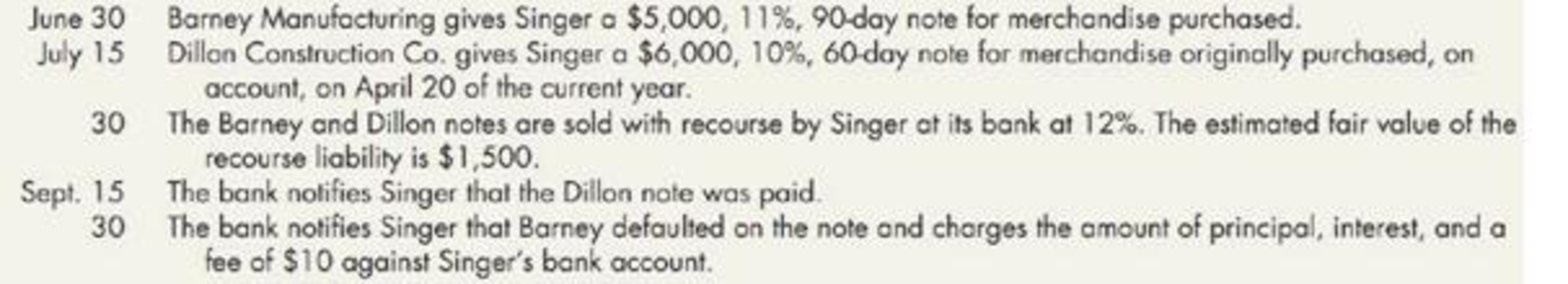

Recording the Sale of Notes Receivable Singer Corporation was involved in the following events in the current year:

Required:

Prepare the

Provide journal entries to record the previous information on Corporation S’ accounts.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Prepare journal entries:

| Date | Account titles and explanation | Debit ($) | Credit ($) |

| June 30 | Notes Receivable (Company B) | 5,000 | |

| Sales Revenue | 5,000 | ||

| (To record the receipt of the interest bearing note) | |||

| July 15 | Notes Receivable (Company D) | 6,000 | |

| Accounts Receivable | 6,000 | ||

| (To record the notes receivable) | |||

| June 30 | Cash | 11,043.25 | |

| Loss from Sale of Receivable | |||

| 1,527.58 | |||

| Recourse Liability | 1,500.00 | ||

| Notes Receivable (Company B and D) | 11,000.00 | ||

| Interest Income | 70.83 | ||

| (To record the note discounted on July 30) | |||

| September 30 | Recourse liability | 1,500 | |

| Notes receivable dishonored | 3,647.50 | ||

| Cash | 5,147.50 | ||

| (To record the notes dishonored) |

Table (1)

To record the receipt of the interest bearing note:

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $5,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $5,000.

To record the notes receivable:

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $6,000.

- Accounts receivable is an asset and it is decreased. Therefore, credit accounts receivable account by $6,000.

To record the note discounted on July 30:

- Cash is an asset and it is increased. Therefore, debit cash account by $11,043.25

- Loss from sale of receivable is a component of stockholders’ equity and it is decreased. Therefore, debit loss from sale of receivables by $1,527.58

- Recourse liability is a liability and it is increased. Therefore, credit recourse liability by $1,500.

- Notes receivable is an asset and it is increased. Therefore, credit notes receivable account by $11,000.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $70.83.

To record the notes dishonored:

- Recourse liability is a liability and it is decreased. Therefore, debit recourse liability account by $1,500.

- Notes dishonored are a component of stockholders’ equity and it is decreased. Therefore, debit notes dishonored account by $3,647.50.

- Cash is an asset and it is decreased. Therefore, credit cash account by $5,147.50.

Working note:

(1) Calculate the loss from sale of receivables:

| Particulars | Company B | Company D |

| Face value of note | $5,000 | $6,000 |

| Interest to maturity | (2)$137.50 | (6)$100 |

| Maturity value of note | $5,137.50 | $6,100 |

| Discount | (3)($102.75) | (7)($91.50) |

| Proceeds | $5,034.75 | $6,008.50 |

| Book value of note | (5)$5,045.83 | (9)$6,025 |

| Loss from sale of receivable | ($11.08) | ($16.50) |

Table (2)

(2) Calculate the interest to maturity of note for Company B:

(3) Calculate the discount amount for company B:

Note: 30 days is calculated from June 30 to July 30.

(4) Calculate the amount of accrued interest income for Company B:

Note: 30 days is calculated from June 30 to July 30.

(5) Calculate the amount of book value note for company B:

(6) Calculate the interest to maturity of note for Company D:

(7) Calculate the discount amount for company D:

Note: 15 days is calculated from June 30 to July 15.

(8) Calculate the amount of accrued interest income for company D:

Note: 15 days is calculated from June 30 to July 15.

(9) Calculate the amount of book value note company D:

Want to see more full solutions like this?

Chapter 6 Solutions

Intermediate Accounting: Reporting And Analysis

- Notes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.) Required: 1. Prepare the journal entries to record the preceding note transactions and the necessary adjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) 2. Show how Harris notes receivable would be disclosed on the December 31 balance sheet. (Assume these are the only note transactions encountered by Harris during the year.)arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: A. Journalize the transactions under the direct write-off method. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of 36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method than under the allowance method?arrow_forwardA customer was unable to pay the accounts receivable on time in the amount of $34,000. The customer was able to negotiate with the company and transferred the accounts receivable into a note that includes interest, along with an up-front cash payment of $6,000. The note maturity date is 24 months with a 15% annual interest rate. What is the entry to recognize this transfer?arrow_forward

- Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September 1, 2019, Yarnell sold a $10,000 system to Ross Company. Ross gave Yarnell a 6-month, 7% note as payment. b. On December 1, 2019, Yarnell sold a $6,000 system to Searfoss Inc. Searfoss gave Yarnell a 9-month, 9% note as payment. c. On March 1, 2020, Ross paid the amount due on its note. d. On September 1, 2020, Searfoss paid the amount due on its note. Required: Prepare the necessary journal and adjusting entries for Yarnell Electronics to record these transactions.arrow_forwardOn June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forwardCasebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forward

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardInferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of 4,350 and 9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of 1,530,000, collected receivables in the amount of 1,445,700, and recorded bad debt expense of 83, 750. Required: Next Level Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year.arrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning