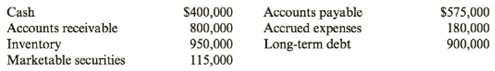

JRL’s financial statements contain the following information:

Required:

1. What is its

2. What is its quick ratio?

3. What is its cash ratio?

4. Discuss JRL’s liquidity using these ratios.

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 1:

To calculate:

The Current Ratio.

Answer to Problem 58BE

The Current Ratio is 3.

Explanation of Solution

The Current Ratio is calculated as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Inventory | $ 950,000 |

| Total Current Assets (A) | $ 2,265,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Current Ratio (A/B) | 3.00 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 2:

To calculate:

The Quick Ratio.

Answer to Problem 58BE

The Quick Ratio is 1.74.

Explanation of Solution

The Quick Ratio is calculated as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Total Quick Assets (A) | $ 1,315,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Quick Ratio (A/B) | 1.74 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 3:

To calculate:

The Cash Ratio.

Answer to Problem 58BE

The Cash Ratio is 0.68.

Explanation of Solution

The Cash Ratio is calculated as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Cash and Cash Equivalents (A) | $ 515,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Cash Ratio (A/B) | 0.68 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 4:

To discuss:

Liquidity of the company.

Answer to Problem 58BE

The Cash ratio shows that company does not have a good liquidity position.

Explanation of Solution

The Current, Quick and Cash ratio shows liquidity position as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Inventory | $ 950,000 |

| Total Current Assets (A) | $ 2,265,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Current Ratio (A/B) | 3.00 |

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Total Quick Assets (A) | $ 1,315,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Quick Ratio (A/B) | 1.74 |

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Cash and Cash Equivalents (A) | $ 515,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Cash Ratio (A/B) | 0.68 |

Want to see more full solutions like this?

Chapter 8 Solutions

Cornerstones of Financial Accounting

- Liquidity Ratios NWAs financial statements contain the following information: Note: Round answers to two decimal places. Required: 1. What is its current ratio? 2. What is its quick ratio? 3. What is its cash ratio? 4. Discuss NWAs liquidity using these ratios.arrow_forwardDefine each of the following terms: Liquidity ratios: current ratio; quick, or acid test, ratio Asset management ratios: inventory turnover ratio; days sales outstanding (DSO); fixed assets turnover ratio; total assets turnover ratio Financial leverage ratios: debt ratio; times-interest-earned (TIE) ratio; EBITDA coverage ratio Profitability ratios: profit margin on sales; basic earning power (BEP) ratio; return on total assets (ROA); return on common equity (ROE) Market value ratios: price/earnings (P/E) ratio; price/cash flow ratio; market/book (M/B) ratio; book value per share Trend analysis; comparative ratio analysis; benchmarking DuPont equation; window dressing; seasonal effects on ratiosarrow_forwardCalculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?arrow_forward

- Explain the major financial ratios and financial cycles, debt ratio, debt to equity ratio, return on assets, return on equity, current ratio, quick ratio, inventory turnover, days in inventory, accounts receivable turnover, accounts receivable cycle in days, accounts payable turnover, accounts payable cycle in days, earnings per share (EPS), price to earnings ratio (P/E), and cash conversion cycle (CCC) and state the significance of each for financial management. Include examples based on a hypothetical balance sheet and income statement. Can CCC be negative? If so, what does it indicate?Explain working capital and its significance. Evaluate working capital in your example given in part “a”. Perform a vertical financial analysis incorporating :Debt ratio Debt to equity ratio Return on assets Return on equity Current ratio Quick ratio Inventory turnover Days in inventory Accounts receivable turnover Accounts receivable cycle in days Accounts payable turnover Accounts payable cycle in…arrow_forwardExplain the major financial ratios and financial cycles, debt ratio, debt to equity ratio, return on assets, return on equity, current ratio, quick ratio, inventory turnover, days in inventory, accounts receivable turnover, accounts receivable cycle in days, accounts payable turnover, accounts payable cycle in days, earnings per share (EPS), price to earnings ratio (P/E), and cash conversion cycle (CCC) and state the significance of each for financial management. Include examples based on a hypothetical balance sheet and income statement. Can CCC be negative? If so, what does it indicate? Explain working capital and its significance. Evaluate working capital in your example given in part “a” of this DQ2.arrow_forwardHow is the short term debt repayment capacity of a company is assessed ? Choose the INCORRECT OPTIONa) Current Ratio is analyzedb) Liquidity Ratios and the Cashc) Quick Ratio is analyzedd) The statement of Cash Flows is analyzedarrow_forward

- What are the siginificance of financial ratios (i.e. current ratio; DSO; TATO; profit margin; ROA; ROI)? How do they help us interpert financial data? What are the differences between ratios (i.e. profiability; liquidity; leverage)? What information do they provide for us?arrow_forwardDefine current ratio and quick ratio. Discuss what the liquidity ratios reveal about the company financial health, including any description of trend analysis, benchmarks, standard measurements or other types of analysis used once the ratio amount is known.arrow_forwardFrom the given Statement of Financial Position and Income statement, solve for the following: 1) Compute the FINANCIAL ratios that measure: a) Liquidity -Current Ratio -Quick Ratio -Working Capital -Cash Ratio b) Leverage -Degree of Operating Leverage -Financial Leverage Ratio -Total Debt to Total Capital Ratio -Debt to Equity Ratio -Long Term Debt to Equity Ratio -Debt to Asset Ratio -Times Interest Earned c) Operating Activity -Accounts Receivable Turnover -Days Sales in Receivable -Inventory Turnover -Days in Inventory d) Profitability -Earnings per Share -Return on Asset -Return on Equity -Operating Profit Margin -Net Profit Margin 2) Analyze, interpret, and draw conclusions based on the results of your computations.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning