r and Payroll Journal Entry Mary Losch operates a travel agency called Mary’s Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal. Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for th

Payroll Register and Payroll

Mary Losch operates a travel agency called Mary’s Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal.

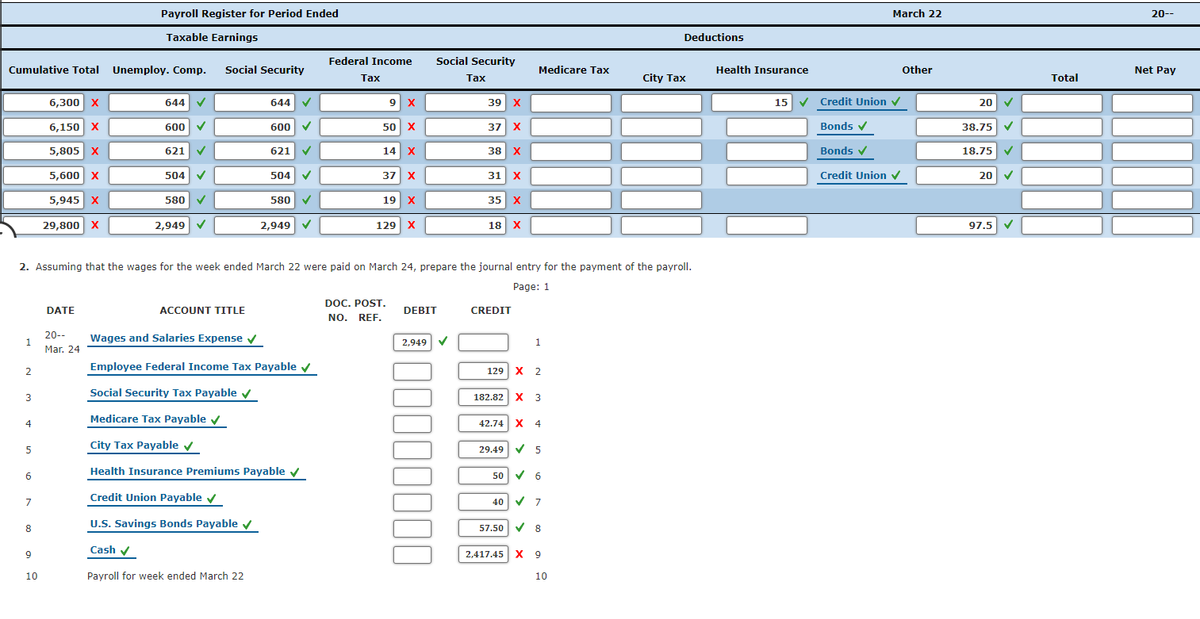

Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week.

Name |

No. of Allowances |

Marital Status |

Total Hours Worked Mar. 16–22 |

Rate |

Total Earnings Jan. 1–Mar. 15 |

| Bacon, Andrea | 4 | M | 44 | $14.00 | $6,300.00 |

| Cole, Andrew | 1 | S | 40 | 15.00 | 6,150.00 |

| Hicks, Melvin | 3 | M | 44 | 13.50 | 5,805.00 |

| Leung, Cara | 1 | S | 36 | 14.00 | 5,600.00 |

| Melling, Melissa | 2 | M | 40 | 14.50 | 5,945.00 |

Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency’s credit union. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan.

Mary’s Luxury Travel’s payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423.

Required:

1. Prepare a payroll register for Mary’s Luxury Travel for the week ended March 22, 20--. (In the Taxable Earnings/

If required, round your answers to the nearest cent.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps