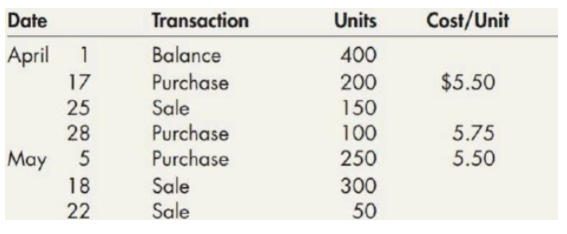

Date Transaction Units Cost/Unit April 1 Balance 400 17 Purchase 200 $5.50 Sale Purchase Purchase 25 150 5.75 5.50 28 100 May 5 18 22 250 Sale Sale 300 50

Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May:

The cost of the inventory on April 1 is $5, $4, and $2 per unit, respectively,

under the FIFO, average, and LIFO cost flow assumptions.

Required:

1. Compute the inventories at the end of each month and the cost of

goods sold for each month for the following alternatives:

a. FIFO periodic

b. FIFO perpetual

c. LIFO periodic

d. LIFO perpetual

e. Weighted average (Round unit costs to 4 decimal places.)

f. Moving average (Round unit costs to 4 decimal places.)

2. Next Level Reconcile and explain the difference between the LIFO

periodic and the LIFO perpetual results.

3. Next Level If Garrett uses IFRS, which of the previous alternatives

would be acceptable, and why?

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images