Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 8, Problem 7E

Professional foes earned budget for a service company

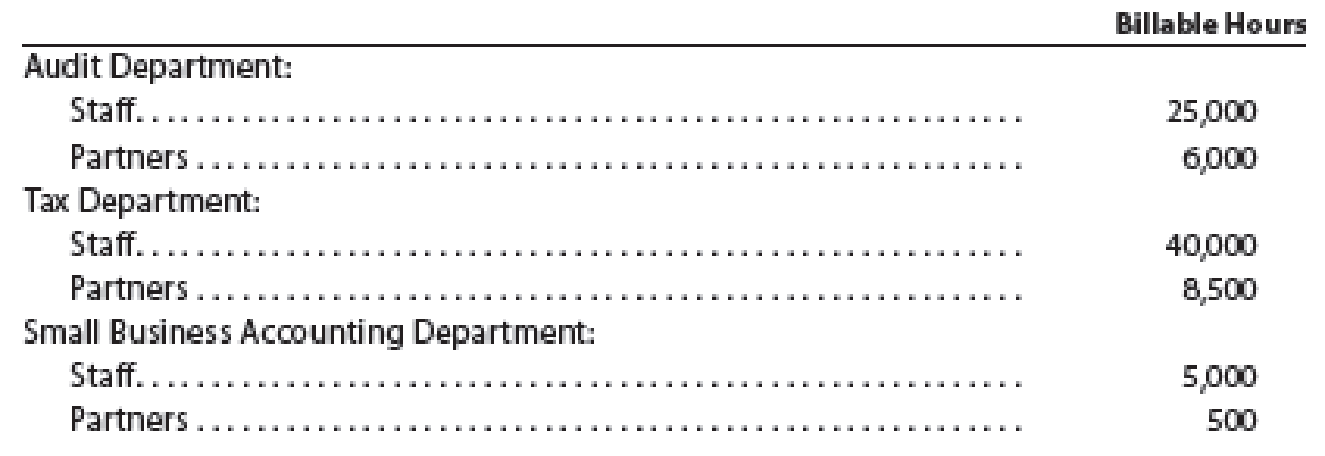

Lundquist & Fret well. CPAs, offer three types of services to clents: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending May 31. 20Y8:

The average billing rate for staff is $140 per hour, and the average billing rate for partners is $450 per hour. Prepare a professional fees earned budget for Lundquist & Fretwell, CPAs, for the year ending May 31, 20Y8, using the following column headings and showing the estimated professional fees by type of service rendered:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Managerial Accounting

Ch. 8 - Prob. 1DQCh. 8 - Briefly describe the type of human behavior...Ch. 8 - What behavioral problems are associated with...Ch. 8 - What behavioral problems are associated with...Ch. 8 - Under what circumstances would a static budget be...Ch. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Why should the timing of direct materials...Ch. 8 - Prob. 9DQCh. 8 - Give an example of how the capital expenditures...

Ch. 8 - At the beginning of the period, the Fabricating...Ch. 8 - Pasadena Candle Inc. projected sales of 800,000...Ch. 8 - Pasadena Candle Inc. budgeted production of...Ch. 8 - Pasadena Candle Inc. budgeted production of...Ch. 8 - Prob. 5BECh. 8 - Cash budget Pasadena Candle Inc. pays 40% of its...Ch. 8 - At the beginning of the school year, Craig Kovar...Ch. 8 - Digital Solutions Inc. uses flexible budgets that...Ch. 8 - Static budget versus flexible budget The...Ch. 8 - Prob. 4ECh. 8 - Production budget Healthy Measures Inc. produces a...Ch. 8 - Sales and production budgets Sonic Inc....Ch. 8 - Professional foes earned budget for a service...Ch. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Direct labor cost budget Ace Racket Company...Ch. 8 - Prob. 13ECh. 8 - Factory overhead cost budget Sweet Tooth Candy...Ch. 8 - Cost of goods sold budget Delaware Chemical...Ch. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Schedule of cash payments for service company...Ch. 8 - Prob. 20ECh. 8 - Capital expenditures budget On January 1, 20Y6,...Ch. 8 - Prob. 1PACh. 8 - Sales, production, direct materials purchases, and...Ch. 8 - Budgeted income statement and supporting budgets...Ch. 8 - Budgeted income statement and supporting budgets...Ch. 8 - Cash budget The controller of Bridgeport...Ch. 8 - Budgeted income statement and balance sheet As a...Ch. 8 - Prob. 1PBCh. 8 - Sales, production, direct materials purchases, and...Ch. 8 - Budgeted income statement and supporting budgets...Ch. 8 - Prob. 4PBCh. 8 - Cash budget The controller of Mercury Shoes Inc....Ch. 8 - Budgeted income statement and balance sheet As a...Ch. 8 - Analyze Johnson Stores staffing budget for...Ch. 8 - Prob. 2MADCh. 8 - Prob. 3MADCh. 8 - Prob. 4MADCh. 8 - Ethics in Action The director of marketing for...Ch. 8 - Prob. 3TIFCh. 8 - Evaluating the budgeting system in a service...Ch. 8 - Static budget for a service company A hank manager...Ch. 8 - Objectives of the master budget Dominos Pizza LLC...Ch. 8 - When compared to static budgets, flexible budgets:...Ch. 8 - Prob. 2CMACh. 8 - Ming Company has budgeted sales at 6,300 units for...Ch. 8 - Krouse Company produces two products, forged...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Professional labor cost budget for a service company Based on the data in Exercise 7 and assuming that the average compensation per hour for staff is 40 and for partners is 175, prepare a professional labor cost budget for each department forLundquist Fretwell, CPAs, for the year ending May 31, 20Y8. Use the following column headings:arrow_forwardCoral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of 15.9 million and cost of goods sold of 8.75 million. Advertising is a key part of Coral Seas business strategy, and total marketing expense for the year is budgeted at 2.8 million. Total administrative expenses are expected to be 675,000. Coral Seas has no interest expense. Income taxes are paid at the rate of 40 percent of operating income. Required: 1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year. 2. What if Coral Seas had interest payments of 500,000 during the year? What effect would that have on operating income? On income before taxes? On net income?arrow_forwardProfessional labor cost budget Based on the data in Exercise 13-5 and assuming that the average compensation per hour for staff is $36 and for partners is $300. prepare a professional labor cost budget for Day & Spieth, CPAs, for the year ending March 31. 20Y6. Use the following column headings:arrow_forward

- Mesa Aquatics, Inc. estimated direct labor hours as 1,900 in quarter 1, 2,000 in quarter 2.2,200 in quarter 3, and 1,800 in quarter 4. a sales and administration budget using the information provided.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardEastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc., budgeted sales of the following. At the end of the year, actual sales revenue for Product R and Product S was 3,075,000 and 3,254,000, respectively. The actual price charged for Product R was 25 and for Product S was 20. Only 10 was charged for Product T to encourage more consumers to buy it, and actual sales revenue equaled 540,000 for this product. Required: 1. Calculate the sales price and sales volume variances for each of the three products based on the original budget. 2. Suppose that Product T is a new product just introduced during the year. What pricing strategy is Eastman, Inc., following for this product?arrow_forward

- Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardPilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardGHT Tech Inc. sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division for the month ended January 31 is as follows: During January, the costs incurred in the Consumer Products Division were as follows: Instructions 1. Prepare a budget performance report for the director of the Consumer Products Division for the month of January. 2. For which costs might the director be expected to request supplemental reports?arrow_forward

- Relevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardBudgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March: Estimated sales for March: Estimated inventories at March 1: Desired inventories at March 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for March: Estimated operating expenses for March: Estimated other revenue and expense for March: Estimated tax rate: 30% Instructions Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be 14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March.arrow_forwardFriendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complete the application) and number of applications. The bank controller has accumulated the following data for the setup activity: Required: 1. Estimate a regression equation with application hours as the activity driver and the only independent variable. If the bank forecasts 2,600 application hours for the next month, what will be the budgeted application cost? 2. Estimate a regression equation with number of applications as the activity driver and the only independent variable. If the bank forecasts 80 applications for the next month, what will be the budgeted application cost? 3. Which of the two regression equations do you think does a better job of predicting application costs? Explain. 4. Run a multiple regression to determine the cost equation using both activity drivers. What are the budgeted application costs for 2,600 application hours and 80 applications?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY