Concept explainers

A 30-year bond with a face value of $1000 has a coupon rate of 5.5%, with semiannual payments.

- a. What is the coupon payment for this bond?

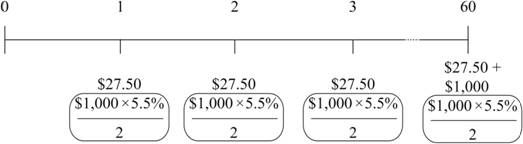

- b. Draw the cash flows for the bond on a timeline.

a.

To determine: The coupon payment on a bond.

Introduction:

Yield to maturity (YTM) is the rate of return projected for a security or a bond, which is apprehended until its maturity period. It is also considered as the internal rate of return (IRR) for a security or bond and it likens the current estimation of bond’s future cash flow to its present market cost. Coupon rate is expressed as an interest rate on a fixed income security like a bond. It is also called as the interest rate that the bondholders receive from their investment. It depends on the yield as of the day when the bond is issued.

Answer to Problem 1P

Explanation of Solution

Determine the coupon payment on a bond

The bond is paid on semi-annual basis.

Therefore, the coupon payment on a bond is $27.50.

b.

To determine: The cash flows of the bond on a timeline.

Explanation of Solution

Cash Flow Timeline:

Want to see more full solutions like this?

Chapter 6 Solutions

Corporate Finance: The Core Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition)

Additional Business Textbook Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Foundations Of Finance

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Engineering Economy (16th Edition) - Standalone book

Microeconomics (9th Edition) (Pearson Series in Economics)

- Bond Yields and Rates of Return A 10-year, 12% semiannual coupon bond with a par value of 1,000 may be called in 4 years at a call price of 1,060. The bond sells for 1,100. (Assume that the bond has just been issued.) a. What is the bonds yield to maturity? b. What is the bonds current yield? c. What is the bonds capital gain or loss yield? d. What is the bonds yield to call?arrow_forwardSuppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?arrow_forwardCurrent Yield with Semiannual Payments A bond that matures in 7 years sells for $1,020. The bond has a face value of $1,000 and a yield to maturity of 10.5883%. The bond pays coupons semiannually. What is the bond’s current yield?arrow_forward

- Bond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of 1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:arrow_forwardCurrent Yield for Annual Payments Heath Food Corporations bonds have 7 years remaining to maturity. The bonds have a face value of 1,000 and a yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield?arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. What is the price of the bonds?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning