Interest Rate Risk [LO2] Both Bond Sam and Bond Dave have 6.5 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 3 years to maturity, whereas Bond Dave has 20 years to maturity. If interest rates suddenly rise by 2 percent what is the percentage change in the price of Bond Sam? Of Bond Dave? If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Sam be then? Of Bond Dave? Illustrate your answers by graphing

To determine: The percentage change in bond price

Introduction:

A bond refers to the debt securities issued by the governments or corporations for raising capital. The borrower does not return the face value until maturity. However, the investor receives the coupons every year until the date of maturity.

Bond price or bond value refers to the present value of the future cash inflows of the bond after discounting at the required rate of return.

Answer to Problem 19QP

The percentage change in bond price is as follows:

| Yield to maturity | Bond S | Bond D |

| 4.5% | (5.19%) | (19.07%) |

| 8.5% | 5.55% | 26.19% |

The interest rate risk is high for a bond with longer maturity, and the interest rate risk is low for a bond with shorter maturity period. The maturity period of Bond S is 3 years, and the maturity period of Bond D is 20 years. Hence, the Bond D’s bond price fluctuates higher than the bond price of Bond S due to longer maturity.

Explanation of Solution

Given information:

There are two bonds namely Bond S and Bond D. The coupon rate of both the bonds is 6.5 percent. The bonds pay the coupons semiannually. The price of the bond is equal to its par value. Assume that the par value of both the bonds is $1,000. Bond S will mature in 3 years, and Bond D will mature in 20 years.

Formulae:

The formula to calculate the bond value:

Where,

“C” refers to the coupon paid per period

“F” refers to the face value paid at maturity

“r” refers to the yield to maturity

“t” refers to the periods to maturity

The formula to calculate the percentage change in price:

Determine the current price of Bond S:

Bond S is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to the yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond S will be $1,000.

Hence, the current price of Bond S is $1,000.

Determine the current yield to maturity on Bond S:

As the bond is selling at its face value, the coupon rate will be equal to the yield to maturity of the bond. The coupon rate of Bond S is 6.5 percent.

Hence, the yield to maturity of Bond S is 6.5 percent.

Determine the current price of Bond D:

Bond D is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to the yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond D will be $1,000.

Hence, the current price of Bond D is $1,000.

Determine the current yield to maturity on Bond D:

As the bond is selling at its face value, the coupon rate will be equal to the yield to maturity of the bond. The coupon rate of Bond D is 6.5 percent.

Hence, the yield to maturity of Bond D is 6.5 percent.

The percentage change in the bond value of Bond S and Bond D when the interest rates rise by 2 percent:

Compute the new interest rate (yield to maturity) when the interest rates rise:

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 6.5 percent. If the interest rates rise by 2 percent, then the new interest rate or yield to maturity will be 8.5 percent

Compute the bond value when the yield to maturity of Bond S rises to 8.5 percent:

The coupon rate of Bond S is 6.5 percent, and its face value is $1,000. Hence, the annual coupon payment is $65

The yield to maturity is 8.5 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.25 percent

The remaining time to maturity is 3 years. As the coupon payment is semiannual, the semiannual periods to maturity are 6

Hence, the bond price of Bond S will be $948.0026 when the interest rises to 8.5 percent.

Compute the percentage change in the price of Bond S when the interest rates rise to 8.5 percent:

The new price after the increase in interest rate is $948.0026. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond S is (5.19 percent) when the interest rates rise to 8.5 percent.

Compute the bond value when the yield to maturity of Bond D rises to 8.5 percent:

The coupon rate of Bond D is 6.5 percent, and its face value is $1,000. Hence, the annual coupon payment is $65

The yield to maturity is 8.5 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.25 percent

The remaining time to maturity is 20 years. As the coupon payment is semiannual, the semiannual periods to maturity are 40

Hence, the bond price of Bond D will be $809.2273 when the interest rises to 8.5 percent.

Compute the percentage change in the price of Bond D when the interest rates rise to 8.5 percent:

The new price after the increase in interest rate is $809.2273. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond D is (19.07 percent) when the interest rates rise to 8.5 percent.

The percentage change in the bond value of Bond S and Bond D when the interest rates decline by 2 percent:

Compute the new interest rate (yield to maturity) when the interest rates decline:

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 6.5 percent. If the interest rates decline by 2 percent, then the new interest rate or yield to maturity will be 4.5 percent

Compute the bond value when the yield to maturity of Bond S declines to 4.5 percent:

The coupon rate of Bond S is 6.5 percent, and its face value is $1,000. Hence, the annual coupon payment is $65

The yield to maturity is 4.5 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.25 percent

The remaining time to maturity is 3 years. As the coupon payment is semiannual, the semiannual periods to maturity are 6

Hence, the bond price of Bond S will be $1,055.5448 when the interest declines to 4.5 percent.

Compute the percentage change in the price of Bond S when the interest rates decline to 4.5 percent:

The new price after the increase in interest rate is $1,055.5448. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond S is 5.55 percent when the interest rates decline to 4.5 percent.

Compute the bond value when the yield to maturity of Bond D declines to 4.5 percent:

The coupon rate of Bond D is 6.5 percent, and its face value is $1,000. Hence, the annual coupon payment is $65

The yield to maturity is 4.5 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.25 percent

The remaining time to maturity is 20 years. As the coupon payment is semiannual, the semiannual periods to maturity are 40

Hence, the bond price of Bond D will be $1,261.9352 when the interest declines to 4.5 percent.

Compute the percentage change in the price of Bond D when the interest rates decline to 4.5 percent:

The new price after the increase in interest rate is $1,261.9352. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond D is 26.19 percent when the interest rates decline to 4.5 percent.

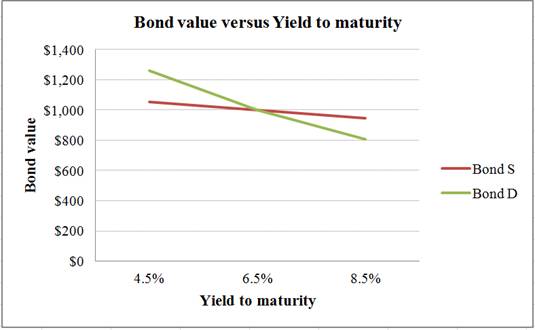

A summary of the bond prices and yield to maturity of Bond S and Bond D:

| Yield to maturity | Bond S | Bond D |

| 4.5% | $1,055.5448 | $1,261.9352 |

| 6.5% | $1,000.0000 | $1,000.0000 |

| 8.5% | $948.0026 | $809.2273 |

Table 1

A graph indicating the relationship between bond prices and yield to maturity based on Table 1:

Interpretation of the graph:

The above graph indicates that the price fluctuation is higher in a bond with higher maturity. Bond D has a maturity period of 20 years. As its maturity period is longer, its price sensitivity to the interest rates is higher. Bond S has a maturity period of 3 years. As its maturity period is shorter, its price sensitivity to the interest rates is lower. Hence, a bond with longer maturity is subject to higher interest rate risk.

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamentals of Corporate Finance

- A4 3 You bought one of BB Co.’s 10% coupon bonds one year ago for $1100. These bonds make annual payments, have a face value of $1000 each, and mature seven years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 8%. If the inflation rate was 3% over the past year, what would be your total real return on investment according to the Exact Fisher Formula?arrow_forwardD3) Finance Suppose that there is 30-year coupon bond with par value of $100 and Macaulay duration of 20.56. The coupon rate is unknown. Currently, the bond is traded at $90 and the yield is flat at 20% pa. Yield to maturity is an annualized simple interest rate compounded annually. If the bond yield increases by 50 basis points, what is the approximation of the percentage capital gain or loss? Please choose the correct range for the percentage capital gain/loss, i.e., if it is -3.5%, please select “A value between -3% and -4%” A value between -9% and -10% A value between -8% and -9% None of the other answers are correct. A value between -7% and -8% A value between -10% and -11%arrow_forwardD6 Assume you own a 2-year US Treasury Note with a 5% coupon and a 7-year US Treasury Note with a 0% coupon. If market interest rates decrease by 100 basis points in the 2-year maturity and declined by only 75 basis points in the 7-year maturity, which bond would experience the smallest market value change? a. 5% US Treasury due in 2 years b. 0% US Treasury due in 7 years c. Both would change by the same amount d. Prices would not change since the coupons are fixedarrow_forward

- 43. One of the above is the most accurate statement?a. In general, distant cash flows are riskier than near-term cash flows.Additionally, a 20-year bond that is callable after five years would have a shorter projected duration, if not none at all, than an otherwise comparable noncallable 20-year bond. Assuming all other features are comparable, investors can demand a lower rate of return on the callable bond than on the noncallable bond.b. The average period of a noncallable 20-year bond is usually equivalent to or greater than the expected life of an otherwise similar callable 20-year bond. Additionally, the interest rate danger that borrowers experience increases with the maturity of a bond. Thus, where all other factors remain stable, callable bonds subject borrowers to fewer interest rate danger than noncallable bonds.c. Both a and b are true.d. None of the above claims are true.arrow_forwardGive the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike Problem 7-19 Interest Rate Risk [LO2]Both Bond Sam and Bond Dave have 6 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has two years to maturity, whereas Bond Dave has 15 years to maturity.a. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Sam and Bond Dave? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)b.If rates were to suddenly fall by 2 percent instead, what would be the percentage change in the price of Bond Sam and Bond Dave? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)a. Bond Sam%a. Bond Dave%b. Bond Sam%b. Bond Davearrow_forwardD4) About rate of return For a consol that pays $100 annually, if the yield to maturity at the beginning of the year is 10%, and the yield to maturity at the end of the year is 5%, please calculate the return of the consol of this year. If a coupon bond that is going to mature in two years is selling at par. Suppose its coupon rate is 10%, the yield to maturity at the begging of the year is 10%, and the yield to maturity at the end of the year is 5%. Please calculate the return of the coupon bond of this year.arrow_forward

- 29. Which of the following has the greatest interest rate (price) risk?a. A 10-year, $1,000 face value, 10 percent coupon bond with semiannualinterest payments.b. A 10-year, $1,000 face value, 10 percent coupon bond with annualinterest payments.c. A 10-year, $1,000 face value, zero coupon bond.d. A 10-year $100 annuity.e. All of the above have the same price risk since they all mature in 10years.arrow_forward6. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. A. Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that a one-year bond purchased today will have the same return as a one-year bond purchased five years from now. False True B. The yield on a one-year Treasury security is 5.8400%, and the two-year Treasury security has a 8.7600% yield. Assuming that the pure expectations theory is correct, what is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 14.936% 13.4071% 11.7606% 9.9965% C. Recall that on a one-year Treasury security the yield is 5.8400% and 8.7600% on a two-year Treasury security. Suppose the one-year security does not have a…arrow_forwardBond J has a coupon rate of 4%. Bond K has a coupon rate of 14%. Both bonds have 17 years to maturity, a par value of $1000 and a yield to maturity of 8% , and both make semi annual payments. If interest rates suddenly rise by 2%, what is the percentage price change in these bonds? What if rates suddenly fall by 2% instead? What does this problem tell you about interest rate risk of lower coupon bonds? Excel would be good. Thanks.arrow_forward

- Answer number 1 and 2: 1.) Suppose the yield on a 10-year T-bond is currently 5.05% and that on a 10-year Treasury Inflation Protected Security (TIPS) is 2.15%. Suppose further that the MRP on a 10-year T-bond is 0.90%, that no MRP is required on a TIPS, and that no liquidity premium is required on any T-bond. Given this information, what is the expected rate of inflation over the next 10 years? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average. 2.) Koy Corporation's 5-year bonds yield 7.00%, and 5-year T-bonds yield 5.15%. The real risk-free rate is r* = 3.0%, the inflation premium for 5-year bonds is IP = 1.75%, the liquidity premium for Koy's bonds is LP = 0.75% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP = (t − 1) × 0.1%, where t = number of years to maturity. What is the default risk premium (DRP) on Koy's bonds?arrow_forward47. One of the points below is the most accurate?a. A 10-year 10% coupon bond has a lower chance of reinvestment than a 10-year 5% coupon bond (assuming all else equal).b. The net return on a bond over a specified year is comprised by both the year's coupon interest payments and the shift in the bond's valuation from the start of the end of the year.c. The price of a 20-year 10% bond is less susceptible to interest rate fluctuations (and hence has less interest rate risk) than the price of a 5-year 10% bond.d. A $1,000 bond with $100 nominal interest payments and a five-year term (not likely to default) will sell for a discount if interest rates were below 9% and for a profit if interest rates were above 11%.e. All of the statements a, b, and c are true.arrow_forwardD2) You are asked to invest $30 million in a bond portfolio consisting of only two bonds. Bond A has a yield of 6% and is a 5 year coupon bond a duration of 4.36 years, and bond B has a yield 7% and is a 7 year coupon bond duration of 6.50 years. The portfolio is to have an investment horizon of 5 years. How much of each bond issue would you have to buy to immunize the portfolio? A. Invest in 70 percent bond A and 30 percent bond B. B. Invest in 60 percent bond A and 40 percent bond B. C. Invest in 30 percent bond A and 70 percent bond B D. Invest in 40 percent bond A and 60 percent bond Barrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education