Allocate payments and receipts to fixed asset accounts

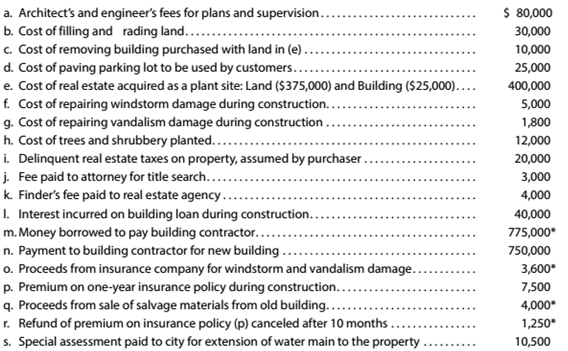

The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale apparel business. The receipts are identified by an asterisk.

Instructions

Determine the increases to Land, Lind Improvements. and Building.

Concept Introduction:

Capital Expenditures are that type of expenses which a company incurs on its tangible or fixed assets in regard to either its purchase or for its repairs or installation. These assets are those which are used for more than one year i.e. which are not held for sale. These expenditures are like purchase of land, building, equipment, repairs or improvement in the building or machinery, etc. These expenses are meant for capitalization in the balance sheet in the respective fixed assets.

The net increase in the value of land, land improvement, and building

Answer to Problem 7.1.2P

The increase in the value of land, land improvement, and building is

Explanation of Solution

| Transaction no. | Transaction | Land | Land improvements | Buildings | Other accounts |

| a. | Architect and engineer fees | | |||

| b. | Cost of filing and grading land | | |||

| c. | Cost of removing the building | | |||

| d. | Cost of paving parking lot | | |||

| e. | Cost of real estate acquired as plant site | | |||

| f. | Cost of repairing windstorm damage | | |||

| g. | Cost of repairing vandalism damage | | |||

| h. | Cost of trees and shrubbery | | |||

| i. | Delinquent real estate taxes on property | | |||

| j. | Fee paid to attorney for title | | |||

| k. | Finder's fee paid to real estate agency | | |||

| l. | Interest incurred on building loan | | |||

| m. | Money borrowed to pay building contractor | | |||

| n. | Payment to contractor for new building | | |||

| o. | Proceeds from insurance windstorm and vandalism | | |||

| p. | Premium on one-year insurance policy | | |||

| q. | Proceeds from sale of salvage materials | | |||

| r. | Refund of premium on insurance policy in | | |||

| s. | Special assessment paid to city for extension of water | | |||

| Total | | | | |

As per the assignment transactions, the net increase in the values of land, land improvement, and building are:

| Transaction no. | Transaction | Land | Land improvements | Buildings | Other accounts |

| Total | | | | |

Want to see more full solutions like this?

Chapter 7 Solutions

Survey of Accounting (Accounting I)

- The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. Instructions 1. Assign each payment and receipt to Land (unlimited life), Land Improvements (limited life), Building, or Other Accounts. Indicate receipts by an asterisk. Identify each item by letter and list the amounts in columnar form, as follows: 2. Determine the amount debited to Land, Land Improvements, and Building. 3. The costs assigned to the land, which is used as a plant site, will not be depreciated, while the costs assigned to land improvements will be depreciated. Explain this seemingly contradictory application of the concept of depreciation. 4. What would be the effect on the current years income statement and balance sheet if the cost of filling and grading land of 12,000 [payment (i)] was incorrectly classified as Land Improvements rather than Land? Assume that Land Improvements are depreciated over a 20-year life using the double-declining-balance method.arrow_forwardAllocating payments and receipts to fixed asset accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search $3,000 b. Cost of real estate acquired as a plant site: Land 280,000 Building (to be demolished) 55,000 c. Delinquent real estate taxes on property, assumed by purchaser 16,000 d. Cost of razing and removing building acquired in (b) 5,000 e. Proceeds from sale of salvage materials from old building 5,000 * f. Special assessment paid to city for extension of water main to the property 28,000 g. Architect’s and engineer’s fees for plans and supervision 70,000 h. Premium on one-year insurance policy during construction 7,000 i. Cost of filling and grading land 11,000 j. Money borrowed to pay building…arrow_forwardAllocating payments and receipts to fixed asset accountsThe following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. A. Fee paid to attorney for title search.............. $2,500 B. Cost of real estate acquired as a plant site: Land 285,000 C. Delonquent real estate taxes on property, assumed by purchaser...... 15,500 D. Cost of razing and removing building acquired in B......... 5,000 E. Proceeds from sale of salvage materials from old building........ 4,000* F. Special assessment paid to city for extension of water main to the property...... 29,000 G. Architect's and engineer's fees for plans and supervision........ 60,000 H. Premium on one-year insurance policy during construction..... 6,000 I. Cost of filling and grading land............. 12,000 J. Money borrowed to pay building contactor....... 900,000* K. Cost of…arrow_forward

- The cost of installing new equipment would be debited to which of the following accounts? Oa. Land Improvements Ob. Buildings Oc. Repairs and Maintenance Expense Od. Machinery and Equipmentarrow_forwardA company may acquire property, plant, and equipment and intangible assets for cash, in exchange for a deferred payment contract, by exchanging other assets, or by a combination of these methods. Required: 1. Identify six types of costs that should be capitalized as the cost of a parcel of land. For your answer, assume that the land has an existing building that is to be removed in the immediate future in order that a new building can be constructed on the site. 2. At what amount should a company record an asset acquired in exchange for a deferred payment contract? 3. In general, at what amount should assets received in exchange for other nonmonetary assets be valued? Specifically, at what amount should a company value a new machine acquired by exchanging an older, similar machine and paying cash?arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(294,600 ) (b) Payment for construction from note proceeds 294,600 (c) Cost of land fill and clearing 10,250 (d) Delinquent real estate taxes on property assumed by purchaser 7,170 (e) Premium on 6-month insurance policy during construction 11,100 (f) Refund of 1-month insurance premium because construction completed early (1,850 ) (g) Architect’s fee on building 26,350 (h) Cost of real estate purchased as a plant site (land $208,600 and building $51,900) 260,500 (i) Commission fee paid to real estate agency 9,500 (j) Installation of fences around property 4,120 (k) Cost of razing and removing building 10,230 (l) Proceeds from salvage of…arrow_forward

- The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(294,600 ) (b) Payment for construction from note proceeds 294,600 (c) Cost of land fill and clearing 10,250 (d) Delinquent real estate taxes on property assumed by purchaser 7,170 (e) Premium on 6-month insurance policy during construction 11,100 (f) Refund of 1-month insurance premium because construction completed early (1,850 ) (g) Architect’s fee on building 26,350 (h) Cost of real estate purchased as a plant site (land $208,600 and building $51,900) 260,500 (i) Commission fee paid to real estate agency 9,500 (j) Installation of fences around property 4,120 (k) Cost of razing and removing building 10,230 (l) Proceeds from salvage of…arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(290,400 ) (b) Payment for construction from note proceeds 290,400 (c) Cost of land fill and clearing 11,780 (d) Delinquent real estate taxes on property assumed by purchaser 7,360 (e) Premium on 6-month insurance policy during construction 11,340 (f) Refund of 1-month insurance premium because construction completed early (1,890 ) (g) Architect’s fee on building 25,930 (h) Cost of real estate purchased as a plant site (land $207,300 and building $57,700) 265,000 (i) Commission fee paid to real estate agency 9,860 (j) Installation of fences around property 3,860 (k) Cost of razing and removing building 10,800 (l) Proceeds from salvage of…arrow_forwardWhich of the following are includable to the cost of property and equipment? Transportation costs on machinery purchased under terms FOB shipping point Interest on loans borrowed to purchase an equipment Installation costs and cost of trial runs of a machinery Repairs on broken glass windows of a purchased buildings prior to occupancyarrow_forward

- The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(282,600) (b) Payment for construction from note proceeds 282,600 (c) Cost of land fill and clearing 11,200 (d) Delinquent real estate taxes on property assumed by purchaser 8,870 (e) Premium on 6-month insurance policy during construction 10,260 (f) Refund of 1-month insurance premium because construction completed early (1,710) (g) Architect’s fee on building 25,770 (h) Cost of real estate purchased as a plant site (land $207,200 and building $52,900) 260,100 (i) Commission fee paid to real estate agency 9,490 (j) Installation of fences around property 4,130 (k) Cost of razing and removing building 9,910 (l) Proceeds from salvage…arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(282,600 ) (b) Payment for construction from note proceeds 282,600 (c) Cost of land fill and clearing 11,200 (d) Delinquent real estate taxes on property assumed by purchaser 8,870 (e) Premium on 6-month insurance policy during construction 10,260 (f) Refund of 1-month insurance premium because construction completed early (1,710 ) (g) Architect’s fee on building 25,770 (h) Cost of real estate purchased as a plant site (land $207,200 and building $52,900) 260,100 (i) Commission fee paid to real estate agency 9,490 (j) Installation of fences around property 4,130 (k) Cost of razing and removing building 9,910 (l) Proceeds from salvage of…arrow_forwardThe following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(280,800 ) (b) Payment for construction from note proceeds 280,800 (c) Cost of land fill and clearing 12,020 (d) Delinquent real estate taxes on property assumed by purchaser 7,470 (e) Premium on 6-month insurance policy during construction 12,360 (f) Refund of 1-month insurance premium because construction completed early (2,060 ) (g) Architect’s fee on building 28,020 (h) Cost of real estate purchased as a plant site (land $208,600 and building $50,000) 258,600 (i) Commission fee paid to real estate agency 8,480 (j) Installation of fences around property 3,960 (k) Cost of razing and removing building 10,190 (l) Proceeds from salvage of…arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning