Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System The following were selected from among the transactions completed by Harrison Company during November of the current year: Nov. 3. Purchased merchandise on account from Moonlight Co., list price $89,000, trade discount 20%, terms FOB destination, 2/10, n/30. 4. Sold merchandise for cash, $34,690. The cost of the merchandise sold was $24,670. 5. Purchased merchandise on account from Papoose Creek Co., $46,100, terms FOB shipping point, 2/10, n/30, with prepaid freight of $780 added to the invoice. 6. Returned $16,000 ($20,000 list price less trade discount of 20%) of merchandise purchased on November 3 from Moonlight Co. 8. Sold merchandise on account to Quinn Co., $14,740 with terms n/15. The cost of the merchandise sold was $8,660. 13. Paid Moonlight Co. on account for purchase of November 3, less return of November 6. 14. Sold merchandise on VISA, $235,120. The cost of the merchandise sold was $136,990. 15. Paid Papoose Creek Co. on account for purchase of November 5. 23. Received cash on account from sale of November 8 to Quinn Co. 24. Sold merchandise on account to Rabel Co., $62,600, terms 1/10, n/30. The cost of the merchandise sold was $34,960. 28. Paid VISA service fee of $3,340. 30. Paid Quinn Co. a cash refund of $1,490 for damaged merchandise from sale of November 8. Quinn Co. kept the merchandise.

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System The following were selected from among the transactions completed by Harrison Company during November of the current year: Nov. 3. Purchased merchandise on account from Moonlight Co., list price $89,000, trade discount 20%, terms FOB destination, 2/10, n/30. 4. Sold merchandise for cash, $34,690. The cost of the merchandise sold was $24,670. 5. Purchased merchandise on account from Papoose Creek Co., $46,100, terms FOB shipping point, 2/10, n/30, with prepaid freight of $780 added to the invoice. 6. Returned $16,000 ($20,000 list price less trade discount of 20%) of merchandise purchased on November 3 from Moonlight Co. 8. Sold merchandise on account to Quinn Co., $14,740 with terms n/15. The cost of the merchandise sold was $8,660. 13. Paid Moonlight Co. on account for purchase of November 3, less return of November 6. 14. Sold merchandise on VISA, $235,120. The cost of the merchandise sold was $136,990. 15. Paid Papoose Creek Co. on account for purchase of November 5. 23. Received cash on account from sale of November 8 to Quinn Co. 24. Sold merchandise on account to Rabel Co., $62,600, terms 1/10, n/30. The cost of the merchandise sold was $34,960. 28. Paid VISA service fee of $3,340. 30. Paid Quinn Co. a cash refund of $1,490 for damaged merchandise from sale of November 8. Quinn Co. kept the merchandise.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.3BE: Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as...

Related questions

Topic Video

Question

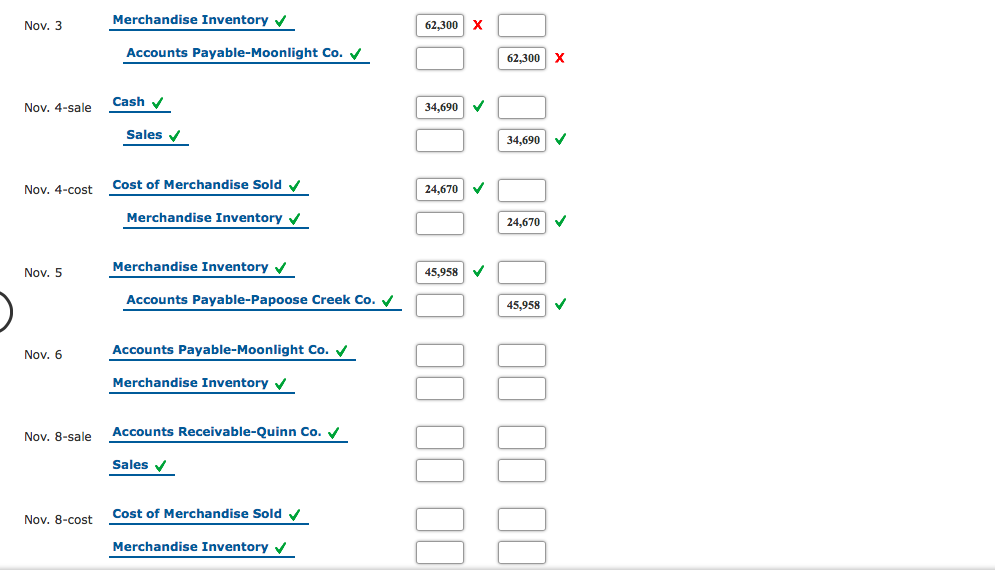

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System

The following were selected from among the transactions completed by Harrison Company during November of the current year:

| Nov. 3. | Purchased merchandise on account from Moonlight Co., list price $89,000, trade discount 20%, terms FOB destination, 2/10, n/30. |

| 4. | Sold merchandise for cash, $34,690. The cost of the merchandise sold was $24,670. |

| 5. | Purchased merchandise on account from Papoose Creek Co., $46,100, terms FOB shipping point, 2/10, n/30, with prepaid freight of $780 added to the invoice. |

| 6. | Returned $16,000 ($20,000 list price less trade discount of 20%) of merchandise purchased on November 3 from Moonlight Co. |

| 8. | Sold merchandise on account to Quinn Co., $14,740 with terms n/15. The cost of the merchandise sold was $8,660. |

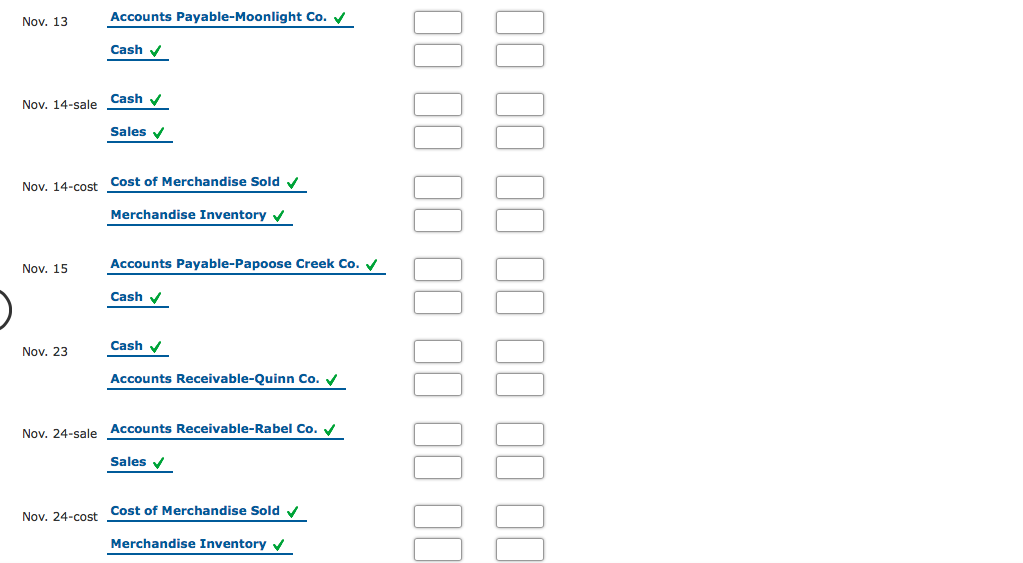

| 13. | Paid Moonlight Co. on account for purchase of November 3, less return of November 6. |

| 14. | Sold merchandise on VISA, $235,120. The cost of the merchandise sold was $136,990. |

| 15. | Paid Papoose Creek Co. on account for purchase of November 5. |

| 23. | Received cash on account from sale of November 8 to Quinn Co. |

| 24. | Sold merchandise on account to Rabel Co., $62,600, terms 1/10, n/30. The cost of the merchandise sold was $34,960. |

| 28. | Paid VISA service fee of $3,340. |

| 30. | Paid Quinn Co. a cash refund of $1,490 for damaged merchandise from sale of November 8. Quinn Co. kept the merchandise. |

Transcribed Image Text:Nov. 3

Merchandise Inventory V

62,300

Accounts Payable-Moonlight Co. V

62,300 X

Cash v

Nov. 4-sale

34,690

Sales v

34,690

Nov. 4-cost

Cost of Merchandise Sold v

24,670

Merchandise Inventory v

24,670 V

Nov. 5

Merchandise Inventory

45,958

Accounts Payable-Papoose Creek Co. V

45,958 V

Accounts Payable-Moonlight Co. V

Nov. 6

Merchandise Inventory V

Accounts Receivable-Quinn Co. V

Nov. 8-sale

Sales v

Nov. 8-cost

Cost of Merchandise Sold v

Merchandise Inventory v

I II 1I I1

Transcribed Image Text:Nov. 13

Accounts Payable-Moonlight Co. V

Cash v

Cash v

Nov. 14-sale

Sales v

Nov. 14-cost Cost of Merchandise Sold v

Merchandise Inventory v

Nov. 15

Accounts Payable-Papoose Creek Co. V

Cash v

Nov. 23

Cash v

Accounts Receivable-Quinn Co. V

Nov. 24-sale Accounts Receivable-Rabel Co. V

Sales

Nov. 24-cost Cost of Merchandise Sold

Merchandise Inventory v

I0 II II II II II II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning