Concept explainers

Direct Labor and Variable Manufacturing Overhead Variances

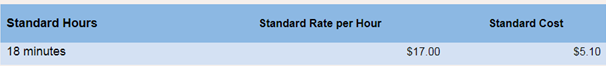

Eric Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows:

During August, 5,750 hours of direct labor time were needed to make 20.000 units of the Jogging Mate. The direct labor cost totaled $ 102.350 for the month.

Required:

- What is the standard labor-hours allowed (SH) to makes 20.000 Jogging Mates?

1

Standard labor hours

Standard hours represent the number of hours that should have been used by the labors during production in a particular accounting period.

To calculate:Standard labor hours that can be used to produce 20,000 units.

Answer to Problem 10E

Standard labor hours allowed to use for 20,000 units of given product are 6,000 hours.

Explanation of Solution

Standard hours allowed are determined by multiplying actual number of units that a company produce and standard hours available for each unit.

Here, number of units are given as 20,000 and standard time for one unit is 18 minutes. So thw standard hours allowed will be:

So, standard hours allowed are 6,000 hours.

2

Standard labor cost

Standard cost represents the amount of cost that should be incurred on labors during a period.

To calculate: Standard cost allowed for 20,000 units.

Answer to Problem 10E

Standard cost allowed for 20,000 units is $102,000.

Explanation of Solution

Allowed standard labor cost is calculated by the product of allowed standard labor hours and standard rate for one hour.

Here, allowed standard hours are 6,000 (calculated in sub part 1) and standard rate is $17 per hour. So, allowed standard labor cost will be:

Allowed standard labor cost is $102,000.

3

Spending variance

A spending variance represents the difference between actual amount of expense incurred and standard expense.

labor spending variance with the given figures.

Answer to Problem 10E

Labor spending variance is $350 unfavorable.

Explanation of Solution

Labor spending variance is determined by deducting actual labor cost from the standard labor cost.

Here, standard labor cost is $102,000 (calculated in sub part 2) and actual cost of labor is $102,350.

So, required variance will be:

Labor spending variance is $350 unfavorable.

4

Labor rate variance

labor cost variance represents the difference between actual cost incurred on labor and expected cost.

Labor efficiency variance

Labor efficiency variance represents the difference between actual hours worked by labors and the expected hours.

Amount of labor rate and efficiency variances.

Answer to Problem 10E

Labor rate variance is $4,600 unfavorable and labor efficiency variance is $4,250 favorable.

Explanation of Solution

The formula to calculate labor rate variance is:

Here, standard rate is given as $17 per hour and actual labor hours are given as 5,750. Actual rate will be calculated as:

So, actual rate is $17.8 for every hour. Now, variance will be calculated as:

Formula to calculate labor efficiency variance is:

Here, actual hours are given as 5,750, standard hours are 6,000 (calculated in sub part 1) and standard rate is $17 per hour. So, variance will be calculated as:

So, labor rate variance is calculated as $4,600 and labor efficiency variance is calculated as $4,250.

5

Variable overhead rate variance

This variance represents the difference between actual variable cost incurred and standard cost on variable overheads.

Variable overhead efficiency variance

This variance represents the difference between actual hours spent on variable production overhead and the budgeted hours.

Amount of variable overhead rate and efficiency variances.

Answer to Problem 10E

Variable overhead rate variance is $1,150 favorable and variable efficiency variance is 1,000 favorable.

Explanation of Solution

Formula to calculate variable overhead rate variance is:

Here, actual hours worked are 5,750 and standard variable overhead rate is given as $4 per hour. Actual variable overhead rate will be calculated as:

So, actual variable overhead rate is $3.8 per hour. Now, variance will be calculated as:

Formula to calculate variable overhead efficiency variance is:

Here, standard overhead efficiency variance is given as $4 per hour, actual hours are 5,750 and standard hours are 6,000 (calculated in sub part 1). So, the calculation of variance will be:

So, variable overhead rate variance is calculated as $1,150 favorable and variable overhead efficiency variance is calculated as $1,000 favorable.

Want to see more full solutions like this?

Chapter 9 Solutions

Introduction To Managerial Accounting

- Standard unit cost and journal entries The normal capacity of Algonquin Adhesives Inc. is 40,000 direct labor hours and 20,000 units per month. A finished unit requires 6 lb of materials at an estimated cost of 2 per pound. The estimated cost of labor is 10.00 per hour. The plant estimates that overhead (all variable) for a month will be 40,000. During the month of March, the plant totaled 34,800 direct labor hours at an average rate of 9.50 an hour. The plant produced 18,000 units, using 105,000 lb of materials at a cost of 2.04 per pound. 1. Prepare a standard cost summary showing the standard unit cost. 2. Make journal entries to charge materials and labor to Work in Process.arrow_forwardUse the following information for Exercises 9-63 and 9-64: Palladium Inc. produces a variety of household cleaning products. Palladiums controller has developed standard costs for the following four overhead items: Next year, Palladium expects production to require 90,000 direct labor hours. Exercise 9-64 Performance Report Based on Actual Production Refer to the information for Palladium Inc. above. Assume that actual production required 93,000 direct labor hours at standard. The actual overhead costs incurred were as follows: Required: Prepare a performance report for the period based on actual production.arrow_forwardShinto Corp. uses a standard cost system and manufactures one product. The variable costs per product follow: Budgeted fixed overhead costs for the month are $4,000, and Shinto expected to manufacture 2,000 units. Actual production, however, was only 1,800 units. Materials prices were 10% over standard, and labor rates were 5% over standard. Of the factory overhead expense, only 80% was used, and fixed overhead was $100 over budget. The actual variable overhead cost was $4,800. In materials usage, 8% more parts were used than were allowed for actual production by the standard, and 6% more labor hours were used than were allowed. Required: Calculate the materials and labor variances. Calculate the variances for overhead by the four-variance method. (Hint: First compute the fixed and variable overhead rates per hour.)arrow_forward

- Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardJameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forwardApril Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forward

- Cozy, Inc., manufactures small and large blankets. It estimates $350,000 in overhead during the manufacturing of 75,000 small blankets and 25,000 large blankets. What is the predetermined overhead rate if a small blanket takes 1 machine hour and a large blanket takes 2 machine hours?arrow_forwardPlata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forward

- ABC Inc. spent a total of $48,000 on factory overhead. Of this, $28,000 was fixed overhead. ABC Inc. had budgeted $27,000 for fixed overhead. Actual machine hours were 5.000. Standard hours for units made were 4,800. The standard variable overhead rate was $4.10. What is the variable overhead rate variance?arrow_forwardJoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of 600,000 and fixed factory overhead of 400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced using standard direct labor hours. The level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was 596,000, and actual fixed factory overhead was 410,000 for the year. Based on this information, the variable factory overhead controllable variance for JoyT for this year was: a. 24,000 unfavorable. b. 2,000 unfavorable. c. 4,000 favorable. d. 22,000 favorable.arrow_forwardCozy, Inc., manufactures small and large blankets. It estimates $950,000 in overhead during the manufacturing of 360,000 small blankets and 120,000 large blankets. What is the predetermined overhead rate if a small blanket takes 2 hours of direct labor and a large blanket takes 3 hours of direct labor?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning