Concept explainers

Posting a revenue journal

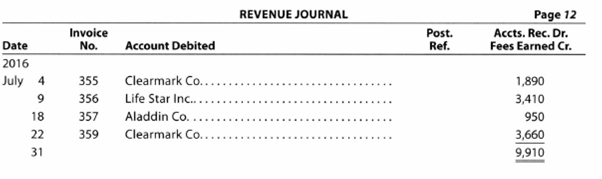

The revenue journal for Sapling Consulting Inc. follows. The accounts receivable controlling account has a July 1, 2016, balance of $625 consisting of an amount due from Aladdin Co. There were no collections during July.

a. Prepare a T account for the accounts receivable customer accounts.

b.

c. Prepare T accounts for the accounts receivable and fees earned accounts. Post control totals to the two accounts, and determine the ending balances.

d. Prepare a schedule of the customer account balances to verify the equality of the sum of the customer account balances and the accounts receivable controlling account balance.

e. How might a computerized system differ from a revenue journal in recording revenue transactions?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Accounting (Text Only)

- The revenue and cash receipts journals for Mirage Productions Inc. follow. The accounts receivable control account has a August 1, 2016, balance of 4,230 consisting of an amount due from Celestial Studios Inc. Prepare a listing of the accounts receivable customer balances and verify that the total agrees with the ending balance of the accounts receivable controlling account.arrow_forwardThe purchases journal for Newmark Exterior Cleaners Inc. follows. The accounts payable account has a March 1, 2016, balance of 580 for an amount owed to Nicely Co. There were no payments made on creditor invoices during March. a. Prepare a T account for the accounts payable creditor accounts. b. Post the transactions from the purchases journal to the creditor accounts, and determine their ending balances. c. Prepare T accounts for the accounts payable control and cleaning supplies accounts. Post control totals to the two accounts, and determine their ending balances. Cleaning Supplies had a zero balance at the beginning of the month. d. Prepare a schedule of the creditor account balances to verify the equality of the sum of the accounts payable creditor balances and the accounts payable controlling account balance. e. How might a computerized accounting system differ from the use of a purchases journal in recording purchase transactions?arrow_forwardPost the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500arrow_forward

- Transactions related to revenue and cash receipts completed by Albany Architects Co. during the period November 230, 2016, are as follows: Instructions 1. Insert the following balances in the general ledger as of November 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of November 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for November. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer balances agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable?arrow_forwardBased on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Sunrise Enterprises, which had a 480 beginning balance. In addition, there were no collections during the period. a. Set up a T account for Accounts Receivable and T accounts for the four accounts b. needed in the customer ledger. c. Post to the T accounts. d. Determine the balance in the accounts. e. Prepare a listing of the accounts receivable customer balances as of March 31, 2016.arrow_forwardTransactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 230, 2016, are as follows: Instructions 1. Insert the following balances in the general ledger as of June 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for June. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer accounts agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a control account as performed in step 5 for Accounts Receivable?arrow_forward

- The transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardPost the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. sold products to customers for cash, $7,500 B. sold products to customers on account, $12,650 C. collected cash from customer accounts, $9,500arrow_forwardHorizon Consulting Company had the following transactions during the month of October: a. Record the October revenue transactions for Horizon Consulting Company in the following revenue journal format: b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for October? c. What is the October 31 balance of the Pryor Corp. customer account assuming a zero balance on October 1?arrow_forward

- Post the following July transactions to T-accounts for Accounts Receivable and Cash, indicating the ending balance (assume no beginning balances in these accounts): A. sold products to customers for cash, $8,500 B. sold products to customers on account, $2,900 C. collected cash from customer accounts, $1,600arrow_forwardGlobal Services Company had the following transactions during the month of August: a. Record the August revenue transactions for Global Services Company into the following revenue journal format: b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for August? c. What is the August 31 balance of the Morgan Corp. customer account assuming a zero balance on August 1?arrow_forwardPost the following February transactions to T-accounts for Accounts Receivable and Cash, indicating the ending balance (assume no beginning balances in these accounts). A. provided legal services to customers for cash, $5,600 B. provided legal services to customers on account, $4,700 C. collected cash from customer accounts, $3,500arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning