Concept explainers

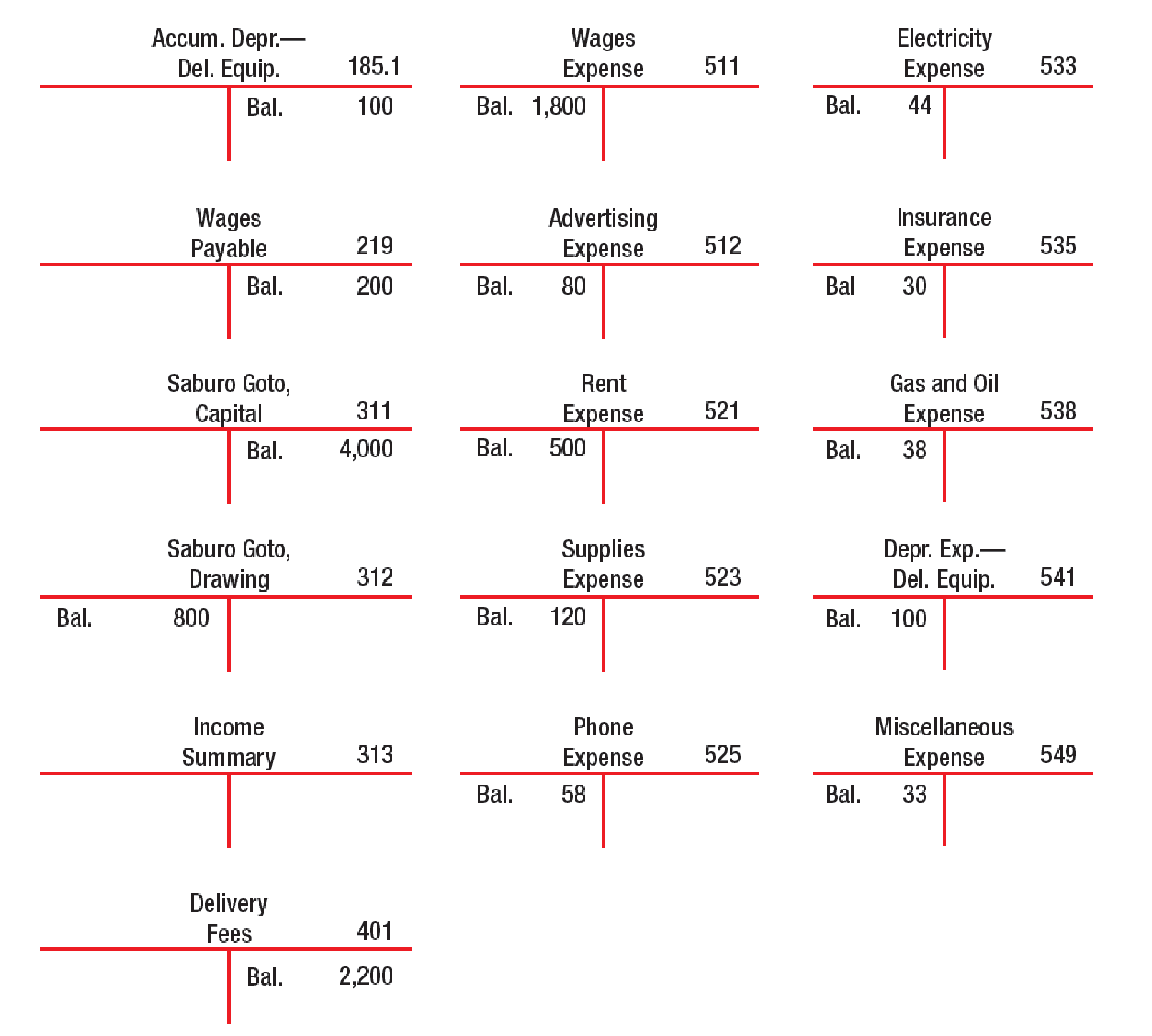

CLOSING ENTRIES (NET LOSS) Using the following partial listing of T accounts, prepare closing entries in general journal form dated January 31, 20--. Then

Prepare closing journal entries in general journal form and post those entries to the T accounts.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to permanent account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entries.

| Date | Accounts and Explanation |

Account Number |

Debit ($) | Credit ($) |

| June 30 | Referral fees (SE–) | 401 | 2,813 | |

| Income Summary (SE+) | 313 | 2,813 | ||

| (To close the revenue account.) | ||||

| June 30 | Income summary (SE–) | 313 | 2,987 | |

| Wages expense (SE+) | 511 | 1,080 | ||

| Advertising expense (SE+) | 512 | 34 | ||

| Rent expense (SE+) | 521 | 900 | ||

| Supplies expense (SE+) | 523 | 322 | ||

| Phone expense (SE+) | 525 | 133 | ||

| Utilities expense (SE+) | 533 | 102 | ||

| Insurance expense (SE+) | 535 | 120 | ||

| Gas and oil expense (SE+) | 538 | 88 | ||

| Depreciation expense (SE+) | 541 | 110 | ||

| Miscellaneous expense (SE+) | 549 | 98 | ||

| (To close the expense accounts.) | ||||

| June 30 | RZ, Capital (SE+) | 313 | 174 | |

| Income Summary (SE–) | 313 | 174 | ||

| (To close the income summary accounts) | ||||

| June 30 | RZ, Capital (SE–) | 311 | 2,000 | |

| RZ, Drawings (SE+) | 312 | 2,000 | ||

| (To close withdrawals account.) |

Table (1)

Working Note:

Calculate the amount of RZ capital (transferred).

Revenue account: In this closing entry, the referral fees account is closed by transferring the amount of referral fees account to Income summary account in order to bring the revenue account balance to zero. Hence, debit referral fees account and credit Income summary account.

Expense account: In this closing entry, all expense accounts are closed by transferring the amount of total expense to the Income summary account in order to bring the expense account balance to zero. Hence, debit the Income summary account and credit all expenses account.

Income summary account: Income summary account is a temporary account. This account is debited to close the net income value to RZ capital account.

RZ capital is a component of stockholders’ equity account. The value of RZ capital increased because net income is transferred. Therefore, it is credited.

Withdrawals account: RZ capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

RZ withdrawals are a component of owner’s equity. It is credited because the balance of owners’ withdrawals account is transferred to owners ‘capital account.

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Posting the closing entries to the T- account:

| Accumulated Depreciation | Account No – 181.1 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Ending balance | 110 | Beginning balance | 110 | |||

| Beginning balance | 110 | |||||

Table (2)

| Wages Payable | Account No - 219 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Ending balance | 260 | Beginning balance | 260 | |||

| Beginning balance | 260 | |||||

Table (3)

| RZ Capital | Account No – 311 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Income summary | 174 | Beginning balance | 6,000 | |||

| RZ Drawings | 2,000 | |||||

| Ending balance | 3,826 | |||||

| Beginning balance | 3,826 | |||||

Table (4)

| SG Drawings | Account No - 312 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 2,000 | RZ Capital | 2,000 | |||

| Total | 2,000 | Total | 2,000 | |||

Table (5)

| Income Summary | Account No - 313 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Total expense | 2,987 | Referral fees | 2,813 | |||

| RZ Capital | 174 | |||||

| Total | 2,987 | Total | 2,987 | |||

Table (6)

| Referral Fees | Account No - 401 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Income summary | 2,813 | Beginning balance | 2,813 | |||

| Total | 2,813 | Total | 2,813 | |||

Table (7)

| Wages Expense | Account No - 511 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 1,080 | Income summary | 1,080 | |||

| Total | 1,080 | Total | 1,080 | |||

Table (8)

| Advertising Expense | Account No - 512 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 34 | Income summary | 34 | |||

| Total | 34 | Total | 34 | |||

Table (9)

| Rent Expense | Account No - 521 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 900 | Income summary | 900 | |||

| Total | 900 | Total | 900 | |||

Table (10)

| Supplies Expense | Account No - 524 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 322 | Income summary | 322 | |||

| Total | 322 | Total | 322 | |||

Table (11)

| Phone Expense | Account No - 525 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 133 | Income summary | 133 | |||

| Total | 133 | Total | 133 | |||

Table (12)

| Utilities Expense | Account No - 533 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 102 | Income summary | 102 | |||

| Total | 102 | Total | 102 | |||

Table (13)

| Insurance Expense | Account No - 535 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 120 | Income summary | 120 | |||

| Total | 120 | Total | 120 | |||

Table (14)

| Gas and Oil Expense | Account No - 538 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 88 | Income summary | 88 | |||

| Total | 88 | Total | 88 | |||

Table (15)

| Depreciation Expense | Account No - 541 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 110 | Income summary | 110 | |||

| Total | 110 | Total | 110 | |||

Table (16)

| Miscellaneous Expense | Account No - 549 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 98 | Income summary | 98 | |||

| Total | 98 | Total | 98 | |||

Table (17)

Want to see more full solutions like this?

Chapter 6 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- Reconstruction of Closing Entries The following T accounts summarize entries made to selected general ledger accounts of Cooper $ Company. Certain entries, dated December 31, are closing entries. Prepare the closing entries that were made on December 31.arrow_forwardClosing Entries Lloyd Bookstore shows the following dividends, revenue, and expense account balances before closing: Required: Prepare closing entries.arrow_forwardCLOSING JOURNAL ENTRIES Prepare closing journal entries for Koehn Company for the year ended December 31. Data for the closing entries are as follows:arrow_forward

- From the following T accounts, journalize the closing entries dated December 31 for Baylor Company.arrow_forwardAfter the adjusting entries are recorded and posted and the financial statements have been prepared, you are ready to record the closing entries. Closing entries zero out the temporary owners equity accounts (revenue(s), expenses(s), and Drawing). This process transfers the net income or net loss and the withdrawals to the Capital account. In addition, the closing process prepares the records for the new fiscal period. Required 1. Journalize the dosing entries in the general journal. (If you are using Working Papers to prepare the closing entries, enter your transactions beginning on page 5.) 2. Post the closing entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a post-dosing trial balance as of October 31, 20--. Check Figures 1. Debit to Income Summary second entry, 12,023.25 2. Post-closing trial balance total, 37,420.00arrow_forwardAs of December 31, the end of the current year, the ledger of Harris Company contained the following account balances after adjustment. All accounts have normal balances. Journalize the closing entries.arrow_forward

- Closing entries; net income Based on the data presented in Exercise 5-27, journalize the closing entries.arrow_forwardIf Income from Services had a 20,400 credit balance before closing entries, which of the following would be the appropriate closing entry to close revenues?arrow_forwardCLOSING ENTRIES Using the spreadsheet and partially completed Income Summary Account on page 598, prepare the following: 1. Closing entries for Gimbels Gifts and Gadgets in a general journal. 2. A post-closing trial balance. EXERCISE 15-5Aarrow_forward

- CLOSING ENTRIES Using the spreadsheet and partially completed Income Summary Account on page 605 prepare the following: 1. Closing entries for Balloons and Baubbles in a general journal. 2. A post-closing trial balance. EXERCISE 15-5Barrow_forwardUse the following partial listing of T accounts to complete this exercise. 1. Prepare closing entries dated January 31, 20--. Do not enter the posting references until you have completed part 2. If an amount box does not require an entry, leave it blank. 2. Post the closing entries to the T accounts following the top-down journal entry order. If there is more than one closing entry for an account, enter in the order given in the journal above. Then, complete the posting for part 1. Closing Entries (Net Loss) Accum. Depr.—Delivery Equip 185.1 Bal. 100 Wages Payable 219 Bal. 200 Kylea Vasquez, Capital 311 Bal. 4,000 Kylea Vasquez, Drawing 312 Bal. 800 Income Summary 313 Delivery Fees 401 Bal. 2,200 Wages Expense 511 Bal. 1,710 Advertising Expense 512 Bal. 80 Rent Expense 521 Bal. 400 Supplies Expense 523 Bal. 120 Phone Expense 525 Bal. 58…arrow_forwardUse the following information to answer Exercises E5-23 through E5-25. The adjusted trial balance of Quality Office Systems at March 31, 2018, follows: Journalizing closing entries Requirements Journalize the required dosing entries at March 31, 2018. Set up T-accounts for Income Summary; Retained Earnings; and Dividends. Post the closing entries to the T-accounts, and calculate their ending balances. How much was Quality Office’s net income or net loss?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub