Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 10CE

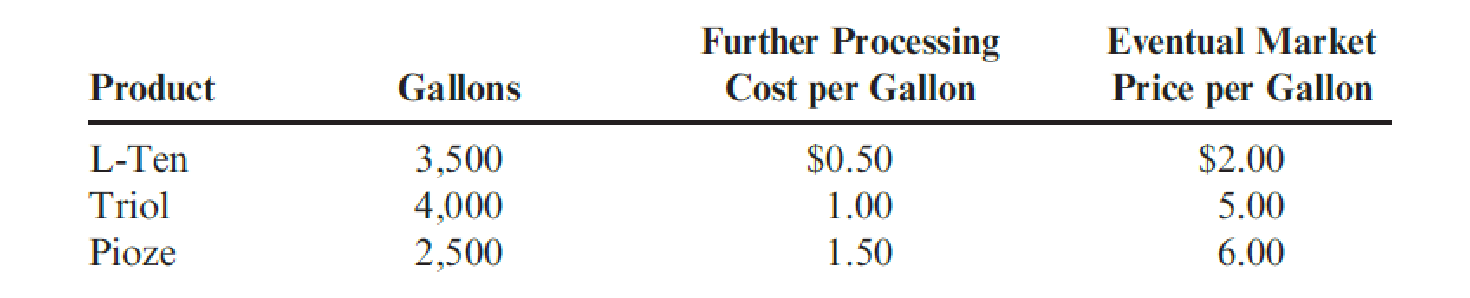

A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs $12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows:

Required:

- 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. (Round the percentages to four significant digits. Round all cost allocations to the nearest dollar.)

- 2. What if it cost $2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Allison, Inc., produces two products, X and Y, in a single joint process. Last month the joint costs were $75,000 when 10,000 units of Product X and 15,000 units of Product Y were produced. Addi-tional processing costs were $15,000 for Product X and $10,000 for Product Y. Product X sells for $10, and Product Y sells for $5.

The joint cost allocations to Products X and Y using the net realizable value method would be:

Group of answer choices

$42,500 $32,500

$30,000 $45,000

$42,857 $32,143

$45,000 $30,000

none of the above.

Flag question: Question 2

Question 23 pts

The joint cost allocations to Products X and Y using the physical units method would be:

Group of answer choices

$30,000 $45,000

$42,500 $32,500

$42,857 $32,143

$45,000 $30,000

none of the above.

Flag question: Question 3

Question 33 pts

The joint cost allocations to Products X and Y using the constant gross margin percentage method would be:

Group of answer choices

$42,143…

The XYZ Corp. manufactures pots, pans, and bowls from a joint process. May production is 4,000 pots, 7,000 pans, and 8,000 bowls. Respective per unit selling prices at split-off are $15, $10, $5. Joint costs up to the split-off point are $75,000. If joint costs are allocated based upon the sales (market) value at split-off, what amount of joint costs will be allocated to the pots?

Integrity Company manufactures two products, Alpha and Beta from a joint process. One production run costs P20,000 and results in 3,000 units of Alpha and 4,000 units of Beta. Neither product is salable at split-off but must be processed further such that the separable cost for Alpha is P10 per unit and for Beta is P5 per unit. The eventual market price for Alpha is P20 and for Beta, P10. If the company uses the constant gross margin approach in allocating joint cost to joint products, determine the total cost of product Alpha.

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 7 - Describe the two-stage allocation process for...Ch. 7 - Why must support service costs be assigned to...Ch. 7 - Explain how allocation of support service costs is...Ch. 7 - Prob. 4DQCh. 7 - Explain how allocating support service costs will...Ch. 7 - Prob. 6DQCh. 7 - Explain why it is better to allocate budgeted...Ch. 7 - Why is it desirable to allocate variable costs and...Ch. 7 - Explain why either normal or peak capacity of the...Ch. 7 - Explain why variable bases should not be used to...

Ch. 7 - Prob. 11DQCh. 7 - Explain the difference between the direct method...Ch. 7 - The reciprocal method of allocation is more...Ch. 7 - What is a joint cost? How does it relate to...Ch. 7 - How do joint costs differ from other common costs?Ch. 7 - The expected costs for the Maintenance Department...Ch. 7 - Prob. 2CECh. 7 - Valron Company has two support departments, Human...Ch. 7 - Refer to Cornerstone Exercise 7.3. Now assume that...Ch. 7 - Refer to Cornerstone Exercise 7.3. Now assume that...Ch. 7 - Refer to Cornerstone Exercise 7.3 and solve for...Ch. 7 - Orchard Fresh, Inc., purchases apples from local...Ch. 7 - Refer to Cornerstone Exercise 7.7. Assume that...Ch. 7 - Refer to Cornerstone Exercise 7.7. Assume that...Ch. 7 - A company manufactures three products, L-Ten,...Ch. 7 - Refer to Cornerstone Exercise 7.10. (Round...Ch. 7 - Classify each of the following departments in a...Ch. 7 - Prob. 13ECh. 7 - Identify some possible causal factors for the...Ch. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Kumar, Inc., evaluates managers of producing...Ch. 7 - Refer to the data in Exercise 7.18. When the...Ch. 7 - Jasmine Company manufactures both pesticide and...Ch. 7 - Refer to the data in Exercise 7.20. The company...Ch. 7 - Eilers Company has two producing departments and...Ch. 7 - Refer to the data in Exercise 7.22. The company...Ch. 7 - Refer to the data in Exercise 7.22. The support...Ch. 7 - Alomar Company manufactures four products from a...Ch. 7 - Refer to Exercise 7.25 and allocate the joint...Ch. 7 - Pacheco, Inc., produces two products, overs and...Ch. 7 - Minor Co. has a job order cost system and applies...Ch. 7 - A CPA would recommend changing from plantwide...Ch. 7 - A company uses charging rates to allocate service...Ch. 7 - Chester Company provided information on overhead...Ch. 7 - Which of the following statements is true? a. The...Ch. 7 - Biotechtron, Inc., has two research laboratories...Ch. 7 - AirBorne is a small airline operating out of...Ch. 7 - Duweynie Pottery, Inc., is divided into two...Ch. 7 - Macalister Corporation is developing departmental...Ch. 7 - Prob. 37PCh. 7 - Welcome Inns is a chain of motels serving business...Ch. 7 - Sonimad Sawmill, Inc. (SSI), purchases logs from...Ch. 7 - Prob. 40P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forwardPacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were 50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, 18,000; unders, 23,040. Overs sell for 2.00 per unit; unders sell for 3.14 per unit. Required: 1. Allocate the 50,000 joint costs using the estimated net realizable value method. 2. Suppose that overs could be sold at the split-off point for 1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations.arrow_forwardBreegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of 22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit? a. B-40 only b. J-60 only c. H-102 only d. B-40 and H-102 onlyarrow_forward

- LeMoyne Manufacturing Inc.’s joint cost of producing 2,000 units of Product X, 1,000 units of Product Y, and 1,000 units of Product Z is $50,000. The unit sales values of the three products at the split-off point are Product X–$30, Product Y–$100, and Product Z–$90. Ending inventories include 200 units of Product X, 300 units of Product Y, and 100 units of Product Z. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales values at split-off. Assume that Product Z can be sold for $120 a unit if it is processed after split-off at a cost of $10 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forwardVenezuela Oil Inc. transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and by-product base oil. The base oil is sold at the split-off point for $1,000,000 of annual revenue, and the joint processing costs to get the crude oil to split-off are $10,000,000. Additional information includes: Required: Determine the allocation of joint costs using the net realizable value method, rounding the sales value percentages to the nearest tenth of a percent. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)arrow_forwardMan OFort Inc. produces two different styles of door handles, standard and curved. The door handles go through a joint production molding process costing 29,000 per batch and producing 2,000 standard door handles and 1,000 curved door handles at the split-off point. Both door handles undergo additional production processes after the split-off point, but could be sold at that point: the standard style for 4 per door handle and the curved style for 2 per door handle. Determine the amount of joint production costs allocated to each style of door handle using the market value at split-off method.arrow_forward

- Laramie Industries produces two joint products, H and C. Prior to the split-off point, the company incurred costs of $66,000. Product H weighs 44 pounds and product C weighs 66 pounds. Product H sells for $250 per pound and product C sells for $295 per pound. Based on a physical measure of output, allocate joint costs to products H and C.arrow_forwardClarion Industries produces two joint products, Y and Z. Prior to the split-off point, the company incurred costs of $36,000. Product Y weighs 25 pounds and product Z weighs 75 pounds. Product Y sells for $150 per pound and product Z sells for $125 per pound. Based on a physical measure of output, allocate joint costs to products Y and Z.arrow_forwardEagle Brand Inc. produces two products as follows: Eagle Brand has 1,000 lbs. of raw materials that can be used to produce Products X and Y. Which of the following alternatives should Eagle Brand accept to maximize the contribution margin? a. 100 units of Product Y. b. 250 units of Product X. c. 200 units of Product X and 20 units of Product Y. d. 200 units of Product X and 50 units of Product Y.arrow_forward

- Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forwardMorrill Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. Includes depreciation. The density gauge uses a subassembly that is purchased from an external supplier for 25 per unit. Each quarter, 2,000 subassemblies are purchased. All units produced are sold, and there are no ending inventories of subassemblies. Morrill is considering making the subassembly rather than buying it. Unit-level variable manufacturing costs are as follows: No significant non-unit-level costs are incurred. Morrill is considering two alternatives to supply the productive capacity for the subassembly. 1. Lease the needed space and equipment at a cost of 27,000 per quarter for the space and 10,000 per quarter for a supervisor. There are no other fixed expenses. 2. Drop the thickness gauge. The equipment could be adapted with virtually no cost and the existing space utilized to produce the subassembly. The direct fixed expenses, including supervision, would be 38,000, 8,000 of which is depreciation on equipment. If the thickness gauge is dropped, sales of the density gauge will not be affected. Required: 1. Should Morrill Company make or buy the subassembly? If it makes the subassembly, which alternative should be chosen? Explain and provide supporting computations. 2. Suppose that dropping the thickness gauge will decrease sales of the density gauge by 10 percent. What effect does this have on the decision? 3. Assume that dropping the thickness gauge decreases sales of the density gauge by 10 percent and that 2,800 subassemblies are required per quarter. As before, assume that there are no ending inventories of subassemblies and that all units produced are sold. Assume also that the per-unit sales price and variable costs are the same as in Requirement 1. Include the leasing alternative in your consideration. Now, what is the correct decision?arrow_forwardPatz Company produces two types of machine parts: Part A and Part B, with unit contribution margins of 300 and 600, respectively. Assume initially that Patz can sell all that is produced of either component. Part A requires two hours of assembly, and B requires five hours of assembly. The firm has 300 assembly hours per week. Required: 1. Express the objective of maximizing the total contribution margin subject to the assembly-hour constraint. 2. Identify the optimal amount that should be produced of each machine part and the total contribution margin associated with this mix. 3. What if market conditions are such that Patz can sell at most 75 units of Part A and 60 units of Part B? Express the objective function with its associated constraints for this case and identify the optimal mix and its associated total contribution margin.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License