Concept explainers

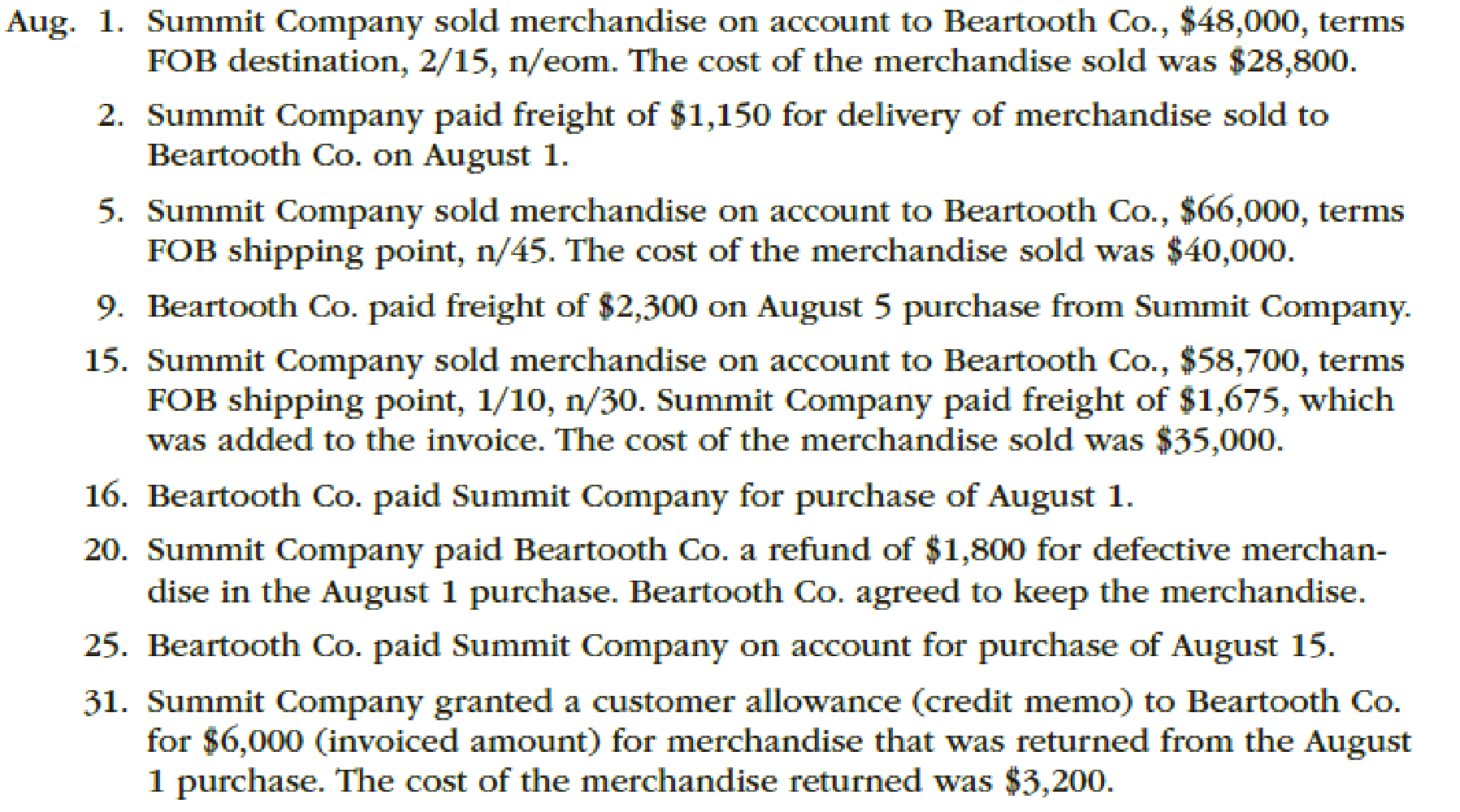

The following selected transactions were completed during August between Summit Company and Beartooth Co.:

Instructions

Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.

(1)

Prepare journal entries to record the transactions of Company S during the month of August using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System refers to the Merchandise Inventory system that maintains the detailed records of every Merchandise Inventory transactions related to purchases and sales on a continuous basis. It shows the exact on-hand-merchandise inventory at any point of time.

Journal entry: Journal is the book of original entry whereby all the financial transactions are recorded in chronological order. Under this method each transaction has two sides, debit side and credit side. Total amount of debit side must be equal to the total amount of credit side. In addition, it is the primary books of accounts for any entity to record the daily transactions and processed further till the presentation of the financial statements.

The following are the rules of debit and credit:

- 1. Increase in assets and expenses accounts are debited. Decrease in liabilities and stockholders’ equity accounts are debited.

- 2. Increase in liabilities, revenues, and stockholders’ equity accounts are credited. Decreases in all asset accounts are credited.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 1 | Accounts Receivable | 47,040 (1) | |

| Sales Revenue | 47,040 | ||

| (To record the sale of inventory on account) |

Table (1)

Working Note (1):

Calculate the amount of accounts receivable.

Sales = $48,000

Discount percentage = 2%

- Accounts receivable is an asset and it is increased by $47,040. Therefore, debit accounts receivable with $47,040.

- Sales revenue is revenue and it increases the value of equity by $47,040. Therefore, credit sales revenue with $47,040.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 1 | Cost of Merchandise Sold | 28,800 | |

| Merchandise Inventory | 28,800 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $28,800. Therefore, debit cost of merchandise sold account with $28,800.

- Merchandise Inventory is an asset and it is decreased by $28,800. Therefore, credit inventory account with $28,800.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 2 | Delivery expense | 1,150 | |

| Cash | 1,150 | ||

| (To record the payment of delivery expenses) |

Table (3)

- Delivery expense is an expense account and it decreases the value of equity by $1,150. Therefore, debit delivery expense account with $1,150.

- Cash is an asset and it is decreased by $1,150. Therefore, credit cash account with $1,150.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 5 | Accounts Receivable | 66,000 | |

| Sales Revenue | 66,000 | ||

| (To record the sale of inventory on account) |

Table (4)

- Accounts receivable is an asset and it is increased by $66,000. Therefore, debit accounts receivable with $66,000.

- Sales revenue is revenue and it increases the value of equity by $66,000. Therefore, credit sales revenue with $66,000.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 5 | Cost of Merchandise Sold | 40,000 | |

| Merchandise Inventory | 40,000 | ||

| (To record the cost of goods sold) |

Table (5)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $40,000. Therefore, debit cost of merchandise sold account with $40,000.

- Merchandise Inventory is an asset and it is decreased by $40,000. Therefore, credit inventory account with $40,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 15 | Accounts Receivable | 58,113 (2) | |

| Sales Revenue | 58,113 | ||

| (To record the sale of inventory on account) |

Table (6)

- Accounts receivable is an asset and it is increased by $58,113. Therefore, debit accounts receivable with $58,113.

- Sales revenue is revenue and it increases the value of equity by $58,113. Therefore, credit sales revenue with $58,113.

Working Note (2):

Calculate the amount of accounts receivable.

Sales = $58,700

Discount percentage = 1%

Record the journal entry for the freight paid.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 15 | Accounts Receivable | 1,675 | |

| Cash | 1,675 | ||

| (To record the freight paid) |

Table (7)

- Accounts receivable is an asset and it is increased by $1,675. Therefore, debit accounts receivable with $1,675.

- Cash is an asset and it is decreased by $1,675. Therefore, credit cash account with $1,675.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 15 | Cost of Merchandise Sold | 35,000 | |

| Merchandise Inventory | 35,000 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $35,000. Therefore, debit cost of merchandise sold account with $35,000.

- Merchandise Inventory is an asset and it is decreased by $35,000. Therefore, credit inventory account with $35,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 16 | Cash | 47,040 | |

| Accounts Receivable | 47,040 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $47,040. Therefore, debit cash account with $47,040.

- Accounts Receivable is an asset and it is increased by $47,040. Therefore, debit accounts receivable with $47,040.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 20 | Customer Refunds Payable | 1,800 | ||

| Cash | 1,800 | |||

| (To record sales returns) |

Table (10)

- Customer refunds payable is a liability account and it is decreased by $1,800. Therefore, debit customer refunds payable account with $1,800.

- Accounts Receivable is an asset and it is decreased by $1,800. Therefore, credit account receivable with $1,800.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 25 | Cash | 59,788 (3) | |

| Accounts Receivable | 59,788 | ||

| (To record the receipt of cash against accounts receivables) |

Table (11)

- Cash is an asset and it is increased by $59,788. Therefore, debit cash account with $59,788.

- Accounts Receivable is an asset and it is increased by $59,788. Therefore, debit accounts receivable with $59,788.

Working Note (3):

Calculation the amount of cash receipt.

Net accounts receivable = $58,113

Accounts receivable for freight paid = $1,675

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 31 | Customer Refunds Payable | 5,880 (4) | ||

| Accounts Receivable | 5,880 | |||

| (To record sales returns) |

Table (12)

- Customer refunds payable is a liability account and it is decreased by $5,880. Therefore, debit customer refunds payable account with $5,880.

- Accounts Receivable is an asset and it is decreased by $5,880. Therefore, credit account receivable with $5,880.

Working Note (4):

Calculate the amount of refund owed to the customer.

Sales return = $6,000

Discount percentage = 2%

Record the journal entry for the return of the merchandise.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 31 | Merchandise Inventory | 3,200 | |

| Estimated Returns Inventory | 3,200 | ||

| (To record the return of the merchandise) |

Table (13)

- Merchandise Inventory is an asset and it is increased by $3,200. Therefore, debit inventory account with $3,200.

- Estimated returns inventory is an expense account and it increases the value of equity by $3,200. Therefore, credit estimated returns inventory account with $3,200.

(2)

Prepare journal entries to record the transactions of Company B during the month of August using perpetual inventory system.

Explanation of Solution

Record the journal entry of Company B during August.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 1 | Merchandise Inventory | 47,040 | ||

| Accounts payable | 47,040 | |||

| (To record purchase on account) |

Table (14)

- Merchandise Inventory is an asset and it is increased by $47,040. Therefore, debit Merchandise Inventory account with $47,040.

- Accounts payable is a liability and it is increased by $47,040. Therefore, credit accounts payable account with $47,040.

Record the journal entry of Company B during August.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 5 | Merchandise Inventory | 66,000 | ||

| Accounts payable | 66,000 | |||

| (To record purchase on account) |

Table (15)

- Merchandise Inventory is an asset and it is increased by $66,000. Therefore, debit Merchandise Inventory account with $66,000.

- Accounts payable is a liability and it is increased by $66,000. Therefore, credit accounts payable account with $66,000.

Record the journal entry of Company B during August.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 9 | Merchandise Inventory | 2,300 | ||

| Cash | 2,300 | |||

| (To record freight paid) |

Table (16)

- Merchandise Inventory is an asset and it is increased by $2,300. Therefore, debit Merchandise Inventory account with $2,300.

- Cash is an asset and it is decreased by $2,300. Therefore, credit cash account with $2,300.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 15 | Merchandise Inventory | 59,788 | ||

| Accounts payable | 59,788 (5) | |||

| (To record purchase on account) |

Table (17)

Working Note (5):

Calculate the amount of accounts payable.

Purchases = $58,700

Discount percentage = 1%

Freight charges = $1,675

- Merchandise Inventory is an asset and it is increased by $59,788. Therefore, debit Merchandise Inventory account with $59,788.

- Accounts payable is a liability and it is increased by $59,788. Therefore, credit accounts payable account with $59,788.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 16 | Accounts payable | 47,040 | ||

| Cash | 47,040 | |||

| (To record payment made in full settlement less discounts) |

Table (18)

- Accounts payable is a liability and it is decreased by $47,040. Therefore, debit accounts payable account with $47,040.

- Cash is an asset and it is decreased by $47,040. Therefore, credit cash account with $47,040.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 20 | Cash | 1,800 | ||

| Merchandise Inventory | 1,800 | |||

| (To record purchase return) |

Table (19)

- Cash is an asset and it is increased by $1,800. Therefore, debit cash account with $1,800.

- Merchandise Inventory is an asset and it is decreased by $1,800. Therefore, credit Merchandise Inventory account with $1,800.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 25 | Accounts payable | 59,788 | ||

| Cash | 59,788 | |||

| (To record payment made in full settlement less discounts) |

Table (20)

- Accounts payable is a liability and it is decreased by $59,788. Therefore, debit accounts payable account with $59,788.

- Cash is an asset and it is decreased by $59,788. Therefore, credit cash account with $59,788.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 31 | Accounts payable | 5,880 (6) | ||

| Merchandise Inventory | 5,880 | |||

| (To record purchase return) |

Table (21)

- Accounts payable is a liability and it is decreased by $5,880. Therefore, debit accounts payable account with $5,880.

- Merchandise Inventory is an asset and it is decreased by $5,880. Therefore, credit Merchandise Inventory account with $5,880.

Working Note (6):

Calculate the amount of accounts payable.

Purchases return = $6,000

Discount percentage = 2%

Want to see more full solutions like this?

Chapter 6 Solutions

Financial Accounting

- The following selected transactions were completed during August between Summit Company and Beartooth Co.: Instructions Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.arrow_forwardThe following were selected from among the transactions completed by Essex Company during July of the current year: Instructions Journalize the transactions.arrow_forwardThe following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forward

- The following selected transactions were completed during April between Swan Company and Bird Company: Instructions Journalize the April transactions for (1) Swan Company and (2) Bird Company.arrow_forwardThe following selected transactions were completed by Capers Company during October of the current year: Instructions Journalize the entries to record the transactions of Capers Company for October.arrow_forwardCedar Springs Company completed the following selected transactions during June 2016: Instructions Journalize the transactions.arrow_forward

- The financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forwardThe financial statements at the end of Wolverine Realtys first month of operations are as follows: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forward

- The transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardDuring the first month of operation, Graham Expeditions recorded the following transactions. Describe what has happened in each of the transactions (a) through (k).arrow_forwardA) Journalize the transaction of February 11, April 30, and August 22arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage