Concept explainers

Welcome Inns is a chain of motels serving business travelers in New Mexico and southwest Texas. The chain has grown from one motel several years ago to five motels. In 20x1, the owner of the company decided to set up an internal Accounting Department to centralize control of financial information. (Previously, local CPAs handled each motel’s bookkeeping and financial reporting.) The accounting office was opened in January 20x1 by renting space adjacent to corporate headquarters in Ruidoso, New Mexico. All motels have been supplied with personal computers and internet access to transfer information to central accounting on a daily basis.

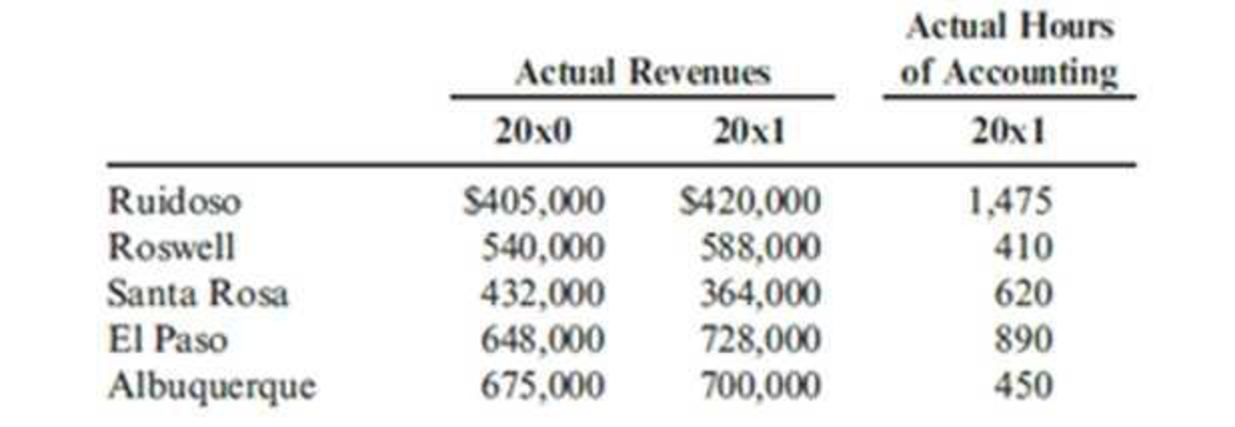

The Accounting Department has budgeted fixed costs of $135,000 per year. Variable costs are budgeted at $20 per hour. In 20x1, actual cost for the Accounting Department was $223,000. Further information is as follows:

Required:

- 1. Suppose the total actual costs of the Accounting Department are allocated on the basis of 20x1 sales revenue. How much will be allocated to each motel?

- 2. Suppose that Welcome Inns views 20x0 sales figures as a proxy for budgeted capacity of the motels. Thus, fixed Accounting Department costs are allocated on the basis of 20x0 sales, and variable costs are allocated according to 20x1 usage multiplied by the variable rate. How much Accounting Department cost will be allocated to each motel?

- 3. Comment on the two allocation schemes. Which motels would prefer the method in Requirement 1? The method in Requirement 2? Explain.

Trending nowThis is a popular solution!

Chapter 7 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- After working for years as a regional manager for a retail organization, Scott Parry opened his own business with Susan Gonzalez, one of his district managers, as his partner. They formed Scott and Susan (S&S) to sell appliances and consumer electronics. S&S pursued a “clicks and bricks” strategy by renting a building in a busy part of to`wn and adding an electronic storefront. S&S invested enough money to see them through the first six months. They will hire 15 employees within the next two weeks – three to stock the shelves, four sales representatives, six checkout clerks, and two to develop and maintain the electronic storefront. S&S will host its grand opening in five weeks. To meet that deadline, they have to address the following important issues: 17. What decisions do they need to make to be successful and profitable? 18. What information do S&S need to make those decisions?arrow_forwardJenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached) What is Computron’s free cash flow (FCF)? What are Computron’s “net uses” of its FCF? Calculate Computron’s return on invested capital (ROIC). Computron has a 10% cost of capital (WACC). What caused the decline in the ROIC? Was it due to operating profitability or capital utilization? Do you think Computron’s growth added value? What is Computron's EVA? The cost of capital was 10% in both years. Assume that a corporation has $200,000 of taxable income…arrow_forwardPart of the Fry’s Electronics, Inc. ’s experience involves providing technical support to its customers. This includes in-home installations of electronics and also computer support at their retail store locations. Requirements Suppose Fry’s Electronics, Inc. provides $10,500 of computer support at the Dallas-Fort Worth store during the month of November. How would Fry's Electronics record this transaction? Assume all customers paid in cash. What financial statement(s) would this transaction affect? Assume Fry’s Electronics, Inc.’s Modesto, California, location received $24,000 for an annual contract to provide computer support to the local city government. How would Fry’s Electronics record this transaction? What financial statement(s) would this transaction affect? What is the difference in how revenue is recorded in requirements 1 and 2? Clearly state when revenue is recorded in each requirement.arrow_forward

- Ginnian and Fitch, a regional accounting firm, performs yearly audits on a number of different for-profit and not-for-profit entities. Two years ago, Luisa Mellina, Ginnians partner in charge of operations, became concerned about the amount of audit time required by not-for-profit entities. As a result, she instituted a series of training programs focusing on the auditing of not-forprofit entities. Now, she would like to see if the training seemed to work. So, she ran a multiple regression on 22 months of data for Ginnian for three variables: the total monthly cost of audit professional time, the number of not-for-profit audits, and the hours of training in the audit of not-for-profit entities. The following printout was obtained: Required: 1. Write out the cost equation for Ginnians audit professional time. 2. If Ginnian expects to have 9 audits of not-for-profits next month and expects that audit professionals will have a total of 130 hours of not-for-profit training, what is the anticipated cost of professional time? 3. Are the hours spent auditing not-for-profit entities positively or negatively correlated with audit professional costs? Is percentage of experienced team members positively or negatively correlated with audit professional cost? 4. What does R2 mean in this equation? Overall, what is your evaluation of the cost equation that was developed for the cost of audit professionals?arrow_forwardElitz and Van Aken, CPAs, offer three types of services to clients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending December 31, 2020: Service Billable Hours Audit Department: Staff 22,400 Partners 7,900 Tax Department: Staff 13,200 Partners 5,500 Small Business Accounting Department: Staff 3,000 Partners 600 The average billing rate for staff is $160 per hour, and the average billing rate for partners is $350 per hour. Prepare a professional fees earned budget for Elitz and Van Aken, CPAs, for the year ending December 31, 2020, using the following column headings and showing the estimated professional fees by type of service rendered and add additional rows in the table as needed:arrow_forward'Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached) What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What do you conclude from the statement of cash flows? What is Computron’s net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have? What is Computron’s free cash flow…arrow_forward

- Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached) What caused the decline in the ROIC? Was it due to operating profitability or capital utilization? Do you think Computron’s growth added value? What is Computron's EVA? The cost of capital was 10% in both years. Assume that a corporation has $200,000 of taxable income from operations. What is the company's federal tax liability? Assume that you are in the 25% marginal tax bracket and that you have $50,000 to invest. You have narrowed your investment…arrow_forwardWise Limited has an online platform for purchase and sale of goods and services which connects customers all around the world. It provides additional services of invoicing and data collation for sellers on the platform. Sellers process sales orders and transport the orders to the customers. Payment is made through the platform directly to the seller for which Wise limited collects a fee for invoicing services Further to the requirement of the Code of Corporate Governance Wise limited has decided to change its auditors after a period of 10 years. Your firm was approached and due process followed in the appointment of new Auditors including appropriate professional clearance. The audit is now set to commence. You are the Audit Manager responsible for this engagement but some of your Team members are not conversant with controls in on-line businesses. b. A computer-based information system is expected to have general IT controls in place. Discuss the main categories of general IT…arrow_forwardBryan Eubank began his accounting career as an auditor for a Big 4 CPA firm. He focused on clients in the high-technology sector, becoming an expert on topics such as inventory write-downs, stock options, and business acquisitions. Impressed with his technical skills and experience, General Electronics, a large consumer electronics chain, hired Bryan as the company controller responsible for all of the accounting functions within the corporation. Bryan was excited about his new position— for about a week until he took the first careful look at General Electronics' financial statements. The cause of Bryan's change in attitude is the set of financial statements he's been staring at for the past few hours. For some time prior to his recruitment, he had been aware that his new employer had experienced a long trend of moderate profitability. The reports on his desk confirm the slight but steady improvements in net income in recent years. The disturbing trend Bryan is now noticing,…arrow_forward

- Bryan Eubank began his accounting career as an auditor for a Big 4 CPA firm. He focused on clients in the high-technology sector, becoming an expert on topics such as inventory write-downs, stock options, and business acquisitions. Impressed with his technical skills and experience, General Electronics, a large consumer electronics chain, hired Bryan as the company controller responsible for all of the accounting functions within the corporation. Bryan was excited about his new position— for about a week until he took the first careful look at General Electronics' financial statements. The cause of Bryan's change in attitude is the set of financial statements he's been staring at for the past few hours. For some time prior to his recruitment, he had been aware that his new employer had experienced a long trend of moderate profitability. The reports on his desk confirm the slight but steady improvements in net income in recent years. The disturbing trend Bryan is now noticing, though,…arrow_forwardAfter working for years as a regional manager for a retail organization, Scott Parry opened his own business with Susan Gonzalez, one of his district managers, as his partner. They formed S&S to sell appliances and consumer electronics. Scott and Susan pursued a “clicks and bricks” strategy by renting a building in a busy part of town and adding an electronic storefront. Scott and Susan invested enough money to see them through the first six months. They will hire 15 employees within the next two weeks – three to stock the shelves, four sales representatives, six checkout clerks, and two to develop and maintain the electronic storefront. Scott and Susan will host S&S’s grand opening in five weeks. To meet that deadline, they have to address the following important issues: 16. What business processes are needed, and how should they be carried out? 17. What functionality should be provided on the website?arrow_forwardHide-It (HI), a family-owned business based in Tombstone, Arizona, builds custom homes with special features, such as hidden rooms and hidden wall safes. Hide-It has been an audit client for three years. You are about to sign off on a “clean” unmodified opinion on HI’s current annual financial statements when Art Hyde, the VP-Finance, calls to tell you that the Arizona Department of Revenue has seized control of a Hide-It bank account that includes about $450,000 of company funds; the account is not currently recorded in the accounting system and you had been unaware of it. In response to your questions about the origin of the funds, Art assures you that the funds, though not recorded as revenue, had been obtained legitimately. He explains that all of the money came from separately billed but unrecorded change orders to items in contracts completed before you became HI’s auditor, and before he or any members of current management became involved with the company. You subsequently…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning