Concept explainers

Time-Driven Activity-Based Costing LO5—6

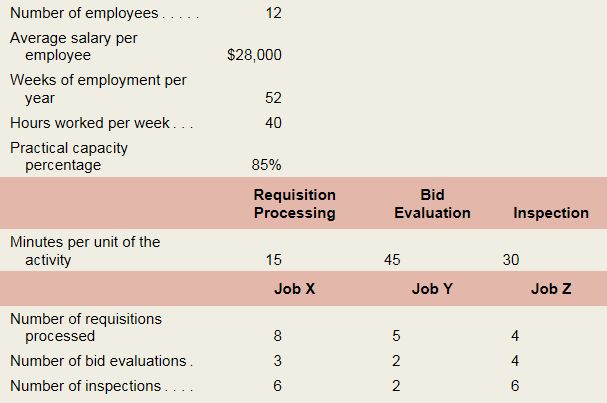

Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs:

Required:

Calculate the cost per minute of the resource supplied in the Purchasing Department.

1.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

The cost per minute of the resource supplied.

Answer to Problem 5A.1E

The cost per minute of the resource supplied is 0.40.

Explanation of Solution

Determine the cost per minute of the resource supplied:

Thus, the cost per minute of the resource supplied is 0.40.

Working note 1:

Calculate the total cost of resources supplied:

Working note 2:

Calculate the capacity per employee:

Working note 3:

Calculate the practical capacity of resources supplied:

2.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

To Calculate: The time-driven activity rate for the given activities.

Answer to Problem 5A.1E

The time-driven activity rate is $6, $18 and $12 for requisition processing,bid evaluation, and inspection.

Explanation of Solution

Calculate the time-driven activity rate for the given activities:

| Particulars | Requisition Processing | Bid Evaluation | Inspection |

| Minutes per unit of the activity (a) | 15 | 45 | 30 |

| Cost per minute of the resource supplied (b) | $0.40 | $0.40 | $0.40 |

| Time-driven activity rate (a × b) | $6.00 | $18.00 | $12.00 |

Table: (1)

Thus, the time-driven activity rate is $6, $18, and $12 for requisition processing,bid evaluation, and inspection.

3.

Concept introduction:

Cost allocation:

Costallocation refers to the process where the common cost of the production and service rendered to the various departments of the business are distributed. It is used to calculate the actual cost attributed to a specific department.

The purchasing labor cost for Job X, Job Y, and Job Z.

Answer to Problem 5A.1E

The total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Explanation of Solution

Determine the purchasing labor cost for Job X, Job Y, and Job Z:

| Particulars | Job X | Job Y | Job Z |

| Requisition processing costs | $48 | $30 | $24 |

| Bid evaluation costs | $54 | $36 | $72 |

| Inspection costs | $72 | $24 | $72 |

| Total costs | $174 | $90 | $168 |

Table: (2)

Thus, the total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Working note 1:

Calculate the requisition processing costs:

| Particulars | Time-driven activity rate(a) | Number of requisitions processed(b) | Requisition processing costs(c = a × b) |

| Job X | $6.00 | 8 | $48.00 |

| Job Y | $6.00 | 5 | $30.00 |

| Job Z | $6.00 | 4 | $24.00 |

Table: (3)

Calculate the bid evaluation costs:

| Particulars | Time-driven activity rate(a) | Number of bid evaluations(b) | Bid evaluation costs(c = a × b) |

| Job X | $18.00 | 3 | $54.00 |

| Job Y | $18.00 | 2 | $36.00 |

| Job Z | $18.00 | 4 | $72.00 |

Table: (4)

Calculate the bid inspection costs:

| Particulars | Time-driven activity rate(a) | Number of inspections(b) | Inspection costs(c = a × b) |

| Job X | $12.00 | 6 | $72.00 |

| Job Y | $12.00 | 2 | $24.00 |

| Job Z | $12.00 | 6 | $72.00 |

Table: (5)

Want to see more full solutions like this?

Chapter 5A Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- (Appendix 3A) Separating Fixed and Variable Costs, Service Setting Louise McDermott, controller for the Galvin plant of Veromar Inc., wanted to determine the cost behavior of moving materials throughout the plant. She accumulated the following data on the number of moves (from 100 to 800 in increments of 100) and the total cost of moving materials at those levels of moves: Required: 1. Prepare a scattergraph based on these data. Use cost for the vertical axis and number of moves for the horizontal axis. Based on an examination of the scattergraph, does there appear to be a linear relationship between the total cost of moving materials and the number of moves? 2. Compute the cost formula for moving materials by using the high-low method. Calculate the predicted cost for a month with 550 moves by using the high-low formula. (Note: Round the answer for the variable rate to three decimal places and the answer for total fixed cost and total cost to the nearest dollar.) 3. CONCEPTUAL CONNECTION Compute the cost formula for moving materials using the method of least squares. (Note: For the method of least squares, round the variable rate to two decimal places and total fixed cost and total cost to the nearest dollar.) Using the regression cost formula, what is the predicted cost for a month with 550 moves? What does the coefficient of determination tell you about the cost formula computed by regression? 4. CONCEPTUAL CONNECTION Evaluate the cost formula using the least squares coefficients. Could it be improved? Try dropping the third data point (300, 3,400), and rerun the regression.arrow_forwardComprehensive Activity-Based Costing Exercise [LO7–2, LO7–3, LO7–4, LO7–5] A dvanced Products Corporation has supplied the following data from its activity-based costing system: Overhead Costs Wages and salaries . . . . . . . . . . . . . $300,000 Other overhead costs . . . . . . . . . . . 100,000 Total overhead costs . . . . . . . . . . . . $400,000 Activity Cost Pool Activity Measure Total Activity for the Year Supporting direct labor . . . . . . . . . . . . . Number of direct labor-hours 20,000 DLHs Order processing . . . . . . . . . . . . . . . . . . Number of customer orders 400 orders Customer support . . . . . . . . . . . . . . . . . Number of customers 200 customers Other . . . . . . . . . . . . . . . . . . . . . . . . . . . This is an organization sustaining activity Not applicable Distribution of Resource Consumption Across Activities Supporting Direct Labor Order Processing Customer Support Other Total Wages and salaries . . . . . 40% 30% 20% 10% 100% Other overhead costs . .…arrow_forwardDeuter Int’l Business manufactures two products, Product L11 and Product L12. The company is considering adopting an activity-based costing system with the following activity pools, activity measures, and expected activity: Expected Activity Activity Cost Pools Estimated Overhead Cost Product L11 Product 12 Total Machine setups required $200,000 600 1,400 2,000 Purchase orders issued 38,382 500 100 600 Machine-hours required 92,650 6,800 10,200 17,000 $331,032 The amount overhead costs assigned to Product L11 would be closest to: Question 15 options: 1) $331,032 2) $129,045 3) $165,516 4) $130,758arrow_forward

- (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Sanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Support Departments Producing Departments S1 S2 Assembly Painting Direct costs $200,000 $140,000 $115,000 $96,000 Normal activity: Square footage — 500 1,875 625 Machine hours 337 — 3,200 12,800 Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratios—one for Assembly and the other for Painting.) Round your answers to two decimal places. Assembly Painting S1 fill in the blank 1 fill in the blank 2 S2 fill in the blank 3 fill in the blank 4 2. Allocate the support department…arrow_forward3 2. An intern suggested that the company use activity-based costing to cost its products. A team was formed to investigate this idea, and it came back with the recommendation that four activity cost pools be used. These cost pools and their associated activities follow: 5 ints 00:40:40 Activity Cost Pool and Activity Measure Purchase orders (number of orders) Rework requests (number of requests) Product testing (number of tests) Machine related (machine-hours) Activity Cost Pool Purchase orders Rework requests Product testing Machine related Estimated Overhead Cost $ 170,000 374,400 350,000 1,150,000 $2,044,400 Compute the activity rate (i.e., predetermined overhead rate) for each of the activity cost pools. Activity Rate per order per request per test per MH Deluxe 1,000 600 5,000 18,000 Activity Regular 1,500 1,200 12,500 28,000 Total 2,500 1,800 17,500 46,000 3. Assume that actual activity is as expected for the year. Using activity-based costing, do the following: a. Determine the…arrow_forwardE10-3Using variable costing and absorption costing The chief executive officer of Acadia, Inc. attended a conference in which one of the sessions was devoted to variable costing. The CEO was impressed by the presentation and has asked that the following data of Acadia, Inc. be used to prepare comparative statements using variable costing and the company’s absorption costing. The data follow: Direct materials $99,000 Direct labor 126,000 Variable factory overhead 72,000 Fixed factory overhead 171,000 Fixed marketing and administrative expense 211,500 The factory produced 90,000 units during the period, and 78,750units were sold for $787,500. 1.Prepare an income statement using variable costing. 2.Prepare an income statement using absorption costing.(Round unit costs to three decimal places.)arrow_forward

- Exercise 04-8 Using the plantwide overhead rate to assess prices LO P1 Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and round "Cost per unit and OH rate" answers to 2 decimal places.) Process Activity Overhead Cost Driver Quantity Components Changeover $ 458,500 Number of batches 750 Machining 300,400 Machine hours 7,670 Setups 228,000 Number of setups 20 $ 986,900 Finishing Welding $ 181,600 Welding hours 4,100 Inspecting 233,000 Number of inspections 760 Rework 60,500 Rework orders 160 $ 475,100…arrow_forwardChange A company is thinking about changing from a traditional absorption costing approach, based on machine hours, to an activity based costing system. Its three products are usually produced in batches of 10 items. Details are as follows: J K L Budget (units) 300 240 460 Direct material £50 £70 £60 Direct labour £20 £25 £16 Machine hours 3 5 2 Material requisitions 25 25 25 Orders from customers 15 12 23 Total production overheads budgeted are as follows: £ Quality control related 2,772 Stores and raw material related 6,300 Despatch related 9,702 Machine maintenance related 14,826 Quality inspections are carried out twice during each production run. Required: Calculate the unit cost of each product under both the traditional approach and activity based costing.arrow_forwardY2 Part 1 Clean−It−Up, Inc., is a manufacturer of vacuums and uses standard costing. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of budgeted machine-hours. In 2020, budgeted fixed manufacturing overhead cost was$18,000,000. Budgeted variable manufacturing overhead was $8 per machine-hour. The denominator level was 1,000,000 machine-hours.arrow_forward

- Required information Problem 04-5A Pricing analysis with ABC and a plantwide overhead rate LO A1, A2, P1, P3 Skip to question [The following information applies to the questions displayed below.] Sara’s Salsa Company produces its condiments in two types: Extra Fine for restaurant customers and Family Style for home use. Salsa is prepared in department 1 and packaged in department 2. The activities, overhead costs, and drivers associated with these two manufacturing processes and the company’s production support activities follow. Process Activity Overhead cost Driver Quantity Department 1 Mixing $ 5,800 Machine hours 2,200 Cooking 12,900 Machine hours 2,200 Product testing 113,800 Batches 1,000 $ 132,500 Department 2 Machine calibration $ 315,000 Production runs 500 Labeling 20,000 Cases of output 145,000 Defects 9,000 Cases of output 145,000 $ 344,000 Support Recipe formulation $ 82,000 Focus groups 40 Heat,…arrow_forwardRequired information Problem 04-5A Pricing analysis with ABC and a plantwide overhead rate LO A1, A2, P1, P3 Skip to question [The following information applies to the questions displayed below.] Sara’s Salsa Company produces its condiments in two types: Extra Fine for restaurant customers and Family Style for home use. Salsa is prepared in department 1 and packaged in department 2. The activities, overhead costs, and drivers associated with these two manufacturing processes and the company’s production support activities follow. Process Activity Overhead cost Driver Quantity Department 1 Mixing $ 5,800 Machine hours 2,200 Cooking 12,900 Machine hours 2,200 Product testing 113,800 Batches 1,000 $ 132,500 Department 2 Machine calibration $ 315,000 Production runs 500 Labeling 20,000 Cases of output 145,000 Defects 9,000 Cases of output 145,000 $ 344,000 Support Recipe formulation $ 82,000 Focus groups 40 Heat,…arrow_forwardAppendix 4B) Assigning Support Department Costs by Using the Direct Method Quillen Company manufactures a product in a factory that has two producing departments, Cutting and Sewing, and two support departments, S1 and S2. The activity driver for S1 is number of employees, and the activity driver for S2 is number of maintenance hours. The following data pertain to Quillen: Support Departments Producing Departments S1 S2 Cutting Sewing Direct costs $180,000 $150,000 $122,000 $90,500 Normal activity: Number of employees — 30 63 147 Maintenance hours 1,200 — 16,000 4,000 Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratios—one for Cutting and the other for Sewing.) Enter your answers as decimal values. S1 S2 Cutting Sewing 2. Allocate the support department costs to the producing departments by using the direct method. Use a…arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning