Concept explainers

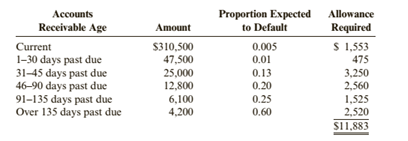

Glencoe Supply had the following accounts receivable aging schedule at the end of a recent year.

The balance in Glencoe’s allowance for doubtful accounts at the beginning of the year was $58,620 (credit). During the year, accounts in the total amount of $62,400 were written off.

Required:

1. Determine bad debt expense.

2. Prepare the

3. If Glencoe had written off $90,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense.

Answer to Problem 68E

The amount of bad debt expense is

Explanation of Solution

The Glencoe Supply accounts receivables and balance in allowance for doubtful accounts for the Glencoe Supply is as follows:

| Accounts Receivables | Amount |

Proportion expected | Allowance required |

| Total |

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Glencoe Supply is as follows:

| Allowance for doubtful accounts | |

| Opening Balance | |

| Add: Written off | |

| Add: Closing Balance |

|

| Bad Debt Expense |

(b)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The necessary adjusting journal entry for recording the bad debt.

Answer to Problem 68E

The necessary journal adjusting entry has been recorded properly.

Explanation of Solution

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The adjusting journal entry for the Glencoe Supply is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Bad debt expense......... Allowance for Doubtful accounts.... (Record the adjusting entry for bad debt estimation) |

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense after changing in the written off amount.

Answer to Problem 68E

The amount of bad debt expense after the change in the written off amount is

Explanation of Solution

The Glencoe Supply accounts receivables and balance in allowance for doubtful accounts for the Glencoe Supply is as follows:

| Accounts Receivables | Amount |

Proportion expected | Allowance required |

| Total |

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Glencoe Supply is as follows:

| Allowance for doubtful accounts | |

| Opening Balance | |

| Add: Written off | |

| Add: Closing Balance |

|

| Bad Debt Expense |

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Financial Accounting

- Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: Required: 1. Determine the desired post adjustment balance in allowance for doubtful accounts. 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. 4. Prepare the adjusting entry to record bad debt expense.arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: A. Journalize the transactions under the direct write-off method. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of 36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method than under the allowance method?arrow_forwardAging Receivables and Bad Debt Expense Perkinson Corporation sells paper products to a large number of retailers. Perkinsons accountant has prepared the following aging schedule for its accounts receivable at the end of the year. Before adjusting entries are entered, the balance in the allowance for doubtful accounts is a debit of $480. Required: 1. Calculate the desired postadjustment balance in Perkinsons allowance for doubtful accounts. 2. Determine bad debt expense for the year.arrow_forward

- AGING ACCOUNTS RECEIVABLE An analysis of the accounts receivable of Johnson Company as of December 31, 20--, reveals the following: REQUIRED 1. Prepare an aging schedule as of December 31, 20--, by adding the following column to the three columns shown above: Estimated Amount Uncollectible. 2. Assuming that Allowance for Doubtful Accounts had a credit balance of 620 before adjustment, record the end-of-period adjusting entry in general journal form to enter the estimate for uncollectible accounts.arrow_forwardAging Method Bad Debt Expense Carol Simon, the manager of Handy Plumbing has provided the following aging schedule for Handys accounts receivable: Carol indicates that the $125,200 of accounts receivable identified in the table does not include $9,400 of receivables that should be written off. Required: 1. Journalize the $9,400 write-off. 2. Determine the desired post adjustment balance in allowance for doubtful accounts. 3. If the balance in allowance for doubtful accounts before the $9,400 write-off was a debit of $550, compute bad debt expense. Prepare the adjusting entry to record bad debt expense.arrow_forwardAging Method Bad Debt Expense Cindy Bagnal, the manager of Cayce Printing Service, has provided the following aging schedule for Cayces accounts receivable Cindy indicates that the $121,100 of accounts receivable identified in the table does not include $4,600 of receivables that should be written off. Required: 1. Journalize the $4,600 write-off. 2. Determine the desired post adjustment balance in allowance for doubtful accounts (round each aging category to the nearest dollar). 3. If the balance in allowance for doubtful accounts before the $4,600 write-off was a debit of $700, compute bad debt expense. Prepare the adjusting entry to record bad debt expense.arrow_forward

- AGING ACCOUNTS RECEIVABLE An analysis of the accounts receivable of Matsushita Company as of December 31, 20--, reveals the following: REQUIRED 1. Prepare an aging schedule as of December 31, 20--, by adding the following column to the three columns shown above: Estimated Amount Uncollectible. 2. Assuming that Allowance for Doubtful Accounts had a credit balance of 1,750 before adjustment, record the end-of-period adjusting entry in general journal form to enter the estimate for uncollectible accounts.arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: A. Journalize the write-offs under the direct write-off method. B. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. C. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forwardEstimating allowance for doubtful accounts Evers Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 8-8.arrow_forward

- UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Parkers Nursery Supplies has a debit balance of 350,000. Credit sales are 2,300,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,920. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 24,560 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,280. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 22,440 in uncollectible accounts.arrow_forwardUNCOLLECTIBLE ACCOUNTS-PERCENTAGE OF RECEIVABLES Charlies Chevy Sales and Service estimates the amount of uncollectible accounts using the percentage of receivables method. Based on aging the accounts, it is estimated that 3,935 will not be collected. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 245. 2. Allowance for Doubtful Accounts has a debit balance of 560.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Glenns Nursery Supplies has a debit balance of 390,000. Credit sales are 2,800,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,760. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,330 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 29,890 in uncollectible accounts.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College