Concept explainers

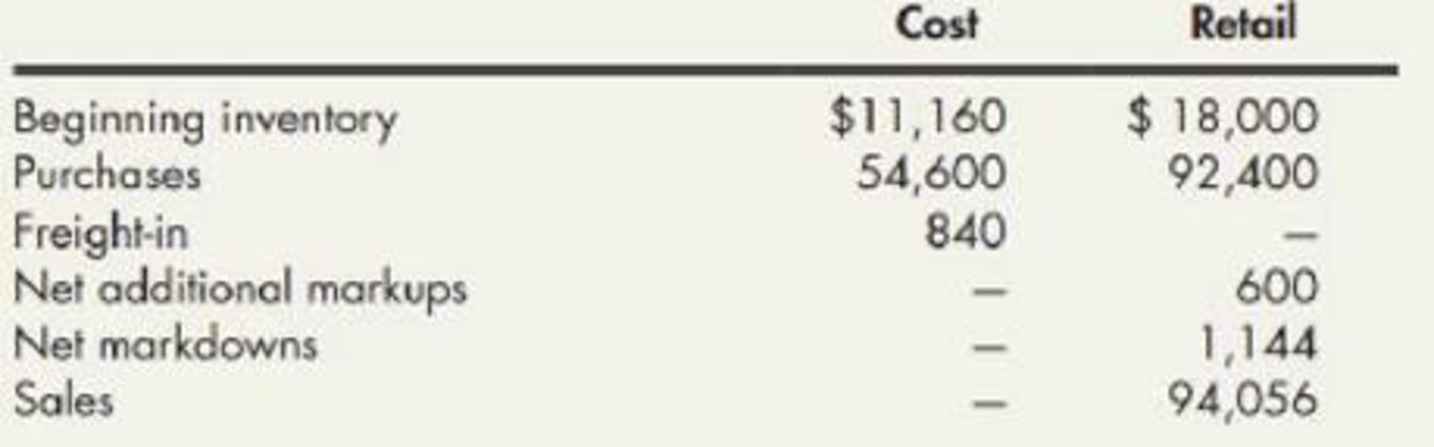

Retail Inventory Method The following information relates to the retail inventory method used by Jeffress Company:

Required:

- 1. Compute the ending inventory by the retail inventory method using the following cost flow' assumptions (round the cost-to-retail ratio to 3 decimal places):

- a. FIFO

- b. average cost

- c. LIFO

- d. lower of cost or market (based on average cost)

- 2. Next Level What assumptions are necessary for the retail inventory method to produce accurate estimates of ending inventory?

1.

Calculate the cost of ending inventory by the retail method using FIFO, average cost, LIFO, and LCM cost flow assumptions.

Explanation of Solution

Retail inventory method: It takes into account all the retail amounts that is, the current selling prices. Under this method, the goods available for sale, at retail is deducted from the sales, at retail to determine the ending inventory, at retail.

Conventional Retail Method: Conventional retail method refers to the estimation of the lower of average cost or market by eliminating the markdowns from the calculation of the cost-to-retail percentage.

In this case, the cost-to-retail percentage will be determined by dividing the goods available for sale at cost by the goods available for at retail (excluding markdowns). Thus, the conventional retail method will always result in lower estimation of ending inventory when the markdowns exist.

a.

FIFO: Under this inventory method, the units that are purchased first are sold first. Thus, it starts from the selling of the beginning inventory, followed by the units purchased in a chronological order of their purchases took place during a particular period.

Calculate the cost of ending inventory by the retail method using FIFO cost flow.

| Ending Inventory - FIFO | ||

| Details | Cost ($) | Retail ($) |

| Purchases | 54,600 | 92,400 |

| Freight-in | 840 | |

| Markups (net) | 600 | |

| Markdowns | 0 | (1,144) |

| 55,440 | 91,856 | |

| Add: Beginning inventory | 11,160 | 18,000 |

| Goods available for sale | 66,600 | 109,856 |

| Less: Sales | (94,056) | |

| Ending inventory at retail | $15,800 | |

| Ending inventory at cost | $9,543 | |

Table (1)

Working note 1:

Calculate ending inventory at cost:

Step 1: Calculate cost-to-retail ratio.

Step 2: Calculate ending inventory at cost.

b.

Average cost method: Under this method, the cost of the goods available for sale is divided by the number of units available for sale during a particular period.

Calculate the cost of ending inventory by the retail method using average cost flow.

| Ending Inventory - Average Cost | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 11,160 | 18,000 |

| Add: Net purchase | 54,600 | 92,400 |

| Freight in | 840 | |

| Net markups (net) | 600 | |

| Less: Net markdowns | 0 | (1,144) |

| Goods available for sale | 66,600 | 109,856 |

| Less: Sales | (94,056) | |

| Estimated ending inventory at retail | $15,800 | |

| Estimated ending inventory at cost | $9,575 | |

Table (2)

Working note 1:

Calculate ending inventory at cost.

Step 1: Calculate cost-to-retail ratio.

Step 2: Calculate ending inventory at cost.

c.

LIFO: Under this inventory method, the units that are purchased last are sold first. Thus, it starts from the selling of the units recently purchased and ending with the beginning inventory.

Calculate the cost of ending inventory by the retail method using LIFO cost flow.

| Ending Inventory - LIFO | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 11,160 | 18,000 |

| Net purchase | 54,600 | 92,400 |

| Freight-in | 840 | |

| Net markups | 600 | |

| Less: Net markdowns | 0 | (1,144) |

| 55,440 | 91,856 | |

| 11,160 | 18,000 | |

| Goods available for sale | 66,600 | 109,856 |

| Less: Sales | (94,056) | |

| Estimated ending inventory at retail | $15,800 | |

| Estimated ending inventory at LIFO cost | 9,796 | |

Table (3)

Working note 1:

Calculate ending inventory at cost for beginning layer.

Step 1: Calculate cost-to-retail ratio (Beginning layer).

Step 2: Calculate ending inventory at cost (Beginning layer).

d.

Lower-of-cost-or-market: The lower-of-cost-or-market (LCM) is a method which requires the reporting of the ending merchandise inventory in the financial statement of a company, either at current market value or at historical cost price of the inventory, whichever is less.

Calculate the cost of ending inventory by the retail method using lower of cost or market rule:

| Ending Inventory - LCM | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 11,160 | 18,00 |

| Add: Net purchase | 54,600 | 92,400 |

| Freight-in | 840 | |

| Net markups | 0 | 600 |

| Goods available for sale before markdowns | 66,600 | 111,000 |

| Less: Net markdowns | 0 | (1,144) |

| Sales | (94,056) | |

| Estimated ending inventory at retail | $15,800 | |

| Estimated ending inventory at cost (LCM) | $9,480 | |

Table (4)

Working note 1:

Calculate ending inventory at cost:

Step 1: Calculate cost-to-retail ratio.

Step 2: Calculate ending inventory at cost.

2.

Indicate the needed assumptions for the retail inventory method to produce correct estimated of ending inventory.

Explanation of Solution

There are two general assumptions are required for the retail inventory method to produce a correct estimates of inventory.

- Firstly, the company’s inventory items should be adequately homogeneous so that all of the items have the same markup, or if different markups exist and the items in ending inventory should be in the same proportion to those items in goods available for sale.

- Secondly, over the accounting period the cost-to-retail ratio must remain constant.

Want to see more full solutions like this?

Chapter 8 Solutions

Intermediate Accounting: Reporting And Analysis

- Inventory Costing: Average Cost Refer to the information for Filimonov Inc. and assume that the company uses a perpetual inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.)arrow_forwardInventory Valuation Specific identification method Weighted average cost method FIFO method LIFO method LIFO liquidation LIFO conformity rule LIFO reserve Replacement cost Inventory profit Lower-of-cost-or-market (LCM) rule Inventory turnover ratio Number of days sales in inventory Moving average (Appendix) The name given to an average cost method when a weighted average cost assumption is used with a perpetual inventory system. An inventory costing method that assigns the same unit cost to all units available for sale during the period. A conservative inventory valuation approach that is an attempt to anticipate declines in the value of inventory before its actual sale. An inventory costing method that assigns the most recent costs to ending inventory. The current cost of a unit of inventory. An inventory costing method that assigns the most recent costs to cost of goods sold. A measure of how long it takes to sell inventory. The IRS requirement that when LIFO is used on a tax return, it must also be used in reporting income to stockholders. An inventory costing method that relies on matching unit costs with the actual units sold. The portion of the gross profit that results from holding inventory during a period of rising prices. The result of selling more units than are purchased during the period, which can have negative tax consequences if a company is using LIFO. The excess of the value of a companys inventory stated at FIFO over the value stated at LIFO. A measure of the number of times inventory is sold during the period.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forward

- Perpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual inventory system b. Periodic inventory system c. Both perpetual and periodic inventory systems Required: Match each option with one of the following: 1. Only revenue is recorded as sales are made during the period; the cost of goods sold is recorded at the end of the period. 2. Cost of goods sold is determined as each sale is made. 3. Inventory purchases are recorded in an inventory account. 4. Inventory purchases are recorded in a purchases account. 5. Cost of goods sold is determined only at the end of the period by subtracting the cost of ending inventory from the cost of goods available for sale. 6. Both revenue and cost of goods sold are recorded during the period as sales are made. 7. The inventory is verified by a physical count.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forwardInventory Write-Down The following information is taken from Aden Companys records: Required: 1. What is the correct inventory value if the company applies the LCNRV rule to each of the following? a. individual items b. groups of items c. the inventory as a whole 2. Next Level Are there any conditions under which a company may ignore the decline in the value of inventory below its cost?arrow_forward

- Perpetual inventory using LIFO Assume that the business in Exercise 6-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4.arrow_forwardUse the first-in, first-out method (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forwardInventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of applying the LCNRV rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows: Inventory Write-Down Use the information in E8-1. Assume that Stiles uses the LIFO cost flow assumption and is applying the LCM rule. Required: 1. What is the correct inventory value for each product? 2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations?arrow_forward

- Inventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of applying the LCNRV rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows:arrow_forwardInventory Write-Down Byron Company has five products in its inventory and uses the FIFO cost flow assumption. Specific data for each product are as follows: Required: 1. What is the correct inventory value, assuming the LCNRV rule is applied to each item of inventory? 2. What is the correct inventory value, assuming the LCNRV rule is applied to the total of inventory? 3. Next Level Comment on any differences that result from applying the LCNRV rule to individual items compared to the total of inventory.arrow_forwardLower of Cost or Market The accountant for Murphy Company prepared the following analysis of its inventory at year end: Required: 1. Compute the carrying value of the ending inventory using the lower of cost or market method applied on an item-by-item basis. 2. Prepare the journal entry required to value the inventory at lower of cost or market.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,