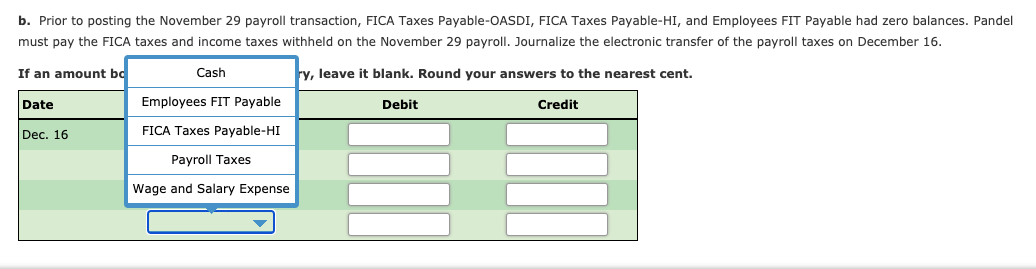

b. Prior to posting the November 29 payroll transaction, FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable had zero balances. Pandel must pay the FICA taxes and income taxes withheld on the November 29 payroll. Journalize the electronic transfer of the payroll taxes on December 16. If an amount bo Cash ry, leave it blank. Round your answers to the nearest cent. Date Employees FIT Payable Debit Credit Dec. 16 FICA Taxes Payable-HI Payroll Taxes Wage and Salary Expense

b. Prior to posting the November 29 payroll transaction, FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable had zero balances. Pandel must pay the FICA taxes and income taxes withheld on the November 29 payroll. Journalize the electronic transfer of the payroll taxes on December 16. If an amount bo Cash ry, leave it blank. Round your answers to the nearest cent. Date Employees FIT Payable Debit Credit Dec. 16 FICA Taxes Payable-HI Payroll Taxes Wage and Salary Expense

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.2.3P: Recording payroll and payroll taxes The following information about the payroll for the week ended...

Related questions

Question

The employees of Carson Bakery Company earn total wages of $7,780 during January. The total amount is taxable under FICA, FUTA, and SUTA. The state contribution rate for the company is 4.3%. The amount withheld for federal income taxes is $998.

Transcribed Image Text:b. Prior to posting the November 29 payroll transaction, FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable had zero balances. Pandel

must pay the FICA taxes and income taxes withheld on the November 29 payroll. Journalize the electronic transfer of the payroll taxes on December 16.

If an amount bo

Cash

ry, leave it blank. Round your answers to the nearest cent.

Date

Employees FIT Payable

Debit

Credit

Dec. 16

FICA Taxes Payable-HI

Payroll Taxes

Wage and Salary Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning