College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 1MP

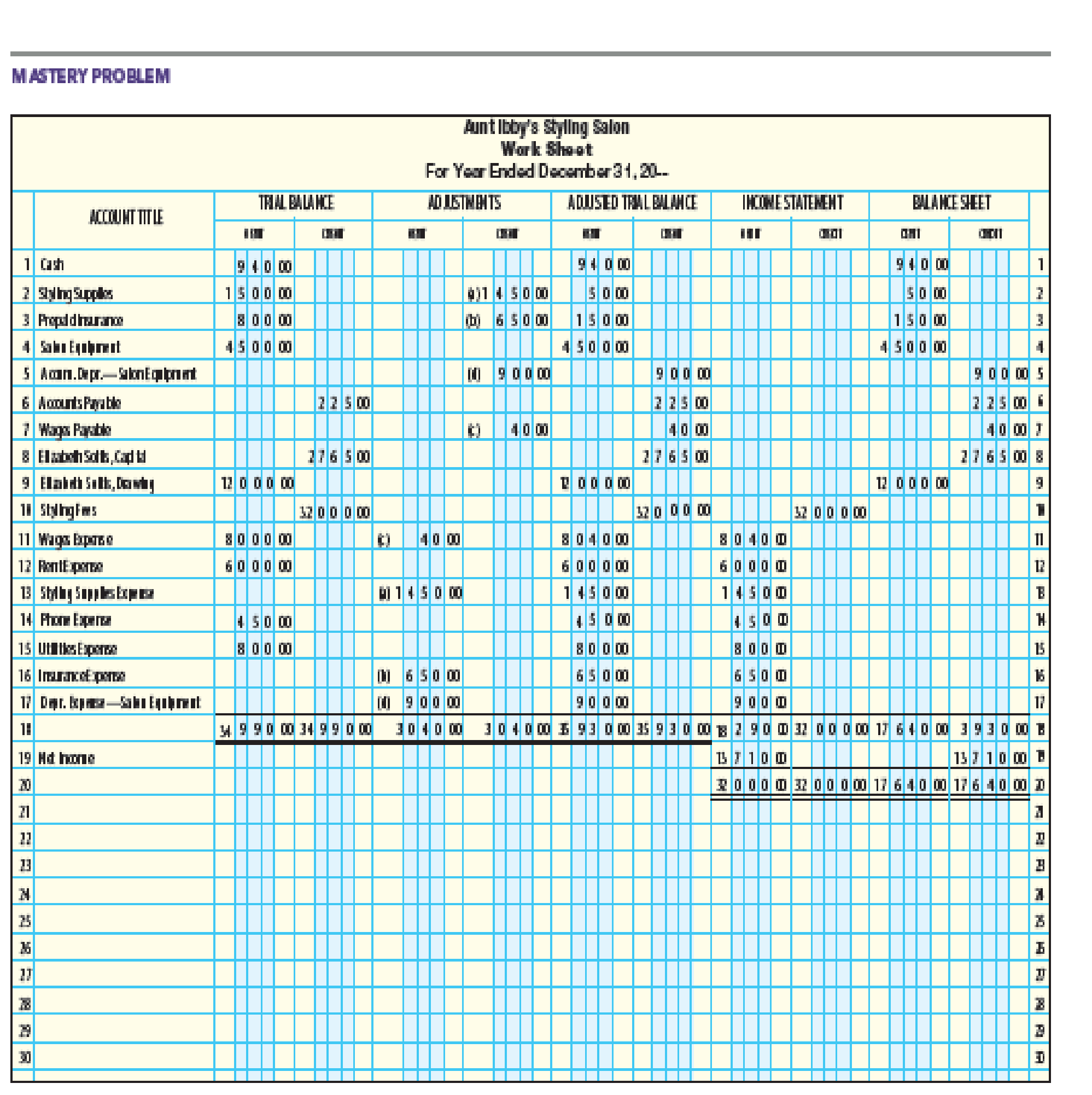

MASTERY PROBLEM

Elizabeth Soltis owns and operates Aunt Ibby’s Styling Salon. A year-end work sheet is provided on the next page. Using this information, prepare

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

QUESTIONS:

Direction: Prepare Trial Balance of balance, Income Statement, and Owner's Equity.

In September of the current year, Reno Mo began a business he called Furniture Repair Shop and completed the following transactions during the month:

September 1 - Invested P300,000 to start the business.

2 - Paid P10,000 for the rent of the shop building.

3 - Purchased P80,000 of shop machinery, giving P30,000 cash and a promissory note in payment of the balance.

5 - Purchased P9,500 of shop supplies from R. Sonora on credit.

9 - Collected cash on delivery of a cabinet to a customer, P20,000.

13 - Completed and delivered sofa bed to J. Belmonte P13,000 on credit.

15 - Paid wages of shop helpers, P15,000.

15 - Paid the delivery services rendered by AKO TRUCKING, P8,000.

18 - Paid the account due to R. Sonora.

20 - Took P1,000 worth of shop supplies for use in his carport.

23 - Received P5,000 from J. Belmonte in partial payment of her account.

25 - Withdrew P5,000 for personal expenses.

28 -…

COMPREHENSIVE ACCOUNTING CYCLE PROBLEM

For the past several years, Emily Page has operated a part-time consulting business from her home. As of June 1, 2010, Emily decided to move to rented quarters and to operate the business, which was to be known as Bottom Line Consulting, on a full-time basis. Bottom Line Consulting entered into the following transactions during June:

June 1. The following assets were received from Emily Page: cash, $20,000; accounts receivable,

$4,500; supplies, $2,000; and office equipment, $11,500. There were no liabilities received.

Paid three months’ rent on a lease rental contract, $6,000.

Paid the premiums on property and casualty insurance policies, $2,400.

Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $2,700.

Purchased additional office equipment on account from Office Depot Co., $3,500.

Received cash from clients on account, $3,000.

Paid cash for a newspaper advertisement, $200.

Paid…

COMPREHENSIVE ACCOUNTING CYCLE PROBLEM

For the past several years, Emily Page has operated a part-time consulting business from her home. As of June 1, 2010, Emily decided to move to rented quarters and to operate the business, which was to be known as Bottom Line Consulting, on a full-time basis. Bottom Line Consulting entered into the following transactions during June:

June 1. The following assets were received from Emily Page: cash, $20,000; accounts receivable,

$4,500; supplies, $2,000; and office equipment, $11,500. There were no liabilities received.

Paid three months’ rent on a lease rental contract, $6,000.

Paid the premiums on property and casualty insurance policies, $2,400.

Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $2,700.

Purchased additional office equipment on account from Office Depot Co., $3,500.

Received cash from clients on account, $3,000.

Paid cash for a newspaper advertisement, $200.

Paid…

Chapter 6 Solutions

College Accounting, Chapters 1-27

Ch. 6 - Expenses are listed on the income statement as...Ch. 6 - Additional investments of capital during the month...Ch. 6 - Prob. 3TFCh. 6 - Prob. 4TFCh. 6 - Temporary accounts are closed at the end of each...Ch. 6 - Multiple choice Which of these types of accounts...Ch. 6 - Which of these accounts is considered a temporary...Ch. 6 - Which of these is the first step in the closing...Ch. 6 - The ________ is prepared after closing entries are...Ch. 6 - Steps that begin with analyzing source documents...

Ch. 6 - Joe Fisher operates Fisher Consulting. A partial...Ch. 6 - Prob. 2CECh. 6 - Prob. 3CECh. 6 - Identify the source of the information needed to...Ch. 6 - Describe two approaches to listing the expenses in...Ch. 6 - Prob. 3RQCh. 6 - If additional investments were made during the...Ch. 6 - Identify the sources of the information needed to...Ch. 6 - What is a permanent account? On which financial...Ch. 6 - Prob. 7RQCh. 6 - Prob. 8RQCh. 6 - Prob. 9RQCh. 6 - Prob. 10RQCh. 6 - List the 10 steps in the accounting cycle.Ch. 6 - Prob. 1SEACh. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS Page 206 shows a work sheet...Ch. 6 - PROBLEM 6-7A CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - INCOME STATEMENT From the partial work sheet for...Ch. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS A work sheet for Juanitas...Ch. 6 - PROBLEM 6-7B CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - MASTERY PROBLEM Elizabeth Soltis owns and operates...Ch. 6 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.arrow_forwardThe transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.arrow_forwardEntries into T accounts and trial balance Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the following transactions connected with her professional practice: a. Transferred cash from a personal bank account to an account to be used for the business, $36,000.b. Paid October rent for office and workroom, $2,400. c. Purchased used automobile for $32,800, paying $7,800 cash and giving a note payable for the remainder.d. Purchased office and computer equipment on account, $9,000.e. Paid cash for supplies, $2,150.f. Paid cash for annual insurance policies, $4,000. g. Received cash from client for plans delivered, $12,200.h. Paid cash for miscellaneous expenses, $815.i. Paid cash to creditors on account, $4,500.j. Paid $5,000 on note payable. k. Received invoice for blueprint service, due in November, $2,890.1. Recorded fees earned on plans delivered, payment to be received in November, $18,300. m. Paid salary of assistants, $6,450.n. Paid…arrow_forward

- Transactions for Joan Jett CPA for the month of October 2020 are presented below. Journalize each transaction in proper format. You may omit journal explanations. Oct 1 Joan invested $42,000 cash to start her business. Oct 2 Purchased land costing $28,000 for cash. Oct 3 Purchased equipment from Staples costing $18,000 for $4,000 cash and the remainder on credit. Oct 4 Purchased supplies on account from ABC Company for $800. Oct 7 Paid $1,200 for a one-year insurance policy. Oct 8 Billed $4,000 for accounting services provided to M. Mott. Oct 9 Received $3,500 cash for services performed. Oct 13 Received $4,000 for services previously performed for M. Mott. Oct 22 Paid wages to employees for $2,800. Oct 31 Additionally, Joan discovers a mathematical error made in 2016 resulting in the understatement of depreciation expense by $35,000.arrow_forwardQUESTIONS: Direction: Journalize the following transactions and post the accounts to the general ledger (Use T-accounts only). In September of the current year, Reno Mo began a business he called Furniture Repair Shop and completed the following transactions during the month: September 1 - Invested P300,000 to start the business. 2 - Paid P10,000 for the rent of the shop building. 3 - Purchased P80,000 of shop machinery, giving P30,000 cash and a promissory note in payment of the balance. 5 - Purchased P9,500 of shop supplies from R. Sonora on credit. 9 - Collected cash on delivery of a cabinet to a customer, P20,000. 13 - Completed and delivered sofa bed to J. Belmonte P13,000 on credit. 15 - Paid wages of shop helpers, P15,000. 15 - Paid the delivery services rendered by AKO TRUCKING, P8,000. 18 - Paid the account due to R. Sonora. 20 - Took P1,000 worth of shop supplies for use in his carport. 23 - Received P5,000 from J. Belmonte in partial payment of her account. 25 - Withdrew…arrow_forwardOn July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the first few days of July follow. DATE TRANSACTIONS July 1 Purchased a one-year insurance policy and issued Check 102 for $1,620 to pay the entire premium. 3 Purchased office furniture for $16,900 from Furniture Warehouse; issued Check 103 for $8,400 and agreed to pay the balance in 60 days. The equipment has an estimated useful life of five years and a $1,600 salvage value. The office furniture will be depreciated using the straight-line method. Required: Record the transactions in the general journal. Assume that the firm initially records prepaid expenses as assets and unearned income as a liability for the year 2019. 1) Record the payment for insurance. 2) Record the purchase of furniture. Date General Journal Debit Credit Jul 01, 2019 July 03, 2019arrow_forward

- Complete accounting cycle.For the past several years, Jolene Upton has operated a part-time consulting business from her home. As of July 1, 2019, Jolene decided to move to rented quarters and to operate the business, which was to be known as Gourmet Consulting, on a full-time basis.Gourmet Consulting entered into the following transactions during July:July 1. The following assets were received from Jolene Upton: cash, $19,000;accounts receivable, $22,300; supplies, $3,800; and office equipment, $8,900.There were no liabilities received.1. Paid three months’ rent on a lease rental contract, $6,000.2. Paid the premiums on property and casualty insurance policies, $4,500.4. Received cash from clients as an advance payment for services to be providedand recorded it as unearned fees, $8,000.5. Purchased additional office equipment on account from Office Necessities Co., $5,100.6. Received cash from clients on account, $12,750.10. Paid cash for a newspaper advertisement, $500.12. Paid…arrow_forwardJournal Entries and Trial Balance On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs. During the month, Kris completed the following transactions related to the business: June 1. Kris transferred cash from a personal bank account to an account to be used for the business, $24,800. 4. Paid rent for period of June 4 to end of month, $2,410. 6. Purchased a used truck for $21,000, paying $2,000 cash and giving a note payable for the remainder. 8. Purchased equipment on account, $9,670. 10. Purchased supplies for cash, $1,660. 12. Paid annual premiums on property and casualty insurance, $3,720. 15. Received cash for job completed, $10,420. Enter the following transactions on Page 2 of the two-column journal: 23. Paid creditor a portion of the amount owed for equipment purchased on June 13, $3,450. 24. Recorded jobs completed on account and sent invoices to customers, $11,850. 25. Received an invoice for…arrow_forwardJournal Entries and Trial Balance On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs. During the month, Kris completed the following transactions related to the business: June 1. Kris transferred cash from a personal bank account to an account to be used for the business, $24,800. 4. Paid rent for period of June 4 to end of month, $2,410. 6. Purchased a used truck for $21,000, paying $2,000 cash and giving a note payable for the remainder. 8. Purchased equipment on account, $9,670. 10. Purchased supplies for cash, $1,660. 12. Paid annual premiums on property and casualty insurance, $3,720. 15. Received cash for job completed, $10,420. Enter the following transactions on Page 2 of the two-column journal: 23. Paid creditor a portion of the amount owed for equipment purchased on June 13, $3,450. 24. Recorded jobs completed on account and sent invoices to customers, $11,850. 25. Received an invoice for…arrow_forward

- Instructions: Make the Journal Entry and the Adjusting Entry Hayley Williams operated FarMore Cleaning Service that was established on December 1, 2020. During December, the company completed the following transactions. 1 Hayley invested 600,00 cash in the business 2 Purchased a used Van for 200, 000 paying 60,000 cash, and issued a promissory note for the balance. 3 Purchased cleaning supplies for 4,000 on a cash basis. 5 Paid 41,200 on a 4-year insurance policy, effective December 1. 8 Bought a laptop from JnF Computer Shop amounting to 90,000. Half of the price was paid. 12 Sent a billed customers 68,000 for cleaning services completed last December 10. 15 Advance collection of the payment was made from Catbalogan Plaza hotel, 80,000. 18 Paid the salary of the employees 18,000. 20 Paid 16,000 for rent of the shop 21 Received 39,000 from the client billed last December 12. 23 Received a promissory note from a client for the cleaning services rendered, 35,000. 25 Billed customers…arrow_forwardSusie Smith opened Susie's Commerical Clearning on April 1, 2021. In Apr, the following transactions were completed. Apr 1. Invested $14,000 cash in the business 1. Purchased a used truck for $26,400, paying $6,400 cash and signing a note payable for the balance 1. Collected $3,000 from XYZ for their cleaning needs for Apr, May and June. 3. Purchased cleaning supplies on account for $850 5. Paid $1,800 on a one-year insurance policy, effective Apr 1 12. Billed customers $3,800 for cleaning services 18. Paid $400 of amount owed on cleaning supplies 20. Paid $1,600 for employee's salaries 21. Collected $1,400 from customers billed on Apr 12 25. Billed customers for $3,000 for cleaning services 30. Paid gas and oil for the month on the truck $350 30 Withdrew $1,600 to pay personal property taxes Additional Information: Annual payments of $3,000 are required on the note. Required: Journalize and post the April transactions. Susie's Commerical Cleaning records all prepaid expenses…arrow_forwardSusie Smith opened Susie's Commerical Clearning on April 1, 2021. In Apr, the following transactions were completed. Apr 1. Invested $14,000 cash in the business 1. Purchased a used truck for $26,400, paying $6,400 cash and signing a note payable for the balance 1. Collected $3,000 from XYZ for their cleaning needs for Apr, May and June. 3. Purchased cleaning supplies on account for $850 5. Paid $1,800 on a one-year insurance policy, effective Apr 1 12. Billed customers $3,800 for cleaning services 18. Paid $400 of amount owed on cleaning supplies 20. Paid $1,600 for employee's salaries 21. Collected $1,400 from customers billed on Apr 12 25. Billed customers for $3,000 for cleaning services 30. Paid gas and oil for the month on the truck $350 30 Withdrew $1,600 to pay personal property taxes Additional Information: Annual payments of $3,000 are required on the note. Prepare a post closing trial balance at Apr 30, 2021. Susie's Commerial Clearning has chosen to prepare reversing…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY