Concept explainers

Effects of Inventory Costing Methods

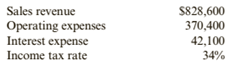

Jefferson Enterprises has the following income statement data available for 2019:

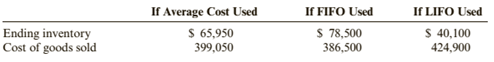

Jefferson uses a perpetual inventory accounting system and the average cost method. Jefferson is considering adopting the FIFO or LIFO method for costing inventory. Jefferson’s accountant prepared the following data:

Required:

1. Compute income before taxes, income taxes expense, and net income for each of the three inventory costing methods. (Round to the nearest dollar.)

2. CONCEPTUAL CONNECTION Why are the cost of goods sold and ending inventory amounts different for each of the three methods? What do these amounts tell us about the purchase price of inventory during the year?

3. CONCEPTUAL CONNECTION Which method produces the most realistic amount for net income? For inventory? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Cornerstones of Financial Accounting

- Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the following data available for inventory, purchases, and sales for a recent year. Required: 1. Compute the cost of ending inventory and the cost of goods sold using the specific identification method. Assume the ending inventory is made up of 40 units from beginning inventory, 30 units from Purchase 1, 80 units from Purchase 2, and 40 units from Purchase 3. 2. Compute the cost of ending inventory and cost of goods sold using the FIFO inventory costing method. 3. Compute the cost of ending inventory and cost of goods sold using the LIFO inventory costing method. 4. Compute the cost of ending inventory and cost of goods sold using the average cost inventory costing method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 5. CONCEPTUAL CONNECTION Compare the ending inventory and cost of goods sold computed under all four methods. What can you conclude about the effects of the inventory costing methods on the balance sheet and the income statement?arrow_forwardAlternative Inventory Methods Nevens Company uses a periodic inventory system. During November, the following transactions occurred: Required: 1. Compute the cost of goods sold for November and the inventory at the end of November for each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost 2. Next Level What can you conclude about the effects of the inventory cost flow assumptions on the financial statements?arrow_forwardRetail Inventory Method Turner Corporation uses the retail inventory method. The following information relates to 2019: Required: Compute the cost of the ending inventory under each of the following cost flow assumptions (round the cost-to-retail ratio to 3 decimal places): 1. FIFO 2. average cost 3. LIFO 4. lower of cost or market (based on average cost)arrow_forward

- ( Appendix 6B) Inventory Costing Methods Grencia Company uses a periodic inventory system. For 2018 and 2019, Grencia has the following data (assume all purchases and sales are for cash): Required: 1. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using FIFO. 2. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using LIFO. 3. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using the average cost method. ( Note: Use four decimal places for per unit calculations and round all other numbers to the nearest dollar.) 4. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes? 5. CONCEPTUAL CONNECTION Which method produces the most realistic amount for income? For inventory? Explain your answer. 6. CONCEPTUAL CONNECTION What is the effect of purchases made later in the year on the gross margin when LIFO is employed? When FIFO is employed? Be sure to explain why any differences occur. 7. CONCEPTUAL CONNECTION If you worked Problem 6-68B, compare your answers. What are the differences? Be sure to explain why any differences occurred.arrow_forwardThe following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 2019. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forwardInventory Write-Down The inventories of Berry Company for the years 2019 and 2020 are as follows: Berry uses a perpetual inventory system and the FIFO inventory cost flow assumption. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the necessary journal entries at the end of each year to record the correct inventory valuation if Berry uses the: a. direct method b. allowance method 2. Next Level Explain any differences in inventory valuation and income between the two methods.arrow_forward

- ( Appendix 6B) Inventory Costing Methods Jet Black Products uses a periodic inventory system. For 2018 and 2019, Jet Black has the following data: All purchases and sales are for cash. Required: 1. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using FIFO. 2. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using LIFO. 3. Compute cost of goods sold, the cost of ending inventory, and gross margin for each year using the average cost method. ( Note: Use four decimal places for per unit calculations and round all other numbers to the nearest dollar.) 4. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes? 5. CONCEPTUAL CONNECTION Which method produces the most realistic amount for income? For inventory? Explain your answer. 6. CONCEPTUAL CONNECTION What is the effect of purchases made later in the year on the gross margin when LIFO is employed? When FIFO is employed? Be sure to explain why any differences occur. 7. CONCEPTUAL CONNECTION If you worked Problem 6-68A, compare your answers. What are the differences? Be sure to explain why any differences occurred.arrow_forwardUse the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardInventory Costing: Average Cost Refer to the information for Filimonov Inc. and assume that the company uses a perpetual inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)arrow_forward

- LIFO and Inventory Pools On January 1, 2016, Grover Company changed its inventory cost flow method to the LIFO cost method from the FIFO cost method for its raw materials inventory. It made the change for both financial statement and income tax reporting purposes. Grover uses the multiple-pools approach under which it groups substantially identical raw materials into LIFO inventory pools. It uses weighted average costs in valuing annual incremental layers. The composition of the December 31, 2018, inventory for the Class F inventory pool is as follows: Inventory transactions for the Class F inventory pool during 2019 were as follows: On March 2, 2019, 4,800 units were purchased at a unit cost of 13.50 for 64,800. On September 1, 2019, 7,200 units were purchased at a unit cost of 14.00 for 100,800. A total of 15,000 units were used for production during 2019. The following transactions for the Class F inventory pool took place during 2020: On January 11, 2020, 7,500 units were purchased at a unit cost of 14.50 for 108,750. On May 14, 2020, 5,500 units were purchased at a unit cost of 15.50 for 85,250. On December 29, 2020, 7,000 units were purchased at a unit cost of 16.00 for 112,000. A total of 16,000 units were used for production during 2020. Required: 1. Prepare a schedule to compute the inventory (units and dollar amounts) of the Class F inventory pool at December 31, 2019. Show supporting computations in good form. 2. Prepare a schedule to compute the cost of Class F raw materials used in production for the year ended December 31, 2019. 3. Prepare a schedule to compute the inventory (units and dollar amounts) of the Class F inventory pool at December 31, 2020. Show supporting computations in good form.arrow_forwardUse the last-in, first-out method (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forwardCalculate the cost of goods sold dollar value for B74 Company for the sale on November 20, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College