Concept explainers

Inventory Costing Methods

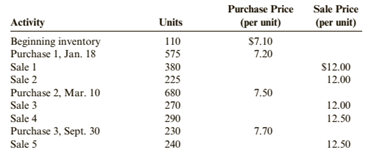

Crandall Distributors uses a perpetual inventory system and has the following data available for inventory, purchases, and sales for a recent year.

Required:

1. Compute the cost of ending inventory and the cost of goods sold using the specific identification method. Assume the ending inventory is made up of 40 units from beginning inventory, 30 units from Purchase 1, 80 units from Purchase 2, and 40 units from Purchase 3.

2. Compute the cost of ending inventory and cost of goods sold using the FIFO inventory costing method.

3. Compute the cost of ending inventory and cost of goods sold using the LIFO inventory costing method.

4. Compute the cost of ending inventory and cost of goods sold using the average cost inventory costing method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

5. CONCEPTUAL CONNECTION Compare the ending inventory and cost of goods sold computed under all four methods. What can you conclude about the effects of the inventory costing methods on the balance sheet and the income statement?

(a)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the specific identification method.

Answer to Problem 50E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

Calculation of Closing Inventory as per specific identification Method:

Under this method, closing inventory is provided to be valued.

| Closing inventory | Cost of Goods sold | |

| Total |

(b)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the FIFO.

Answer to Problem 50E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

(c)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the LIFO.

Answer to Problem 50E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Ending Inventory | Cost of Goods sold | |

| Total |

(d)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the average cost method.

Answer to Problem 50E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

As the fist two sales are done only from two purchases and beginning inventory and the third sale is done including all purchases. Hence, there will requirement of two average cost for computing the cost of goods sold.

| Closing inventory | Cost of Goods sold | |

| Total |

(e)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The comparison of ending inventory and cost of goods sold and comment the effects of these on income statement and balance sheet.

Answer to Problem 50E

The lowest cost of goods sold and the highest closing inventory gives a higher gross profit which is in FIFO method. The highest cost of goods sold and the lowest closing inventory gives lower gross profit which is in LIFO method. This affects the net income and balance sheet also.

Explanation of Solution

The comparisons of the four methods are as follows:

| Ending inventory | Cost of goods sold | |

| Specific identification | ||

| FIFO | ||

| LIFO | ||

| Average Cost |

As per above calculated table, it can be concluded that the FIFO method will give higher gross profits as compared to other methods as it has highest ending inventory and lowest cost of goods sold which also reflect as higher net income and higher asset side of balance sheet.

Likewise, there is opposite scenario in LIFO method. In the LIFO method, there will be lower gross profits as compared to other methods as it has lowest ending inventory and highest cost of goods sold which also reflect as lower net income and lower asset side of balance sheet.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting

- Alternative Inventory Methods Park Companys perpetual inventory records indicate the following transactions in the month of June: Required: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.) 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods? What do these amounts tell us about the purchase price of inventory during the year? 3. Next Level Which method produces the most realistic amount for net income? For inventory? Explain your answer. 4. Next Level If Park uses IFRS, which of the previous alternatives would be acceptable and why?arrow_forwardData on the physical inventory of Katus Products Co. as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost as well as at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item: 1. Draw a line through the quantity and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example.arrow_forwardLower-of-cost-or-market inventory Data on the physical inventory of Katus Products Co. as of December 31 follows: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost and also at the lower of cost or market applied on an item-by-item basis, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet, and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example.arrow_forward

- Alternative Inventory Methods Nevens Company uses a periodic inventory system. During November, the following transactions occurred: Required: 1. Compute the cost of goods sold for November and the inventory at the end of November for each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost 2. Next Level What can you conclude about the effects of the inventory cost flow assumptions on the financial statements?arrow_forwardFIFO perpetual inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. 2. Determine the total sales and the total cost of goods sold for the period. Journalize the entries in the sales and cost of goods sold accounts. Assume that all sales were on account. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost on June 30. 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower?arrow_forwardLower-of-cost-or-market inventory Data on the physical inventory of Ashwood Products Company as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost and also at the lower of cost or market applied on an item-by-item basis, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet, and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example.arrow_forward

- Data on the physical inventory of Ashwood Products Company as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost as well as at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the Lower of C or M column. The first item on the inventory sheet has been completed as an example.arrow_forwardLower-of-cost-or market inventory Data on the physical inventory of Moyer Company as of December 31, 20Y9, are presented below. Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost and at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on an inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed below as an example.arrow_forwardInventory Costing Methods Andersons Department Store has the following data for inventory, purchases, and sales of merchandise for December. Andersons uses a perpetual inventory system. All purchases and sales were for cash. Required: 1. Compute cost of goods sold and the cost of ending inventory using FIFO. 2. Compute cost of goods sold and the cost of ending inventory using LIFO. 3. Compute cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations.) 4. Prepare the journal entries to record these transactions assuming Anderson chooses to use the FIFO method. 5. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes?arrow_forward

- Calculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardPeriodic Inventory System Raynolde Company uses a periodic inventory system. At the end of the year, the following information is available: Required: Prepare a schedule to compute Raynoldes cost of goods sold.arrow_forwardCalculate the cost of goods sold dollar value for A65 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning