Concept explainers

Inventory Costing Methods

On June 1, Welding Products Company had a beginning inventory of 210 cases of welding rods that had been purchased for S88 per case. Welding Products purchased 1,150 cases at a cost of

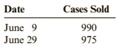

$95 per case on June 3. On June 19, the company purchased another 950 cases at a cost of $112 per case. Sales data for the welding rods are:

Welding Products uses a perpetual inventory system, and the sales price of the welding rods was $130 per case.

Required:

1. Compute the cost of ending inventory and cost of goods sold using the FIFO method.

2. Compute the cost of ending inventory and cost of goods sold using the LIFO method.

3. Compute the cost of ending inventory and cost of goods sold using the average cost method.

( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

4. CONCEPTUAL CONNECTION Assume that operating expenses are $21,600 and Welding

Products has a 30% tax rate. How much will the cash paid for income taxes differ among the three inventory methods?

5. CONCEPTUAL CONNECTION Compute Welding Products' gross profit ratio (rounded to two decimal places) and inventory turnover ratio (rounded to three decimal places) under each of the three inventory costing methods. How would the choice of inventory costing method affect these ratios?

(a)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the FIFO.

Answer to Problem 51E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

Total available units are:

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

(b)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the LIFO.

Answer to Problem 51E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

The given information is as follows:

Total available units are:

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Ending Inventory | Cost of Goods sold | |

| Total |

(c)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cost of ending inventory and the cost of goods sold using the average cost method.

Answer to Problem 51E

| Particular | |

| Cost of goods sold | |

| Closing inventory value |

Explanation of Solution

The given information is as follows:

The given information is as follows:

Total available units are:

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

As the fist two sales are done only from two purchases and beginning inventory and the third sale is done including all purchases. Hence, there will requirement of two average cost for computing the cost of goods sold.

| Closing inventory | Cost of Goods sold | |

| Total |

(d)

Inventory costing methods:

FIFO, LIFO and average cost method, are those method which used for calculation of closing inventory and cost of goods sold.

The cash paid for income as per three inventory costing methods.

Answer to Problem 51E

| FIFO |

LIFO |

Average Cost |

|

| Profit/ Loss before tax | |||

| Income Tax Expense | |||

| Net Income |

Explanation of Solution

The available information by calculating in the above parts as:

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

The computation of income before taxes, income tax expenses and net income as per three inventory costing methods are:

| FIFO |

LIFO |

Average Cost |

|

| Sales | |||

| Less: COGS | |||

| Gross Profit | |||

| Less: Operating Expenses | |||

| Profit/ Loss before tax | |||

| Less: Income Tax |

|||

| Net Income |

The lowest cash paid for income is in LIFO method.

(e)

Gross profit margin ratio:

The gross margin ratio is a type of profitability ratio which is used to measure the returns and earning after direct expenses and compute the ratio in respect to the sales of the business.

Inventory Turnover ratio:

The ratio which measures the efficiency of the company in managing their inventory by diving the cost of goods sold by the average inventory.

The gross margin ratio and inventory turnover ratio.

Answer to Problem 51E

| Particulars | FIFO | LIFO | Average Cost |

| Gross Profit Ratio | |||

| Inventory Turnover Ratio |

Explanation of Solution

The available information by calculating in the above parts as:

| Particular | |||

| Cost of goods sold | |||

| Closing inventory value |

The formula for computing the gross profit margin is:

The formula for computing inventory turnover ratio is:

| Particulars | FIFO | LIFO | Average Cost |

| Sales |

|||

| Less: Cost of goods sold |

|||

| Gross Profit |

|||

| Opening Inventory |

|||

| Closing Inventory |

|||

| Average Inventory |

|||

| Gross Profit Ratio |

|||

| Inventory Turnover Ratio |

By analyzing the above table, it can be said that FIFO has the highest gross margin ratio and LIFO has the highest inventory turnover ratio.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting

- Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of 250,000. During the year, it made 613,000 of net purchases. At the end of the year, a physical inventory showed it had ending inventory of 140,000. Calculate Reid Companys cost of goods sold for the year.arrow_forwardInventory Costing Methods VanderMeer Inc. reported the following information for the month of February: During February, VanderMeer sold 140 units. The company uses a periodic inventory system. Required What is the value of ending inventory and cost of goods sold for February under the following assumptions: Of the 140 units sold, 55 cost $20, 35 cost $22, 45 cost $23, and 5 cost $24. FIFO LIFO Weighted averagearrow_forwardCarla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.arrow_forward

- FIFO perpetual inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. 2. Determine the total sales and the total cost of goods sold for the period. Journalize the entries in the sales and cost of goods sold accounts. Assume that all sales were on account. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost on June 30. 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower?arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forwardComparison of Inventory Costing Methods—Periodic System Bitten Companys inventory records show 600 units on hand on October 1 with a unit cost of $5 each. The following transactions occurred during the month of October: All expenses other than cost of goods sold amount to $3,000 for the month. The company uses an estimated tax rate of 30% to accrue monthly income taxes. Required Prepare a chart comparing cost of goods sold and ending inventory using the periodic system and the following costing methods: What does the Total column represent? Prepare income statements for each of the three methods. Will the company pay more or less tax if it uses FIFO rather than LIFO? How much more or less?arrow_forward

- Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows: Purchases: Sales: The president of the company, Connie Kilmer, has asked for your advice on which inventory cost flow method should be used for the 32,000-unit physical inventory that was taken on December 31. The company plans to expand its product line in the future and uses the periodic inventory system. Write a brief memo to Ms. Kilmer comparing and contrasting the LIFO and FIFO inventory cost flow methods and their potential impacts on the companys financial statements.arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forwardOn January 1 of Year 1, Dorso Company adopted the dollar-value LIFO method of inventory costing. Dorsos December 31 ending inventory records are as follows: Year 1: Current cost, 20,000; Index, 100 Year 2: Current cost, 33,600; Index, 120 Using the dollar-value LIFO method, compute Dorsos December 31 ending inventory for Year 2.arrow_forward

- Jessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December.arrow_forwardLIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 6-1B. Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. 2. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period. 3. Determine the ending inventory cost on June 30.arrow_forwardInventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the following data available for inventory, purchases, and sales for a recent year. Required: 1. Compute the cost of ending inventory and the cost of goods sold using the specific identification method. Assume the ending inventory is made up of 40 units from beginning inventory, 30 units from Purchase 1, 80 units from Purchase 2, and 40 units from Purchase 3. 2. Compute the cost of ending inventory and cost of goods sold using the FIFO inventory costing method. 3. Compute the cost of ending inventory and cost of goods sold using the LIFO inventory costing method. 4. Compute the cost of ending inventory and cost of goods sold using the average cost inventory costing method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 5. CONCEPTUAL CONNECTION Compare the ending inventory and cost of goods sold computed under all four methods. What can you conclude about the effects of the inventory costing methods on the balance sheet and the income statement?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning