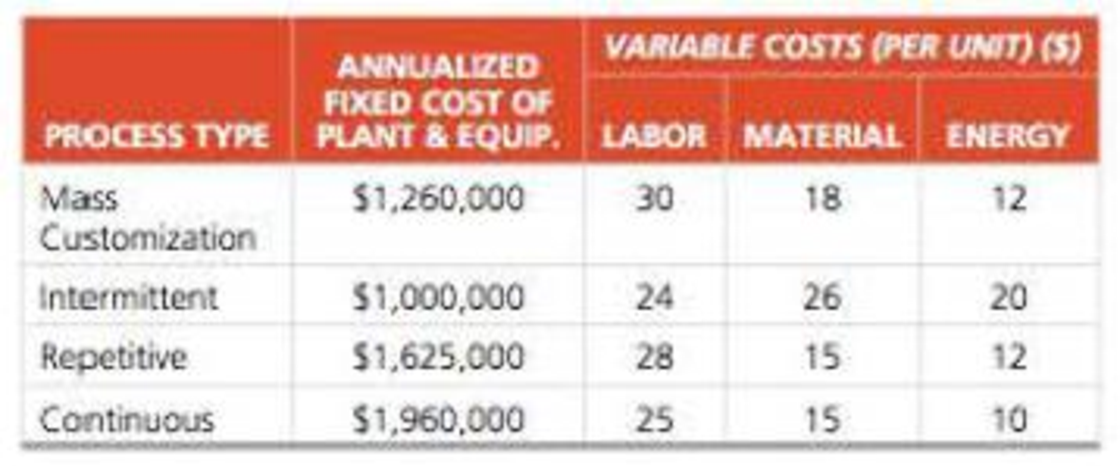

Metters Cabinets, Inc., needs to choose a production method for its new office shelf, the Maxistand. To help accomplish this, the firm has gathered the following production cost data:

Metters Cabinets projects an annual demand of 24,000 units for the Maxistand. The Maxistand will sell for $120 per unit. a) Which process type will maximize the annual profit from producing the Maxistand?

b) What is the value of this annual profit?

a)

To determine: The process type that will maximize the annual profit by producing the Maxistand.

Answer to Problem 9P

The process type that will maximize the annual profit by producing the Maxistand is the intermittent process.

Explanation of Solution

Given information:

| Process type | Annual fixed cost of plant & equip |

Variable costs (Per Unit) ($) | ||

| Labor | Material | Energy | ||

| Mass customization | $1,260,000 | 30 | 18 | 12 |

| Intermittent | $1,000,000 | 24 | 26 | 20 |

| Repetitive | $1,625,000 | 28 | 15 | 12 |

| Continuous | $1,960,000 | 25 | 15 | 10 |

Annual demand = 24,000 units

Maxistand selling price = $120 / unit

Calculation of number of units:

Let ‘x’ be the number of units. The units is calculated by multiplying annual fixed cost with ‘x’ and summing with the total variable cost and equating it with multiplying the Maxistand selling price with ‘x’.

Mass customization:

Intermittent:

Repetitive:

Continuous:

Identifying least cost process at x = 24000 units:

The least cost is calculated by multiplying variable cost with the value of ‘x’ and summing it with the annual fixed cost.

Mass customization:

Intermittent:

Repetitive:

Continuous:

The cost is lower for intermittent process ($2,680,000) with the break-even point of 20,000. The intermittent process will increase the annual profit.

Hence, the best process is the intermittent process.

b)

To determine: The annual profit by following the intermittent process.

Answer to Problem 9P

The annual profit is $200, 000

Explanation of Solution

Given information:

| Process type | Annual fixed cost of plant & equip |

Variable costs (Per Unit) ($) | ||

| Labor | Material | Energy | ||

| Mass customization | $1,260,000 | 30 | 18 | 12 |

| Intermittent | $1,000,000 | 24 | 26 | 20 |

| Repetitive | $1,625,000 | 28 | 15 | 12 |

| Continuous | $1,960,000 | 25 | 15 | 10 |

Annual demand = 24,000 units

Maxistand selling price = $120 / unit

Calculation of number of units:

Let ‘x’ be the number of units. The units is calculated by multiplying annual fixed cost with ‘x’ and summing with the total variable cost and equating it with multiplying the Maxistand selling price with ‘x’.

Mass customization:

Intermittent:

Repetitive:

Continuous:

Identifying least cost process at x = 24000 units:

The least cost is calculated by multiplying variable cost with the value of ‘x’ and summing it with the annual fixed cost.

Mass customization:

Intermittent:

Repetitive:

Continuous:

Calculation of annual profit:

The annual profit is calculated by multiplying the selling price with annual demand and subtracting it from the cost of the intermittent process.

The annual profit is $200, 000.

Want to see more full solutions like this?

Chapter 7 Solutions

Principles Of Operations Management

- Tribal Systems, Inc., is opening a new plant and has yet todecide on the type of process to employ. A labor-intensiveprocess would cost $10,000 for tools and equipment and $14 for labor and materials per item produced. A more au-tomated process costs $50,000 in plant and equipment but has a labor/material cost of $8 per item produced. A fullyautomated process costs $300,000 for plant and equipmentand $2 per item produced. If process selection were basedsolely on lowest cost, for what range of production wouldeach process be chosen?arrow_forwardSamoset Fans, Inc. manufacturers its fan blades in-house. The owner, Betty Dice, doesn't outsource any fan parts except fan motors — all other fans parts are made in-house. Their current process and its equipment are getting old. Maintenance and repair costs are increasing at seven percent per year. She and her company team are evaluating two new processes. The first process has an annual fixed cost of $730,000 and a variable cost of $12 per fan blade. The second process is more automated and requires an annual fixed cost of $1,050,000 and a variable cost of $10 per fan blade. The internal transfer cost of a fan blade is $22, and this helps the firm determine the total manufactured cost of a completed fan. Use the Excel template Break-Even in MindTap to answer the following questions: What is the break-even quantity between these two processes? Round your answer to the nearest whole number. fan blades If predicted demand for next year is 110,000 blades, what process do you…arrow_forwardSamoset Fans, Inc. manufacturers its fan blades in-house. The owner, Betty Dice, doesn't outsource any fan parts except fan motors — all other fans parts are made in-house. Their current process and its equipment are getting old. Maintenance and repair costs are increasing at eleven percent per year. She and her company team are evaluating two new processes. The first process has an annual fixed cost of $760,000 and a variable cost of $19 per fan blade. The second process is more automated and requires an annual fixed cost of $1,100,000 and a variable cost of $11 per fan blade. The internal transfer cost of a fan blade is $24, and this helps the firm determine the total manufactured cost of a completed fan. Use the Excel template Break-Even in MindTap to answer the following questions: What is the break-even quantity between these two processes? Round your answer to the nearest whole number. fan blades If predicted demand for next year is 160,000 blades, what process do you…arrow_forward

- An organization is considering three process configuration options. There are two different intermittent processes, as well as a repetitive focus. The smaller intermittent process has fixed costsof $30000 per month, and variable costs of $9 per unit. The larger intermittent process has fixed costs of $11000 per month and variable costs of $2 per unit. A repetitive focus plant has fixed costs of $48000 and variable costs of $1 per unit.a. If the company produced 22000 units, what would be its cost under each of the threechoices?b. Which process offers the lowest cost to produce 39000 units? What is that cost?arrow_forwardThe Andrews family is in the process of hiring a five-star chef who can cook a variety of food to meet customers’ tastes and wants (top quality). In addition, the restaurant is designed to provide complete privacy to customers. Therefore, tables ought to be separated by no less than 5 feet. Using Chapter 2 and the assigned videos as your theoretical foundations, please answer the following question. What production process should the restaurant choose? Explain your answer. In contrast to the Andrews family restaurant, the Sweet family restaurant sells burgers, burritos, and hotdogs. The restaurant relies on high school students to cook food, and customers cannot customize their food choices. The Sweet family restaurant sells 2000 burgers per restaurant each day. The average costs of burgers, burritos, and hot dogs are $2, $3, and $0.50, respectively. Using Chapters 1 and 2 as your theoretical foundations, please answer the following question: What are the Sweet family…arrow_forwardSpartan Castings must implement a manufacturing process that reduces the amount of particulates emitted into the atmosphere. Two processes have been identified that provide the same level of particulate reduction. The first process is expected to incur $350,000 of fixed cost and add $50 of variable cost to each casting Spartan produces. The second process has fixed costs of $150,000 and adds $90 of variable cost per casting.a. What is the break-even quantity beyond which the first process is more attractive?b. What is the difference in total cost if the quantity produced is 10,000?arrow_forward

- Explain the two conditions that are required in process flexibility ?arrow_forwardExplain and state the five process typess and indicate the kinds of situations in which each would be used ?arrow_forwardTwo manufacturing processes are being considered for making a new product. Process A is less capital intensive, with fixed costs of $60,000 per year and variable costs of $700 per unit. Process B has fixed costs of $400,000 annually, with variable costs of $300 per unit. What is the break-even quantity for the two processes? If annual sales are expected to be 700 units, which process should be selected? Operations and Engineering have found a way to reduce the cost of Process B, such that the fixed costs for this process decrease from $400,000 to $300,000 annually. All other costs remain the same. Does this change the process selection for the annual sales volume of 700 units?arrow_forward

- As a manager what strategy, style, or action plan in Scope for Reducing Costs in terms of Process Optimization. Please explain.arrow_forwardConstruct a process flowchart of a process with which youare familiar. Identify bottlenecks, potential failure points,and opportunities for improvement.arrow_forwardby matching process capabilities with product requirements, we get the most efficient process possible? Explain?arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,