Inventory Costing and LCM

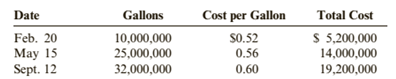

Ortman Enterprises sells a chemical used in various manufacturing processes. On January 1, 2019, Ortman had 5,000,000 gallons on hand, for which it had paid $0.50 per gallon. During 2019, Ortman made the following purchases:

During 2019, Ortman sold 65 000,000 gallons at $0.75 per gallon (35,000,000 gallons were sold on June 29 and 30,000,000 gallons were sold on Nov. 22), leaving an ending inventory of 7,000,000 gallons. Assume that Ortman uses a perpetual inventory system. Ortman uses the lower of cost or market for its inventories, as required by generally accepted accounting principles.

Required:

1. Assume that the market value of the chemical is $0.76 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

2. Assume that the market value of the chemical is $0.58 per gallon on December 31, 2019. Compute the cost of ending inventory using the FIFO and average cost methods, and then apply LCM. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)

(a)

Lower of cost or market value:

Usually the businesses follow the historical cost principle in which the inventory is valued at the cost of the purchase. But in some instances, it has been seen that the market value falls below the cost due to its obsolescence or damaged nature. In those cases, the businesses follow the principle to value the inventory at lower of cost or market value.

The cost of ending inventory using the FIFO and other cost methods and then apply LCM with given market value of

Answer to Problem 70APSA

| Particular | |||

| Closing inventory value |

Explanation of Solution

The given information for the year

Total available gallons are:

The given market value in the question is of

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory are

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

(b)

Lower of cost or market value:

Usually the businesses follow the historical cost principle in which the inventory is valued at the cost of the purchase. But in some instances, it has been seen that the market value falls below the cost due to its obsolescence or damaged nature. In those cases, the businesses follow the principle to value the inventory at lower of cost or market value.

The cost of ending inventory using the FIFO and other cost methods and then apply LCM with given market value of

Answer to Problem 70APSA

| Particular | |||

| Closing inventory value |

Explanation of Solution

The given information for the year

Total available gallons are:

The given market value in the question is of

Calculation of Closing Inventory as per FIFO Method:

Under this method, which material purchased first, issued first for production. However closing inventory includes last purchased materials in stock. Due to latest purchase in closing inventory, higher value of latest purchase effects cost of goods sold as lower and profit margin will be high.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

Calculation of closing inventory as per LIFO Method:

Under this method, which material purchased last, issued first for production. However closing inventory includes earliest purchased material in stock. Due to earliest purchase material in stock, lower value of earliest purchased effects cost of goods sold as high and profit margin will be lower.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory are

Calculation of closing inventory as per weighted average method:

Under this method, average cost per unit of inventory is calculated and closing inventory value is to be calculated on that basis. Average cost of inventory is changed on purchase high or low. However we follow indirect method of average cost to calculate closing inventory.

| Closing inventory | Cost of Goods sold | |

| Total |

As the cost of closing inventory is

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Financial Accounting

- Inventory Pools Stone Shoe Company adopted dollar-value LIFO on January 1, 2019. The company produces four products and uses a single inventory pool. The companys beginning inventory consists of the following: During 2019, the company has the following purchases and sales: Required: 1. Compute the dollar-value LIFO cost of the ending inventory. Round the cost index to 4 decimal places and all other amounts to the nearest dollar. 2. Next Level By how much would the companys gross profit differ if it had used four pools instead of a single pool?arrow_forwardComprehensive The following information for 2019 is available for Marino Company: 1. The beginning inventory is 100,000. 2. Purchases returns of 4,000 were made. 3. Purchases of 300,000 were made on terms of 2/10, n/30. Eighty percent of the discounts were taken. 4. At December 31, purchases of 20,000 were in transit, FOB destination, on terms of 2/10, n/30. 5. The company made sales of 640,000. The gross selling price per unit is twice the net cost of each unit sold. 6. Sales allowances of 6,000 were made. 7. The company uses the LIFO periodic method and the gross method for purchase discounts. Required: 1. Compute the cost of the ending inventory before the physical inventory is taken. 2. Compute the amount of the cost of goods sold that came from the purchases of the period and the amount that came from the beginning inventory.arrow_forwardWebster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X, Y, and Z. Websters beginning inventory consisted of the following: During 2019, Webster had the following purchases and sales: Required: 1. Compute the LIFO cost of the ending inventory assuming Webster uses a single inventory pool. Round cost index to 4 decimal places. 2. Compute the LIFO cost of the ending inventory assuming Webster uses three inventory pools. Round cost indexes to 4 decimal places.arrow_forward

- Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases of welding rods that had been purchased for S88 per case. Welding Products purchased 1,150 cases at a cost of $95 per case on June 3. On June 19, the company purchased another 950 cases at a cost of $112 per case. Sales data for the welding rods are: Welding Products uses a perpetual inventory system, and the sales price of the welding rods was $130 per case. Required: 1. Compute the cost of ending inventory and cost of goods sold using the FIFO method. 2. Compute the cost of ending inventory and cost of goods sold using the LIFO method. 3. Compute the cost of ending inventory and cost of goods sold using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 4. CONCEPTUAL CONNECTION Assume that operating expenses are $21,600 and Welding Products has a 30% tax rate. How much will the cash paid for income taxes differ among the three inventory methods? 5. CONCEPTUAL CONNECTION Compute Welding Products' gross profit ratio (rounded to two decimal places) and inventory turnover ratio (rounded to three decimal places) under each of the three inventory costing methods. How would the choice of inventory costing method affect these ratios?arrow_forwardRefer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forwardAt December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600arrow_forward

- The cost of the inventory on January 31, 2019, under the FIFO method is: a. 400 b. 2,700 c. 3,100 d. 3,200arrow_forwardShaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille's cost of goods sold for the current year.arrow_forwardOn January 5, 2019, ShoeKing Corp. sells for cash 500 pairs of volleyball shoes to FootAction, a shoe retailer, for 70 each. FootAction has the right to return the shoes for any reason up to March 31, 2019, for a full refund. The cost of each pair of shoes is 32. ShoeKing predicts that it is probable that 40 pairs of the shoes will be returned. ShoeKing uses the perpetual method for inventory. Required: 1. Prepare ShoeKings journal entry on January 5, 2019, to account for this transaction. 2. Assume that FootAction returns 35 pairs of shoes on March 31, 2019. Prepare the journal entry to record this return.arrow_forward

- Assume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forwardGoods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was shipped FOB destination, and the second for 4,000 was shipped FOB shipping point. Neither purchase had been received nor paid for on December 31, 2019. Required: Which of these purchases, if either, does Gravais include in inventory on December 31, 2019? What is the cost?arrow_forwardThe moving average inventory cost flow assumption is applicable to which of the following inventory systems? Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College