Concept explainers

Profitability strategies

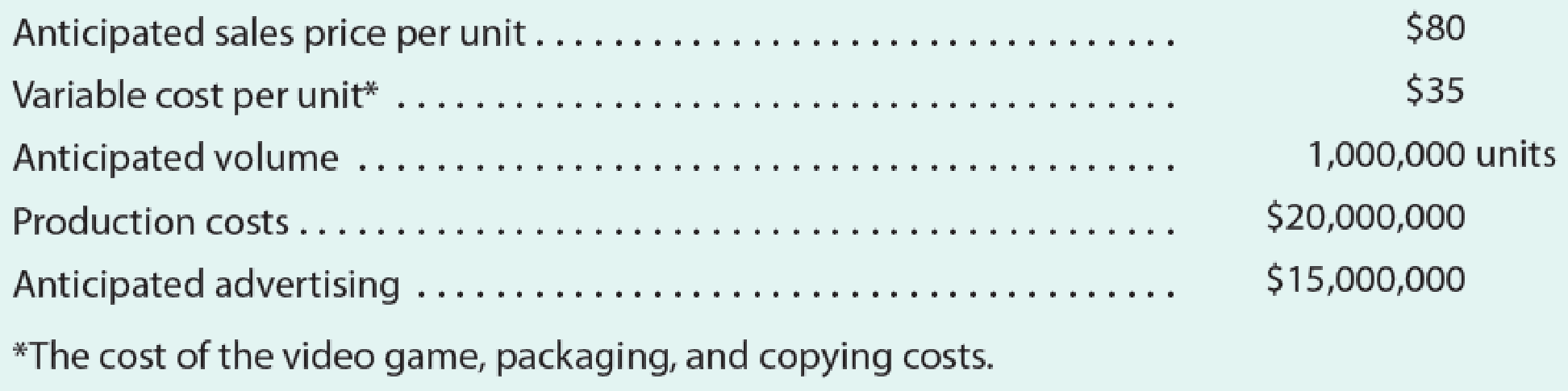

Somerset Inc. has finished a new video game, Snowboard Challenge. Management is now considering its marketing strategies. The following information is available:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

James: I think we need to think of some way to increase our profitability. Do you have any ideas?

Thomas: Well, I think the best strategy would be to become aggressive on price.

James: How aggressive?

Thomas: If we drop the price to $60 per unit and maintain our advertising budget at $15,000,000, I think we will generate total sales of 2,000,000 units.

James: I think that’s the wrong way to go. You’re giving up too much on price. Instead, I think we need to follow an aggressive advertising strategy.

Thomas: How aggressive?

James: If we increase our advertising to a total of $25,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price.

Thomas: I don’t think that’s reasonable. We’ll never cover the increased advertising costs.

Which strategy is best: Keep the price and advertising budget as set, follow the advice of Thomas Seymour, or follow the advice of James Hamilton?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting

- Video Tech is considering marketing one of two new video games for the coming holiday season: Battle Pacific or Space Pirates. Battle Pacific is a unique game and appears to have no competition. Estimated profits (in thousands of dollars) under high, medium, and low demand are as follows: Video Tech is optimistic about its Space Pirates game. However, the concern is that profitability will be affected by a competitor’s introduction of a video game viewed as similar to Space Pirates. Estimated profits (in thousands of dollars) with and without competition are as follows: Develop a decision tree for the Video Tech problem. For planning purposes, Video Tech believes there is a 0.6 probability that its competitor will produce a new game similar to Space Pirates. Given this probability of competition, the director of planning recommends marketing the Battle Pacific video game. Using expected value, what is your recommended decision? Show a risk profile for your recommended decision. Use sensitivity analysis to determine what the probability of competition for Space Pirates would have to be for you to change your recommended decision alternative.arrow_forwardSouthland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forwardEthical Situation: What Would You Do? Discussion Question As one of the newer district sales managers for a fast-growing technology company, you've asked your salespeople to give you three sales forecasts in their territories for the coming year: (a) optimistic, (b) pessimistic, and (c) most likely. After totaling their three different sales forecasts, you realize that the optimistic forecast will increase sales by nearly 20% in your district, the pessimistic forecast by 10%, and the most likely by about 15%. Your national sales manager has asked each district sales manager to give her their most likely sales forecast for the coming year, so she can assign sales quotas. Your thoughts are that it's probably best to give her the most pessimistic sales forecast because this should help ensure that she assigns your district a quota that you should easily achieve. If you can exceed your assigned district sales quota by a substantial amount, you'll probably get a large bonus, and you may…arrow_forward

- Suppose you are analyzing a firm that is successfully executing a strategy that differentiates its products from those of its competitors. Because of this strategy, you project that next year the firm will generate 6.0% revenue growth from price increases and 3.0% revenue growth from sales volume increases. Assume that the firms production cost structure involves strictly variable costs. (That is, the cost to produce each unit of product remains the same.) Should you project that the firms gross profit will increase next year? If you project that the gross profit will increase, is the increase a result of volume growth, price growth, or both? Should you project that the firms gross profit margin (gross profit divided by sales) will increase next year? If you project that the gross profit margin will increase, is the increase a result of volume growth, price growth, or both?arrow_forwardThe president of Poleski would like to know the effect that each of the following suggestions for improving performance would have on contribution margin per unit, sales needed to break even, and projected net income for next year. Each change should be considered independently. Reset the Data Section to its original values after each suggestion is analyzed. Fill in the table following the suggestions with the results of your analysis. a. The president suggests cutting the products price. Since the market is relatively sensitive to price, . . . a 10% cut in price ought to generate a 30% increase in sales (to 156,000 units). How can you lose? b. The sales manager feels that putting all sales personnel on straight commission would help. This would eliminate 77,000 in fixed sales salaries expense. Variable sales commissions would increase to 2.00 per unit. This move would also increase sales volume by 30%. c. Poleskis head of product engineering wants to redesign the package for the product. This will cut 1.00 per unit from direct materials and 0.50 per unit from direct labor, but will increase fixed factory overhead by 100,000 for additional depreciation on the new packaging machine. The package redesign would not affect sales volume. d. The firms consumer marketing manager suggests undertaking a new advertising campaign on Facebook. This would cost 30,000 more than is currently planned for advertising but would be expected to increase sales volume by 30%. e. The production superintendent suggests raising quality and raising price. This will increase direct materials by 1.00 per unit, direct labor by 0.50 per unit, and fixed factory overhead by 110,000. With improved quality, . . . raise the price to 18.50 and advertise the heck out of it. If you double your current planned advertising, Ill bet you can increase your sales volume by 30%.arrow_forwardVideo Tech Ltd manufactures video game machines. Market saturation and technological innovations have caused pricing pressures that have resulted in declining profits. To stem the slide in profits until new products can be introduced, top management has started to focus on achieving cost savings in manufacturing and increases in sales volume. Sales can be increased only if production volume increases. Therefore, an incentive program has been developed to reward those production managers who contribute to an increase in the number of units produced and achieve cost reductions. In addition, a just-in-time purchasing program has been implemented, and raw materials are purchased on an as-needed basis.The production managers have responded to the pressure to improve manufacturing performance and this has resulted in an increase in the number of completed units over normal production levels. The video game machines are put together by the assembly group, which requires parts from both the…arrow_forward

- Jacobs Inc. is a relatively new company that has established a position in the highly competitive biotechnology industry. Which of the following statements is correct regarding Jacobs’ profitability? Profits will increase when buyers have lower switching costs. Significant up-front capital requirements for new entrants will help Jacobs’ profit margins. Profitability is diminished when there are many suppliers. Rival firms willing to spend a lot of money on advertising will increase Jacobs’ profitsarrow_forwardConsider a company faced with a competitor's price reduction. Should the company also reduce price in order to maintain market share or should the company maintain its current price? The company has conducted some preliminary research showing the financial outcomes of each decision under two competitor responses: the competition maintains its price or the competition lowers its price further. The company feels pretty confident that the competitor cannot lower its price further and assigns that outcome a probability (p) of 0.8, which means the other outcome would have only a 20 percent chance of occurring (1-p=0.2). These outcomes are shown in the table below:arrow_forwardConsider a company faced with a competitor's price reduction. Should the company also reduce price in order to maintain market share or should the company maintain its current price? The company has conducted some preliminary research showing the financial outcomes of each decision under two competitor responses: the competition maintains its price or the competition lowers its price further. The company feels pretty confident that the competitor cannot lower its price further and assigns that outcome a probability (p) of 0.8, which means the other outcome would have only a 20 percent chance of occurring (1-p=0.2). These outcomes are shown in the table below:Competitive ResponseCompany action Maintain Price, p=0.8 Reduce Price, (1-p)=0.2Reduce Price $165,000 $125,000Maintain Price $175,000 $105,000The expected monetary value (EMV) of reducing the price isarrow_forward

- Eve Corporation is considering a significant expansion to its product line. The sales force is excited about the opportunities that the new products will bring. The new products are a significant step up in quality above the company’s current offerings but offer a complementary fit to its existing product line. Sergei Bates, senior production department manager, is very excited about the high-tech new equipment that will have to be acquired to produce the new products. Will Smith, the company’s CFO, has provided the following projections based on results with and without the new products. Without New Products With New Products Sales revenue $10,000,000 $16,000,000 Net income $500,000 $960,000 Average total assets $5,000,000 $12,000,000 Instructions a) Compute the company’s return on assets, profit margin, and asset turnover, both with and without the new product line. b) Discuss the implications that your findings in part (a) have for the company’s decision.arrow_forwardA furniture's store is considering tow marketing strategies: a loyalty program that would cost $3,000 and increase revenue by $15,000, or a seasonal sale that would cost $5,000 and increase revenue by $25,000. The store's contribution margin is 30%. Which strategy should they pursue if the goal is to maximize ROMI? What about if the goal is to maximize revenue growth?arrow_forwardSee questions 1 - 3 in image Question 4: If you were in Dell Havasi's position, would you accept or reject the new product? Question 5: Would the new line increase or decrease the company's overall ROI?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning