1.

Journalize the transactions for the month of July.

1.

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journalize the transactions for the month of July:

| Date | Account title and explanation | Post Ref. | Amount | ||

| Debit | Credit | ||||

| 20-- | |||||

| July | 1 | Cash | 111 | $25,000.00 | |

| Person AV's Capital | 311 | $25,000.00 | |||

| 1 | Spa Supplies | 115 | $490.00 | ||

| Accounts Payable - Company GSS | 211/✓ | $490.00 | |||

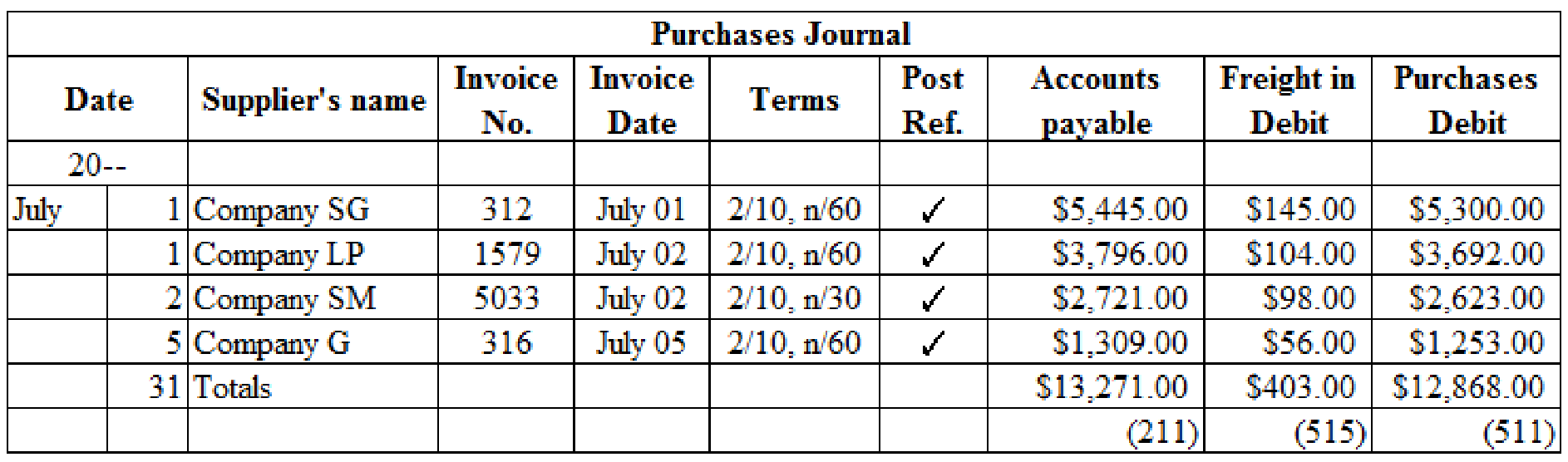

| 1 | Purchases | 511 | $5,300.00 | ||

| Freight In | 515 | $145.00 | |||

| Accounts Payable - Company SG | 211/✓ | $5,445.00 | |||

| 1 | Purchases | 511 | $3,692.00 | ||

| Freight In | 515 | $104.00 | |||

| Accounts Payable – Company LP | 211/✓ | $3,796.00 | |||

| 2 | Purchases | 511 | $2,623.00 | ||

| Freight In | 515 | $98.00 | |||

| Accounts Payable - Company SM | 211/✓ | $2,721.00 | |||

| 2 | Accounts receivable - Company LOL | 113/✓ | $351.00 | ||

| Merchandise Sales | 412 | $325.00 | |||

| Sales Tax Payable | 215 | $26.00 | |||

| 3 | Spa Equipment | 128 | $8,235.00 | ||

| Accounts Payable -Incorporation SE | 211/✓ | $6,235.00 | |||

| Cash | 111 | $2,000.00 | |||

| 3 | Rent Expense | 612 | $1,650.00 | ||

| Cash | 111 | $1,650.00 | |||

| 4 | Accounts Receivable- Company C | 113/✓ | $520.02 | ||

| Merchandise Sales | 412 | $481.50 | |||

| Sales Tax Payable | 215 | $38.52 | |||

| 5 | Accounts Payable - Company GSS | 211/✓ | $492.00 | ||

| Cash | 111 | $492.00 | |||

| 5 | Accounts Payable - Company OS | 211/✓ | $120.00 | ||

| Cash | 111 | $120.00 | |||

| 5 | Miscellaneous Expense | 630 | $98.00 | ||

| Cash | 111 | $98.00 | |||

| 5 | Accounts Payable - Incorporation A | 211/✓ | $397.00 | ||

| Cash | 111 | $397.00 | |||

| 5 | Wages Payable | 212 | $369.50 | ||

| Wages Expense | 611 | $1,476.00 | |||

| Cash | 111 | $1,845.50 | |||

| 5 | Office Equipment | 124 | $420.00 | ||

| Accounts Payable - Company SE | 211/✓ | $420.00 | |||

| 5 | Promotion Expense | 630 | $186.00 | ||

| Accounts Payable - Company OS | 211/✓ | $186.00 | |||

| 5 | Office Supplies | 114 | $118.00 | ||

| Accounts Payable -Company OS | 211/✓ | $118.00 | |||

| 5 | Purchases | 511 | $1,253.00 | ||

| Freight In | 515 | $56.00 | |||

| Accounts Payable - Company G | 211/✓ | $1,309.00 | |||

| 5 | Accounts receivable - Company PS | 113/✓ | $1,961.23 | ||

| Merchandise Sales | 412 | $1,815.95 | |||

| Sales Tax Payable | 215 | $145.28 | |||

| 7 | Cash | 111 | $4,881.60 | ||

| Merchandise Sales | 412 | $1,410.00 | |||

| Income from Services | 411 | $3,110.00 | |||

| Sales Tax Payable | 215 | $361.60 | |||

| 7 | Cash | 111 | $150.00 | ||

| Accounts Receivable - Company JA | 113/✓ | $150.00 | |||

| 10 | Accounts Receivable - Company HC | 113/✓ | $367.47 | ||

| Merchandise Sales | 412 | $340.25 | |||

| Sales Tax Payable | 215 | $27.22 | |||

| 10 | Accounts Receivable - Company MS | 113/✓ | $222.48 | ||

| Merchandise Sales | 412 | $206.00 | |||

| Sales Tax Payable | 215 | $16.48 | |||

| 12 | Wages Expense | 611 | $1,845.50 | ||

| Cash | 111 | $1,845.50 | |||

| 12 | Accounts Receivable - Company AFS | 113/✓ | $521.59 | ||

| Merchandise Sales | 412 | $482.95 | |||

| Sales Tax Payable | 215 | $38.64 | |||

| 14 | Cash | 111 | $200.00 | ||

| Accounts Receivable - Company JM | 113/✓ | $200.00 | |||

| 14 | Cash | 111 | $4,158.00 | ||

| Merchandise Sales | 412 | $1,220.00 | |||

| Income from Services | 411 | $2,630.00 | |||

| Sales Tax Payable | 215 | $308.00 | |||

| 18 | Accounts Payable - Company SE | 211/✓ | $1,150.00 | ||

| Cash | 111 | $1,150.00 | |||

| 19 | Wages Expense | 611 | $1,840.50 | ||

| Cash | 111 | $1,840.50 | |||

| 21 | Cash | 111 | $180.00 | ||

| Accounts Receivable - Company TL | 113/✓ | $180.00 | |||

| 21 | Cash | 111 | $5,248.80 | ||

| Merchandise Sales | 412 | $1,940.00 | |||

| Income from Services | 411 | $2,920.00 | |||

| Sales Tax Payable | 215 | $388.80 | |||

| 25 | Spa Equipment | 128 | $173.00 | ||

| Cash | 111 | $173.00 | |||

| 26 | Wages Expense | 611 | $1,842.00 | ||

| Cash | 111 | $1,842.00 | |||

| 28 | Laundry Expense | 615 | $84.00 | ||

| Cash | 111 | $84.00 | |||

| 28 | Cash | 111 | $109.00 | ||

| Accounts Receivable - Company JW | 113/✓ | $109.00 | |||

| 31 | Cash | 111 | $6,471.36 | ||

| Merchandise Sales | 412 | $1,930.00 | |||

| Income from Services | 411 | $4,062.00 | |||

| Sales Tax Payable | 215 | $479.36 | |||

| 31 | Person AV's Drawing | 312 | $2,500.00 | ||

| Cash | 111 | $2,500.00 | |||

| 31 | Utilities Expense | 617 | $225.00 | ||

| Cash | 111 | $225.00 | |||

| 31 | Utilities Expense | 617 | $248.00 | ||

| Cash | 111 | $248.00 | |||

| 31 | Spa Equipment | 128 | $1,800.00 | ||

| Person AV's Capital | 311 | $1,800.00 | |||

Table (1)

2.

2.

Explanation of Solution

Post the entries to the accounts receivable, accounts payable and general ledger:

General Ledger:

| Sales journal | |||||||

| Date | Invoice No. | Customer's name | Post Ref. | Accounts Receivable debit ($) | Sales tax payable credit ($) | Merchandise sales credit ($) | |

| 20-- | |||||||

| July | 2 | 14 | Company LOL | 351.00 | 26.00 | 325.00 | |

| 4 | 15 | Company C | 520.02 | 38.52 | 481.50 | ||

| 5 | 16 | Company PS | 1,961.23 | 145.28 | 1,815.95 | ||

| 10 | 17 | Company HC | 367.47 | 27.22 | 340.25 | ||

| 10 | 18 | Company MS | 222.48 | 16.48 | 206.00 | ||

| 12 | 19 | Company AFS | 521.59 | 38.64 | 482.95 | ||

| 31 | Totals | 3,943.79 | 292.14 | 3,651.65 | |||

| (113) | (215) | (412) | |||||

Table (2)

Table (3)

| Account: Cash | Account No. 111 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $15,170.00 | |||

| 1 | J6 | $25,000.00 | $40,170.00 | ||||

| 3 | J6 | $2,000.00 | $38,170.00 | ||||

| 3 | J6 | $1,650.00 | $36,520.00 | ||||

| 3 | J7 | $89.00 | $36,431.00 | ||||

| 5 | J7 | $492.00 | $35,939.00 | ||||

| 5 | J7 | $120.00 | $35,819.00 | ||||

| 5 | J7 | $98.00 | $35,721.00 | ||||

| 5 | J7 | $397.00 | $35,324.00 | ||||

| 5 | J7 | $1,845.50 | $33,478.50 | ||||

| 7 | J8 | $4,881.60 | $38,360.10 | ||||

| 7 | J8 | $150.00 | $38,510.10 | ||||

| 12 | J8 | $1,845.50 | $36,664.60 | ||||

| 14 | J8 | $200.00 | $36,864.60 | ||||

| 14 | J9 | $4,158.00 | $41,022.60 | ||||

| 18 | J9 | $1,150.00 | $39,872.60 | ||||

| 19 | J9 | $1,840.50 | $38,032.10 | ||||

| 21 | J9 | $180.00 | $38,212.10 | ||||

| 21 | J9 | $5,248.80 | $43,460.90 | ||||

| 25 | J9 | $173.00 | $43,287.90 | ||||

| 26 | J9 | $1,842.00 | $41,445.90 | ||||

| 28 | J9 | $84.00 | $41,361.90 | ||||

| 28 | J9 | $109.00 | $41,470.90 | ||||

| 31 | J9 | $6,471.36 | $47,942.26 | ||||

| 31 | J10 | $2,500.00 | $45,442.26 | ||||

| 31 | J10 | $225.00 | $45,217.26 | ||||

| 31 | J10 | $248.00 | $44,969.26 | ||||

Table (4)

| Account: Accounts receivable | Account No. 113 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,273.00 | |||

| 2 | J6 | $367.20 | $1,640.20 | ||||

| 4 | J7 | $513.54 | $2,153.74 | ||||

| 5 | J8 | $1,639.39 | $3,793.82 | ||||

| 7 | J8 | $150.00 | $3,643.82 | ||||

| 10 | J8 | $351.54 | $3,995.36 | ||||

| 10 | J8 | $244.08 | $4,239.44 | ||||

| 12 | J8 | $503.23 | $4,742.67 | ||||

| 14 | J8 | $200.00 | $4,542.67 | ||||

| 21 | J9 | $185.00 | $4,357.67 | ||||

| 28 | J9 | $110.00 | $4,247.67 | ||||

Table (5)

| Account: Office supplies | Account No. 114 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $130.00 | |||

| 2 | J7 | $118.00 | $248.00 | ||||

Table (6)

| Account: Spa supplies | Account No. 115 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $205.00 | |||

| 5 | J7 | $490.00 | $695.00 | ||||

Table (7)

| Account: Prepaid insurance | Account No. 117 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $800.00 | |||

Table (8)

| Account: Office equipment | Account No. 124 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,150.00 | |||

| 5 | J7 | $420.00 | $1,570.00 | ||||

Table (9)

| Account: | Account No. 125 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $10.00 | |||

Table (10)

| Account: Spa equipment | Account No. 128 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $7,393.00 | |||

| 3 | J6 | $8,235.00 | $15,628.00 | ||||

| 25 | J9 | $173.00 | $15,801.00 | ||||

| 31 | J10 | $1,800.00 | $17,601.00 | ||||

Table (11)

| Account: Accumulated Depreciation, Spa equipment | Account No. 129 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $64.88 | |||

Table (12)

| Account: Accounts payable | Account No. 211 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $2,248.00 | |||

| 1 | J6 | $490.00 | $2,738.00 | ||||

| 1 | J6 | $5,445.00 | $8,183.00 | ||||

| 1 | J6 | $3,796.00 | $11,979.00 | ||||

| 2 | J6 | $2,721.00 | $14,700.00 | ||||

| 3 | J6 | $6,235.00 | $20,935.00 | ||||

| 3 | J7 | $89.00 | $20,846.00 | ||||

| 5 | J7 | $492.00 | $20,354.00 | ||||

| 5 | J7 | $120.00 | $20,234.00 | ||||

| 5 | J7 | $397.00 | $19,837.00 | ||||

| 5 | J7 | $420.00 | $20,257.00 | ||||

| 5 | J7 | $186.00 | $20,443.00 | ||||

| 5 | J7 | $118.00 | $20,561.00 | ||||

| 5 | J8 | $1,309.00 | $21,870.00 | ||||

| 18 | J9 | $1,150.00 | $20,720.00 | ||||

Table (13)

| Account: Wages payable | Account No. 212 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $369.50 | |||

| 5 | J7 | $369.50 | |||||

Table (14)

| Account: Sales tax payable | Account No. 215 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $26.00 | $26.00 | |||

| 4 | J7 | $38.52 | $64.52 | ||||

| 5 | J8 | $145.28 | $209.80 | ||||

| 7 | J8 | $361.60 | $571.40 | ||||

| 10 | J8 | $27.22 | $598.62 | ||||

| 10 | J8 | $16.48 | $615.10 | ||||

| 12 | J8 | $38.64 | $653.74 | ||||

| 14 | J9 | $308.00 | $961.74 | ||||

| 21 | J9 | $388.80 | $1,350.54 | ||||

| 31 | J9 | $479.36 | $1,829.90 | ||||

Table (15)

| Account: Person AV, Capital | Account No. 311 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $23,419.62 | |||

| 1 | J6 | $25,000.00 | 48,419.62 | ||||

| 31 | J10 | $1,800.00 | 50,219.62 | ||||

Table (16)

| Account: Person AV, Drawing | Account No. 312 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $2,500.00 | $2,500.00 | |||

Table (17)

| Account: Income summary | Account No. 313 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (18)

| Account: Income from services | Account No. 411 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 7 | J8 | $3,110.00 | $3,110.00 | |||

| 14 | J9 | $2,630.00 | $5,740.00 | ||||

| 21 | J9 | $2,920.00 | $8,660.00 | ||||

| 31 | J9 | $4,062.00 | $12,722.00 | ||||

Table (19)

| Account: Merchandise sales | Account No. 412 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $325.00 | $325.00 | |||

| 4 | J7 | $481.50 | $806.50 | ||||

| 5 | J8 | $1,815.95 | $2,622.45 | ||||

| 7 | J8 | $1,410.00 | $4,032.45 | ||||

| 10 | J8 | $340.25 | $4,372.70 | ||||

| 10 | J8 | $206.00 | $4,578.70 | ||||

| 12 | J8 | $482.95 | $5,061.65 | ||||

| 14 | J9 | $1,220.00 | $6,281.65 | ||||

| 21 | J9 | $1,940.00 | $8,221.65 | ||||

| 31 | J9 | $1,930.00 | $10,151.65 | ||||

Table (20)

| Account: Purchases | Account No. 511 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $5,300.00 | $5,300.00 | |||

| 1 | J6 | $3,692.00 | $8,992.00 | ||||

| 2 | J6 | $2,623.00 | $11,615.00 | ||||

| 5 | J8 | $1,253.00 | $12,868.00 | ||||

Table (21)

| Account: Freight In | Account No. 515 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $145.00 | $145.00 | |||

| 1 | J6 | $104.00 | $249.00 | ||||

| 2 | J6 | $98.00 | $347.00 | ||||

| 5 | J8 | $56.00 | $403.00 | ||||

Table (22)

| Account: Wages expense | Account No. 611 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $1,476.00 | $1,476.00 | |||

| 12 | J8 | $1,845.50 | $3,321.50 | ||||

| 19 | J9 | $1,840.50 | $5,162.00 | ||||

| 26 | J9 | $1,842.00 | $7,004.00 | ||||

Table (23)

| Account: Rent expense | Account No. 612 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 3 | J6 | $1,650.00 | $1,650.00 | |||

Table (24)

| Account: Office supplies expense | Account No. 613 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (25)

| Account: Spa supplies expense | Account No. 614 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (26)

| Account: Laundry expense | Account No. 615 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 28 | J9 | $84.00 | $84.00 | |||

Table (27)

| Account: Advertising expense | Account No. 616 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (28)

| Account: Utilities expense | Account No. 617 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $225.00 | $225.00 | |||

| 31 | J10 | $248.00 | $473.00 | ||||

Table (29)

| Account: Insurance expense | Account No. 618 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (30)

| Account: Depreciation expense, Office equipment | Account No. 619 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (31)

| Account: Depreciation expense, Spa equipment | Account No. 620 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (32)

| Account: Miscellaneous expense | Account No. 630 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $98.00 | $98.00 | |||

| 5 | J7 | $186.00 | $284.00 | ||||

Table (33)

Accounts receivable ledger:

| Accounts receivable ledger | ||||||

| Name : Company AFS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 12 | J8 | $521.59 | $521.59 | ||

Table (34)

| Accounts receivable ledger | ||||||

| Name : Company JA | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $325.00 | |||

| 7 | J8 | $150.00 | $175.00 | |||

Table (35)

| Accounts receivable ledger | ||||||

| Name : Company C | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 4 | J7 | $520.02 | $520.02 | ||

Table (36)

| Accounts receivable ledger | ||||||

| Name : Company HC | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $367.47 | $367.47 | ||

Table (37)

| Accounts receivable ledger | ||||||

| Name : Company TL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $344.00 | ||

| 21 | J9 | $180.00 | $164.00 | |||

Table (38)

| Accounts receivable ledger | ||||||

| Name : Company LOL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $351.00 | $351.00 | ||

Table (39)

| Accounts receivable ledger | ||||||

| Name : Company MS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $222.48 | $222.48 | ||

Table (40)

| Accounts receivable ledger | ||||||

| Name : Company JM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $486.00 | |||

| 14 | J8 | $200.00 | $286.00 | |||

Table (41)

| Accounts receivable ledger | ||||||

| Name : Company PS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,961.23 | $1,961.23 | ||

Table (42)

| Accounts receivable ledger | ||||||

| Name : Company JW | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $109.00 | ||

| 28 | J8 | $109.00 | ||||

Table (43)

Accounts payable ledger:

| Accounts payable ledger | ||||||

| Name : Incorporation A | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $397.00 | ||

| August | 5 | $397.00 | ||||

Table (44)

| Accounts payable ledger | ||||||

| Name : Company G | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,309.00 | $1,309.00 | ||

Table (45)

| Accounts payable ledger | ||||||

| Name : Company GSS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $492.00 | ||

| 1 | J6 | $490.00 | $982.00 | |||

| 5 | J7 | $492.00 | $490.00 | |||

Table (46)

| Accounts payable ledger | ||||||

| Name : Company LP | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | J6 | $3,796.00 | $3,796.00 | |

Table (47)

| Accounts payable ledger | ||||||

| Name : Company OS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $120.00 | ||

| 5 | J7 | $120.00 | $0.00 | |||

| 5 | J7 | $186.00 | $186.00 | |||

| 5 | J7 | $118.00 | $304.00 | |||

Table (48)

| Accounts payable ledger | ||||||

| Name : Incorporation SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $89.00 | ||

| 3 | J6 | $6,235.00 | $6,324.00 | |||

| 3 | J7 | $89.00 | $6,235.00 | |||

Table (49)

| Accounts payable ledger | ||||||

| Name : Company SG | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | J6 | $5,445.00 | $5,445.00 | ||

Table (50)

| Accounts payable ledger | ||||||

| Name : Company SM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $2,721.00 | $2,721.00 | ||

Table (51)

| Accounts payable ledger | ||||||

| Name : Company SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $1,150.00 | ||

| 5 | J7 | $420.00 | $1,570.00 | |||

| 18 | J9 | $1,150.00 | $420.00 | |||

Table (52)

3.

Prepare

3.

Explanation of Solution

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare the trial balance.

| Company AAY | ||

| Trial balance | ||

| As on July 31, 20-- | ||

| Account name | Debit | Credit |

| Cash | $44,969.26 | |

| Accounts Receivable | $4,568.79 | |

| Office Supplies | $248.00 | |

| Spa Supplies | $695.00 | |

| Prepaid Insurance | $800.00 | |

| Office Equipment | $1,570.00 | |

| Accumulated | $10.00 | |

| Spa Equipment | $17,601.00 | |

| Accumulated Depreciation, Spa Equipment | $64.88 | |

| Accounts Payable | $20,720.00 | |

| Sales Tax Payable | $1,829.90 | |

| Person AV, Capital | $50,219.62 | |

| Person AV, Drawing | $2,500.00 | |

| Income from Services | $12,722.00 | |

| Merchandise Sales | $10,151.65 | |

| Purchases | $12,868.00 | |

| Freight In | $403.00 | |

| Wages Expense | $7,004.00 | |

| Rent Expense | $1,650.00 | |

| Laundry Expense | $84.00 | |

| Utilities Expense | $473.00 | |

| Miscellaneous Expense | $284.00 | |

| Total | $95,718.05 | $95,718.05 |

Table (53)

Thus, the total of trial balance of Company AAY is $95,718.05.

4.

Prepare a schedule of accounts receivable.

4.

Explanation of Solution

Schedule of accounts receivable: A schedule of accounts receivable is a subsidiary ledger that list out the accounts of credit customers individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of accounts receivable:

| Company AAY | |

| Schedule of Accounts receivable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company AFS | $521.59 |

| Company JA | $175.00 |

| Company C | $520.02 |

| Company HC | $367.47 |

| Incorporation TL | $164.00 |

| Company LOL | $351.00 |

| Company MS | $222.48 |

| Company JM | $286.00 |

| Company PS | $1,961.23 |

| Total Accounts receivable | $4,568.79 |

Table (54)

5.

Prepare a schedule of Accounts payable.

5.

Explanation of Solution

Schedule of accounts payable: A schedule of accounts payable lists is a subsidiary ledger that list out the accounts of creditors (vendors/suppliers) individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of Accounts payable:

| Company AAY | |

| Schedule of Accounts payable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company G | $1,309.00 |

| Company GSS | $490.00 |

| Company LP | $3,796.00 |

| Company OS | $304.00 |

| Incorporation SE | $6,235.00 |

| Company SG | $5,445.00 |

| Company SM | $2,721.00 |

| Company SE | $420.00 |

| Total Accounts payable | $20,720.00 |

Table (55)

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting (Book Only): A Career Approach

- Sales and Purchases Ms. Valli of All About You Spa has decided to expand her business by adding two lines of merchandisea selection of products used in the salon for the body, the feet, and the face, as well as logo mugs, T-shirts, and baseball caps that can provide advertising benefits. She believes she will be able to increase her profits significantly. July Journal Entries So that you can complete the journal entries for the month of July, Ms. Valli has also left the information you will need and directions on how to proceed. Note that with the expansion of the business into merchandising, new accounts have been added to the chart of accounts. For example, an additional revenue account, Merchandise Sales, is needed. Because All About You Spa now needs a Purchases account, the chart of accounts needs to be modified as follows: The 500599 range is used for the purchase-related accounts (for example, Purchases 511 and Freight In 515). Your new chart of accounts is as follows: CHART OF ACCOUNTS FOR ALL ABOUT YOU SPA Also note that because you will be making purchases on account and sales on account, subsidiary ledgers will be needed to track what is due from individual customers and owed to individual vendors. A listing of customers and vendors with current balances are as follows: Checkbook Register Purchases Invoices for Merchandise Bought on Account During July All About You Spa will pay all freight costs associated with purchases of merchandise to the supplier. Use the new accounts Purchases 511 and Freight In 515. Sales Invoices for Gift Certificates Sold on Account During July All About You Spa is responsible for collecting and paying the sales tax on merchandise that it sells. The sales tax rate where All About You Spa does business is 8 percent of each sale (for example, 340.00 0.08 = 27.20). Note: All gift certificates were redeemed for merchandise by the end of the month. Other July Transactions There were five other transactions in July. None involved cash. Required 1. Journalize the transactions for July (in date order). Ask your instructor whether you should use the special journals or the general journal for this problem. If you are preparing the journal entries using Working Papers, enter your transactions beginning on page 6. 2. Post the entries to the accounts receivable, accounts payable, and general ledgers. Ignore this step if you are using CLGL. 3. Prepare a trial balance as of July 31, 20--. 4. Prepare a schedule of accounts receivable as of July 31, 20--. 5. Prepare a schedule of accounts payable as of July 31, 20--.arrow_forwardElla Maksimov is CEO of her own marketing firm. The firm recently moved from a strip mall in the suburbs to an office space in a downtown building, in order to make the firms employees more accessible to clients. Two new clients are interested in using Ellas advertising services but both clients are in the same line of business, meaning that Ellas company can represent only one of the clients. Pampered Pooches wants to hire Ellas firm for a one-year contract for web, newspaper, radio, and direct mail advertising. Pampered will pay $126,000 for these services. Ella estimates the cost of the services requested by Pampered Pooches to be $83,000. Delightful Dogs is interested in hiring Ella to produce mass mailings and web ads. Delightful will pay Ella $94,000 for these services and Ella estimates the cost of these services to be $47,000. Identify any relevant costs, relevant revenues, sunk costs, and opportunity costs that Ella Graham has to consider in making the decision whether to represent Pampered Pooches or Delightful Dogs.arrow_forwardAfter working for years as a regional manager for a retail organization, Scott Parry opened his own business with Susan Gonzalez, one of his district managers, as his partner. They formed S&S to sell appliances and consumer electronics. Scott and Susan pursued a “clicks and bricks” strategy by renting a building in a busy part of town and adding an electronic storefront. Scott and Susan invested enough money to see them through the first six months. They will hire 15 employees within the next two weeks – three to stock the shelves, four sales representatives, six checkout clerks, and two to develop and maintain the electronic storefront. Scott and Susan will host S&S’s grand opening in five weeks. To meet that deadline, they have to address the following important issues: 16. What business processes are needed, and how should they be carried out? 17. What functionality should be provided on the website?arrow_forward

- You have just begun your summer internship at Omni Instruments. The company supplies sterilized surgical instruments for physicians. To expand sales, Omni is considering paying a commission to its sales force. The controller, Matthew Barnhill, asks you to compute: (1) the new breakeven sales figure, and (2) the operating profit if sales increase 15% under the new sales commission plan. He thinks you can handle this task because you learned CVP analysis in your accounting class. You spend the next day collecting information from the accounting records, performing the analysis, and writing a memo to explain the results. The company president is pleased with your memo. You report that the new sales commission plan will lead to a significant increase in operating income and only a small increase in breakeven sales. The following week, you realize that you made an error in the CVP analysis. You overlooked the sales personnel’s $2,800 monthly salaries, and you did not include this fixed…arrow_forwardABC is an online-to-offline platform that sells e-commerce products to offline customers through a network of agents. ABC gives a commission to agents for each sale made. ABC has 4 main product categories: electronics, fashion, supermarket, and others. Please refer to the exhibits for data sets pertaining to the questions below. Today is May 16th. 1. What is the average growth in average sales per agent per month from March to May target? Answer: %2. Which one is the category with the highest and lowest average month-on- month sales growth from March to May target? Answer: Highest: Lowest:3. Today is May We have got the interim result of the sales figures in the first half of May. Typically, the first half of the month constitutes of 40% of sales. Using this assumption, will we reach our May target? What % over the target will we over/under-deliver? Answer: under/over-deliver by % of target4. Using that assumption, which category (or categories) will not reach the targeted sales…arrow_forwardThe following events occur during September: Webworks purchases supplies worth $120 on account. At the beginning of September, Webworks had 19 keyboards costing $100 each and 110 flash drives costing $10 each. Webworks has decided to use perpetual FIFO to cost its inventory. On account, Webworks purchases thirty keyboards for $105 each and fifty flash drives for $11 each. Webworks starts and completes five more Web sites and bills clients for $3,000. Webworks pays Nancy $500 for her work during the first three weeks of September. Webworks sells 40 keyboards for $6,000 and 120 flash drives for $2,400 cash. Webworks collects $2,500 in accounts receivable. Webworks pays off its salaries payable from August. Webworks pays off $5,500 of its accounts payable. Webworks pays off $5,000 of its outstanding note payable. Webworks pays Leon salary of $2,000. Webworks pays taxes of $795 in cash. Required: Prepare journal entries for the above events. Post the journal entries to T-accounts.…arrow_forward

