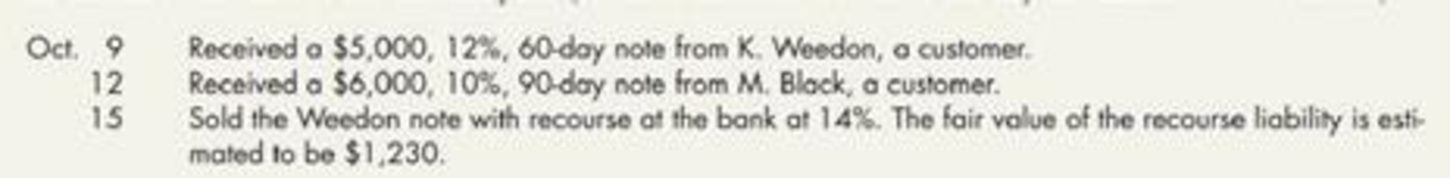

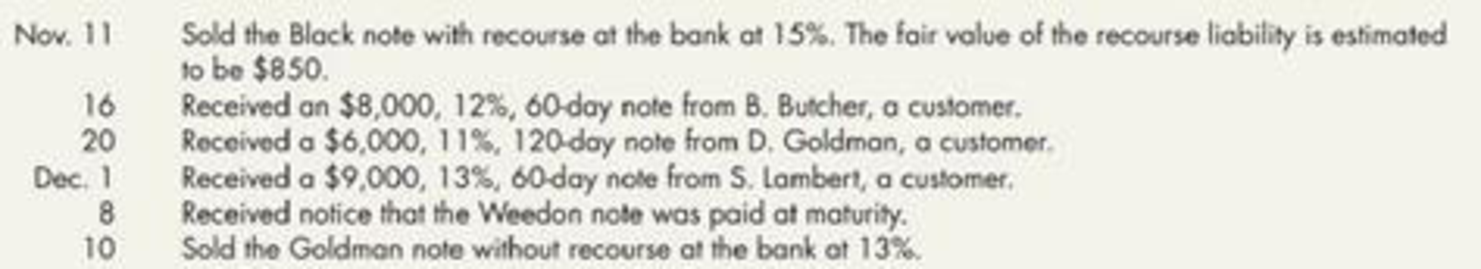

Notes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.)

Required:

- 1. Prepare the

journal entries to record the preceding note transactions and the necessaryadjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) - 2. Show how Harris’ notes receivable would be disclosed on the December 31 balance sheet. (Assume these are the only note transactions encountered by Harris during the year.)

1.

Record journal entries for previous note transactions and prepare the adjusting entries.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Accounts receivable:

Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

| Date | Account Title and Explanation | Debit | Credit |

| December 1 | Notes receivable | $9,000 | |

| Accounts receivable | $9,000 | ||

| (To record the notes receivable) |

Table (1)

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $9,000.

- Accounts receivable is an asset and it is decreased. Therefore, credit accounts receivable account by $9,000.

| Date | Account Title and Explanation | Debit | Credit |

| December 8 | Recourse liability | $1,230 | |

| Gain from sale of notes | $1,230 | ||

| (To record the fair value of recourse liability) |

Table (2)

- Recourse liability is a liability and it is decreased. Therefore, debit recourse liability account by $1,230.

- Gain from sale of notes is a component of stockholders’ equity and it is increased. Therefore, credit gain from sale of notes account by $1,230.

| Date | Account Title and Explanation | Debit | Credit |

| December 10 | Cash (1) | $5,995.39 | |

| Loss from sale of receivable (1) | $41.28 | ||

| Notes receivable | $6,000 | ||

| Interest income (5) | $36.67 | ||

| (To record note discounted on November 20 ) |

Table (3)

- Cash is an asset and it is increased. Therefore, debit cash account by $5,995.39

- Loss from sale of receivable is a component of stockholders’ equity and it is decreased. Therefore, debit loss from sale of receivables by $41.28

- Notes receivable is an asset and it is increased. Therefore, credit notes receivable account by $6,000.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $36.67.

| Date | Account Title and Explanation | Debit | Credit |

| December 31 | Interest receivable | $217.50 | |

| Interest income(6) | $217.50 | ||

| (To record the interest income of note) |

Table (4)

- Interest receivable is an asset and it is increased. Therefore, debit interest receivable account by $217.50.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $217.50.

Working note:

(1) Calculate the amount of loss from receivable:

| Particulars | Amount ($) |

| Face value of the note | 6,000 |

| Interest to maturity (2) | 220 |

| Maturity value of note | 6,220 |

| Less: Discount (3) | ($224.61) |

| Proceeds | 5,995.39 |

| Less: Book value of note (4) | (6,036.67) |

| Loss from sale of receivable | 41.28 |

Table (5)

(2) Calculate the interest to maturity:

(3) Calculate the amount of discount:

Note: 20 days is calculated from November 1 to November 20.

(4) Calculate the book value of note:

(5) Calculate accrued interest income:

Note: 20 days is calculated from November 1 to November 20.

(6) Calculate the interest income of note:

2.

State the manner in which the notes receivable of Company H will be disclosed on the balance sheet on December 31.

Explanation of Solution

Disclose the notes receivable in the balance sheet of Company H:

| Assets (Partial) | Amount |

| Notes Receivable | $17,000 |

| Interest Receivable | $217.50 |

| Liabilities (Partial) | |

| Recourse liability | $850 |

Table (6)

Want to see more full solutions like this?

Chapter 6 Solutions

Intermediate Accounting: Reporting And Analysis

- Recording the Sale of Notes Receivable Singer Corporation was involved in the following events in the current year: Required: Prepare the journal entries to record the preceding information on Singers accounting records. Assume that the company does not normally sell its notes. (Assume a 360-day year and round all answers to the nearest penny.)arrow_forwardNotes Receivable On September 1, 2016, Dougherty Corp. accepted a six-month, 7%, $45,000 interest-bearing note from Rozelle Company in payment of an account receivable. Doughertys year-end is December 31. Rozelle paid the note and interest on the due date. Required Who is the maker and who is the payee of the note? What is the maturity date of the note? Prepare all necessary journal entries that Dougherty needs to make in connection with this note.arrow_forwardCasebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forward

- UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Andersons Greeting Cards was 180,000. Credit sales for the year were 1,950,000. REQUIRED Make the necessary adjusting entry in general journal form under each of the following assumptions. Show calculations for the amount of each adjustment and the resulting net realizable value. 1. Allowance for Doubtful Accounts has a credit balance of 2,600. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.5% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,250 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.0% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 20,500 in uncollectible accounts.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Parkers Nursery Supplies has a debit balance of 350,000. Credit sales are 2,300,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,920. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 24,560 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,280. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 22,440 in uncollectible accounts.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Glenns Nursery Supplies has a debit balance of 390,000. Credit sales are 2,800,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,760. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,330 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 29,890 in uncollectible accounts.arrow_forward

- Receivables Issues Magrath Company has an operating cycle of less than one year and provides credit terms for all of its customers. On April 3, 2019, the company factored, without recourse, some of its accounts receivable. Magrath does not normally factor its receivables. On August 1, 2019, Magrath sold special order merchandise and received an interest-bearing note due April 30, 2020. Magrath uses the allowance method to account for uncollectible accounts. During 2019, some accounts were written off as uncollectible, and other accounts previously written off as uncollectible were collected. Required: 1. Explain how Magrath should account for and report the accounts receivable factored on April 3, 2019. Why is this accounting treatment appropriate? 2. Explain how Magrath should report the effects of the interest-bearing note on its income statement for the year ended December 31, 2019, and its December 31, 2019, balance sheet. 3. Explain how Magrath should account for the collection of the accounts previously written off as uncollectible. 4. What are the two basic approaches to estimating uncollectible accounts under the allowance method? What is the rationale for each approach?arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Yangs Gift Shop was 30,000. Credit sales for the year were 355,200. REQUIRED Make the necessary adjusting entry in general journal form under each of the following assumptions. Show calculations for the amount of each adjustment and the resulting net realizable value. 1. Allowance for Doubtful Accounts has a credit balance of 330. (a) The percentage of sales method is used and bad debt expense is estimated to be 2% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 6,950 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 400. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.5% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 5,685 in uncollectible accounts.arrow_forwardACCRUED INTEREST RECEIVABLE The following is a list of outstanding notes receivable as of December 31, 20--: REQUIRED 1. Compute the accrued interest at the end of the year. 2. Prepare the adjusting entry in the general journal.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning