Concept explainers

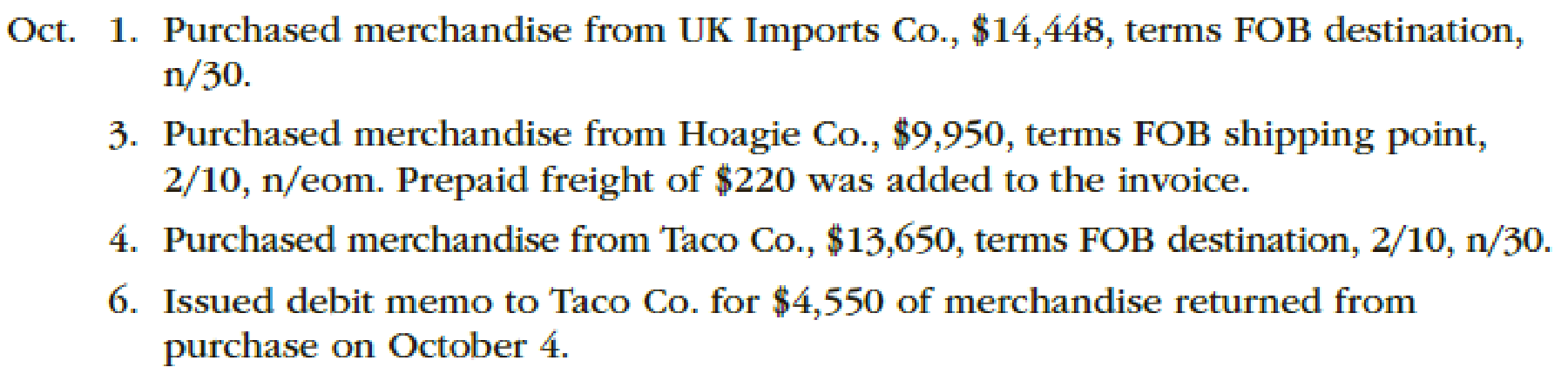

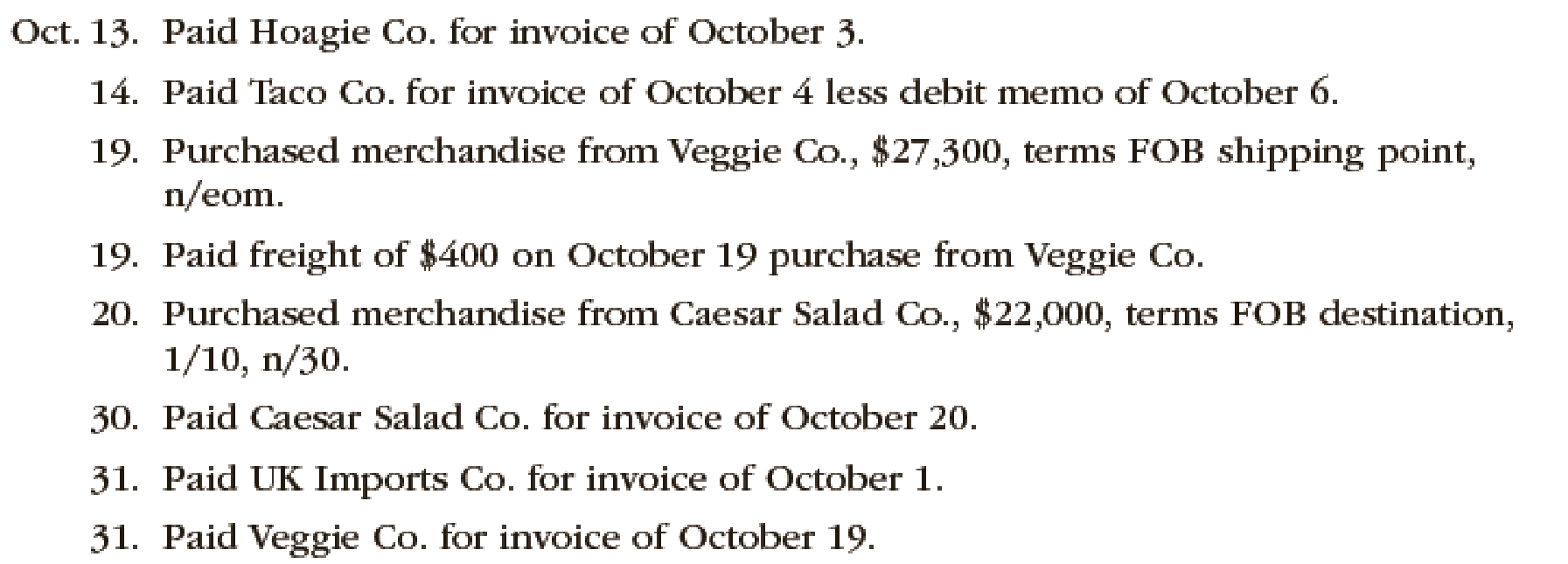

The following selected transactions were completed by Capers Company during October of the current year:

Instructions

Prepare journal entries to record the transactions of Company C during the month of October using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System refers to the Merchandise Inventory system that maintains the detailed records of every Merchandise Inventory transactions related to purchases and sales on a continuous basis. It shows the exact on-hand-merchandise inventory at any point of time.

Record the journal entry of Company C during October.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 1 | Merchandise Inventory | 14,448 | ||

| Accounts payable | 14,448 | |||

| (To record purchase on account) |

Table (1)

- Merchandise Inventory is an asset and it is increased by $14,448. Therefore, debit Merchandise Inventory account with $14,448.

