Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 42P

Larkin Company produces leather strips for western belts using three processes: cutting, design and coloring, and punching. The weighted average method is used for all three departments. The following information pertains to the Design and Coloring Department for the month of June:

- a. There was no beginning work in process.

- b. There were 400,000 units transferred in from the Cutting Department.

- c. Ending work in process, June 30: 50,000 strips, 80 percent complete with respect to conversion costs.

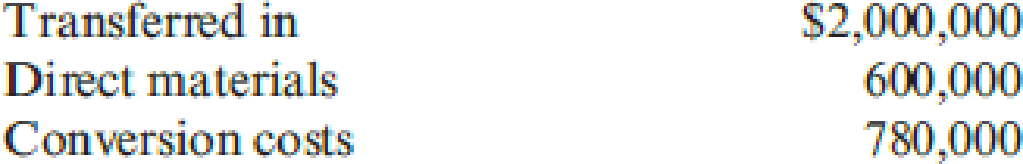

- d. Units completed and transferred out: 330,000 strips. The following costs were added during the month:

- a. Direct materials are added at the beginning of the process.

- b. Inspection takes place at the end of the process. All spoilage is considered normal.

Required:

- 1. Calculate equivalent units of production for transferred-in materials, direct materials added, and conversion costs.

- 2. Calculate unit costs for the three categories of Requirement 1.

- 3. What is the total cost of units transferred out? What is the cost of ending work-in-process inventory? How is the cost of spoilage treated?

- 4. Assume that all spoilage is considered abnormal. Now, how is spoilage treated? Give the

journal entry to account for the cost of the spoiled units. Some companies view all spoilage as abnormal. Explain why. - 5. Assume that 80 percent of the units spoiled are abnormal and 20 percent are normal spoilage. Show the spoilage treatment for this scenario.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 6 - What is a process? Provide an example that...Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 3DQCh. 6 - What are transferred-in costs?Ch. 6 - Explain why transferred-in costs are a special...Ch. 6 - What is a production report? What purpose does...Ch. 6 - Can process costing be used for a service...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - How is the equivalent unit calculation affected...Ch. 6 - Describe the five steps in accounting for the...

Ch. 6 - Under the weighted average method, how are...Ch. 6 - Under what conditions will the weighted average...Ch. 6 - In assigning costs to goods transferred out, how...Ch. 6 - Prob. 14DQCh. 6 - What is operation costing? When is it used?Ch. 6 - Lamont Company produced 80,000 machine parts for...Ch. 6 - Lising Therapy has a physical therapist who...Ch. 6 - Fleming, Fleming, and Johnson, a local CPA firm,...Ch. 6 - During October, McCourt Associates incurred total...Ch. 6 - Tomar Company produces vitamin energy drinks. The...Ch. 6 - Apeto Company produces premium chocolate candy...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Gunnison Company had the following equivalent...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Morrison Company had the equivalent units schedule...Ch. 6 - Shorts Company has three process departments:...Ch. 6 - A local barbershop cuts the hair of 1,200...Ch. 6 - Friedman Company uses JIT manufacturing. There are...Ch. 6 - Lacy, Inc., produces a subassembly used in the...Ch. 6 - Softkin Company manufactures sun protection...Ch. 6 - Heap Company manufactures a product that passes...Ch. 6 - K-Briggs Company uses the FIFO method to account...Ch. 6 - The following data are for four independent...Ch. 6 - Using the data from Exercise 6.18, compute the...Ch. 6 - Holmes Products, Inc., produces plastic cases used...Ch. 6 - Dama Company produces womens blouses and uses the...Ch. 6 - Fordman Company has a product that passes through...Ch. 6 - Using the same data found in Exercise 6.22, assume...Ch. 6 - Baxter Company has two processing departments:...Ch. 6 - Tasty Bread makes and supplies bread throughout...Ch. 6 - Under either weighted average or FIFO, when...Ch. 6 - During the month of June, the mixing department...Ch. 6 - As goods are transferred from a prior process to a...Ch. 6 - During March, Hanks Manufacturing started and...Ch. 6 - Proteger Company manufactures insect repellant...Ch. 6 - Swasey Fabrication, Inc., manufactures frames for...Ch. 6 - Refer to the data in Problem 6.31. Assume that the...Ch. 6 - Hatch Company produces a product that passes...Ch. 6 - FIFO Method, Single Department Analysis, One Cost...Ch. 6 - Hepworth Credit Corporation is a wholly owned...Ch. 6 - Muskoge Company uses a process-costing system. The...Ch. 6 - Prob. 37PCh. 6 - Healthway uses a process-costing system to compute...Ch. 6 - FIFO Method, Two-Department Analysis Refer to the...Ch. 6 - Jacson Company produces two brands of a popular...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - Larkin Company produces leather strips for western...Ch. 6 - Novel Toys, Inc., manufactures plastic water guns....Ch. 6 - Prob. 44P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000. Required: 1. Assuming the use of the weighted average method, prepare a schedule of equivalent units. 2. Compute the unit cost for the month.arrow_forwardHolmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forwardNarwhal Swimwear has a beginning work in process inventory of 13,500 units and transferred in 130,000 units before ending the month with 14,000 units that were 100% complete with regard to materials and 30% complete with regard to conversion costs. The cost per unit of material is $5.80 and the cost per unit for conversion is $8.20 per unit. Using the weighted-average method, what is the amount of material and conversion costs assigned to the department for the month?arrow_forward

- During the month of June, the mixing department produced and transferred out 3,500 units. Ending work in process had 1,000 units, 40 percent complete with respect to conversion costs. There was no beginning work in process. The equivalent units of output for conversion costs for the month of June are: a. 3,500 b. 4,500 c. 3,900 d. 1,000arrow_forwardPetrini Products Co. has two departments: Mixing and Cooking. At the beginning of the month, Cooking had 4,000 units in process with costs of 8,600 from Mixing, and its own departmental costs of 500 for materials, 1,000 for labor, and 2,500 for factory overhead. During the month, 10,000 units were received from Mixing with a cost of 25,000. Cooking incurred costs of 4,250 for materials, 8,500 for labor, and 21,250 for factory overhead, and finished 12,000 units. At the end of the month, there were 2,000 units in process, one-half completed. Required: 1. Determine the unit cost for the month in Cooking. 2. Determine the adjusted weighted average unit cost for all units received from Mixing. 3. Determine the unit cost of goods finished. 4. Determine the accumulated cost of the goods finished and of the ending work in process. (Round unit costs to three decimal places.)arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

- The Converting Department of Worley Company had 2,400 units in work in process at the beginning of the period, which were 35% complete. During the period, 10,800 units were completed and transferred to the Packing Department. There were 1,900 units in process at the end of the period, which were 60% complete. Direct materials are placed into the process at the beginning of production. Determine the number of equivalent units of production with respect to direct materials and conversion costs.arrow_forwardAAA Appliances Inc. has two production departments. The nature of the process is such that no units remain in process in Finishing at the end of the period. At the beginning of the period, 10,000 units with a cost of 30,000 were transferred from Assembly to Finishing. Finishing incurred costs of 8,800 for materials, 7,200 for labor, and 8,800 for factory overhead, and finished 10,000 units during the month. a. Determine the unit cost for the month in Finishing. b. Determine the unit cost of the products transferred to finished goods.arrow_forwardUsing the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forward

- Chavez Concrete Inc. has two production departments. Blending had 1,000 units in process at the beginning of the period, two-fifths complete. During the period 7,800 units were received from Mixing, 8,200 units were transferred to the finished goods storeroom, and 600 units were in process at the end of the period, 1/3 complete. The cost of the beginning work in process was: The costs during the month were: 1. Using the data in E5-15, prepare a cost of production summary for the month ended January 31, 2016. 2. Prepare a journal entry to transfer the cost of the completed units from Blending to the finished goods storeroom.arrow_forwardClearwater Candy Co. had a cost per equivalent pound for the month of 4.56 for materials, 1.75 for labor, and 1.00 for overhead. During the month, 10,250 lb were completed and transferred to finished goods. The 3,200 lb in ending work in process were 100% complete as to materials and 60% complete as to labor and overhead. At the beginning of the month, 1,500 lb were in process, 100% complete as to materials and 50% complete as to labor and overhead. The beginning inventory had a cost of 8,775. Clearwater uses FIFO costing. Required: 1. Calculate the cost of the pounds completed and transferred to finished goods. 2. Calculate the cost of the ending work in process.arrow_forwardArdt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY