Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 17E

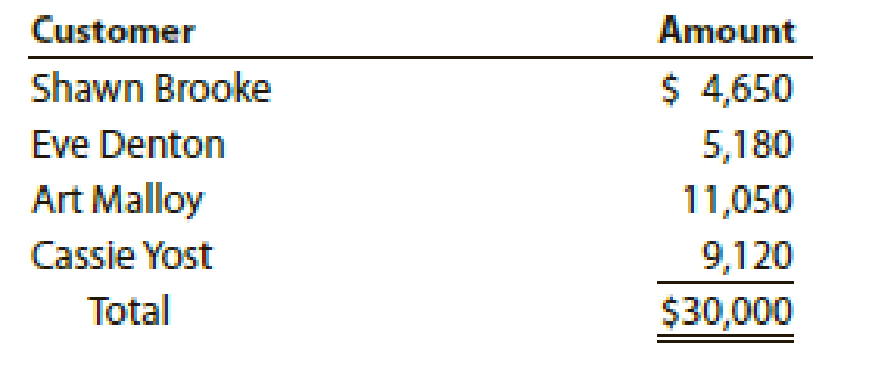

Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:

a. Journalize the write-offs under the direct write-off method.

b. Journalize the write-offs under the allowance method. Also, journalize the

c. How much higher (lower) would Casebolt Company’s net income have been under the direct write-off method than under the allowance method?

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 9 Solutions

Financial Accounting

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Journalize the following transactions, using the...Ch. 9 - Journalize the following transactions, using the...Ch. 9 - Journalize the following transactions, using the...Ch. 9 - Journalize the following transactions, using the...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - Lundquist Company received a 60-day, 9% note for...Ch. 9 - Prefix Supply Company received a 120-day, 8% note...Ch. 9 - Financial statement data for years ending December...Ch. 9 - Financial statement data for years ending December...Ch. 9 - Prob. 1ECh. 9 - MGM Resorts International owns and operates hotels...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Quantum Solutions Company, a computer consulting...Ch. 9 - At the end of the current year, the accounts...Ch. 9 - Toot Auto Supply distributes new and used...Ch. 9 - The accounts receivable clerk for Kirchhoff...Ch. 9 - Kirchhoff Industries has a past history of...Ch. 9 - Using data in Exercise 9-9, assume that the...Ch. 9 - Performance Bike Co. is a wholesaler of motorcycle...Ch. 9 - Using the data in Exercise 9-11, assume that the...Ch. 9 - The following selected transactions were taken...Ch. 9 - The following selected transactions were taken...Ch. 9 - Prob. 15ECh. 9 - Using the data in Exercise 9-15, assume that...Ch. 9 - Casebolt Company wrote off the following accounts...Ch. 9 - Seaforth International wrote off the following...Ch. 9 - Determine the due date and the amount of interest...Ch. 9 - Spring Designs Decorators issued a 120-day, 4%...Ch. 9 - The series of five transactions recorded in the...Ch. 9 - The following selected transactions were completed...Ch. 9 - Journalize the following transactions of Trapper...Ch. 9 - Journalize the following transactions in the...Ch. 9 - List any errors you can find in the following...Ch. 9 - Ralph Lauren Corporation designs, markets, and...Ch. 9 - The Campbell Soup Company manufactures and markets...Ch. 9 - Prob. 28ECh. 9 - Prob. 29ECh. 9 - The following transactions were completed by Daws...Ch. 9 - Trophy Fish Company supplies flies and fishing...Ch. 9 - Call Systems Company, a telephone service and...Ch. 9 - Flush Mate Co. wholesales bathroom fixtures....Ch. 9 - The following data relate to notes receivable and...Ch. 9 - Prob. 6PACh. 9 - The following transactions were completed by The...Ch. 9 - Wig Creations Company supplies wigs and hair care...Ch. 9 - Prob. 3PBCh. 9 - Gen-X Ads Co. produces advertising videos. During...Ch. 9 - The following data relate to notes receivable and...Ch. 9 - Prob. 6PBCh. 9 - Bud Lighting Co. is a retailer of commercial and...Ch. 9 - Prob. 2CPCh. 9 - Prob. 4CPCh. 9 - For several years, Xtreme Co.s sales have been on...Ch. 9 - Best Buy is a specialty retailer of consumer...Ch. 9 - Apple Inc. designs, manufactures, and markets...Ch. 9 - Prob. 8CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: A. Journalize the write-offs under the direct write-off method. B. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. C. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Parkers Nursery Supplies has a debit balance of 350,000. Credit sales are 2,300,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,920. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 24,560 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,280. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 22,440 in uncollectible accounts.arrow_forward

- UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Glenns Nursery Supplies has a debit balance of 390,000. Credit sales are 2,800,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,760. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,330 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 29,890 in uncollectible accounts.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Andersons Greeting Cards was 180,000. Credit sales for the year were 1,950,000. REQUIRED Make the necessary adjusting entry in general journal form under each of the following assumptions. Show calculations for the amount of each adjustment and the resulting net realizable value. 1. Allowance for Doubtful Accounts has a credit balance of 2,600. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.5% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,250 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.0% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 20,500 in uncollectible accounts.arrow_forwardJars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Yangs Gift Shop was 30,000. Credit sales for the year were 355,200. REQUIRED Make the necessary adjusting entry in general journal form under each of the following assumptions. Show calculations for the amount of each adjustment and the resulting net realizable value. 1. Allowance for Doubtful Accounts has a credit balance of 330. (a) The percentage of sales method is used and bad debt expense is estimated to be 2% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 6,950 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 400. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.5% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 5,685 in uncollectible accounts.arrow_forwardTonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit sales will be uncollectible. Allowance for Doubtful Accounts has a credit balance of 275. Prepare the adjusting entry at year-end for the estimated bad debt expense. (a) Based on an aging of its accounts receivable, Kyles Cyclery estimates that 3,200 of its year-end accounts receivable will be uncollectible. Allowance for Doubtful Accounts has a debit balance of 280 at year-end. Prepare the adjusting entry at year-end for the estimated uncollectible accounts.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forward

- Using data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardBristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts receivable. The uncollectible percentage is 3.1% for the income statement method and 4.5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $17,430; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License