Public Finance (The McGraw-Hill Series in Economics)

10th Edition

ISBN: 9780078021688

Author: Harvey S Rosen, Ted Gayer

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 3DQ

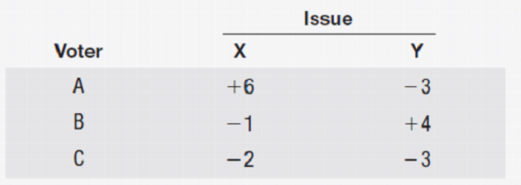

Three voters, A, B, and C, will decide by majority rule whether to pass bills on issues X and Y. Each of the two issues will be voted on separately. The change in net benefits (in dollars) that would result from passage of each bill is as follows:

- a. Which issues (if any) would pass if decided by majority rule? Is this the efficient out-come?

- b. Which issues (if any) would pass if logrolling were allowed? Would logrolling improve efficiency? Would it result in the efficient outcome?

- c. Suppose that it were legal for one voter to pay another to vote a certain way. Would allowing such side payments improve efficiency from part b? Would it result in the efficient outcome?

- d. What amount of side payments would take place if paying for votes were allowed?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

A community public works project will cost $92,000 and will benefit five different individuals.

Individual

Individual Benefit ($)

Individual Cost ($)

1

4,500

6,000

2

18,500

15,000

3

19,000

17,000

4

30,000

24,000

5

29,000

30,000

Is this project economically feasible? Please show work in an Excel spreadsheet that lists the benefit for each individual.

Would this project be approved by a majority at a community referendum?

1) Determine whether each of the following elements should be classified as taxes, licenses, permits, intergovernmental revenues, service fees, fines, forfeiture, or miscellaneous income in a government fund.

A) Government sales and usage taxes. B) Citizen payments for the use of the city pool.

C) Building permits to build a roof in a house

2) Explain income, expenses, receipts, and payment? Draw the figure with an example? What is the difference between the two statements? 15 degrees.

Explain why the Public-Choice view supports the deficit budget rule by using one of the voter’s behavior hypotheses to support your answer

Chapter 6 Solutions

Public Finance (The McGraw-Hill Series in Economics)

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance

Opportunity cost of capital Which of the following statements are true? The opportunity cost of capital:

Equals...

PRIN.OF CORPORATE FINANCE

The value of the shareholders equity account of a firm. Introduction: Shareholders’ equity refers to the residu...

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Risk Premiums and Discount Rates. Top hedge fund manager Sally Buffit believes that a stock with the same marke...

FUNDAMENTALS OF CORPORATE FINANCE

How did the recession of 2007-2009 compare with other recessions since the Great Depression in terms of length?...

Foundations of Financial Management

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Choose the best answer from the four choices Assuming that a government will collect its sales taxes in sufficient time to satisfy the “available” criterion, it would ordinarily recognize revenue from sales taxes in its governmental fund statements When the underlying sales transaction takes place On the date the merchant must remit the taxes to the government On the date the merchant must file a tax return When the taxes are received by the government Assuming that a government will collect its sales taxes in sufficient time to satisfy the “available” criterion, it would ordinarily recognize revenue from sales taxes in its government‐wide statements When the underlying sales transaction takes place On the date the merchant must remit the taxes to the government On the date the merchant must file a tax return When the taxes are received by the governmentarrow_forwardSocial Security represents a large portion of the Federal budget, so it is often looked at as a candidate for revision by Congress. a) True b) Falsearrow_forwardWould a grant of $24,000 by the state to each district be equalizing in its effect on the two districts?arrow_forward

- Which of the following statements about state budget processes is correct? All states require biennial budgets. All governors have line-item veto power. Not all states have budget messages prepared by the governor. States normally spend through systems of entitlements instead of appropriations.arrow_forwardWhich among the type of taxes (national or local) do you think can be reduced, removed, or revised to the benefit of both the government and the common individual? Cite relevant sources such as previous research studies, taxation reform programs, and the like.arrow_forwardIf Member Jane has a total share capital for the entire year 2020 of P32,000.00, what is her average share? How much is the Optional Fund? * How much is the Reserve Fund? * The interest on share capital and patronage refund was decided by the BODs to be 50-50. How much will be allocated for the Patronage Refund? * How much is the Community Development Fund? * If Member Jane has a total share capital for the entire year 2020 of P32,000.00, and the total share capital of all members is P378,000 how much is her interest on Share Capital? * How much is the Training and Education Fund? * Your Cooperative-Income Statement How much is the total Statutory Reserves of Your Cooperative? * The interest on share capital and patronage refund was decided by the BODs to be 50-50. How much will be allocated for the Interest on Share Capital? *arrow_forward

- At the Techiman METROPOLITAN ASSEMBLY, a resolution was passed in line with the provisions of chapter 13 of the 1992 Constitution of Ghana. During the meeting to pass the resolution, the Lord Mayor, Hon. Alhaji Prekese reiterated that “no money shall be spent for any purpose without the prior approval of the local assembly.” In approving the budget for the year, the Assembly had authorized spending of GHS 1,300,000 for road maintenance. Later in the year, after the Assembly had spent virtually the entire budgeted amount, a major storm washed out portions of several roads leading to one of the Local Authority Schools- Offinso Kokoti Local Authority Middle School (OKLAMS). The school was inaccessible, and the Lord Mayor wanted to enter into an emergency contract to repair the roads. City engineers estimated that the cost of the repairs would be about GHS 350,000. If the assembly entered into such a contract, the total amount spent on road maintenance for the year would be greater than…arrow_forwardUse the table below for the next few questions Table for Single Taxpayers Over But not over $51 $195......................10% of excess over $51 $195 $645......................$14.40 plus 15% of excess over $195 $645 $1,482...................$81.90 plus 25% of excess over $645 $1,482 $3,131...................$291.15 plus 28% of excess over $1,482 $3,131 $6,763...................$752.87 plus 33% of excess over $3,131 $6,763...........................................$1,951.43 plus 35% of excess over $6,763arrow_forwardUse the table below for the next few questions Table for Single Taxpayers Over But not over $51 $195......................10% of excess over $51 $195 $645......................$14.40 plus 15% of excess over $195 $645 $1,482...................$81.90 plus 25% of excess over $645 $1,482 $3,131...................$291.15 plus 28% of excess over $1,482 $3,131 $6,763...................$752.87 plus 33% of excess over $3,131 $6,763...........................................$1,951.43 plus 35% of excess over $6,763 Herb Becker had gross earnings of $465 last week. He is single and claims a withholding allowance for himself only. The amount of each weekly withholding allowance is $65.38. Using the Table for Single Taxpayers above, compute the amount that will be withheld from his paycheck for federal income tax. (Figure withholding to the nearest cent.) 40.59 54.09 45.09 35.09arrow_forward

- A continuing resolution enables an agency to do which of the following tasks? Continue operations in a fiscal year, despite the fact that it overspent its appropriation for the prior fiscal year Continue operations in a fiscal year, despite the fact that it has received no appropriation for that year Negotiate its appropriations between the House and the Senate Continue operations in a fiscal year, despite the fact that it overspent its appropriation for that fiscal yeararrow_forwardAt the Berekum ASSEMBLY, a resolution was passed in line with the provisions of chapter 13 of the 1992 Constitution of Ghana. During the meeting to pass the resolution, the Lord Mayor, Hon. Alhaji Prekese reiterated that “no money shall be spent for any purpose without the prior approval of the local assembly.” In approving the budget for the year, the Assembly had authorized spending of GHS 1,300,000 for road maintenance. Later in the year, after the Assembly had spent virtually the entire budgeted amount, a major storm washed out portions of several roads leading to one of the Local Authority Schools- Offinso Kokoti Local Authority Middle School (OKLAMS). The school was inaccessible, and the Lord Mayor wanted to enter into an emergency contract to repair the roads. City engineers estimated that the cost of the repairs would be about GHS 350,000. If the assembly entered into such a contract, the total amount spent on road maintenance for the year would be greater than the amount…arrow_forwardIn the classical budgeting era from WWWII to the early 70s, most citizens agreed on public policy and where to spend tax dollars. a). True b). Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is Budgeting? | Budgetary control | Advantages & Limitations of Budgeting; Author: Educationleaves;https://www.youtube.com/watch?v=INnPo0QPXf4;License: Standard youtube license