Concept explainers

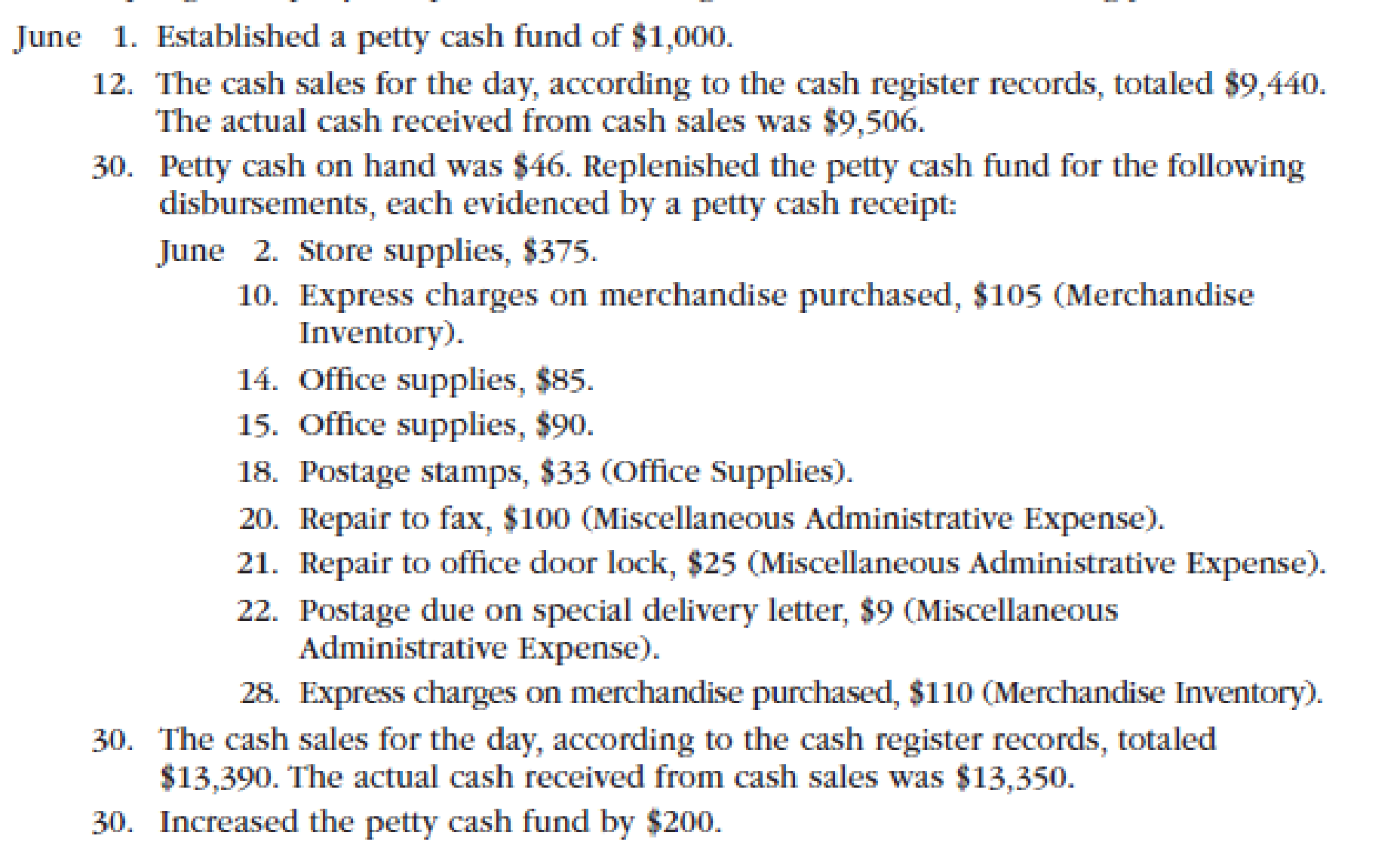

Cedar Springs Company completed the following selected transactions during June 2016:

Instructions

Journalize the transactions.

Journalize the petty cash transactions.

Explanation of Solution

Petty cash fund: Petty cash fund is a fund established to pay insignificant amounts like postage, office supplies, and lunches. In day-to-day life, it becomes difficult to use checks for daily expenses. Therefore, companies maintain some minimum amount of funds in the hand for such daily expenses. These funds are called as petty cash funds. These funds are managed by custodian. This system is otherwise called as imprest system.

Journal entry 1: Establish petty cash fund.

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| June | 1 | Petty Cash | 1,000 | ||||

| Cash | 1,000 | ||||||

| (Open petty cash fund.) | |||||||

Table -1

Description: Petty Cash is an asset and is increased by $1,000. Therefore, debit the Petty Cash account by $1,000. Cash is an asset and decreased by $1,000. Therefore, credit the Cash account by $1,000.

Journal entry 2: Record the cash sales.

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| June | 12 | Cash | 9,506 | ||||

| Cash Short and Over | 66 | ||||||

| Sales | 9,440 | ||||||

| (To record the cash sales.) | |||||||

Table -2

Description: Cash is an asset and is increased due to cash sales. Thus, cash is debited with $9,506. Therefore, debit Cash account by $9,506. Sales as per cash records are $9,440. Thus, sales is credited with $9,440. The difference of $66 is credited with $66. Cash short and over is determined as follows:

Journal entry 3: Replenishment of funds.

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| June | 30 | Store Supplies | 375 | ||||

| Merchandise inventory | 215 | ||||||

| Office Supplies | 208 | ||||||

| Miscellaneous Administrative Expense | 134 | ||||||

| Cash Short and Over | 22 | ||||||

| Cash | 954 | ||||||

| (To record the replenishment of the petty cash fund.) | |||||||

Table -3

Description: Store supplies and Office Supplies is an asset and it increases the value of asset. Therefore, debit store supplies and office supplies by $375 and $208 respectively. Merchandise inventory is an asset and it increases the value of equity. Therefore, debit Merchandise inventory by $215. Miscellaneous administrative expenses are an expense. It decreases the equity by $134. Thus, debit miscellaneous administrative expense with $134. Cash Short and Over decreases the value of equity. The cash is short by $22. Therefore, debit Cash Short and Over by $22. Cash is an asset and decreased by $954. Therefore, credit the cash account by $954.

Working notes for cash spent and cash short and over are provided below:

Calculate the cash spent as below:

Calculate the total payments.

| Payments | Amount ($) |

| Store Supplies | 375 |

| Merchandise inventory | 215 |

| Office Supplies | 208 |

| Miscellaneous Administrative Expense | 134 |

| Total payments | 932 |

Table -4

Next, calculate cash short and over.

Description: Determining of petty cash before replenishment involves two steps. First, calculate the total payments. Then determine the difference between imprest balance and total payments. This amount is petty cash fund before replenishment.

Journal entry 4: Record the cash sales.

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| June 30 | Cash | 13,350 | |||||

| Cash Short and Over | 40 | ||||||

| Sales | 13,390 | ||||||

| (To record the cash sales.) | |||||||

Table -5

Description: Cash is an asset and is increased due to cash sales. Thus, cash is debited with $13,350. Therefore, debit Cash account by $13,350. The difference of $40 and is debited. Sales as per cash records are $13,390. Thus, sales is credited with $13,390. Cash short and over is determined as follows:

Journal entry 5: Decrease in petty cash

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| June | 30 | Cash | 200 | ||||

| Petty cash | 200 | ||||||

| Open petty cash fund. | |||||||

Table -6

Description: Cash is an asset and increased by $200. Therefore, debit Cash account with $200. Petty cash is an asset and decreased with $200. Thus, credit petty cash account with $200.

Want to see more full solutions like this?

Chapter 8 Solutions

Financial Accounting

- Cactus Restoration Company completed the following selected transactions during May 2016: Instructions Journalize the transactions.arrow_forwardThe following were selected from among the transactions completed by Essex Company during July of the current year: Instructions Journalize the transactions.arrow_forwardWhitaker Consulting Company has prepared a trial balance on the following partially completed worksheet for the year ended December 31, 2016arrow_forward

- Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2016, are as follows: Prepare a statement of owners equity for the year.arrow_forwardThe following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forwardThe following selected transactions were completed by Capers Company during October of the current year: Instructions Journalize the entries to record the transactions of Capers Company for October.arrow_forward

- Apex Systems Co. offers its services to residents in the Seattle area. Selected accounts from the ledger of Apex Systems Co. for the fiscal year ended December 31, 2016, are as follows: Prepare a statement of owners equity for the year.arrow_forwardEMB Consulting Services had the following transactions for the month of November. Journalize the transactions and include an explanation with each entry. Thank youarrow_forwardOn January 1, 2018 the general ledger of acme fireworks included the following account balances.arrow_forward

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardThe following selected transactions were completed during August between Summit Company and Beartooth Co.: Instructions Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.arrow_forwardLeanders Landscaping Service maintains the following chart of accounts: The following transactions were completed by Leander: Required 1. Journalize the transactions in the general journal. Prepare a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated April 30, 20. If you are using CLGL, use the year 2020 when recording transactions and preparing reports.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub