Concept explainers

(1)

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or borrower to lender or creditor. Notes receivable is an asset of a business.

To prepare:

(1)

Explanation of Solution

Journal entries of FL bank are as follows:

FL bank agreed to settle the debt in exchange for land worth $16 million.

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| Land | 16,000,000 | |||

| Loss on debt restructuring | 6,000,000 | |||

| Note receivable | 20,000,000 | |||

| Accrued interest receivable (1) | 2,000,000 | |||

| (To record the settlement of land for the debt) |

Table (1)

Working note:

(2)(a)

Interest accrued from last year.

(2)(a)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| January 1, 2018 | Loss on troubled debt restructuring | 8,584,980 | ||

| Accrued interest receivable (1) | 2,000,000 | |||

| Note receivable

|

6,584,980 | |||

| (To record accrued interest) |

Table (2)

Working note:

| $ | $ | |

| Previous value: | ||

| Interest Accrued 2017 (1) | 2,000,000 | |

| Principal | 20,000,000 | |

| Carrying amount of the receivables | 22,000,000 | |

| New value: | ||

| Interest

|

3,169,870 | |

| Principal

|

10,245,150 | |

| Present value of the receivable | (13,415,02) | |

| Loss | 8,584,980 |

Table (3)

- PV factor of 3.16987 (Present value of an ordinary annuity of $1: n = 4, i = 10%) is taken from the table value (Refer Table 4 in Appendix from textbook).

- PV factor of 0.68301 (Present value of $1: n = 4, i = 10%) is taken from the table value (Refer Table 2 in Appendix from textbook).

(b)

Reduce the interest payment to $1 Million each:

(b)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2018 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 341,502 | |||

| Interest revenue

|

1,341,502 | |||

| (To record the interest revenue ) |

Table (4)

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2019 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 375,652 | |||

| Interest revenue

|

1,375,652 | |||

| (To record the interest revenue ) |

Table (5)

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2020 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 413,217 | |||

| Interest revenue

|

1,413,217 | |||

| (To record the interest revenue ) |

Table (6)

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2021 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 454,609 | |||

| Interest revenue

|

1,454,609 | |||

| (To record the interest revenue ) |

Table (7)

(c)

Reduce the principal to $15 Million:

(c)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2021 | Cash (required by new agreement) | 15,000,000 | ||

| Note receivable (Balance) | 15,000,000 | |||

| (To record the principal ) |

Table (8)

Note:

- $15,000,000 is rounded to amortize the note.

Working note:

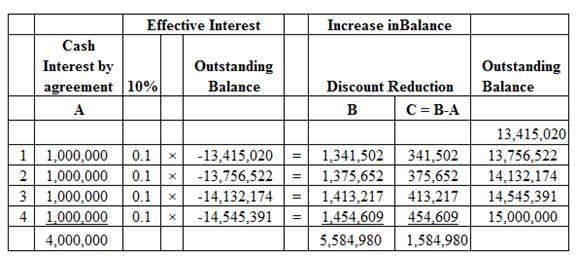

Amortization schedule:

Image (1)

(3)

To defer all payments until the maturity date:

(3)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| January 1, 2018 | Loss on troubled debt restructuring | 3,029,397 | ||

| Accrued interest receivable (1) | 2,000,000 | |||

| Note receivable

|

1,029,397 | |||

| (To record the loss on debt ) | ||||

| December 31, 2018 | Note receivable (Balance) | 1,897,060 | ||

| Interest revenue

|

1,897,060 | |||

| (To record the interest revenue ) | ||||

| December 31, 2019 | Note receivable (Balance) | 2,086,766 | ||

| Interest revenue

|

2,086,766 | |||

| (To record the interest revenue ) | ||||

| December 31, 2020 | Note receivable (Balance) | 2,295,443 | ||

| Interest revenue (Refer schedule) | 2,295,443 | |||

| To record the interest revenue ) | ||||

| December 31, 2021 | Note receivable (Balance) | 2,295,443 | ||

| Interest revenue (Refer schedule) | 2,295,443 | |||

| To record the interest revenue ) | ||||

| December 31, 2021 | Cash (required by new agreement) | 27,775,000 | ||

| Note receivable (Balance) | 27,775,000 | |||

| (To record the principal ) | ||||

Table (8)

Working notes:

| $ | |

| Previous value: | |

| Interest Accrued 2017 (1) | 2,000,000 |

| Principal | 20,000,000 |

| Carrying amount of the receivables | |

| New value: | |

| Principal

|

18,970,603 |

| Loss | 3,029,397 |

Table (9)

- PV factor of 0.68301 (Present value of $1: n = 4, i = 10%) is taken from the table value (Refer Table 2 in Appendix from textbook).

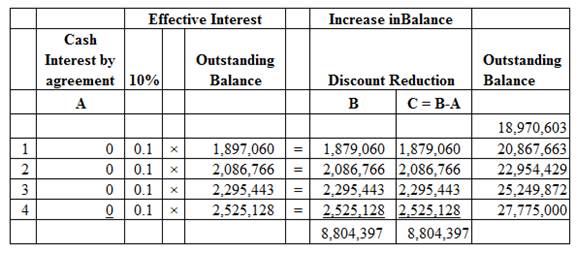

Amortization schedule:

Image (2)

Want to see more full solutions like this?

Chapter 7 Solutions

Intermediate Accounting

- Long-Term Debt and Ethics You arc the CFO of Diversified Industries. Diversified has suffered through 4 or 5 tough years. This has deteriorated its financial condition to the point that Diversified is in danger of violating two loan covenants related to its largest loan, which is not due for 12 more years. The loan contract states that if Diversified violates any of these covenants, the loan principal becomes immediately due and payable. Diversified would be unable to make this payment, and any additional loans taken to repay this loan would likely be at higher rates, forcing Diversified into bankruptcy. An investment banker suggests forming another entity (called special purpose entities or SPE) and transferring some debt to this SPE. Structuring the SPE very carefully will have the effect of moving enough debt off Diversifier's balance sheet to keep the company in compliance with all its loan covenants. The investment banker assures you that accounting rules permit such accounting treatment. Required: How do you react to the investment banker?arrow_forward3. Down Company has an overdue Notes Payable to City Bank of P8,000,000 and recorded accrued interest of P640,000 based on 8% interest rate. This rate of interest is presumed to be the market rate at the time of debt restructuring. As a result of a settlement on December 31, 2012, City Bank agreed to these restructuring arrangements: reduce the principal obligation to P6,000,000; forgive the P640,000 accrued interest; extend the maturity date to December 31, 2014; and annual interest of 10% is to be paid on December 31, 2013 and 2014.What is Down Company’s gain on debt restructuring? (Round off present value factors to four decimal places) * a. P 2,640,000 b. P 2,426,220 c. P 1,440,000 d. P 0arrow_forwardDEBT RESTRUCTURING On January 1, 2022, ACT company borrowed funds from DEF Finance by issuing a promissory note for P1,500,000. Due to the economic downtrend in the industry of ACT Company, the company experienced low sales and therefore cannot meet its obligation in 2024. On December 31, 2024, which is the maturity date of the obligation, DEF finance accepted the offer of ACT Company’s building with a cost of P 2,500,000 and accumulated depreciation balance on this date of P 750,000 in full settlement of the note and annual accrued interest at 12%. Interest is payable annually and the building has a fair value on the date of restructuring of P 1,600,000. Provide the journal entries for each problems and assumptions.arrow_forward

- Problem 16 Lozano Company sells a portfolio of short-term accounts receivable with a carrying amount of P900,000 for P1,000,000 and promises to pay up to P30,000 to compensate the buyer if and when any defaults occur. Lozano Company neither transfers nor retains substantially all the risks and rewards of ownership of the transferred asset, and retains control of the transferred asset. How much should be recognized as continuing involvement in the receivables?arrow_forward(Settlement of Debt) Strickland Company owes $200,000 plus $18,000 of accrued interest to Moran State Bank. The debt is a 10-year, 10% note. During 2017, Strickland’s business deteriorated due to a faltering regional economy. On December 31, 2017, Moran State Bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of $390,000, accumulated depreciation of $221,000, and a fair value of $180,000.Instructions(a) Prepare journal entries for Strickland Company and Moran State Bank to record this debt settlement.(b) How should Strickland report the gain or loss on the disposition of machine and on restructuring of debt in its 2017 income statement?(c) Assume that, instead of transferring the machine, Strickland decides to grant 15,000 shares of its common stock ($10 par) which has a fair value of $180,000 in full settlement of the loan obligation. If Moran State Bank treats Strickland’s stock as a trading investment, prepare the entries to record the…arrow_forward8 Company A invests in a $55 million bond. It was purchased at par and is accounted for using amortized cost. At year-end Company A believes that there is a 5% the company will not collect 50% of the face value over its life. Company A uses the expected loss impairment model. Discuss any financial reporting issues (should we recognize them or not recognize them) and provide any recommendations on how to handle this situation.arrow_forward

- 3. Gliezel company has an overdue 8% note payable to City Bank at P4,000,000 and recorded accrued interest of P320,000. As a result of a settlement on January 1, 2018, City Bank agreed to the following restructuring arrangement: a. reduced the principal obligation to P3,500,000; b. forgave the P320,000 accrued interest; c. extended the maturity date to December 31, 2019 and d. annual interest of 10% is to be paid on December 31, 2018 and 2019. The present value of 1 at 8% for two periods is 0.8573, and the present value of an ordinary annuity of 1 at 8% for two periods is 1.7833. What amount of gain on extinguishment of debt to be recognized in 2018?arrow_forward(Based on Appendix 14B) Pratt Industries owes First National Bank $5 million but, due to financial difficulties,is unable to comply with the original terms of the loan. The bank agrees to settle the debt in exchange for landhaving a fair value of $3 million. The book value of the property on Pratt’s books is $2 million. For the reportingperiod in which the debt is settled, what amount(s) will Pratt report on its income statement in connection withthe troubled debt restructuring?arrow_forward4. A company borrowed $200,000 on January 1, 2019 to pay them on January 1, 2022. On January 1, 2019, the company received an amount equal to $200,000, less interest discounted at an annual rate of 11.5%, which is the market rate. The company closes its books every December 31.a. Prepare the journal entry for the debtor on January 1, 2019.b. Prepare the journal entry on December 31, 2020 related to this debt. 5. Suppose that the company from the previous exercise number 4 received the full sum of $200,000 on January 1, 2019 and agreed to repay the loan by making three annual payments (January 1, 2020, 2021 and 2022) equal to the base at an interest rate of 11.5%.Prepare the journal entry to record the second of the three annual payments.arrow_forward

- 60. On December 31, 2021, the CPA Finance Company had a P3,000,000 note receivable from IntAcc1 Company. The note bears 10% interest. The books reported accrued interest of P300,000 on this date. Because of financial distress suffered by IntAcc1 Company, CPA Finance agreed to the restructuring and modification of the terms as follows: (1) Reduction of principal to P2,000,000; (2) Reduction of interest to 7% payable annually beginning December 31, 2022; (3) Accrued interest on December 31, 2021 is condoned; and (4) Principal payment was reset to December 31, 2024. How much impairment loss should CPA Finance Company record on December 31, 2021 as a result of restructuring? Round off present value figures to two decimal places.arrow_forward0 (Based on Appendix 7B) Marshall Companies, Inc., holds a note receivable from a former subsidiary. Dueto financial difficulties, the former subsidiary has been unable to pay the previous year’s interest on the note.Marshall agreed to restructure the debt by both delaying and reducing remaining cash payments. The concessionsimpair the creditor’s investment in the receivable. How is this impairment recorded?arrow_forwardE17.22 (L04) HIT (Impairment) Komissarov SA has a debt investment in the bonds issued by Keune AG The bonds were purchased at par for € 400,000 and, at the end of 2019, have a remaining life of 3 years with annual interest payments at 10%, paid at the end of each year. This debt investment is classified as held-for-collection. Keune is facing a tough economic environment and informs its investors that it will be unable to make all payments according to the contractual terms. The con troller of Komissarov has prepared the following revised expected cash flow forecast for this bond investment. Dec. 31 Expected Cash Flows 2020 € 35,000 2021 35,000 2022 385,000 total cash flow € 455,000 Instructions a. Determine the impairment loss for Komissarov at December 31, 2019. b. Prepare the entry to record the impairment loss for Komissarov at December 31, 2019. c. On January 15, 2020, Keune receives a…arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning