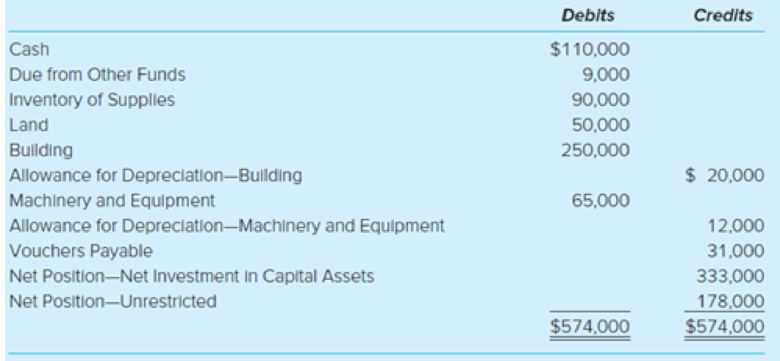

Central Garage Internal Service Fund. (LO7-2) The City of Ashville operates an internal service fund to provide garage space and repairs for all city-owned-and-operated vehicles. The Central Garage Fund’s preclosing

The following information, not yet reflected in the preclosing figures above, applies to the current Fiscal year:

- 1. Supplies were purchased on account for $92,000; the perpetual inventory method is used.

- 2. The cost of supplies used during the year was $110,000. A physical count taken as of that date showed materials and supplies on hand totaled $72,000 at cost.

- 3. Salaries and wages paid to employees totaled $235,000, including related costs.

- 4. Billings totaling $30,000 were received from the enterprise fund for utility charges. The Central Garage Fund paid $27,000 of the amount owed. (At the government-wide level, record the payable amount as Internal Balances.)

- 5.

Depreciation of the building was recorded in the amount of $10,000; depreciation of the machinery and equipment amounted to $9,000. - 6. Billings to other departments for services provided to them were as follows:

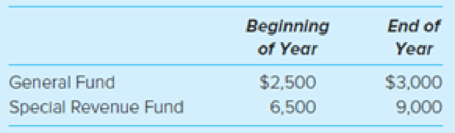

- 7. Unpaid interfund receivable balances were as follows:

- 8. Vouchers payable at year-end were $16,000.

- 9. Closing entries were prepared for the Central Garage Fund (ignore government-wide closing entry).

Required

- a. Prepare

journal entries to record all of the transactions for this period in the Central Garage Fund accounts and in the governmental activities accounts. Assume all expenses at the government-wide level are charged to the General Government function. - b. Prepare a statement of revenues, expenses, and changes in fund net position for the Central Garage Fund for the period.

- c. Prepare a statement of net position for the Central Garage Fund as of year-end.

- d. Explain what the Central Garage Fund would need to report at the governmental activities level, and where the information would be reported.

a.

Prepare journal entries to record all the transactions in Central Garage Fund accounts and governmental activities accounts.

Explanation of Solution

Internal service funds record the activities that are related to purchase and distribution within the departments of the government. Internal service fund accounts for the internal financial transactions.

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The purchase of inventory is recorded as below in Central Garage Fund accounts and governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Inventory of supplies | 92,000 | |||

| Vouchers payable | 92,000 | |||

| (To record the purchase of inventory) |

Table (1)

The value of supplies used is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cost of supplies used | 110,000 | |||

| Inventory of supplies | 110,000 | |||

| (To record the cost of supplies used) |

Table (2)

The value of supplies used is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 110,000 | |||

| Inventory of supplies | 110,000 | |||

| (To record the cost of supplies used) |

Table (3)

The payment of salaries and wages is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Salaries and Wages Expense | 235,000 | |||

| Cash | 235,000 | |||

| (To record the payment of salaries and wages) |

Table (4)

The payment of salaries and wages is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 235,000 | |||

| Cash | 235,000 | |||

| (To record the payment of salaries and wages) |

Table (5)

The accrual and payment of utilities expense is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Utilities expense | 30,000 | |||

| Due to other funds | 3,000 | |||

| Cash | 27,000 | |||

| (To record the payment of utilities expense to the utility fund and the accrual of remaining bills) |

Table (6)

The accrual and payment of utilities expense is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 30,000 | |||

| Internal balances | 3,000 | |||

| Cash | 27,000 | |||

| (To record the payment of utilities expense to the utility fund and the accrual of remaining bills) |

Table (7)

The depreciation expense is recorded is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense - Building | 10,000 | |||

| Depreciation expense – Machinery and Equipment | 9,000 | |||

| Allowance for depreciation - Building | 10,000 | |||

| Allowance for depreciation - Machinery and Equipment | 9,000 | |||

| (To record the allowance for depreciation on building and machinery and equipment) |

Table (8)

The depreciation expense is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 19,000 | |||

| Allowance for depreciation - Building | 10,000 | |||

| Allowance for depreciation - Machinery and Equipment | 9,000 | |||

| (To record the allowance for depreciation on building and machinery and equipment) |

Table (9)

The due from other funds is recorded is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Due to other funds | 397,000 | |||

| Billings to other departments | 397,000 | |||

| (To record the accrual of revenue from general fund and special revenue fund) |

Table (10)

Working Note: It is given that the “central garage fund” is billed $270,000 to general fund and $127,000 to special revenue fund. Hence, the total due to other funds is $397,000

Note: As the “central garage fund” has dues from the other governmental funds like general fund and special revenue fund, there is no need for an entry in the governmental activities. The reason is that both the “internal service funds” and “governmental funds” will be recorded in the same column of the governmental activities.

The receipt of dues from other funds is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 394,000 | |||

| Due to other funds | 394,000 | |||

| (To record the receipt of due from general fund and special revenue fund) |

Table (11)

Working note: The opening balance of general fund is $2,500 and the special revenue fund is $6,500. Hence, the opening balance of dues from other funds would be $9,000

Note: As the “central garage fund” has dues from the other governmental funds like general fund and special revenue fund, there is no need for an entry in the governmental activities. The reason is that both the “internal service funds” and “governmental funds” will be recorded in the same column of the governmental activities.

The payment of vouchers payable is recorded as below in Central Garage Fund accounts and governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Vouchers payable | 107,000 | |||

| Cash | 107,000 | |||

| (To record the vouchers paid) |

Table (12)

The closing entry is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Billings to departments | 397,000 | |||

| Cost of supplies issued | 110,000 | |||

| Salaries and wages expense | 235,000 | |||

| Utilities expense | 30,000 | |||

| Depreciation expense-building | 10,000 | |||

| Depreciation expense- machinery and equipment | 9,000 | |||

| Excess of net billings over cost | 3,000 | |||

| (To record closing of nominal accounts) |

Table (13)

The journal entry to transfer the excess of net billing over cost to the unrestricted net position is recorded as below:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Excess of net billings over cost | 3,000 | |||

| Net position-unrestricted | 3,000 | |||

| (To transfer the excess of net billings over cost to the “unrestricted net position”) |

Table (14)

The journal entry to allocate the decrease in “net investment in capital assets” to the “unrestricted net position” is recorded as below:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Net position-net investments in capital assets | 19,000 | |||

| Net position-unrestricted | 19,000 | |||

| (To charge he decrease in the “net position-net investment in capital assets” to the “unrestricted net position”) |

Table (15)

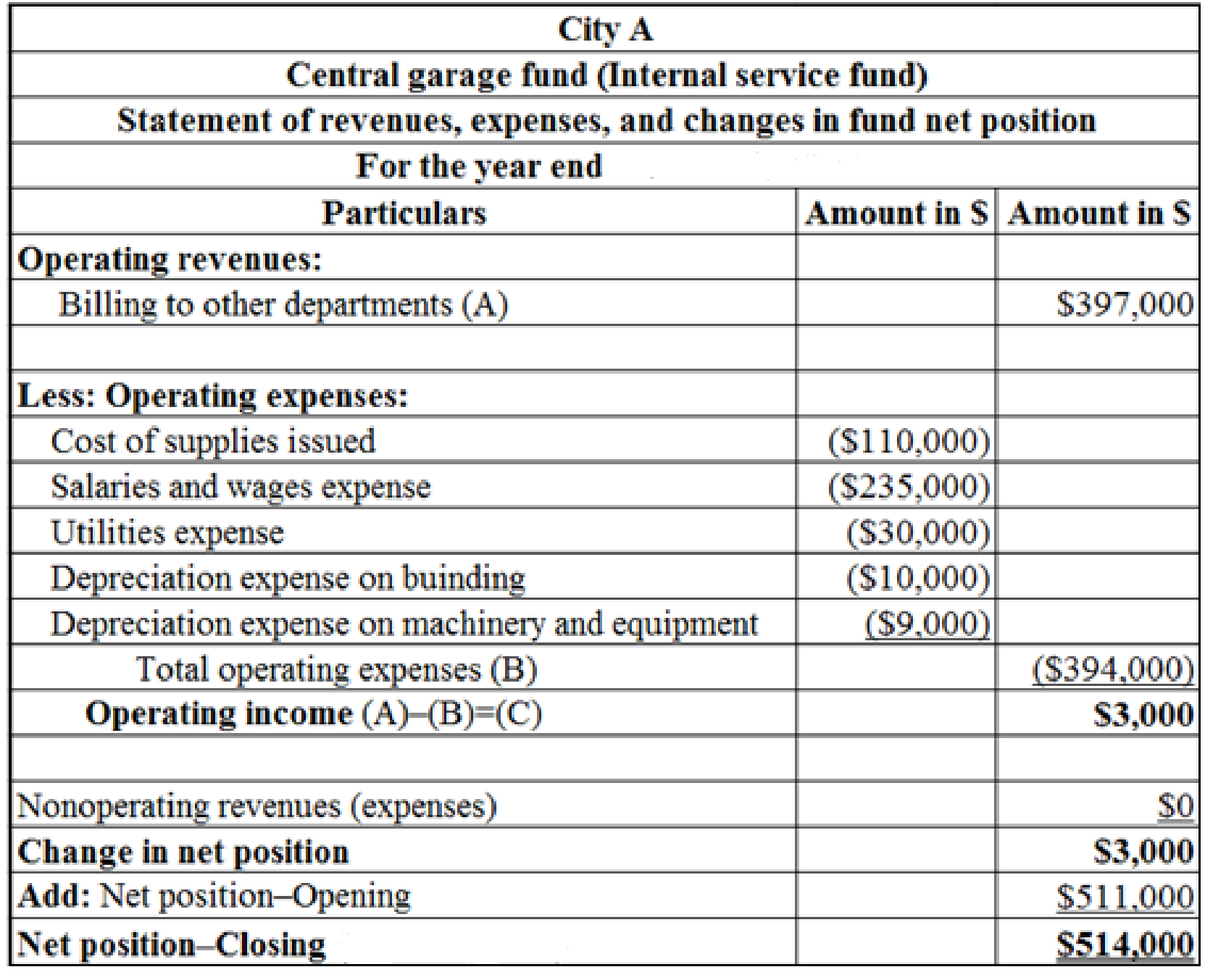

b.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Garage Fund.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Garage Fund.

Table (16)

Working note: Determine the opening net position.

Before the fiscal year adjustments, the net position of “net investment is capital assets” is $333,000 and the unrestricted net position is $178,000. Hence, the total opening net position is $511,000

(c)

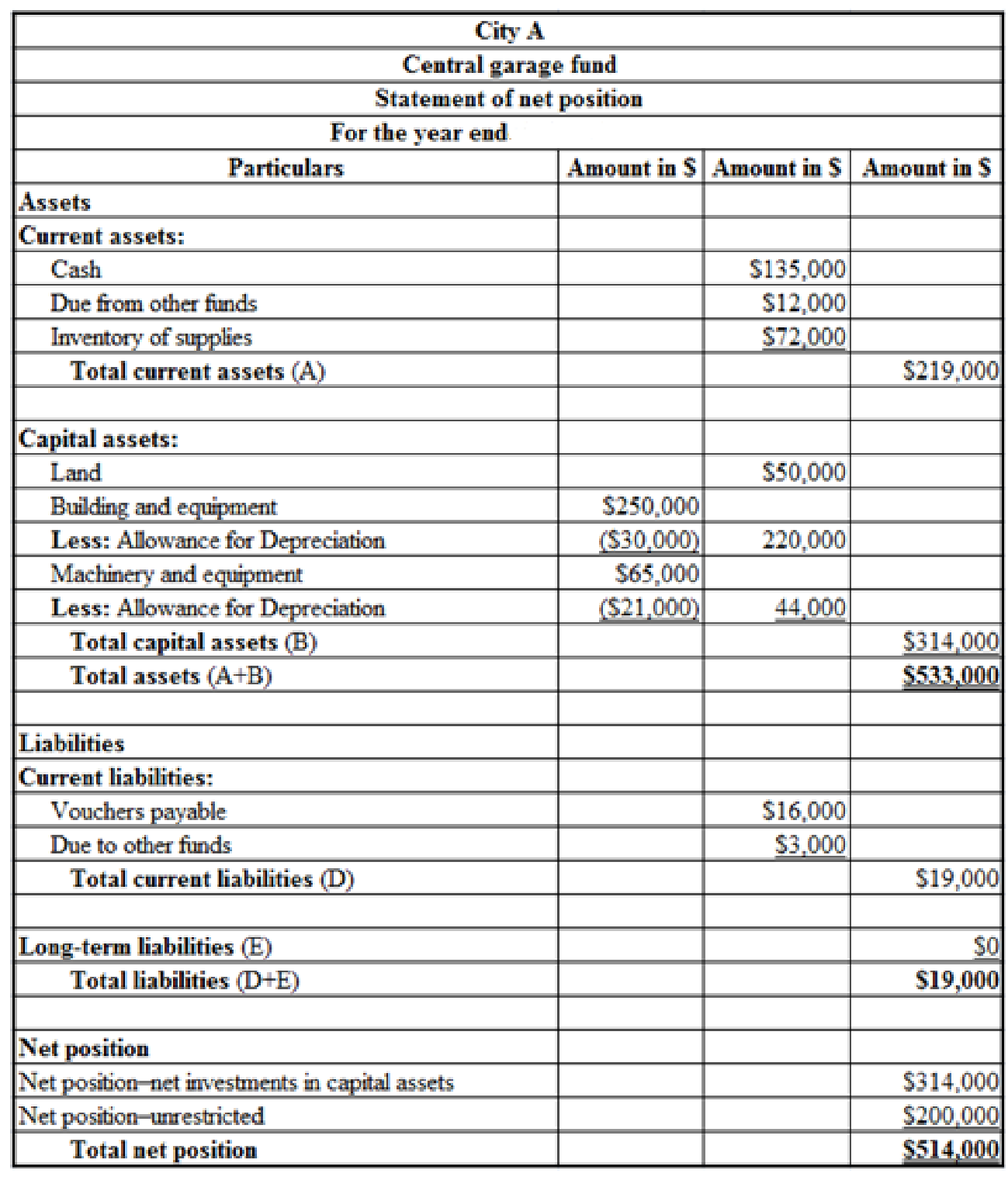

Prepare a “statement of net position” for Central Garage Fund.

Explanation of Solution

Statement of net position: Statement of financial position is a balance sheet that reports the assets, deferred outflow of resources, liabilities, deferred inflow of resources and the residual amount or net position of the government at the end of the fiscal year.

Prepare a “statement of net position” for Central Garage Fund.

Table (17)

Working notes:

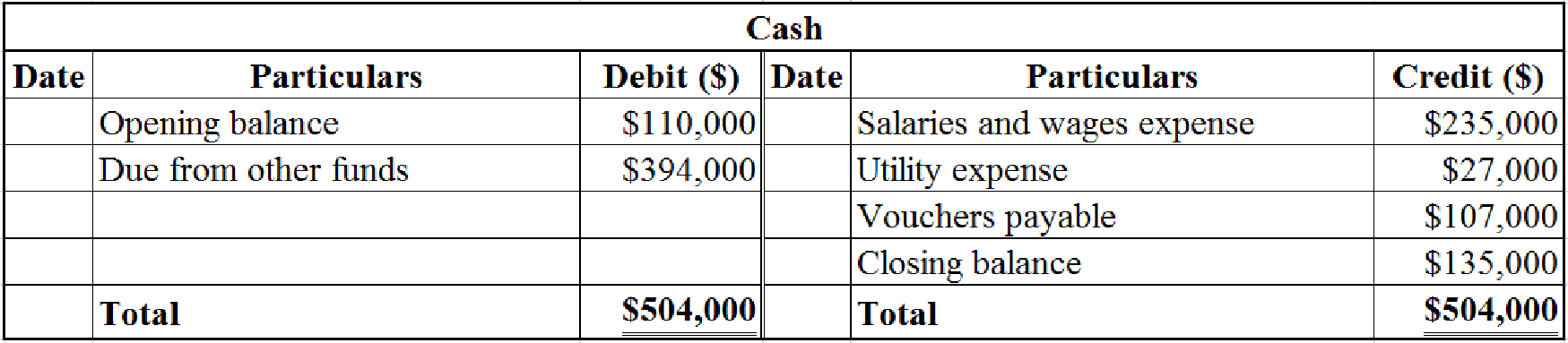

- Determine the closing balance of cash.

Table (18)

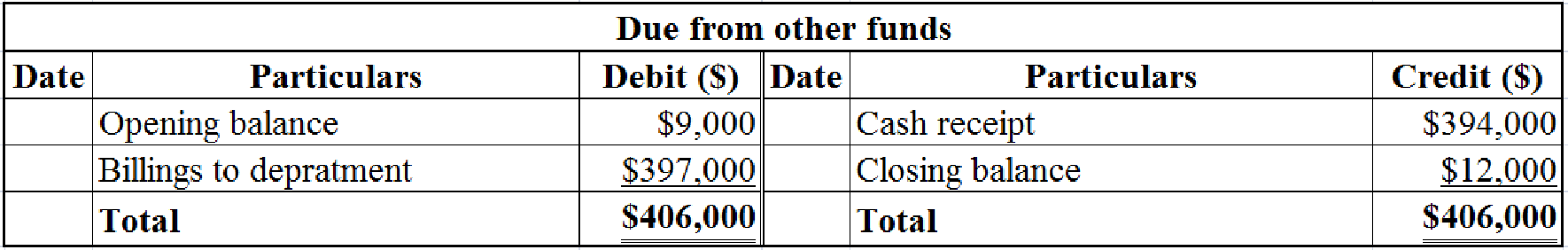

- Determine the closing balance of due from other funds.

Table (19)

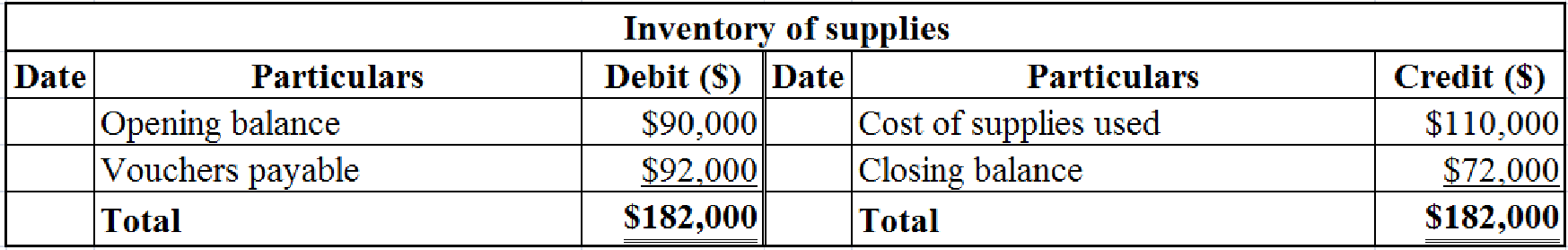

- Determine the closing balance of inventory of supplies.

Table (20)

- Determine the accumulated depreciation for building.

The accumulated depreciation on building is the sum of current year depreciation ($10,000) and the previous year accumulated depreciation (20,000). Hence, the accumulated depreciation for current year is $30,000

- Determine the accumulated depreciation for machinery and equipment.

