Sales-Related and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System The following selected transactions were completed during April between Swan Company and Bird Company: Apr. 2. Swan Company sold merchandise on account to Bird Company, $14,100, terms FOB shipping point, 2/10, n/30. Swan Company paid freight of $345, which was added to the invoice. The cost of the merchandise sold was $8,900. 8. Swan Company sold merchandise on account to Bird Company, $22,000, terms FOB destination, 1/15, n/30. The cost of the merchandise sold was $13,200. 8. Swan Company paid freight of $780 for delivery of merchandise sold to Bird Company on April 8. 12. Bird Company paid Swan Company for purchase of April 2. 18. Swan Company paid Bird Company a refund of $2,000 for defective merchandise in the April 2 purchase. Bird Company agreed to keep the merchandise. 23. Bird Company paid Swan Company for purchase of April 8. 24. Swan Company sold merchandise on account to Bird Company, $8,900, terms FOB shipping point, n/45. The cost of the merchandise sold was $5,300. 26. Bird Company paid freight of $430 on April 24 purchase from Swan Company.

Sales-Related and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System The following selected transactions were completed during April between Swan Company and Bird Company: Apr. 2. Swan Company sold merchandise on account to Bird Company, $14,100, terms FOB shipping point, 2/10, n/30. Swan Company paid freight of $345, which was added to the invoice. The cost of the merchandise sold was $8,900. 8. Swan Company sold merchandise on account to Bird Company, $22,000, terms FOB destination, 1/15, n/30. The cost of the merchandise sold was $13,200. 8. Swan Company paid freight of $780 for delivery of merchandise sold to Bird Company on April 8. 12. Bird Company paid Swan Company for purchase of April 2. 18. Swan Company paid Bird Company a refund of $2,000 for defective merchandise in the April 2 purchase. Bird Company agreed to keep the merchandise. 23. Bird Company paid Swan Company for purchase of April 8. 24. Swan Company sold merchandise on account to Bird Company, $8,900, terms FOB shipping point, n/45. The cost of the merchandise sold was $5,300. 26. Bird Company paid freight of $430 on April 24 purchase from Swan Company.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 5E: Inventory Write-Down The following information is taken from Aden Companys records: Required: 1....

Related questions

Topic Video

Question

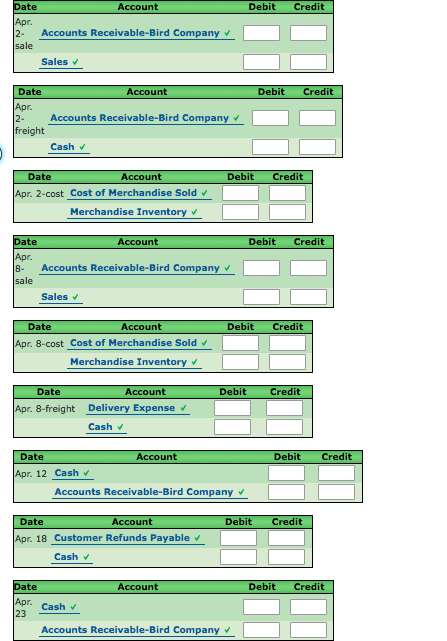

Sales-Related and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System

The following selected transactions were completed during April between Swan Company and Bird Company:

| Apr. 2. | Swan Company sold merchandise on account to Bird Company, $14,100, terms FOB shipping point, 2/10, n/30. Swan Company paid freight of $345, which was added to the invoice. The cost of the merchandise sold was $8,900. |

| 8. | Swan Company sold merchandise on account to Bird Company, $22,000, terms FOB destination, 1/15, n/30. The cost of the merchandise sold was $13,200. |

| 8. | Swan Company paid freight of $780 for delivery of merchandise sold to Bird Company on April 8. |

| 12. | Bird Company paid Swan Company for purchase of April 2. |

| 18. | Swan Company paid Bird Company a refund of $2,000 for defective merchandise in the April 2 purchase. Bird Company agreed to keep the merchandise. |

| 23. | Bird Company paid Swan Company for purchase of April 8. |

| 24. | Swan Company sold merchandise on account to Bird Company, $8,900, terms FOB shipping point, n/45. The cost of the merchandise sold was $5,300. |

| 26. | Bird Company paid freight of $430 on April 24 purchase from Swan Company. |

Transcribed Image Text:Date

Account

Debit

Credit

Apr.

2-

Accounts Receivable-Bird Company v

sale

Sales v

Date

Account

Debit

Credit

Apr.

2-

freight

Accounts Receivable-Bird Company v

Cash v

Date

Account

Debit

Credit

Apr. 2-cost Cost of Merchandise Sold v

Merchandise Inventory v

Date

Account

Debit

Credit

Apr.

8-

Accounts Receivable-Bird Company v

sale

Sales v

Date

Account

Debit

Credit

Apr. 8-cost Cost of Merchandise Sold v

Merchandise Inventory v

Date

Account

Debit

Credit

Apr. 8-freight Delivery Expense v

Cash v

Date

Account

Debit

Credit

Apr. 12 Cash v

Accounts Receivable-Bird Company v

Date

Account

Debit

Credit

Apr. 18 Customer Refunds Payable v

Cash v

Date

Account

Debit

Credit

Apr.

23

Cash v

Accounts Receivable-Bird Company v

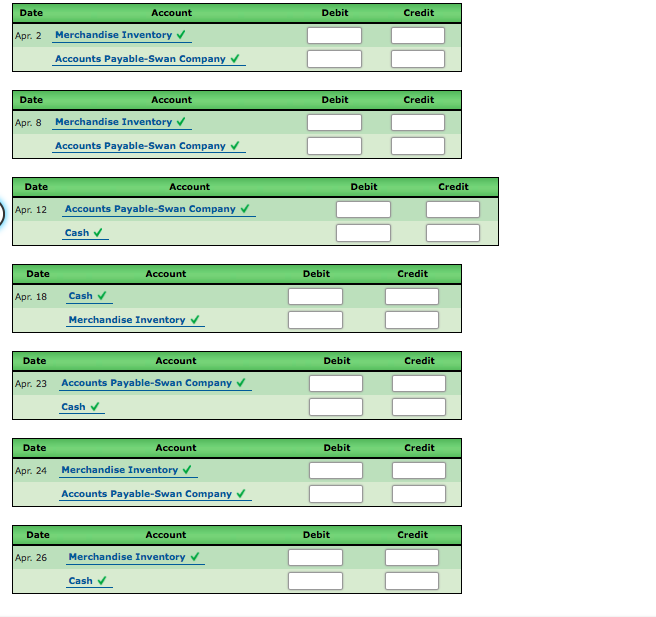

Transcribed Image Text:Date

Account

Debit

Credit

Apr. 2

Merchandise Inventory v

Accounts Payable-Swan Company v

Date

Account

Debit

Credit

Apr. 8

Merchandise Inventory v

Accounts Payable-Swan Company v

Date

Account

Debit

Credit

Apr. 12

Accounts Payable-Swan Company

Cash v

Date

Account

Debit

Credit

Apr. 18

Cash v

Merchandise Inventory v

Date

Account

Debit

Credit

Apr. 23

Accounts Payable-Swan Company v

Cash

Date

Account

Debit

Credit

Apr. 24

Merchandise Inventory v

Accounts Payable-Swan Company v

Date

Account

Debit

Credit

Apr. 26

Merchandise Inventory v

Cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning