Concept explainers

Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of $320,000 and the 500 units purchased to replace them cost $256,000, so his cash account has increased by $64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her heʼd “make at least $50,000 after taxes. That will give us $25,000 after paying off the investors.”

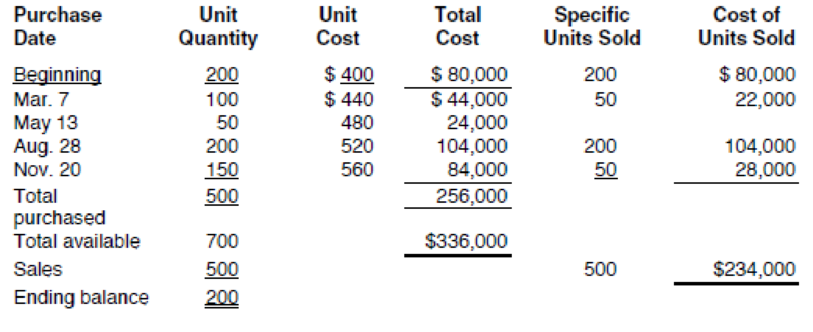

Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales.

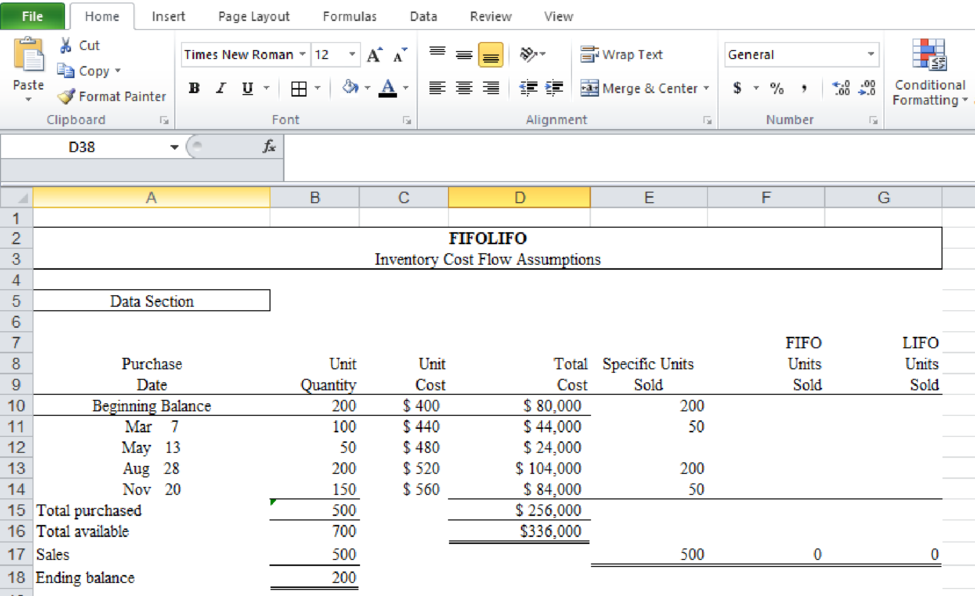

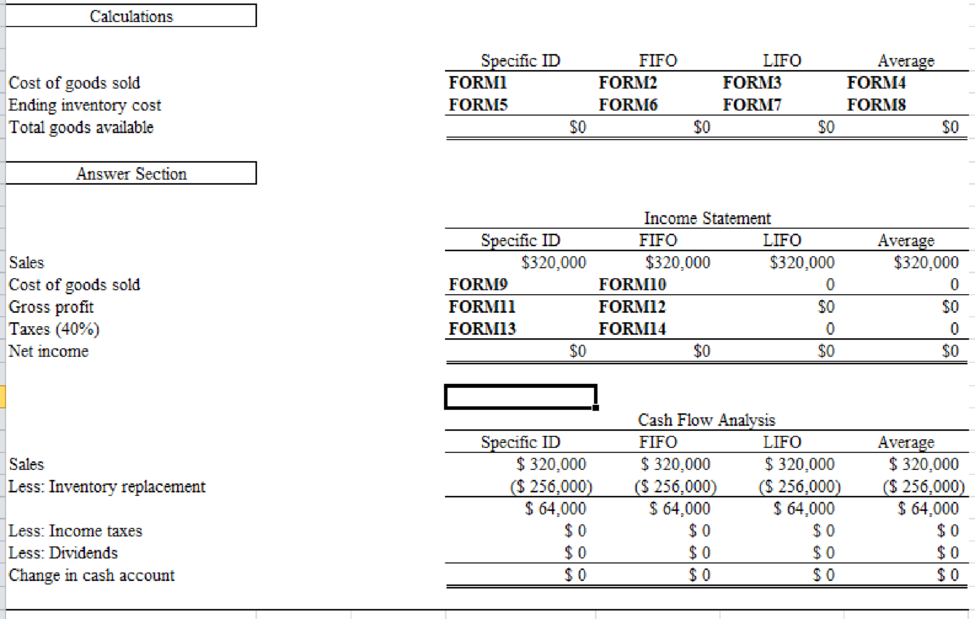

Del has heard that the choice of an inventory cost flow assumption can have a significant effect on net income and taxes. He asks you to show him the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods. Review the worksheet FIFOLIFO that follows these requirements. Note that all of the problem data have been entered in the Data Section of the worksheet.

Prepare a worksheet to show the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods.

Explanation of Solution

Prepare a worksheet to show the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods.

Table (1)

The formulae for the calculation are as follows:

Want to see more full solutions like this?

Chapter 7 Solutions

Excel Applications for Accounting Principles

- Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of 320,000 and the 500 units purchased to replace them cost 256,000, so his cash account has increased by 64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her hed make at least 50,000 after taxes. That will give us 25,000 after paying off the investors. Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales. Using a pencil, fill in columns F and G in the Data Section of the worksheet printout at the end of this problem.arrow_forwardDel Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of 320,000 and the 500 units purchased to replace them cost 256,000, so his cash account has increased by 64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her hed make at least 50,000 after taxes. That will give us 25,000 after paying off the investors. Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales. Examine your completed worksheet and answer the following questions: a. Which inventory cost flow assumption produces the most net income? b. Which inventory cost flow assumption produces the least net income? c. What caused the difference between your answers to a and b? d. Which inventory cost flow assumption produces the highest ending cash balance? e. Which inventory cost flow assumption produces the lowest ending cash balance? f. Does the assumption that produces the highest net income also produce the highest cash balance? Explain. g. As you recall, Del originally used the specific identification method in his initial calculations when he projected 51,600 net income. According to Dels reckoning, that should have left him cash of 25,800 (50% of 51,600) after paying his investors. Why would he only have 3,800 left? Explain. h. Which inventory cost flow assumption would you suggest Del use? Explain.arrow_forwardMalone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?arrow_forward

- At year end,Elliott counted the office supplies on hand,which amounted to $1500.The firm had $900 of supplies on hand at the start of the year, and had purchased $600 of supplies during the year.What was the total office supplies expense for the year?arrow_forwardAt the beginning of the year, a software developer quit his job and gave up a salary of $90,000 per year in order to start Turnip Tom’s organic farm. A partial income statement for the first year of operation for Turnip Tom’s, Inc., is shown below: Revenues $ 98,000 Operating costs and expenses Cost of products sold $ 15,500 Selling expenses $ 6,500 Administrative expenses $ 3,200 Total operating costs $ 25,200 Income from Operations $ 72,800 Interest expense (bank loan) $ 9,500 Legal expenses $ 1,200 Income taxes $ 22,000 Net income $ 40,100 To get started, Tom spent $125,000 of his own savings to purchase land and equipment to be used for the farm. During this year, Tom could have earned a 7 percent return by…arrow_forwardIn their first three months of operations, John and Thabo buy parts to the value of R50 000, and resell 80% of this inventory for R85 000. At the end of the year, the closing balance of the inventory is R10 000. According to the information above, the Cost of sales that will need to be recorded in the Income Statement is R40000. Question 9Select one: True False Please step by step answer.arrow_forward