The accumulated depreciation on machinery is the sum of current year depreciation ($9,000) and the previous year accumulated depreciation (12,000). Hence, the accumulated depreciation for current year is $21,000

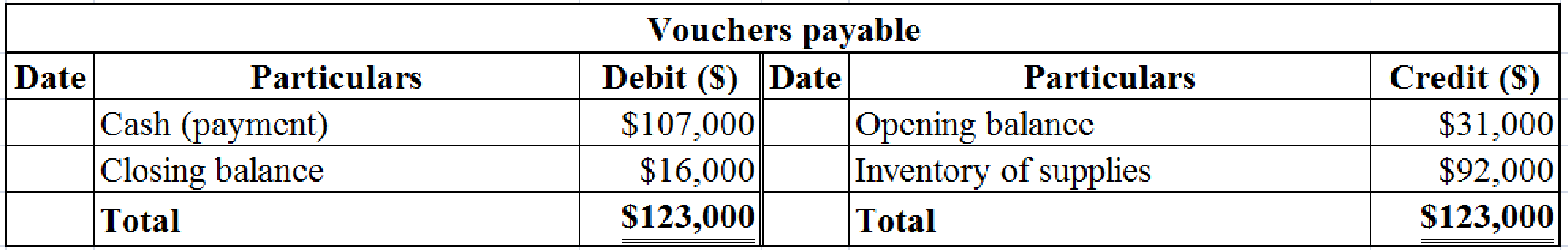

- Determine the closing balance of vouchers payable.

Table (21)

- Determine the net position of “net investment in capital assets”.

The opening balance of “net investment in capital assets” is $333,000. The current year’s depreciation is $19,000. Hence, the closing balance of “net investment in capital assets” is $314,000

- Determine the unrestricted net position as on June 30.

(d)

Discuss about the information that the “central garage fund” has to report in the governmental activities.

Explanation of Solution

Since, the “Central Garage Fund” is an internal service fund; it has to report its activities and net assets in the “governmental activities” statements. It has to merge the “garage fund” with the “governmental funds” and report it in the “governmental activities column”.

Want to see more full solutions like this?

Chapter 7 Solutions

Accounting For Governmental & Nonprofit Entities

- The City of Upper Falls accounts for its inventory using the purchases method. During the year the City bought $400,000 of supplies, for which it owed $100,000 at year-end. The City will pay for the supplies from available expendable financial resources. The entry that should be recorded in the City s General Fund is a. Debit Expenditures $400,000; Credit Cash $300,000 and Accounts Payable $100,000. b. Debit Expenditures $300,000; Credit Cash $300,000. c. Debit Supplies Inventory $400,000; Credit Cash $300,000 and Accounts Payable $100,000. d. Debit Supplies Inventory $300,000; Credit Cash $300,000.arrow_forwardThe unadjusted trial balance for the General Fund of the City of Allensville at June 30, 2019 is as follows: Debits Accounts Receivable $40,000 Cash 75,000 Due from Agency Fund 25,000 Encumbrances 60,000 Estimated Revenues 975,000 Expenditures 750,000 Taxes Receivable 250,000 $2,175,000 Credits Allowance for Doubtful Accounts $ 5,000 Allowance for Uncollectible Taxes 50,000 Appropriations 785,000 Due to a Utility Fund 40,000 Unassigned Fund Balance (160,000) Estimated…arrow_forwardThe unadjusted trial balance for the General Fund of the City of Allensville at June 30, 2019 is as follows: Debits Accounts Receivable $40,000 Cash 75,000 Due from Agency Fund 25,000 Encumbrances 60,000 Estimated Revenues 975,000 Expenditures 750,000 Taxes Receivable 250,000 $2,175,000 Credits Allowance for Doubtful Accounts $ 5,000 Allowance for Uncollectible Taxes 50,000 Appropriations 785,000 Due to a Utility Fund 40,000 Unassigned Fund Balance (160,000) Estimated…arrow_forward

- 1. Shoshone County uses the consumption method to account for supplies. At the beginning of the year the City had no supplies on hand. During the year the City purchased $600,000 of supplies for use by activities accounted for in the General Fund. The City used $400,000 of those supplies during the year. At fiscal year-end the appropriate account balances on the government-wide financial statements would be a. Expenses $600,000; Supplies Inventory $200,000. b. Expenses $600,000; Supplies Inventory $0. c. Expenses $400,000; Supplies Inventory $200,000. d. Expenses $400,000; Supplies Inventory $0. 2. Shoshone County uses the consumption method to account for supplies. At the beginning of the year the City had no supplies on hand. During the year the City purchased $600,000 of supplies for use by activities accounted for in the General Fund. The City used $400,000 of those supplies during the year. At fiscal year-end, the appropriate account balances on the General Fund financial…arrow_forwardThe City of Greystone maintains its books so as to prepare fund accounting statements and prepares worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: The City levied property taxes for the current fiscal year in the amount of $8,000,000. At year-end, $720,000 of the taxes had not been collected. It was estimated that $330,000 of that amount would be collected during the 60 days after the end of the fiscal year and that $360,000 would be collected after that time and the balance would be uncollectible. The City had recognized the maximum of property taxes allowable under modified accrual accounting. $255,000 of property taxes had been deferred at the end of the previous year and was recognized under modified accrual as revenue in the current year. In addition to the expenditures reported under modified accrual accounting, the city computed that an additional $104,000…arrow_forwardBilberry County voted to establish an internal service fund to account for printing and copying for all its departments and agencies. The county engaged in the following activities related to the new fund. REQUIRED: Prepare journal entries to record these events in the internal service fund. If no entry is required, write “No entry required.” a)The county commission voted to transfer $300,000 from the general fund to the internal service fund to establish the new fund. b)Entered into a capital lease for equipment to be used in printing activities. The total present value of the lease obligation is $600,000. c)Issued $2 million in general obligation bonds at 101. The bonds were issued to acquire additional equipment and are to be serviced from the internal service fund. d)Purchased equipment for $1,950,000. The equipment has an estimated useful life of nine years and an estimated salvage value of $150,000. e)Billed the general fund for copying and printing charges, $70,000.…arrow_forward

- The Village of Dove ruses the purchases method of accounting for its inventories of supplies in the General Fund. GASB standards, however, require that the consumption method be used for the government-wide financial statements. Because its computer system is very limited, the Village uses a periodic inventory system, adjusting inventory balances based on a physical inventory of supplies at year-end. When supplies are received during the year, the Village records expenditures and expenses in the general journals of the General Fund and governmental activities, respectively. The Village’s inventory records showed the following information for the fiscal year ending December 31, 2014: Balance of inventory, December 31, 2013 $132,000 Purchases of inventory during 2014 772,000 Balance of inventory, December 31, 2014 150,000 Required a. Provide the required adjusting entries at the end of 2014, assuming that the…arrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardThe police department of the city of Elizabeth acquires a new police car during the current year. In reporting the balance sheet for the governmental funds within the fund-based financial statements, what reporting ismade of this police car?a. It is reported as a police car at its cost.b. It is reported as a police car at cost less accumulated depreciation.c. It is reported as equipment at fair value.d. It is not reported.arrow_forward

- The government health center purchases an ambulance amounting to RO 12,000. Which among the following statement is true for recording the ambulance in government accounting books? a. Treated as income and shown in the statement of revenue and expenditure b. Treated as expenditure for the period and not shown in the statement of Assets and Liabilities c. Shown in the statement of assets and liabilities at its market value d. Shown in the statement of assets and liabilities at its written down valuearrow_forwardThe City of Grinders Switch Maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations. General fixed assets as of the beginning of the year, which had not recorded, were as follows: Land $ 7,554,000 Buildings $33,355,000 Improvements Other Than Buildings $14,820,000 Equipment $11,690,000 Accumulated Depreciation, Capital Assets $25,800,000 2. During the year, expenditures for Capital outlays amounted to $7,500,000. Of that amount $4,800,000 was for buildings; the remainder was for improvements other than buildings. 3. The Capital…arrow_forwardUsing the information below, what amount should be accounted for in a special revenue fund or funds? Warehouse equipment used to store supplies for delivery to all city departments and agencies on a cost-reimbursement basis $ 300,000 Equipment used for supplying electric power to residents $ 1,750,000 Receivables for completed sidewalks to be paid for in installments by affected property owners. Construction was financed by special assessment bonds for which the town has no liability $ 1,500,000 Cash received from federal government, dedicated to highway maintenance, that must be accounted for in a separate fund $ 1,800,000 Multiple Choice A. $1,800,000. B. $2,100,000. C. $5,350,000. D. $3,300,000.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education