- Accounts payable is a liability and it is increased by $14,448. Therefore, credit accounts payable account with $14,448.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 3 | Merchandise Inventory | 9,971 | ||

| Accounts payable | 9,971 (1) | |||

| (To record purchase on account) |

Table (2)

- Merchandise Inventory is an asset and it is increased by $9,971. Therefore, debit Merchandise Inventory account with $9,971.

- Accounts payable is a liability and it is increased by $9,971. Therefore, credit accounts payable account with $9,971.

Working Note (1):

Calculate the amount of accounts payable.

Purchases = $9,950

Discount percentage = 2%

Freight charges = $220

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 4 | Merchandise Inventory | 13,377 | ||

| Accounts payable | 13,377 (2) | |||

| (To record purchase on account) |

Table (3)

- Merchandise Inventory is an asset and it is increased by $13,377. Therefore, debit Merchandise Inventory account with $13,377.

- Accounts payable is a liability and it is increased by $13,377. Therefore, credit accounts payable account with $13,377.

Working Note (2):

Calculate the amount of accounts payable.

Purchases = $13,650

Discount percentage = 2%

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 6 | Accounts payable | 4,459 (3) | ||

| Merchandise Inventory | 4,459 | |||

| (To record purchase return) |

Table (4)

- Accounts payable is a liability and it is decreased by $4,459. Therefore, debit accounts payable account with $4,459.

- Merchandise Inventory is an asset and it is decreased by $4,459. Therefore, credit Merchandise Inventory account with $4,459.

Working Note (3):

Calculate the amount of accounts payable.

Purchases return = $4,550

Discount percentage = 2%

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 13 | Accounts payable | 9,971 | ||

| Cash | 9,971 | |||

| (To record payment made in full settlement less discounts) |

Table (5)

- Accounts payable is a liability and it is decreased by $9,971. Therefore, debit accounts payable account with $9,971.

- Cash is an asset and it is decreased by $9,971. Therefore, credit cash account with $9,971.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 14 | Accounts payable | 8,918 (4) | ||

| Cash | 8,918 | |||

| (To record payment made in full settlement less discounts) |

Table (6)

- Accounts payable is a liability and it is decreased by $8,918. Therefore, debit accounts payable account with $8,918.

- Cash is an asset and it is decreased by $8,918. Therefore, credit cash account with $8,918.

Working Note (4):

Calculate the amount of net accounts payable.

Merchandise Inventory = $13,377 (2)

Purchase returns = $4,459 (3)

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 19 | Merchandise Inventory | 27,300 | ||

| Accounts payable | 27,300 | |||

| (To record purchase on account) |

Table (7)

- Merchandise Inventory is an asset and it is increased by $27,300. Therefore, debit Merchandise Inventory account with $27,300.

- Accounts payable is a liability and it is increased by $27,300. Therefore, credit accounts payable account with $27,300.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 19 | Merchandise Inventory | 400 | ||

| Cash | 400 | |||

| (To record freight charges paid) |

Table (8)

- Merchandise Inventory is an asset and it is increased by $27,300. Therefore, debit Merchandise Inventory account with $27,300.

- Cash is an asset and it is decreased by $400. Therefore, credit cash account with $400.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 20 | Merchandise Inventory | 21,780 | ||

| Accounts payable | 21,780 (5) | |||

| (To record purchase on account) |

Table (9)

- Merchandise Inventory is an asset and it is increased by $21,780. Therefore, debit Merchandise Inventory account with $21,780.

- Accounts payable is a liability and it is increased by $21,780. Therefore, credit accounts payable account with $21,780.

Working Note (5):

Calculate the amount of accounts payable.

Purchases = $22,000

Discount percentage = 1%

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 30 | Accounts payable | 21,780 | ||

| Cash | 21,780 | |||

| (To record payment made in full settlement less discounts) |

Table (10)

- Accounts payable is a liability and it is decreased by $21,780. Therefore, debit accounts payable account with $21,780.

- Cash is an asset and it is decreased by $21,780. Therefore, credit cash account with $21,780.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 31 | Accounts payable | 14,448 | ||

| Cash | 14,448 | |||

| (To record payment made in full settlement less discounts) |

Table (11)

- Accounts payable is a liability and it is decreased by $14,448. Therefore, debit accounts payable account with $14,448.

- Cash is an asset and it is decreased by $14,448. Therefore, credit cash account with $14,448.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 31 | Accounts payable | 27,300 | ||

| Cash | 27,300 | |||

| (To record payment made in full settlement less discounts) |

Table (12)

- Accounts payable is a liability and it is decreased by $27,300. Therefore, debit accounts payable account with $27,300.

- Cash is an asset and it is decreased by $27,300. Therefore, credit cash account with $27,300.

Want to see more full solutions like this?

Chapter 6 Solutions

Financial Accounting

- The following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forwardThe following were selected from among the transactions completed by Essex Company during July of the current year: Instructions Journalize the transactions.arrow_forwardThe following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four journal entries required to close the books:arrow_forward

- The following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books:arrow_forwardRecurring and Adjusting Entries Following are Butler Realty Corporations accounts, identified by number. The company has been in the real estate business for ten years and prepares financial statements monthly. Following the list of accounts is a series of transactions entered into by Butler. For each transaction, enter the number(s) of the account(s) to be debited and credited.arrow_forwardThe following selected transactions were completed during August between Summit Company and Beartooth Co.: Instructions Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.arrow_forward

- The following revenue transactions occurred during November: Record these three transactions into the following revenue journal format:arrow_forwardCedar Springs Company completed the following selected transactions during June 2016: Instructions Journalize the transactions.arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forward

- From the following T accounts, journalize the closing entries dated December 31 for Baylor Company.arrow_forwardThe financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forwardPrepare the assets section of the balance sheet as of December 31 for Hoopers International using the following information:arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,