Aldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The division’s

Required:

- 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.)

- 2. The divisional manager has decided to increase the advertising budget by $250,000. This will increase sales revenues by $1 million. By how much will operating income increase or decrease as a result of this action?

- 3. Suppose sales revenues exceed the estimated amount on the income statement by $1,500,000. Without preparing a new income statement, by how much are profits underestimated?

- 4. Compute the margin of safety based on the original income statement.

- 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)

1.

Calculate contribution margin per unit, break-even point in units, contribution margin ratio and break-even sales revenue.

Answer to Problem 53P

Contribution margin per unit, break-even units, contribution margin ratio and break-even sales revenue are $30, 164,850 units, 0.4286 and $11,538,731 respectively.

Explanation of Solution

Contribution margin:

Contribution margin can be defined as the amount obtained after deducting the variable expense from sales revenue. It means the amount of sales left after covering the variable expenses.

Break-Even Point:

The point or situation where the amount of total cost is equivalent to total revenue is known as the break-even point. It is the point where there is no loss or no profit.

Contribution Margin Ratio:

The sales percentage remaining after covering the amount of total variable cost is known as the contribution margin ratio. It is the available sales dollar percentage which will be used to cover the total fixed cost.

Break-Even Sales Revenue:

Break-even sales revenue can be evaluated by dividing the total amount of fixed cost by the contribution margin ratio.

Use the following formula to calculate contribution margin:

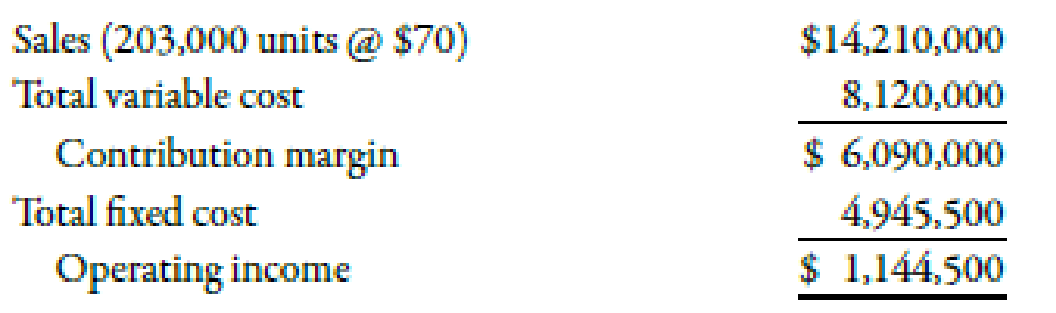

Substitute $6,090,000 for contribution margin and 203,000 for units sold in the above formula.

Therefore, the contribution margin per unit is $30.

Use the following formula to calculate break-even units:

Substitute $4,945,500 for total fixed cost and $30 for contribution margin per unit in the above formula.

Therefore, break-even units are 164,850 units.

Use the following formula to calculate contribution margin ratio:

Substitute $30 for contribution margin per unit and $70 for selling price per unit in the above formula.

Therefore, the contribution margin ratio is 0.4286.

Use the following formula to calculate break-even sales revenue:

Substitute $4,945,500 for the total fixed cost and 0.4286 for contribution margin ratio in the above formula.

Therefore, the break-even point in sales dollars is $11,538,731.

2.

Calculate the effect of increase of in advertising budget and sales revenues on the operating income.

Answer to Problem 53P

Operating income increases by $178,600.

Explanation of Solution

Use the following formula to calculate change in operating income:

Substitute $428,6001 for increase in contribution margin and $250,000 for increase in advertising expense in the above formula.

Therefore, the operating income increases by $178,600.

Working Note:

1. Calculation of change in contribution margin:

3.

Find out the amount of underestimated profit due to increase in estimated amount of sales.

Answer to Problem 53P

The profit is underestimated by $642,900.

Explanation of Solution

Use the following formula to calculate underestimated profit:

Substitute $1,500,000 for increase in sales and 0.4286 for contribution margin ratio in the above formula.

Therefore, the profit is underestimated by $642,900.

4.

Calculate margin of safety on the basis of original information.

Answer to Problem 53P

Margin of safety is $2,671,269.

Explanation of Solution

Margin of Safety:

The number of units sold or the income earned in excess of the break-even sales is known as margin of safety. It is calculated by deducting the break-even sales from the sales revenue.

Use the following formula to calculate the margin of safety:

Substitute $14,210,000 for sales and $11,538,731 for break-even sales revenue in the above formula.

Therefore, the margin of safety is $2,671,269.

5.

Calculate the degree of operating leverage on the basis of original information. Also calculate the percentage increase in operating income if there is increase of 8% in the expected sales revenues.

Answer to Problem 53P

Degree for operating leverage is 5.32 and percentage increase in operating income is 42.56%.

Explanation of Solution

Degree of Operating Leverage (DOL):

The degree of operating leverage can be evaluated by dividing the total contribution margin by the operating income of the company.

Use the following formula to calculate degree of operating leverage:

Substitute $6,090,000 for total contribution margin and $1,144,500 for operating income in the above formula.

Therefore, degree for operating leverage (DOL) is 5.32.

Use the following formula to calculate increase in operating income:

Substitute 0.08 for increase in sales and 5.32 for DOL in the above formula.

Therefore, the percentage increase in operating income is 42.56%.

Want to see more full solutions like this?

Chapter 7 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Klamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardFaldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardKatayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forward

- More-Power Company has projected sales of 75,000 regular sanders and 30,000 mini-sanders for next year. The projected income statement is as follows: Required: 1. Set up the given income statement on a spreadsheet (e.g., ExcelTM). Then, substitute the following sales mixes, and calculate operating income. Be sure to print the results for each sales mix (a through d). 2. Calculate the break-even units for each product for each of the preceding sales mixes.arrow_forwardA company has prepared the following statistics regarding its production and sales at different capacity levels. Total costs: 1. At what point is break-even reached in sales dollars? In units? (Hint: Use the capacity level to determine the number of units.) 2. If the company is operating at 60% capacity, should it accept an offer from a customer to buy 10,000 units at 3 per unit?arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forward

- Abilene Industries manufactures and sells three products (XX, W, and ZZ). The sales price and unit variable cost for the three products are as follows: Their sales mix is reflected as a ratio of 4:2:1. Annual fixed costs shared by the three products are $345.000 per year. What are total variable costs for Abilene with their current product mix? Calculate the number of units of each product that will need to be sold in order for Abilene to break even. What is their break-even point in sales dollars? Using an income statement format, prove that this is the break-even point.arrow_forwardWellington, Inc., reports the following contribution margin income statement for the month of May. The company has the opportunity to purchase new machinery that will reduce its variable cost per unit by $10 but will increase fixed costs by 20%. Prepare a projected contribution margin income statement for Wellington, Inc., assuming it purchases the new equipment. Assume sales level remains unchanged.arrow_forwardMaterials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of 1,350 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of 900 per unit. a. If a transfer price of 1,000 per unit is established and 75,000 units of materials are transferred, with no reduction in the Components Divisions current sales, how much would Ziegler Inc.s total operating income increase? b. How much would the Instrument Divisions operating income increase? c. How much would the Components Divisions operating income increase?arrow_forward

- Kerr Manufacturing sells a single product with a selling price of $600 with variable costs per unit of $360. The companys monthly fixed expenses are $72,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of January when they will sell 500 units. How many units will Kerr need to sell in order to realize a target profit of $120,000? What dollar sales will Kerr need to generate in order to realize a target profit of $120,000? Construct a contribution margin income statement for the month of June that reflects $600,000 in sales revenue for Kerr Manufacturing.arrow_forwardMorrill Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. Includes depreciation. The density gauge uses a subassembly that is purchased from an external supplier for 25 per unit. Each quarter, 2,000 subassemblies are purchased. All units produced are sold, and there are no ending inventories of subassemblies. Morrill is considering making the subassembly rather than buying it. Unit-level variable manufacturing costs are as follows: No significant non-unit-level costs are incurred. Morrill is considering two alternatives to supply the productive capacity for the subassembly. 1. Lease the needed space and equipment at a cost of 27,000 per quarter for the space and 10,000 per quarter for a supervisor. There are no other fixed expenses. 2. Drop the thickness gauge. The equipment could be adapted with virtually no cost and the existing space utilized to produce the subassembly. The direct fixed expenses, including supervision, would be 38,000, 8,000 of which is depreciation on equipment. If the thickness gauge is dropped, sales of the density gauge will not be affected. Required: 1. Should Morrill Company make or buy the subassembly? If it makes the subassembly, which alternative should be chosen? Explain and provide supporting computations. 2. Suppose that dropping the thickness gauge will decrease sales of the density gauge by 10 percent. What effect does this have on the decision? 3. Assume that dropping the thickness gauge decreases sales of the density gauge by 10 percent and that 2,800 subassemblies are required per quarter. As before, assume that there are no ending inventories of subassemblies and that all units produced are sold. Assume also that the per-unit sales price and variable costs are the same as in Requirement 1. Include the leasing alternative in your consideration. Now, what is the correct decision?arrow_forwardMaple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning