Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 1MAD

Analyze and compare Amazon.com to Netflix

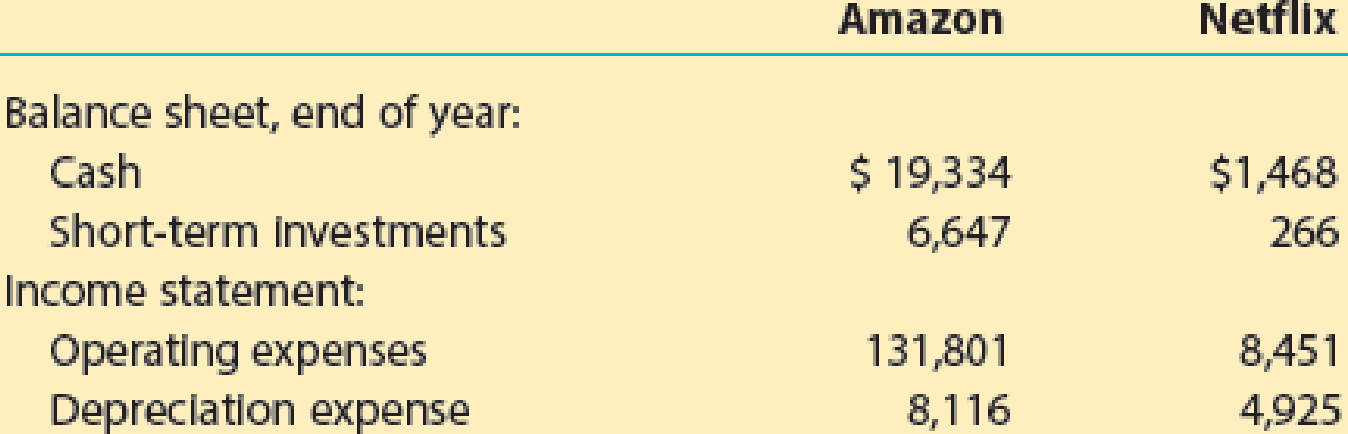

Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Netflix, Inc. (NFLX) provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services; however, Amazon also sells many other products online. The cash, temporary investments, operating expenses, and

- a. Determine the days’ cash on hand for Amazon and Netflix. Round all calculations to one decimal place.

- b. Interpret the results.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ortel Telecom sells telecommunication products and services to a varietyof small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next3 years:

Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel isheadquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a requiredrate of return of 12%.Q. What is the expected net cash flow from Square and Cloudburst for the next 3 years?

Ortel Telecom sells telecommunication products and services to a varietyof small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next3 years:

Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel isheadquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a requiredrate of return of 12%.Q. Based on the net present value from cash flows over the next 3 years, is Cloudburst or Square a morevaluable customer for Ortel?

Ortel Telecom sells telecommunication products and services to a varietyof small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next3 years:

Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel isheadquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a requiredrate of return of 12%.Q. Cloudburst threatens to switch to another supplier unless Ortel gives a 10% price reduction on all salesstarting in 2018. Calculate the 3-year NPV of Cloudburst after incorporating the 10% discount. ShouldOrtel continue to transact with Cloudburst? What other factors should it consider before making itsfinal decision?

Chapter 7 Solutions

Financial And Managerial Accounting

Ch. 7 - Prob. 1DQCh. 7 - Why should the employee who handles cash receipts...Ch. 7 - Prob. 3DQCh. 7 - Why should the responsibility for maintaining the...Ch. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 1BECh. 7 - Prob. 2BECh. 7 - Prob. 3BECh. 7 - Prob. 4BECh. 7 - Prob. 5BECh. 7 - Sarbanes-Oxley internal control report Using...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6ECh. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Entry for cash sales; cash short The actual cash...Ch. 7 - Entry for cash sales; cash over The actual cash...Ch. 7 - Prob. 14ECh. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Prob. 18ECh. 7 - Prob. 19ECh. 7 - Prob. 20ECh. 7 - Prob. 21ECh. 7 - Prob. 22ECh. 7 - Prob. 23ECh. 7 - Prob. 24ECh. 7 - Prob. 1PACh. 7 - Prob. 2PACh. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - Prob. 5PACh. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - Prob. 5PBCh. 7 - Analyze and compare Amazon.com to Netflix...Ch. 7 - Analyze and compare J. C. Penney and Macys J. C....Ch. 7 - Prob. 3MADCh. 7 - Prob. 4MADCh. 7 - Analyze and compare Nike, lululemon, and Under...Ch. 7 - Ethics in Action Tehra Dactyl is an accountant for...Ch. 7 - Bank error During the preparation of the bank...Ch. 7 - Prob. 4TIFCh. 7 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Interest expense and income before income tax expense from the financial statements of both companies for two recent years follow (in millions): a. Compute the times interest earned ratio for both companies for the two years. Round to one decimal place. b. Interpret Amazons interest coverage from Year 1 to Year 2. c. Does a times interest earned ratio less than 1.0 mean that creditors will not get paid interest? d. Interpret Wal-Marts interest coverage from Year 1 to Year 2. e. Which company appears to have the greater protection for creditors?arrow_forward. Ortel Telecom sells telecommunication products and services to a variety of small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next 3 years: (in pic) Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel is headquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a required rate of return of 12%. Q. Based on the net present value from cash flows over the next 3 years, is Cloudburst or Square a more valuable customer for Ortel?arrow_forward. Ortel Telecom sells telecommunication products and services to a variety of small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next 3 years: (in pic) Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel is headquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a required rate of return of 12%. Q. What is the expected net cash flow from Square and Cloudburst for the next 3 yearsarrow_forward

- . Ortel Telecom sells telecommunication products and services to a variety of small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next 3 years: (in pic) Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel is headquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a required rate of return of 12%. Q. Cloudburst threatens to switch to another supplier unless Ortel gives a 10% price reduction on all sales starting in 2018. Calculate the 3-year NPV of Cloudburst after incorporating the 10% discount. Should Ortel continue to transact with Cloudburst? What other factors should it consider before making its final decision?arrow_forwardneed asap Given: FABM Company, a service firm rendering computerizedaccounting services has the following transactions for themonth of June 2018:June 1Owner invested his savings worth P10, 000, 000 intothe business.June 3He bought P1.5 M worth of equipmentJune 5He also invested furniture and fixtures with 250,000June 7Rendered services to clients worth 150, 000 andreceived cash payment immediatelyJune 10Rendered services to clients worth 250, 000 onaccountJune 12Purchased computer supplies amounting to 30,000and issued a promissory noteJune 14Rendered services to clients worth 650, 000 withterms 50% down, balance on accountJune 15Paid salaries of employees worth 45,000June 18Collected half of the amount due last June 10June 20Paid the total amount due for utilities amounting to55, 000June 22Cash receipts amounting to 75,000 from cash salesservicesJune 24Paid the whole amount due on the noteJune 26Paid Philhealth contribution of the employeesamounting to 5,000June 28Borrowed P150,000…arrow_forwardAnalyze and compare Hilton and Marriott Hilton Worldwide Holdings, Inc. (HLT) and Marriott International, Inc. (MAR) are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions): a. Compute the times interest earned ratio for each company. Round to one decimal place. b. Which company appears to better protect creditor interest? Why?arrow_forward

- Analyze and compare Alphabet (Google) and Microsoft Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabets primary source of revenue is from advertising, while Microsofts is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies: a. Compute the working capital for each company for both years. b. Which company has the larger working capital at the end of Year 2? c. Is working capital a good measure of relative liquidity in comparing the two companies? Explain. d. Compute the current ratio for both companies. Round to one decimal place. e. Which company has the larger relative liquidity based on the current ratio? f. Based on your analysis, comment on the short-term debt-paying ability of these two companies.arrow_forwardUpton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Uptons balance sheet as of December 31, 2019, is shown here (millions of dollars): Sales for 2019 were 350 million, and net income for the year was 10.5 million, so the firms profit margin was 3.0%. Upton paid dividends of 4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020. a. If sales are projected to increase by 70 million, or 20%, during 2020, use the AFN equation to determine Uptons projected external capital requirements. b. Using the AFN equation, determine Uptons self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds? c. Use the forecasted financial statement method to forecast Uptons balance sheet for December 31, 2020. Assume that all additional external capital is raised as a line of credit at the end of the year. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Assume Uptons profit margin and dividend payout ratio will be the same in 2020 as they were in 2019. What is the amount of the line of credit reported on the 2020 forecasted balance sheets? (Hint: You dont need to forecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2020 addition to retained earnings for the balance sheet without actually constructing a full income statement.)arrow_forwardAnalyze and compare Kroger and Tiffany The Kroger Company (KR), a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: a.Compute the asset turnover ratio. Round to two decimal places. b.Tiffany Co. (TIF) is a large North American retailer of jewelry. Tiffanys asset turnover ratio is 0.78. Why would Tiffanys asset turnover ratio be lower than that of Kroger?arrow_forward

- Conducting a Financial Ratio Analysis on HP INC. Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. In Chapter 3, we looked at Dunkin' Brands' financial statements. In this chapter, we will use financial Internet websites (specifically, www.morningstar.com and wnvcv.google.com/finance) to analyze HP Inc., a computer hardware company. Once on either website, you simply enter HP Inc.'s ticker symbol (HPQ) to obtain the financial information needed. The text mentions that financial statement analysis has two major components: a trend analysis, where we evaluate changes in key ratios over time, and a peer analysis, where we compare financial ratios with firms that are in the same industry and/or line of business. We will do both of these types of analysis in this problem. Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the bottom of the screen you will see that you can click "Glossary to find definitions for the different ratios For example, Morningstar's Financial Leverage ratio is the same as the Equity multiplier that we use in the textbook.) On the Google Finance site, you can find the firms financial statements for the four most recent years or the five most recent quarters and key financial data for related companies for the most recent year or quarter. We will use the related companies' annual data to conduct the firms peer analysis. Notice that when you go to the "Related Companies" screen, you can add or remove columns. Click on that phrase, and you can check which peer data items you'd like to show on tire computer screen. Also, once you have chosen the data, you can click on a term, and the companies will be ranked in either ascending or descending order for the specific term selected. 7. From the Google Finance site, use the DuPont analysis to determine the total assets turnover ratio for each of tire peer companies. (Hint ROA = Profit margin Total assets turnover.) Once you've calculated each peer 's total assets turnover ratio, then you can use the DuPont analysis to calculate each peer's equity multiplier.arrow_forwardContinuing Company Analysis-Amazon: Asset turnover ratio Amazon.com, Inc. is one of the largest Internet retailers in the world. Netflix, Inc. provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services, however Amazon also sells many other products through the Internet. The sales and total assets (in millions) from recent financial statements were reported as follows for both companies: Amazon Netflix Total revenues (sales) 88,988 5,505 Total assets: Beginning of year 40,159 5,413 End of year 54,505 7,057 A. Based on your knowledge of each company, identify three major assets used by each company in generating revenue. B. Compute the asset turnover ratio for each company. (Round to two decimal places). C. Which company generates sales from total assets more efficiently?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License