- ABC is an online-to-offline platform that sells e-commerce products to offline customers through a network of agents. ABC gives a commission to agents for each sale made. ABC has 4 main product categories: electronics, fashion, supermarket, and others. Please refer to the exhibits for data sets pertaining to the questions below. Today is May 16th. What is the average growth in average sales per agent per month from March to May target? Answer:..... % Which one is the category with the highest and lowest average month-on-month sales growth from March to May target? Answer: Highest : .......... Lowest:............. Today is 16th May We have got the interim result of the sales figures in the first half of May. Typically, the first half of the month constitutes of 40% of sales. Using this assumption, will we reach our May target? What % over the target will we over/under-deliver? Answer: under/over-deliver by ......... % of target Using that assumption, which…arrow_forwardJerry is a personnel manager for a large retail department store. He justreceived a memo stating that the company will build three new stores inPhoenix over the next 5 years, with one store opening in 24 months, oneopening in 36 months, and one opening in 60 months. The memo thatJerry received relates to what type of business plan? If Jerry is directedto develop a personnel plan for Phoenix, what type of planning will Jerrybe doing?arrow_forwardIn this activity, you are going to record a comprehensive transactions involving merchandising concern. Prepare the journal entries, T-accounts and trial balance of a merchandising concern. Cielo Bonita is engaged in buying and selling of novelty items. The following transactions have transpired for the month of Sept. 2020. Sept. 1 – She invested P100,500 cash and an old office equipment presently valued at P33,200 which she bought 2 years ago for P50,000. Sept. 2- Purchased MDSE from ABC Enterprise for P20,000. Terms: n/30, FOB destination. ABC paid P1,500 for the freight cost. Sept. 3- Sold MDSE for cash amounted to P10,600. Sept. 6- Purchased MDSE from Ali Commercial for P26,500. Terms: 50% down payment, balance 2/10, n/30. Sept. 7 – Sold MDSE to Jay Cesar for P12,500. Terms: 2/10, n/30, FOB Shipping point. Sept. 8 – Purchased from COVID Furniture a display counted for P6,000. Terms : 50% down payment, balance 1/10, n/30.92 Sept. 9 – Sold MDSE to Giles Anthony for P14,000. Terms:…arrow_forward

- Sahra Ong is the sole proprietor of ‘Vacation’ a beach clothing business. Sahra designs and sews fashionable beachwear that has a high SPF rating. Sahra launched a bespoke beachwear range twelve months ago, and thanks to a cover story of her business published in the inflight magazine of a large airline company, demand for her bespoke beachwear has increased significantly. Sahra is so busy with the growth of the business that she has been unable to attend to the bookkeeping, so she has recently hired Stone & Co Accounting Specialists Pty Ltd to take over the accounting function. You are the graduate accountant working at Stones & Co Accounting Specialists Pty Ltd and are now responsible for preparing the monthly journals for ‘Vacation’. The following is a list of transactions that took place during the month of July 2020 that need to be recorded in the General Journal. July 1 The business purchased a new sewing machine at a cost of $8,500. $2,500 was…arrow_forwardCREATE A TRIAL BALANCE AND FINANCIAL STATEMENTS WITH THE FOLLOWING INFORMATION. EVERYTHING IS BELOW INCLUDING PICTURES OF THE PREVIOUS MONTHS FINANCIAL STATEMENTS The following events occur during September: a. Webworks purchases supplies worth $120 on account. b. At the beginning of September, Webworks had 19 keyboards costing $100 each and 110 flash drives costing $10 each. Webworks has decided to use perpetual FIFO to cost its inventory. c. On account, Webworks purchases thirty keyboards for $105 each and fifty flash drives for $11 each. d. Webworks starts and completes five more Web sites and bills clients for $3,000. e. Webworks pays Nancy $500 for her work during the first three weeks of September. f. Webworks sells 40 keyboards for $6,000 and 120 flash drives for $2,400 cash. g. Webworks collects $2,500 in accounts receivable. h. Webworks pays off its salaries payable from August. i. Webworks pays off $5,500 of its accounts payable. j. Webworks pays off $5,000 of its outstanding…arrow_forwardGreg has operated his shop for 2 years. He buys coffee from a local supplier and bakes the cinnamon rolls in-house. Your business consists of catering events and selling fine mixers. The plan is for you to use the premises Greg currently rents to give you an opportunity to display your cakes and demonstrate the mixers that you sell. You will also hire, train, and supervise staff to bake cookies and muffins sold in the shop. By offering a greater variety of baked goods, both of you would benefit. Another advantage is that the coffee shop will have one central location for selling the mixers. However, you want to have a better understanding of his growth, so you ask to see is balance sheets for the past two years. His comparative balance sheets are as follows: Greg's Cinnamon Rolls Condensed Balance Sheet 31-Oct 2021 2020 Assets Current Assets $10,360 $8,602 Property, plant, and equipment (net) 2,500 2,256…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College