost and the variable rate. 2. If Dohini Manufacturing Company estimates that next month will have 430 purchase orders, what is the total estimated purchasing cost for that month? (Round your answer to the nearest dollar.) 3. What if Dohini Manufacturing wants to estimate purchasing cost for the coming year and expects 5,340 purchase orders? What will estimated total purchasing cost be? (Round your answer to the nearest dollar.) What is the total fixed purchasing cost? Why doesnt it equal the fixed cost calculated in Requirement 1?arrow_forwardContribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 12,000 units will be sold at a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage.arrow_forward

- Scattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forwardAldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward

- Klamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardEstimated income statements, using absorption and variable costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 50,000 units instead of 40,000 units, thus creating an ending inventory of 10,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. Prepare an estimated income statement, comparing operating results if 40,000 and 50,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement?arrow_forwardMarkham Farms reports the following contribution margin income statement for the month of August. The company has the opportunity to purchase new machinery that will reduce its variable cost per unit by $2 but will increase fixed costs by 15%. Prepare a projected contribution margin income statement for Markham Farm assuming it purchases the new equipment. Assume sales level remains unchanged.arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning