Concept explainers

Activity-Based Supplier Costing

Levy Inc. manufactures tractors for agricultural usage. Levy purchases the engines needed for its tractors from two sources: Johnson Engines and Watson Company. The Johnson engine has a price of $1,000. The Watson engine is $900 per unit. Levy produces and sells 22,000 tractors. Of the 22,000 engines needed for the tractors, 4,000 are purchased from Johnson Engines, and 18,000 are purchased from Watson Company. The production manager, Jamie Murray, prefers the Johnson engine. However, Jan Booth, purchasing manager, maintains that the price difference is too great to buy more than the 4,000 units currently purchased. Booth also wants to maintain a significant connection with the Johnson source just in case the less expensive source cannot supply the needed quantities. Jamie, however, is convinced that the quality of the Johnson engine is worth the price difference.

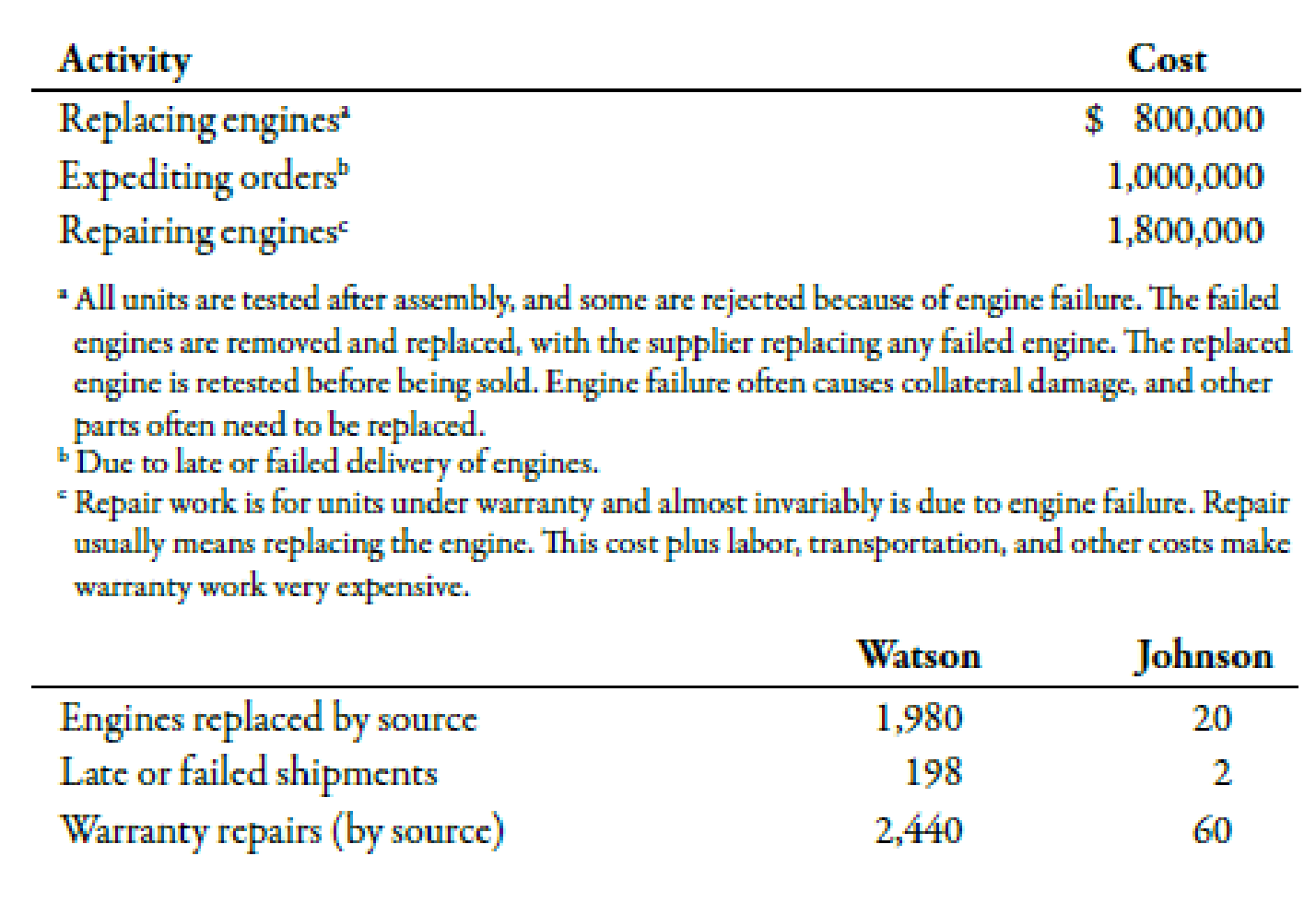

Frank Wallace, the controller, has decided to use activity costing to resolve the issue. The following activity cost and supplier data have been collected:

Required:

- 1. CONCEPTUAL CONNECTION Calculate the activity-based supplier cost per engine (acquisition cost plus supplier-related activity costs). (Round to the nearest cent.) Which of the two suppliers is the low-cost supplier? Explain why this is a better measure of engine cost than the usual purchase costs assigned to the engines.

- 2. CONCEPTUAL CONNECTION Consider the supplier cost information obtained in Requirement 1. Suppose further that Johnson can only supply a total of 20,000 units. What actions would you advise Levy to undertake with its suppliers?

Trending nowThis is a popular solution!

Chapter 5 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Carltons Kitchens makes two types of pasta makers: Strands and Shapes. The company expects to manufacture 70,000 units of Strands, which has a per-unit direct material cost of $10 and a per-unit direct labor cost of $60. It also expects to manufacture 30.000 units of Shapes, which has a per-unit material cost of $15 and a per-unit direct labor cost of $40. It is estimated that Strands will use 140,000 machine hours and Shapes will require 60,000 machine hours. Historically, the company has used the traditional allocation method and applied overhead at a rate of $21 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is shown: The cost driver for each cost pool and its expected activity is shown: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forward

- Patz Company produces two types of machine parts: Part A and Part B, with unit contribution margins of 300 and 600, respectively. Assume initially that Patz can sell all that is produced of either component. Part A requires two hours of assembly, and B requires five hours of assembly. The firm has 300 assembly hours per week. Required: 1. Express the objective of maximizing the total contribution margin subject to the assembly-hour constraint. 2. Identify the optimal amount that should be produced of each machine part and the total contribution margin associated with this mix. 3. What if market conditions are such that Patz can sell at most 75 units of Part A and 60 units of Part B? Express the objective function with its associated constraints for this case and identify the optimal mix and its associated total contribution margin.arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardVollmer Manufacturing makes three components for sale to refrigeration companies. The components are processed on two machines: a shaper and a grinder. The times (in minutes) required on each machine are as follows: The shaper is available for 120 hours, and the grinder for 110 hours. No more than 200 units of component 3 can be sold, but up to 1,000 units of each of the other components can be sold. In fact, the company already has orders for 600 units of component 1 that must be satisfied. The profit contributions for components 1, 2, and 3 are 8, 6, and 9, respectively. a. Formulate and solve for the recommended production quantities. b. What are the objective coefficient ranges for the three components? Interpret these ranges for company management. c. What are the right-hand-side ranges? Interpret these ranges for company management. d. If more time could be made available on the grinder, how much would it be worth? e. If more units of component 3 can be sold by reducing the sales price by 4, should the company reduce the price?arrow_forward