- Three years ago, Linda Williams and her brother-in-law Robert Jones opened Marin Department Store. For the first 2 years, business was good, but the following condensed income statement results for 2022 were disappointing. MARIN DEPARTMENT STOREIncome StatementFor the Year Ended December 31, 2022 Net sales $730,000 Cost of goods sold 584,000 Gross profit 146,000 Operating expenses Selling expenses $103,750 Administrative expenses 20,750 124,500 Net income $21,500 Linda believes the problem lies in the relatively low gross profit rate of 20%. Robert believes the problem is that operating expenses are too high. Linda thinks the gross profit rate can be improved by making two changes. (1) Increase average selling prices by 15%; this increase is expected to lower sales volume so that total sales dollars will increase only 4%. (2) Buy merchandise in larger…arrow_forwardThree years ago, Linda Williams and her brother-in-law Robert Jones opened Marin Department Store. For the first 2 years, business was good, but the following condensed income statement results for 2022 were disappointing. MARIN DEPARTMENT STOREIncome StatementFor the Year Ended December 31, 2022 Net sales $730,000 Cost of goods sold 584,000 Gross profit 146,000 Operating expenses Selling expenses $103,750 Administrative expenses 20,750 124,500 Net income $21,500 Linda believes the problem lies in the relatively low gross profit rate of 20%. Robert believes the problem is that operating expenses are too high. Linda thinks the gross profit rate can be improved by making two changes. (1) Increase average selling prices by 15%; this increase is expected to lower sales volume so that total sales dollars will increase only 4%. (2) Buy merchandise in larger…arrow_forwardThree years ago, Linda Williams and her brother-in-law Robert Jones opened Marin Department Store. For the first 2 years, business was good, but the following condensed income statement results for 2022 were disappointing. MARIN DEPARTMENT STOREIncome StatementFor the Year Ended December 31, 2022 Net sales $730,000 Cost of goods sold 584,000 Gross profit 146,000 Operating expenses Selling expenses $103,750 Administrative expenses 20,750 124,500 Net income $21,500 Linda believes the problem lies in the relatively low gross profit rate of 20%. Robert believes the problem is that operating expenses are too high. Linda thinks the gross profit rate can be improved by making two changes. (1) Increase average selling prices by 15%; this increase is expected to lower sales volume so that total sales dollars will increase only 4%. (2) Buy merchandise in larger…arrow_forward

- A small business sells $10,000 worth of sports memorabilia during its first year .The owner of the business has set a goal of increasing annual sales by $7500 each year for 19years. Assuming that the goal is met ,find the total sales during the first 20years this business is in operation.arrow_forwardCompany L and Company F are identical in all respects except that Company L uses the LIFO method and Company F uses the FIFO method. Each company has been in business for five years and maintains a base inventory of 2,000 units each year. Each year, except the first year, the number of units purchased equaled the number of units sold. Over the five-year period, unit sales increased 10 percent each year, and the unit purchase and selling prices increased at the beginning of each year to reflect inflation of 4 percent per year. In the first year, 20,000 units were sold at a price of $15.00 per unit, and the unit purchase price was $8.00. What were the end of year inventory, sales, cost of sales, and gross profit for each company for each of the five years? Compare the inventory turnover ratios (based on ending inventory carrying amounts) and gross profit margins over the five-year period and between companies.arrow_forwardJames Wright is the chief financial officer (CFO) for The Butcher Block, a major steakhouse restaurant chain. As CFO, James has the final responsibility for all aspects of financial reporting. James tells investors that The Butcher Block should post earnings of at least $1 million. In examining the preliminary year-end numbers, James notices that earnings are coming in at $950,000. He also is aware that The Butcher Block has been depreciating most of its restaurant equipment over a five-year useful life. He proposes to change the estimated useful life for a subset of the equipment to a useful life of seven, rather than five, years. By depreciating over a longer useful life, depreciation expense will be lower in the current year, increasing earnings to just over $1 million. It looks like The Butcher Block is going to exceed earnings of $1 million after all. Do you think James Wright’s change in the depreciable life of assets is ethical? What concerns might you have?arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning