May 1 Received a $6,000, 12%, 90day note from V. Leigh, a customer. 6 Received a $9,000, 10%, 120-day note from C. Gable, a customer. 11 Sold the Leigh and Gable notes with recourse at the bank ot 13%. In addition, borrowed $10,000 from the bank for 90 days at 12%. The bank remits the face value less the interest. The estimated recourse liability for Leigh and Gable is $84 and $110, respectively. The July bank statement indicated that the Leigh note had been paid. July 31 Aug. 10 Repaid the $10,000 borrowed on May 11. Sept. 4 Received nofice that Gable had defaulted on the May 6 note. The bank charged a fee of $10. Paid the amount due on the Gable note to the bank. Informed Gable to pay Tara the entire amount due plus 11% interest on the total of the face amount of the note, the accrued interest, and the fee from the maturity date until Gable remits the amount owed. Received the amount due from Gable. 23

May 1 Received a $6,000, 12%, 90day note from V. Leigh, a customer. 6 Received a $9,000, 10%, 120-day note from C. Gable, a customer. 11 Sold the Leigh and Gable notes with recourse at the bank ot 13%. In addition, borrowed $10,000 from the bank for 90 days at 12%. The bank remits the face value less the interest. The estimated recourse liability for Leigh and Gable is $84 and $110, respectively. The July bank statement indicated that the Leigh note had been paid. July 31 Aug. 10 Repaid the $10,000 borrowed on May 11. Sept. 4 Received nofice that Gable had defaulted on the May 6 note. The bank charged a fee of $10. Paid the amount due on the Gable note to the bank. Informed Gable to pay Tara the entire amount due plus 11% interest on the total of the face amount of the note, the accrued interest, and the fee from the maturity date until Gable remits the amount owed. Received the amount due from Gable. 23

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.6AP

Related questions

Question

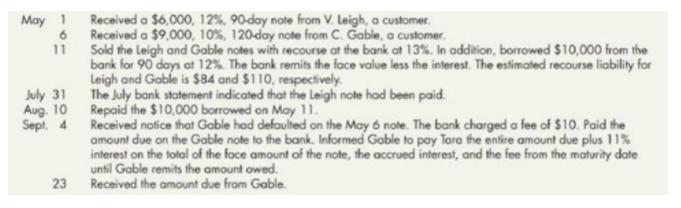

Recording Note Transactions The following information is extracted from Tara

Corporation’s accounting records:

Required:

Prepare

usually does not sell its notes. (Assume a 360-day year for the purposes of computing

interest and round all calculations to the nearest penny.)

Transcribed Image Text:May 1 Received a $6,000, 12%, 90day note from V. Leigh, a customer.

6 Received a $9,000, 10%, 120-day note from C. Gable, a customer.

11

Sold the Leigh and Gable notes with recourse at the bank ot 13%. In addition, borrowed $10,000 from the

bank for 90 days at 12%. The bank remits the face value less the interest. The estimated recourse liability for

Leigh and Gable is $84 and $110, respectively.

The July bank statement indicated that the Leigh note had been paid.

July 31

Aug. 10 Repaid the $10,000 borrowed on May 11.

Sept. 4 Received nofice that Gable had defaulted on the May 6 note. The bank charged a fee of $10. Paid the

amount due on the Gable note to the bank. Informed Gable to pay Tara the entire amount due plus 11%

interest on the total of the face amount of the note, the accrued interest, and the fee from the maturity date

until Gable remits the amount owed.

Received the amount due from Gable.

23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,