- Andalus Furniture Company has two manufacturing plants, one at Aynor and another at Spartanburg. The cost in dollars of producing a kitchen chair at each of the two plants is given here. The cost of producing Q1 chairs at Aynor is: 75Q1+5Q12+100 and the cost of producing Q2 kitchen chairs at Spartanburg is: 25Q2+2.5Q22+150. Andalus needs to manufacture a total of 40 kitchen chairs to meet an order just received. How many chairs should be made at Aynor, and how many should be made at Spartanburg in order to minimize total production cost?arrow_forwardOat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forwardTaylor Company produces two industrial cleansers that use the same liquid chemical input: Pocolimpio and Maslimpio. Pocolimpio uses two quarts of the chemical for every unit produced, and Maslimpio uses five quarts. Currently, Taylor has 6,000 quarts of the material in inventory. All of the material is imported. For the coming year, Taylor plans to import 6,000 quarts to produce 1,000 units of Pocolimpio and 2,000 units of Maslimpio. The detail of each products unit contribution margin is as follows: Taylor Company has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 6,000 quarts it planned to use in the coming years production. There is no other source of the material. Required: 1. Compute the total contribution margin that the company would earn if it could import the 6,000 quarts of the material. 2. Determine the optimal usage of the companys inventory of 6,000 quarts of the material. Compute the total contribution margin for the product mix that you recommend. 3. Assume that Pocolimpio uses three direct labor hours for every unit produced and that Maslimpio uses two hours. A total of 6,000 direct labor hours is available for the coming year. a. Formulate the linear programming problem faced by Taylor Company. To do so, you must derive mathematical expressions for the objective function and for the materials and labor constraints. b. Solve the linear programming problem using the graphical approach. c. Compute the total contribution margin produced by the optimal mix.arrow_forward

- Petrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: During the year, Petrillo had the following activity related to valve production: a. Production of valves totaled 20,600 units. b. A total of 135,400 pounds of direct materials was purchased at 5.36 per pound. c. There were 10,000 pounds of direct materials in beginning inventory (carried at 5.40 per pound). There was no ending inventory. d. The company used 36,500 direct labor hours at a total cost of 656,270. e. Actual fixed overhead totaled 110,000. f. Actual variable overhead totaled 168,000. Petrillo produces all of its valves in a single plant. Normal activity is 20,000 units per year. Standard overhead rates are computed based on normal activity measured in standard direct labor hours. Required: 1. Compute the direct materials price and usage variances. 2. Compute the direct labor rate and efficiency variances. 3. Compute overhead variances using a two-variance analysis. 4. Compute overhead variances using a four-variance analysis. 5. Assume that the purchasing agent for the valve plant purchased a lower-quality direct material from a new supplier. Would you recommend that the company continue to use this cheaper direct material? If so, what standards would likely need revision to reflect this decision? Assume that the end products quality is not significantly affected. 6. Prepare all possible journal entries (assuming a four-variance analysis of overhead variances).arrow_forwardRolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The company needs 100,000 sets per year (currently it pays 1.90 per set of rollers). The rollers can be produced using an available area within the plant. However, equipment for production of the rollers would need to be leased (30,000 per year lease payment). Additionally, it would cost 0.50 per machine hour for power, oil, and other operating expenses. The equipment will provide 60,000 machine hours per year. Direct material costs will average 0.75 per set, and direct labor will average 0.25 per set. Since only one type of roller would be produced, no additional demands would be made on the setup activity. Other overhead activities (besides machining and setups), however, would be affected. The companys cost management system provides the following information about the current status of the overhead activities that would be affected. (The supply and demand figures do not include the effect of roller production on these activities.) The lumpy quantity indicates how much capacity must be purchased should any expansion of activity supply be needed. The purchase price is the cost of acquiring the capacity represented by the lumpy quantity. This price also represents the cost of current spending on existing activity supply (for each block of activity). Production of rollers would place the following demands on the overhead activities: Producing the rollers also means that the purchase of outside rollers will cease. Thus, purchase orders associated with the outside acquisition of rollers will drop by 5,000. Similarly, the moves for the handling of incoming orders will decrease by 200. The company has not inspected the rollers purchased from outside suppliers. Required: 1. Classify all resources associated with the production of rollers as flexible resources and committed resources. Label each committed resource as a short- or long-term commitment. How should we describe the cost behavior of these short- and long-term resource commitments? Explain. 2. Calculate the total annual resource spending (for all activities except for setups) that the company will incur after production of the rollers begins. Break this cost into fixed and variable activity costs. In calculating these figures, assume that the company will spend no more than necessary. What is the effect on resource spending caused by production of the rollers? 3. Refer to Requirement 2. For each activity, break down the cost of activity supplied into the cost of activity output and the cost of unused activity.arrow_forwardOttis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning