Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 63E

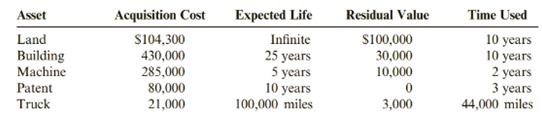

The following information relates to the assets of Westfield Semiconductors as of December 31, 2019. Westfield uses the straight-line method for

Required:

Use the information above to prepare the property, plant, and equipment and intangible assets portions of a classified balance sheet for Westfield.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Comprehensive At December 31, 2018, certain accounts included in theproperty, plant, and equipment section of Townsand Company's balancesheet had the following balances:

LandBuildingsLeasehold improvementsMachinery and equipment

$100,000800,000500,000700,000

During 2019, the following transactions occurred:

1. Land site number 621 was acquired for $1,000,000. Additionally,to acquire the land, Townsand paid a $60,000 commission to a realestate agent. Costs of $15,000 were incurred to clear the land.During the course of clearing the land, timber and gravel were recovered and sold for $5,000.2. A second tract of land (site number 622) with a building wasacquired for $300,000. The closing statement indicated that theland value was $200,000 and the building value was $100,000.Shortly after acquisition, the building was demolished at a cost of $30,000. A new building was constructed for $150,000 plus the following costs:

Excavation feesArchitectural design feesBuilding permit fee…

Journalizing partial-year depreciation and asset disposals and exchanges

During 2018, Mora Corporation completed the following transactions:

Record the transactions in the journal of Mora Corporation.

At December 31, 2019, certain accounts included in the property, plant, and equipment section of Concord Corporation’s statement of financial position had the following balances:

Land

$309,520

Buildings—Structure

882,660

Leasehold Improvements

704,970

Equipment

844,620

During 2020, the following transactions occurred:

1.

Land site No. 621 was acquired for $799,820 plus a fee of $6,880 to the real estate agent for finding the property. Costs of $33,270 were incurred to clear the land. In clearing the land, topsoil and gravel were recovered and sold for $10,720.

2.

Land site No. 622, which had a building on it, was acquired for $559,550. The closing statement indicated that the land’s assessed tax value was $308,860 and the building’s value was $101,820. Shortly after acquisition, the building was demolished at a cost of $27,990. A new building was constructed for $339,860 plus the following costs:

Excavation fees

$37,550

Architectural design fees…

Chapter 7 Solutions

Cornerstones of Financial Accounting

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - How does the cost concept affect accounting for...Ch. 7 - Prob. 4DQCh. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - What factors must be known or estimated in order...Ch. 7 - How do the accelerated and straight-line...Ch. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - Prob. 13DQCh. 7 - Prob. 14DQCh. 7 - Prob. 15DQCh. 7 - Prob. 16DQCh. 7 - Prob. 17DQCh. 7 - Prob. 18DQCh. 7 - Prob. 1MCQCh. 7 - Prob. 2MCQCh. 7 - When depreciation is recorded each period, what...Ch. 7 - Prob. 4MCQCh. 7 - Refer to the information for Cox Inc. above. What...Ch. 7 - Refer to the information for Cox Inc. above. What...Ch. 7 - Which of the following statements is true...Ch. 7 - Normal repair and maintenance of an asset is an...Ch. 7 - Chapman Inc. purchased a piece of equipment in...Ch. 7 - Bradley Company purchased a machine for $34,000 on...Ch. 7 - Prob. 11MCQCh. 7 - Which of the following statements is true? a. The...Ch. 7 - Prob. 13MCQCh. 7 - Heston Company acquired a patent on January 1,...Ch. 7 - Prob. 15MCQCh. 7 - ( Appendix 7 A) Murnane Company purchased a...Ch. 7 - Prob. 17CECh. 7 - Prob. 18CECh. 7 - Straight-Line Depreciation Refer to the...Ch. 7 - Prob. 20CECh. 7 - Prob. 21CECh. 7 - Revision of Depreciation On January 1, 2017, Slade...Ch. 7 - Disposal of an Operating Asset On August 30,...Ch. 7 - Prob. 24CECh. 7 - Cost of Intangible Assets Advanced Technological...Ch. 7 - Prob. 26CECh. 7 - Prob. 27CECh. 7 - (Appendix 7A) Impairment Brown Industries had two...Ch. 7 - Prob. 29BECh. 7 - Acquisition Cost Desert State University installed...Ch. 7 - Depreciation Concepts Listed below are concepts...Ch. 7 - Depreciation Methods On January 1, 2019, Loeffler...Ch. 7 - Expenditures After Acquisition Listed below are...Ch. 7 - Revision of Depreciation On January 1, 2019, the...Ch. 7 - Disposal of an Operating Asset Jolie Company owns...Ch. 7 - Analyzing Fixed Assets Pitt reported the following...Ch. 7 - Prob. 37BECh. 7 - Prob. 38BECh. 7 - ( Appendix 7A) Impairment Listed below is...Ch. 7 - Prob. 40ECh. 7 - Prob. 41ECh. 7 - Prob. 42ECh. 7 - Prob. 43ECh. 7 - Cost of a Fixed Asset Colson Photography Service...Ch. 7 - Prob. 45ECh. 7 - Cost and Depreciation On January 1, 2019, Quick...Ch. 7 - Characteristics of Depreciation Methods Below is a...Ch. 7 - Prob. 48ECh. 7 - Depreciation Methods Clearcopy, a printing...Ch. 7 - Depreciation Methods Quick-as-Lightning, a...Ch. 7 - Inferring Original Cost Barton Construction...Ch. 7 - Choice Among Depreciation Methods Walnut Ridge...Ch. 7 - Revision of Depreciation On January 1, 2017,...Ch. 7 - Capital versus Revenue Expenditure Warrick Water...Ch. 7 - Expenditures After Acquisition The following...Ch. 7 - Expenditures After Acquisition Roanoke...Ch. 7 - Prob. 57ECh. 7 - Prob. 58ECh. 7 - Disposal of Fixed Asset Pacifica Manufacturing...Ch. 7 - Prob. 60ECh. 7 - Prob. 61ECh. 7 - Prob. 62ECh. 7 - Balance Sheet Presentation The following...Ch. 7 - Prob. 64ECh. 7 - Prob. 65ECh. 7 - Prob. 66ECh. 7 - Prob. 67ECh. 7 - Financial Statement Presentation of Operating...Ch. 7 - A Cost of a Fixed Asset Mist City Car Wash...Ch. 7 - Depreciation Methods Hansen Supermarkets purchased...Ch. 7 - Depreciation Schedules Wendt Corporation acquired...Ch. 7 - Expenditures After Acquisition Pasta, a restaurant...Ch. 7 - Prob. 73APSACh. 7 - Prob. 74APSACh. 7 - Prob. 75APSACh. 7 - Prob. 76APSACh. 7 - Prob. 68BPSBCh. 7 - Cost of a Fixed Asset Metropolis Country Club...Ch. 7 - Depreciation Methods Graphic Design Inc. purchased...Ch. 7 - Depreciation Schedules Dunn Corporation acquired a...Ch. 7 - Prob. 72BPSBCh. 7 - Prob. 73BPSBCh. 7 - Prob. 74BPSBCh. 7 - Prob. 75BPSBCh. 7 - Prob. 76BPSBCh. 7 - Prob. 77.1CCh. 7 - Prob. 77.2CCh. 7 - Prob. 78.1CCh. 7 - Prob. 78.2CCh. 7 - Prob. 79.1CCh. 7 - Prob. 79.2CCh. 7 - Prob. 79.3CCh. 7 - Prob. 80.1CCh. 7 - Prob. 80.2CCh. 7 - Prob. 80.3CCh. 7 - Prob. 80.4CCh. 7 - Prob. 80.5CCh. 7 - Prob. 80.6CCh. 7 - Prob. 80.7CCh. 7 - Prob. 80.8CCh. 7 - Comparative Analysis: Under Armour, Inc., versus...Ch. 7 - Prob. 81.2CCh. 7 - Comparative Analysis: Under Armour, Inc., versus...Ch. 7 - CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT After...Ch. 7 - CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT After...Ch. 7 - CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT After...Ch. 7 - CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT After...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. The company reports on the balance sheet the total amount for inventories and the net book value of property, plant, and equipment, with the related details for each account disclosed in notes. 2. The straight line method is used to depreciate buildings, machinery, and equipment, based upon their cost and estimated residual values and lives. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. 3. Patents are amortized on a straight line basis directly to the Patent account. 4. Inventories are listed at the lower of cost or market value using an average cost. The inventories include raw-materials, 22,200; work in process, 34,700; and finished goods, 41,600. 5. Common stock has a 10 par value per share, 12,000 shares are authorized, and 6,280 shares have been issued. 6. Preferred stock has a 100 par value per share, 1,000 shares are authorized, and 400 shares have been issued. 7. The investment in bonds is carried at the original cost, which is the face value, and is being held to maturity. 8. Short-term investments in marketable securities were purchased at year-end. 9. The bonds payable mature on December 31, 2024. 10. The company attaches a 1-year warranty on all the products it sells. Required: 1. Prepare Wicks Constructions December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. 3. Next Level Compute the current ratio and the quick ratio. How do these two ratios provide different information about the companys liquidity? Why are these ratios useful?arrow_forwardComprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes. 2. The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, 29,500; buildings, 164,600; store fixtures, 72,600; and office equipment, 30,000. 3. The accumulated depreciation breakdown is as follows: buildings, 54,600; store fixtures, 37,400; and office equipment, 17,300. 4. The long term debt includes 12%, 36,000 face value bonds that mature on December 31, 2024, and have an unamortized bond discount of 1,000; 11%, 48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of 1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of 6,200 and matures on January 1, 2022. 5. The non-interest-bearing note receivable matures on June 1, 2023. 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost. 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, 50,000, 15-year bonds issued by this affiliate, Jay Company. 8. Common stock has a 10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of 13 per share, resulting in 8,000 shares issued at year-end. 9. Preferred stock has a 50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of 55 per share, resulting in 640 shares issued at year-end. 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of 20,000 and a book value of 7,000 was totally destroyed. Insurance proceeds will amount to only 5,000. 11. Net income and dividends declared and paid during the year were 50,500 and 21,000, respectively. Required: 1. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare a statement of shareholders equity for 2019. (Hint: Work back from the ending account balances.) 3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies, contingent liabilities, and subsequent events. 4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018? Use the following information for P415 and P416: McCormick Company, Inc. is one of the worlds leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormicks consolidated balance sheets for 20X2 and 20X3 follow.arrow_forwardOn December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.arrow_forward

- Investing Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Land and equipment were purchased with cash during the period. c. Equipment with an original cost of 20,000 that had a book value of 4,000 was written off as obsolete. d. A building with an original cost of 60,000 and accumulated depreciation of 25,000 was sold at a 23,000 gain. e. Depreciation expense and amortization expense were recorded. f. Net income for the year was 60,000. g. A patent was acquired during the year in exchange for 1,200 shares of common stock with a par value of 1 per share and a market value of 26 per share. h. Additional marketable securities wefe purchased during the year. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Required: 1. Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. 3. Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019.arrow_forwardFinancial Statement Presentation of Operating Assets Olympic Acquisitions Inc. prepared the following post-closing trial balance at December 31, 2019: Â Required: Prepare a classified balance sheet for Olympic at December 31, 2019. ( Note: Olympic reports the three categories of operating assets in separate subsections of assets.)arrow_forwardStraight-Line Depreciation Refer to the information for Irons Delivery Inc. above. Irons uses the straight-line method of depreciation. Required: Prepare the journal entry to record depreciation expense for 2019 and 2020.arrow_forward

- Analyzing Fixed Assets Pitt reported the following information for 2018 and 2019: Required: Compute Pitts fixed asset turnover ratio and the average age of its fixed assets. ( Note: Round all answers to two decimal places.)arrow_forwardExpenditures after Acquisition McClain Company incurred the following expenditures during 2019: Required: 1. Prepare journal entries to record McClains expenditures for 2019. 2. Next Level What is the effect on the financial statements if management had improperly accounted for the: a. addition of the new wing to the manufacturing facility b. annual maintenance expendituresarrow_forwardAt December 31, 2019, certain accounts included in the property, plant, and equipment section of Blue Spruce Corporation’s statement of financial position had the following balances: Land $309,730 Buildings—Structure 882,700 Leasehold Improvements 704,930 Equipment 844,920 During 2020, the following transactions occurred: 1. Land site No. 621 was acquired for $799,790 plus a fee of $6,780 to the real estate agent for finding the property. Costs of $33,140 were incurred to clear the land. In clearing the land, topsoil and gravel were recovered and sold for $10,950. 2. Land site No. 622, which had a building on it, was acquired for $559,950. The closing statement indicated that the land’s assessed tax value was $308,680 and the building’s value was $101,830. Shortly after acquisition, the building was demolished at a cost of $27,640. A new building was constructed for $339,530 plus the following costs: Excavation fees $37,960 Architectural design…arrow_forward

- Brush Company engaged in the following transactions at the beginning of 2019: 1. Prepare the journal entries to record the preceding transactions. 2. Prepare the journal entries to record the amortization of intangible assets for 2019, if appropriate. Amortize over the legal life unless a better alternative is indicated.arrow_forwardSelected accounts included in the property, plant, and equipment section of Lobo Corporation’s balance sheet at December 31, 2019, had the following balances. LandLand improvementsBuildingsEquipment $300,000140,0001,100,000960,000 During 2020, the following transactions occurred. 1. A tract of land was acquired for $150,000 as a potential future building site. 2. A plant facility consisting of land and building was acquired from Mendota Company in exchange for 20,000 shares of Lobo’s common stock. On the acquisition date, Lobo’s stock had a closing market price of $37 per share on a national stock exchange. The plant facility was carried on Mendota’s books at $110,000 for land and $320,000 for the building at the exchange date. Current appraised values for the land and building, respectively, are $230,000 and $690,000. 3. Items of machinery and equipment were purchased at a total cost of $400,000. Additional costs were incurred as follows. Freight and…arrow_forwardInformation for Blake Corporation’s property, plant, and equipment for 2019 is: 1. For each asset classification, prepare schedules showing depreciation and amortization expense, and accumulated depreciation and amortization that would appear on Blake’s income statement for the year ended December 31, 2019, and on the balance sheet at December 31, 2019, respectively 2. Prepare a schedule showing the gain or loss from disposal of assets that would appear in Blake’s income statement for the year ended December 31, 2019. 3. Prepare the property, plant, and equipment section of Blake’s December 31, 2019, balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Property, Plant and Equipment (PP&E) - Introduction to PPE; Author: Gleim Accounting;https://www.youtube.com/watch?v=e_Hx-e-h9M4;License: Standard Youtube License