Concept explainers

Incomplete Data:

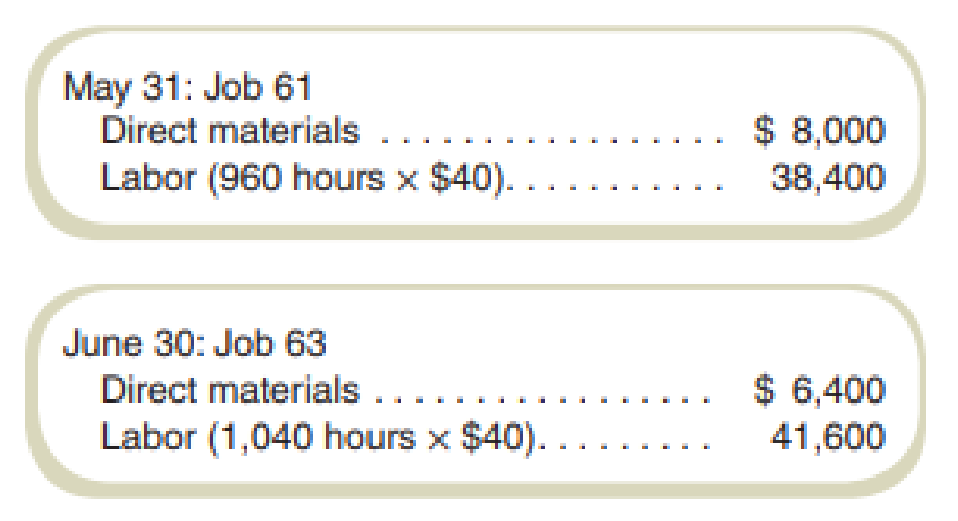

Chelsea Household Renovations (CHR) is a rapidly growing company that has not been profitable despite increases in sales. It has hired you as a consultant to find ways to improve profitability. You believe that the problem results from poor cost control and inaccurate cost estimation on jobs. The company has essentially no accounting system from which to collect data. You are able, however, to piece together the following information for June:

- Production

-

- 1. Completed Job 61.

- 2. Started and completed Job 62.

- 3. Started Job 63.

- Inventory values

-

- 1. Work-in-process inventory (excluding applied

overhead ):

- 1. Work-in-process inventory (excluding applied

- Each job in work-in-process inventory was exactly 50 percent completed as to labor-hours; however, all direct materials necessary to do the entire job were charged to each job as soon as it was started.

- There were no direct materials inventories or finished goods inventories at either May 31 or June 30.

- Actual overhead was $80,000.

- Cost of goods sold (before adjustment for over- or underapplied overhead):

- Overhead was applied to jobs using a predetermined rate per labor dollar that has been used since the company began operations.

- All direct materials were purchased for cash and charged directly to Work-in-Process Inventory when purchased. Direct materials purchased in June amounted to $18,400.

- Direct labor costs charged to jobs in June were $128,000. All labor costs were the same per hour for all laborers for June.

Required

Write a report to management to show:

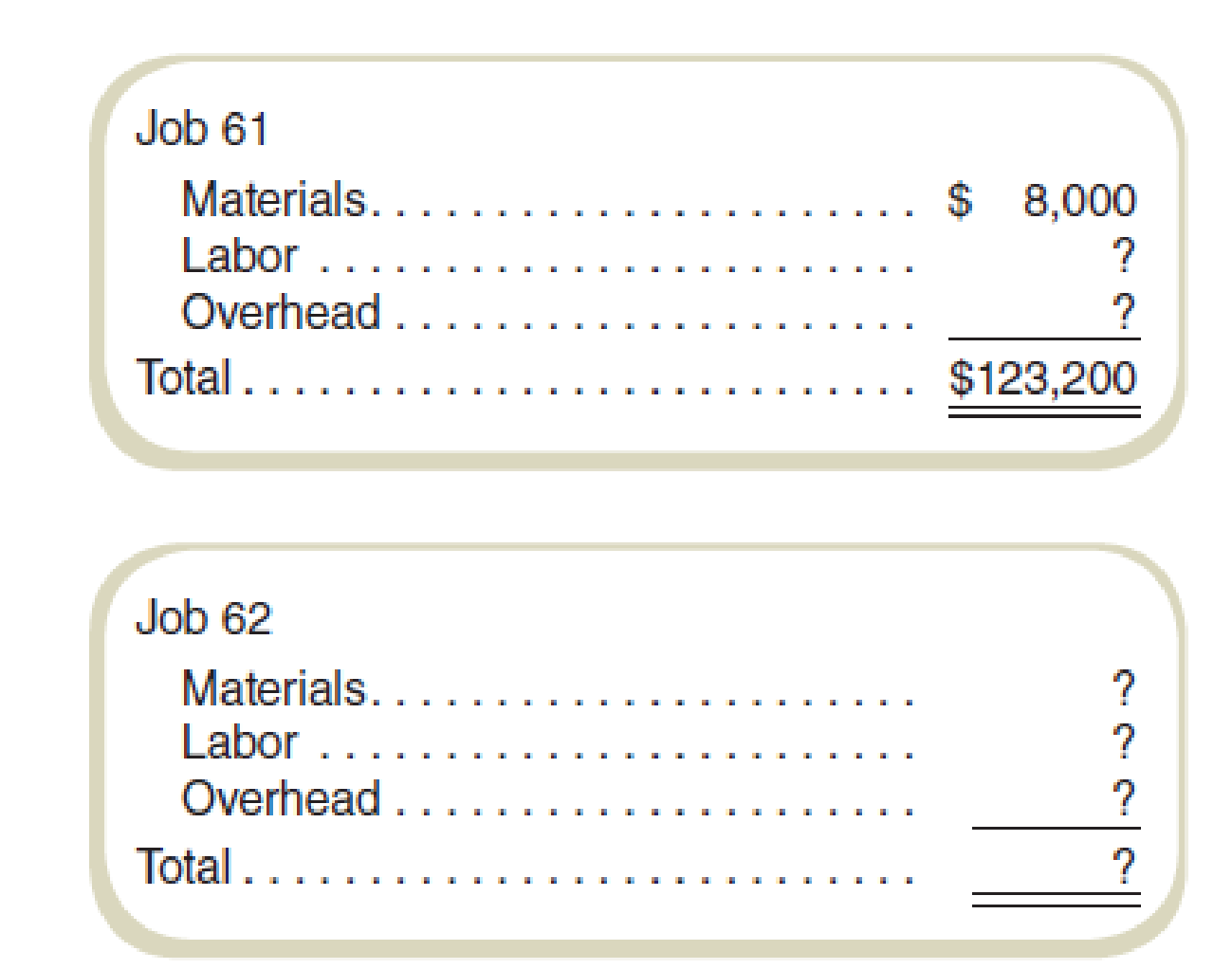

- a. The cost elements (material, labor, and overhead) of cost of goods sold before adjustment for over- or underapplied overhead for each job sold.

- b. The value of each cost element (material, labor, and overhead) for each job in work-in-process inventory at June 30.

- c. Over- or underapplied overhead for June.

a.

Determine cost elements (material, labor, and overhead) of the cost of goods sold before adjustment for over-or under-applied overhead for each job sold.

Explanation of Solution

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

Under-applied overheads: It is the amount of overhead cost which is not applied to the jobs during the period. Under-applied overheads occur when the actual overheads are more than the applied overheads.

Over-applied overheads: This is the amount of overhead which arises when the amount of actual overheads is less than the amount of overheads applied.

Unadjusted cost of goods: It means the cost of goods determined without taking under applied costs or over-applied cost into consideration.

Adjusted cost of goods: It means the cost of goods determined by taking under-applied costs or over-applied cost into consideration.

T-account for work-in-process for job no. 61:

| Cost of goods sold job no. 61 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Materials | $ 8,000 | ||||

| Labor | $ 76,800 (1) | ||||

| Applied overhead | $ 38,400 (2) | ||||

| $ 123,200 | |||||

T-account for work-in-process for the job no. 62:

| Cost of goods sold job no. 62 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Materials | $ 12,000 (3) | ||||

| Labor | $ 48,000 (4) | ||||

| Applied overhead | $ 24,000 (5) | ||||

| $ 84,000 | |||||

Working note 1:

Compute the labor for job number 61:

Working note 2:

Compute the applied overhead for job number 61:

Working note 3:

Compute the materials for job number 62:

Working note 4:

Compute the labor for job number 62:

Working note 5:

Compute the overhead applied for job number 62:

b.

Determine the value of each cost element (material, labor, and overhead) for each job in work-in-process inventory.

Explanation of Solution

Work-in-process: Work-in-process refers to those units which are incomplete in respect or materials cost or conversion cost or both. These units are not complete enough to treat as completed goods.

T-account of work-in-process for job number 61:

| Work-in-process job no. 61 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Materials | $ 8,000 | $ 8,000 | |||

| Labor | $ 38,400 | $ 76,800 | |||

| Overhead | $ 19,200 (6) | $ 38,400 | |||

| Balance | $ 65,600 | ||||

| Labor | $ 38,400 | ||||

| Overhead | $ 19,200 | ||||

T-account of work-in-process for job number 62:

| Work-in-process job no. 62 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Material | $ 12,000 (7) | $ 12,000 | |||

| Labor | $ 48,000 (8) | $ 48,000 | |||

| Overhead | $ 24,000 (9) | $ 24,000 | |||

T-account of work-in-process for job number 63:

| Work-in-process job no. 63 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Material | $ 6,400 | ||||

| Labor | $ 41,600 | ||||

| Overhead | $ 20,800 (10) | ||||

| $ 68,800 | |||||

Working note 6:

Compute the overhead beginning inventory for job number 61:

Working note 7:

Compute the materials for job number 62:

Working note 8:

Compute the labor for job number 62:

Working note 9:

Compute the overhead for job number 62:

Working note 10:

Compute the overhead for job number 63:

c.

Determine the over- or under-applied overhead for June.

Explanation of Solution

Under-applied overheads: It is the amount of overhead cost which is not applied to the jobs during the period. Under-applied overheads occur when the actual overheads are more than the applied overheads.

Over-applied overheads: This is the amount of overhead which arises when the amount of actual overheads is less than the amount of overheads applied.

Compute the value of under-applied overhead for June:

Thus, the value of under-applied overhead for June is $16,000.

Working note 11:

Compute the applied overhead:

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Ventana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forwardNutts management is very concerned about the cost of overhead on its jobs. When jobs are complete, overhead costs should be between 15% and 20% of total costs. For example, the labor cost on Job 8958 is 25% of total costs, higher than the norm. Open Job 8961 and click the Chart sheet tab. A pie chart appears showing the cost components on that job. Record the labor cost percentage in the space provided. Repeat this for each of the jobs worked on in August. Did Nutt maintain good cost control on all its jobs? Explain. Worksheet. During September, Job 8963 required two additional material requisitions to complete the job. Open JOB8963 and modify the job cost sheet to include an area for four direct material requisition entries instead of three. Then enter the following two materials requisitions onto the worksheet: Preview the printout to make sure it will print neatly on one page, and then print the worksheet. Save the completed worksheet as JOBT. Chart. Open JOB8964 and click the Chart sheet tab. Prepare a bar chart for JOB8964 showing the amount of material, labor, and overhead required to complete the job. Use the Chart Data Table found in rows 4246 as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as J0B8964. Print the chart.arrow_forwardRIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the job cost sheets to learn more about the cost effectiveness of the operations. To facilitate a comparison, the job cost sheets for Job 206 (for 50 backhoe buckets completed in October) and Job 228 (for 75 backhoe buckets completed in December) were pulled and presented as follows: Management is concerned about the increase in unit costs over the months from October to December. To understand what has occurred, management interviewed the purchasing manager and quality manager. Purchasing Manager: Prices have been holding steady for our raw materials during the first half of the year. I found a new supplier for our bulk steel that was willing to offer a better price than we received in the past. I saw these lower steel prices and jumped on them, knowing that a reduction in steel prices would have a very favorable impact on our costs. Quality Manager: Something happened around mid-year. All of a sudden, we were experiencing problems with respect to the quality of our steel. As a result, weve been having all sorts of problems on the shop floor in our foundry and welding operation. a. Analyze the two job cost sheets and identify why the unit costs have changed for the backhoe buckets. Complete the following schedule to help in your analysis: b. How would you interpret what has happened in light of your analysis and the interviews?arrow_forward

- Communications Jamarcus Bradshaw, plant manager of Georgia Paper Companys papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following: Jamarcus was concerned about the increased cost per ton from the output of the department. As a result, he asked the plant controller to perform a study to help explain these results. The controller, Leann Brunswick, began the analysis by performing some interviews of key plant personnel in order to understand what the problem might be. Excerpts from an interview with Len Tyson, a paper machine operator, follow: Len: We have two papermaking machines in the department. I have no data, but I think paper machine No. 1 is applying too much pulp and, thus, is wasting both conversion and materials resources. We haven't had repairs on paper machine No. 1 in a while. Maybe this is the problem. Leann: How does too much pulp result in wasted resources? Len: Well, you see, if too much pulp is applied, then we will waste pulp material. The customer will not pay for the extra product; we just use more material to make the product. Also, when there is too much pulp, the machine must be slowed down in order to complete the drying process. This results in additional conversion costs. Leann: Do you have any other suspicions? Len: Well, as you know, we have two productsgreen paper and yellow paper. They are identical except for the color. The color is added to the papermaking process in the paper machine. I think that during August these two color papers have been behaving very differently. I don't have any data, but it just seems as though the amount of waste associated with the green paper has increased. Leann: Why is this? Len: I understand that there has been a change in specifications for the green paper, starting near the beginning of August. This change could be causing the machines to run poorly when making green paper. If this is the case, the cost per ton would increase for green paper. Leann also asked for a database printout providing greater detail on Augusts operating results. September 9 Requested by: Leann Brunswick Papermaking DepartmentAugust detail Prior to preparing a report, Leann resigned from Georgia Paper Company to start her own business. You have been asked to take the data that Leann collected, and write a memo to Jamarcus Bradshaw with a recommendation to management. Your memo should include analysis of the August data to determine whether the paper machine or the paper color explains the increase in the unit cost from July. Include any supporting schedules that are appropriate. Round any calculations to the nearest cent.arrow_forwardPhono Company manufactures a plastic toy cell phone. The following standards have been established for the toys materials and labor inputs: During the first week of July, the company had the following results: The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in July. Also, a new manufacturing layout was implemented on a trial basis. The new layout required a slightly higher level of skilled labor. The higher-quality material has no effect on labor utilization. Similarly, the new manufacturing approach has no effect on material usage. (Note: Round all variances to the nearest dollar.) Required: 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assuming that the materials variances are essentially attributable to the higher quality of materials, would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly. 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing layout, should it be continued or discontinued? Explain. 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new layout should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 13,200 and the labor cost was 132,000. Should the new layout be adopted? Assume the variances are attributable to the new layout. If so, what would be the projected annual savings?arrow_forwardTypes of Responsibility Centers Consider each of the following independent scenarios: a. Terrin Belson, plant manager for the laser printer factory of Compugear Inc., brushed his hair back and sighed. December had been a bad month. Two machines had broken down, and some factory production workers (all on salary) were idled for part of the month. Materials prices increased, and insurance premiums on the factory increased. No way out of it; costs were going up. He hoped that the marketing vice president would be able to push through some price increases, but that really wasnt his department. b. Joanna Pauly was delighted to see that her ROI figures had increased for the third straight year. She was sure that her campaign to lower costs and use machinery more efficiently (enabling her factories to sell several older machines) was the reason why. Joanna planned to take full credit for the improvements at her semiannual performance review. c. Gil Rodriguez, sales manager for ComputerWorks, was not pleased with a memo from headquarters detailing the recent cost increases for the laser printer line. Headquarters suggested raising prices. Great, thought Gil, an increase in price will kill sales and revenue will go down. Why cant the plant shape up and cut costs like every other company in America is doing? Why turn this into my problem? d. Susan Whitehorse looked at the quarterly profit and loss statement with disgust. Revenue was down, and cost was upwhat a combination! Then she had an idea. If she cut back on maintenance of equipment and let a product engineer go, expenses would decreaseperhaps enough to reverse the trend in income. e. Shonna Lowry had just been hired to improve the fortunes of the Southern Division of ABC Inc. She met with top staff and hammered out a 3-year plan to improve the situation. A centerpiece of the plan is the retiring of obsolete equipment and the purchasing of state-of-the-art, computer-assisted machinery. The new machinery would take time for the workers to learn to use, but once that was done, waste would be virtually eliminated. Required: For each of the above independent scenarios, indicate the type of responsibility center involved (cost, revenue, profit, or investment).arrow_forward

- Darnell Poston, owner of Poston Manufacturing, Inc., wants to determine the cost behavior of labor and overhead. Darnell pays his workers a salary; during busy times, everyone works to get the orders out. Temps (temporary workers hired through an agency) may be hired to pack and prepare completed orders for shipment. During slower times, Darnell catches up on bookkeeping and administrative tasks while the salaried workers do preventive maintenance, clean the lines and building, etc. Temps are not hired during slow times. Darnell found that workers salaries, temp agency payments, rentals, utilities, and plant and equipment depreciation are the largest dollar accounts. He believes that workers salaries and plant and equipment depreciation are fixed, temp agency payments are associated with the number of orders (since temp workers are used to pack and prepare completed orders for shipment), and electricity is associated with the number of machine hours. When the number of different parts stored by Poston exceeds the space in the materials storeroom, Darnell rents nearby warehouse space. He can rent as much or as little space as he wants on a month-to-month basis. Therefore, he believes warehouse rental payments are variable with the number of parts purchased and stored. The account balances for the past six months as well as the six-month total are as follows: Information on number of machine hours, orders, and parts for the six-month period follows: Required: 1. Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers. 2. Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost. 3. In July, Darnell predicts there will be 420 orders, 250 parts, and 5,900 machine hours. What is the total labor and overhead cost for July? 4. What if Darnell buys a new machine in July for 24,000? The machine is expected to last 10 years and will have no salvage value at the end of that time. What part of the cost equation will be affected? How? What is the new expected cost in July?arrow_forwardBrady Furniture Company manufactures wooden oak furniture. The company employs a job cost system to trace manufacturing costs to jobs. Each job represents a batch of furniture of the same type. Information regarding direct materials on selected jobs throughout the year is as follows: Dining tables are the most difficult furniture item in Bradys catalog to manufacture. Thus, the most skilled employees are scheduled to make dining tables, unless they are required for other jobs. a. Determine the material cost per unit for each job. b. Use the January material cost per unit for each type of furniture as the base material cost. For each month and each type of furniture, determine the unit material cost as a percent of the base unit material cost. Round percent to one decimal place. Use the following table format: c. Develop a line chart of the percent of unit material cost to the base unit material cost. Place the months on the horizontal axis and use three lines for the three different types of furniture. d. Interpret the chart. What is happening to the dining tables?arrow_forwardPlease ensure that the information from the picture is changed to the information listed below. Use the information in the problem 4-53 (picture listed below) to prepare journal entries for the month of July with the following CHANGES. First, assume that the company uses a plantwide overhead rate based on direct labor dollars. Also assume that estimated information for the year includes Direct labor dollars of $1,642,000. Finally, assume that the company sells its jobs at a selling price equal to (cost + 25% of cost markup).arrow_forward

- Markup on Cost, Job Pricing Ventana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventana’s income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about thesame amount of profit on each job as was earned last year.Required:1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as lastyear? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: Direct materials $1,230Direct labor 250Applied overhead 175Total cost $1,655 What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the…arrow_forwardPareto Chart and Cost of Quality Report for a Manufacturing Company The president of Mission Inc. has been concerned about the growth in costs over the last several years. The president asked the controller to perform an activity analysis to gain a better insight into these costs. The result of the activity analysis is summarized as follows: Activities Activity Cost Correcting invoice errors $11,250 Disposing of incoming materials with poor quality 9,000 Disposing of scrap 31,500 Expediting late production 27,000 Final inspection 22,500 Inspecting incoming materials 4,500 Inspecting work in process 22,500 Preventive machine maintenance 15,750 Producing product 67,500 Responding to customer quality complaints 13,500 Total $225,000 The production process is complicated by quality problems, requiring the production manager to expedite production and dispose of scrap. Required: 1. On paper or in a spreadsheet program, prepare a Pareto chart for each of the…arrow_forwardPVW Company manufactures products to customer specifications. A job costing system is used to accumulate production costs. During the month of September, an order (Job X2) by a customer comprised 5,000 units of the product; manufacturing cost is $5.00 per unit. The processing of this job, however, resulted in spoilage of 400 units, considered normal with no disposal value, attributable to this specific job. Required: How will you account for the above transaction, for example, in a journal entry? Determine the unit cost showing computations.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,