Concept explainers

Average Uncollectible Account Losses and

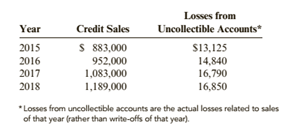

The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts:

Required:

1. Calculate the average percentage of losses from uncollectible accounts for 2015 through 2018.

2. Assume that the credit sales for 2019 are $1,260,000 and that the weighted average percentage calculated in Requirement 1 is used as an estimate of loses from uncollectible accounts for

2019 credit sales. Determine the bad debt expense for 2019 using the percentage of credit sales method.

3. CONCEPTUAL CONNECTION Do you believe this estimate of bad debt expense is reasonable?

4. CONCEPTUAL CONNECTION How would you estimate 2019 bad debt expense if losses from uncollectible accounts for 2018 were What other action would management consider?

(a)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

To calculate:

The average percentage of loss rate for each year from

Answer to Problem 65E

The loss Rate over the period is:

| Year of Sales | Loss Rate Percentage |

The average percentage of loss rate is

Explanation of Solution

The Porile Company has a glass store which sells on credit. The data of past four years showing its credit sales and losses from uncollectible accounts are as follows:

| Year of Sales | Credit Sales |

Losses from Uncollectible Accounts |

This is given in the question.

The loss rate from uncollectible accounts for the Porile Company is as follows:

| Year of Sales | Credit Sales |

Losses from Uncollectible Accounts |

Loss Rate Percentage |

| Average Percentage of losses |

(b)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

To calculate:

The loss rate for estimating the bad debt for

Answer to Problem 65E

The loss rate for estimating the bad debt in the year

Explanation of Solution

The Porile Company has a glass store which sells on credit. The data of past four years showing its credit sales and losses from uncollectible accounts are as follows:

| Year of Sales | Credit Sales |

Losses from Uncollectible Accounts |

The credit sales given in the question is

The loss rate for estimating the bad debt in the year

| Year | Credit Sales |

Losses from Uncollectible Accounts |

Loss Rate Percentage | Weights | Weighted Average of Loss |

So, the bad debt expense to be recognised:

(c)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

The reasonability of estimate of the bad debt expense.

Answer to Problem 65E

The estimation of the bad debts for

Explanation of Solution

The method of calculating the average percentage of loss rate used is the weighted average method which is used for the reason that the amount of uncollectible accounts are on increasing trend. In this trend, this method is the best for calculation. Thus, it can be said that this bad debt expense is reasonable in nature.

(d)

Credit Sales Method:

The method named percentage of credit sales method is the method in which the bad debts are computed on the basis of percentage of sales.

Uncollectible accounts:

These are those accounts which reflect that amount of credit sales which is not to be collected i.e. bad debts.

The estimation of bad debt and the reaction of the management for the bad debt of

Answer to Problem 65E

The bad debt expense should not be computed as per weighted average percentage. The company should go for ascertain a specified percentage to calculate the bad debt.

Explanation of Solution

The Porile Company has a glass store which sells on credit. The losses from uncollectible in

The bad expense for the year

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Financial Accounting

- Bristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts receivable. The uncollectible percentage is 3.1% for the income statement method and 4.5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $17,430; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardClovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000 accounts receivable balance at the end of 2018 and $841,000 at the end of 2019. Clovis uses the income statement method to record bad debt estimation at 4% during 2018. To manage earnings more favorably, Clovis changes bad debt estimation to the balance sheet method at 5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Clovis Enterprises in 2019 as a result of its earnings management.arrow_forwardFortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an $825,000 accounts receivable balance at the end of 2018 and $756,000 at the end of 2019. Fortune uses the balance sheet method to record bad debt estimation at 7.5% during 2018. To manage earnings more favorably, Fortune changes bad debt estimation to the income statement method at 5.5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Fortune in 2019 as a result of its earnings management.arrow_forward

- Aerospace Electronics reports $567,000 in credit sales for 2018 and $632,500 in 2019. They have a $499,000 accounts receivable balance at the end of 2018, and $600,000 at the end of 2019. Aerospace uses the income statement method to record bad debt estimation at 5% during 2018. To manage earnings more favorably, Aerospace changes bad debt estimation to the balance sheet method at 7% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Aerospace Electronics in 2019 as a result of its earnings management.arrow_forwardJars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardFunnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Dortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000 accounts receivable balance at the end of 2018, and $682,000 at the end of 2019. Dortmund uses the balance sheet method to record bad debt estimation at 8% during 2018. To manage earnings more favorably, Dortmund changes bad debt estimation to the income statement method at 6% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Dortmund Stockyard in 2019 as a result of its earnings management.arrow_forwardEstimating Bad Debts from Receivables Balances The following information is extracted from Shelton Corporations accounting records at the beginning of 2019: During 2019, sales on credit amounted to 575,000, 557,400 was collected on outstanding receivables and 2,600 of receivables were written off as uncollectible. On December 31, 2019, Shell on estimastes its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Sheltons estimate of bad debt expense for 2019. 2. Prepare the Accounts Receivable section of Shelton's December 31, 2019, balance sheet. 3. Compute Shelton's receivables turnover. (Round to one decimal place.) 4. It Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2?arrow_forwardAngelos Outlet used to report bad debt using the balance sheet method and is now switching to the income statement method. The percentage uncollectible will remain constant at 5%. Credit sales figures for 2019 were $866,000, and accounts receivable was $732,000. How much will Angelos Outlet report for 2019 bad debt estimation under the income statement method?arrow_forward

- Ink Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardMichelle Company reports $345,000 in credit sales and $267,500 in accounts receivable at the end of 2019. Michelle currently uses the income statement method to record bad debt estimation at 4%. To manage earnings more efficiently, Michelle changes bed debt estimation to the balance sheet method at 4%. How much is the difference in net income between the income statement and balance sheet methods? A. $3,100 B. $13,800 C. $10,700 D. $77,500arrow_forwardThe following accounts receivable information pertains to Luxury Cruises. A. Determine the estimated uncollectible bad debt for Luxury Cruises in 2018 using the balance sheet aging of receivables method. B. Record the year-end 2018 adjusting journal entry for bad debt. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $187,450; record the year-end entry for bad debt, taking this into consideration. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $206,770; record the year-end entry for bad debt, taking this into consideration. E. On January 24, 2019, Luxury Cruises identifies Landon Walkers account as uncollectible in the amount of $4,650. Record the entry for identification.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning