The Mega Supply Corporation has three divisions: Commercial Products, Consumer Products, and Corporate Offices, which are located in Hatfield, South Carolina; Palo Alto, California; and Tulsa, Oklahoma, respectively. The Commercial Products division deals exclusively in sales of industrial products and supplies to business organizations. The Consumer Products division sells nonindustrial products to private consumers. Both divisions have dedicated inventory warehouses at their respective locations in Hatfield and Palo Alto. Because of the dissimilar nature of the commercial and consumer division product lines, they do not share customers or vendors.

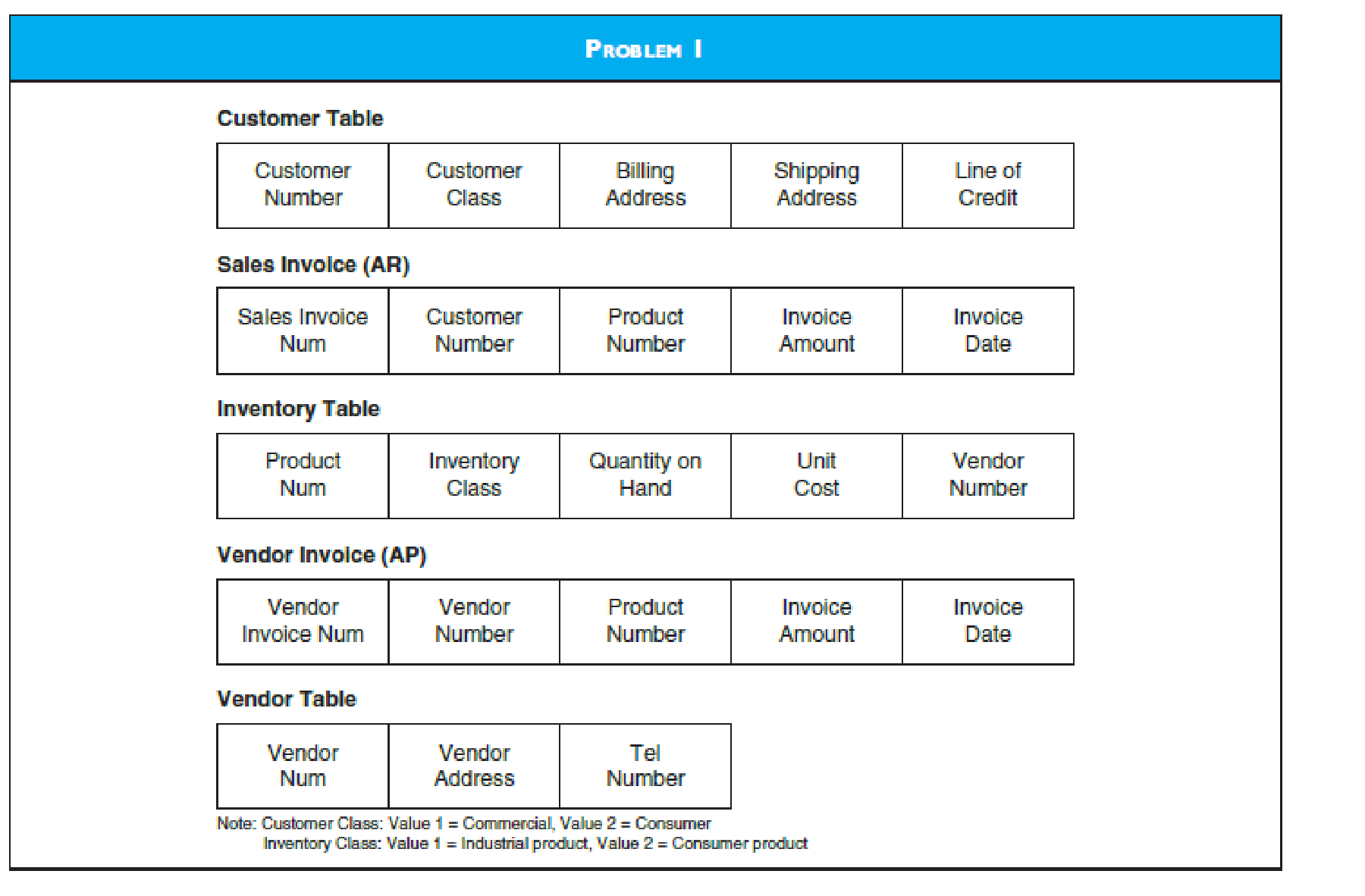

Currently Mega Supply uses a centralized database, which is located at their Corporate Division in Tulsa. Some relevant database tables and attributes are presented in the figure designated Problem 1.

When customers contact their respective sales division, the sales clerk logs into the corporate database, checks credit, determines product availability, and creates a sales invoice. The corporate office typically bills the customer within 3 or 4 days and extends terms of net 30. Inventory control,

Due to Mega’s rapid growth, the company has seen a significant increase in sales and purchase transactions, which has resulted in excessive delays in processing transactions from the central database. Since customer service, including rapid response to customer inquiries and sales order processing, is a cornerstone of Mega’s business model, these delays are unacceptable.

Required

Mega wants to improve response time by distributing some parts of the corporate database while keeping other parts of it centralized.

- (A) Develop a schema for distributing Mega Supply Corporation’s database. Add new tables and attributes as needed but limit the schema to the tables needed to support sales, cash receipts, purchases/AP, and cash disbursements. In your schema, indicate whether tables are centralized, replicated, or partitioned.

- (B) Explain how the new system will operate.

Trending nowThis is a popular solution!

Chapter 9 Solutions

Accounting Information Systems

- The Kelly-Elias Corporation, manufacturer of tractors and other heavy farm equipment, is organized along decentralized product lines, with each manufacturing division operating as a separate profit center. Each division manager has been delegated full authority on all decisions involving the sale of that division’s output both to outsiders and to other divisions of Kelly-Elias. Division C has in the past always purchased its requirement of a particular tractor-engine component from division A. However, when informed that division A is increasing its selling price to $135, division C’s manager decides to purchase the engine component from external suppliers. Division C can purchase the component for $115 per unit in the open market. Division A insists that, because of the recent installation of some highly specialized equipment and the resulting high depreciation charges, it will not be able to earn an adequate return on its investment unless it raises its price. Division A’s manager…arrow_forwardThe Kelly-Elias Corporation, manufacturer of tractors and other heavy farm equipment, is organized along decentralized product lines, with each manufacturing division operating as a separate profit center. Each division manager has been delegated full authority on all decisions involving the sale of that division’s output both to outsiders and to other divisions of Kelly-Elias. Division C has in the past always purchased its requirement of a particular tractor-engine component from division A. However, when informed that division A is increasing its selling price to $135, division C’s manager decides to purchase the engine component from external suppliers. Division C can purchase the component for $115 per unit in the open market. Division A insists that, because of the recent installation of some highly specialized equipment and the resulting high depreciation charges, it will not be able to earn an adequate return on its investment unless it raises its price. Division A’s manager…arrow_forwardPosavek is a wholesale supplier of building supplies building contractors, hardware stores, and home-improvement centers in the Boston metropolitan area. Over the years, Posavek has expanded its operations to serve customers across the nation and now employs over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently, Posavek has experienced fierce competition from the large online discount stores. In addition, the company is suffering from operational inefficiencies related to its archaic information system. Posavek revenue cycle procedures are described in the following paragraphs. Revenue Cycle Posaveks sales department representatives receive orders via traditional mail, e-mail, telephone, and the occasional walk-in customer. Because Posavek is a wholesaler, the vast majority of its business is conducted on a credit basis. The process begins in the sales department, where the sales clerk enters the customers order into the centralized computer sales order system. The computer and file server are housed in Posaveks small data processing department. If the customer has done business with Posavek in the past, his or her data are already on file. If the customer is a first-time buyer, however, the clerk creates a new record in the customer account file. The system then creates a record of the transaction in the open sales order file. When the order is entered, an electronic copy of it is sent to the customers e-mail address as confirmation. A clerk in the warehouse department periodically reviews the open sales order file from a terminal and prints two copies of a stock release document for each new sale, which he uses to pick the items sold from the shelves. The warehouse clerk sends one copy of the stock release to the sales department and the second copy, along with the goods, to the shipping department. The warehouse clerk then updates the inventory subsidiary file to reflect the items and quantities shipped. Upon receipt of the stock release document, the sales clerk accesses the open sales order file from a terminal, closes the sales order, and files the stock release document in the sales department. The sales order system automatically posts these transactions to the sales, inventory control, and cost-of-goods-sold accounts in the general ledger file. Upon receipt of the goods and the stock release, the shipping department clerk prepares the goods for shipment to the customer. The clerk prepares three copies of the bill of lading. Two of these go with the goods to the carrier and the third, along with the stock release document, is filed in the shipping department. The billing department clerk reviews the closed sales orders from a terminal and prepares two copies of the sales invoice. One copy is mailed to the customer, and the other is filed in the billing department. The clerk then creates a new record in the accounts receivable subsidiary file. The sales order system automatically updates the accounts receivable control account in the general ledger file. CASH RECEIPTS PROCEDURES Mail room clerks open customer cash receipts, reviews the check and remittance advices for completeness, and prepares two copies of a remittance list. One copy is sent with the checks to the cash receipts department. The second copy of the remittance advices are sent to the billing department. When the cash receipts clerk receives the checks and remittance list, he verifies the checks received against those on the remittance list and signs the checks For Deposit Only. Once the checks are endorsed, he records the receipts in the cash receipts journal from his terminal. The clerk then fills out a deposit slip and deposits the checks in the bank. Upon receipt of the remittances, the billing department clerk records the amounts in the accounts receivable subsidiary ledger from the department terminal. The system automatically updates the AR control account in the general ledger Posavek has hired your public accounting firm to review its sales order procedures for internal control compliance and to make recommendations for changes. Required a. Create a data flow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the physical internal control weaknesses in the system. d. (Optional) Prepare a system flowchart of a redesigned computer-based system that resolves the control weaknesses that you identified. Explain your solution.arrow_forward

- Phoenix Inc., a cellular communication company, has multiple business units, organized as divisions. Each division’s management is compensated based on the division’s operating income. Division A currently purchases cellular equipment from outside markets and uses it to produce communication systems. Division B produces similar cellular equipment that it sells to outside customers—but not to division A at this time. Division A’s manager approaches division B’s manager with a proposal to buy the equipment from division B. If it produces the cellular equipment that division A desires, division B will incur variable manufacturing costs of $60 per unit. Relevant Information about Division B Sells 90,000 units of equipment to outside customers at $130 per unit Operating capacity is currently 80%; the division can operate at 100% Variable manufacturing costs are $70 per unit Variable marketing costs are $8 per unit Fixed manufacturing costs are $900,000 Income per Unit for Division A…arrow_forwardSembotix Company has several divisions including a Semiconductor Division that sells semiconductors to both internal and external customers. The company’s X-ray Division uses semiconductors as a component in its final product and is evaluating whether to purchase them from the Semiconductor Division or from an external supplier. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard: Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help. Howard: You’ve got that right. We’re producing and selling at about 90% of our capacity to outsiders. Last year, we were selling 100% of capacity. Would it be possible for your division to pick up some of our excess capacity? After all, we are part of the same company. Dave: What kind of price could you give…arrow_forwardSembotix Company has several divisions including a Semiconductor Division that sells semiconductors to both internal and external customers. The company's X-ray Division uses semiconductors as a component in its final product and is evaluating whether to purchase them from the Semiconductor Division or from an external supplier. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard: Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help. Howard: You've got that right. We're producing and selling at about 90% of our capacity to outsiders. Last year we were selling 100% of capacity. Would it be possible for your division to pick up some of the excess capacity? After all, we are part of the same company. Dave: What kind of price can you give me?…arrow_forward

- Code Incorporated has three divisions (Entertainment, Plastics, and Video Card), each of which is considered an investment center for performance evaluation purposes. The Entertainment Division manufactures video arcade equipment using products produced by the other two divisions, as follows: 1. The Entertainment Division purchases plastic components from the Plastics Division that are considered unique (i.e., they are made exclusively for the Entertainment Division). In addition, the Plastics Division makes less-complex plastic components that it sells externally, to other producers. 2. The Entertainment Division purchases, for each unit it produces, a video card from Code's Video Card Division, which also sells this video card externally (to other producers). The per-unit manufacturing costs associated with each of the above two items, as incurred by the Plastic Components Division and the Video Card Division, respectively, are: Plastic Components Video Cards Direct…arrow_forwardAg-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into three brands of agricultural fertilizer: greenup, maintane, and winterizer. The three brands differ with respect to selling price and the proportional content of basic chemicals. Ag-Coop’s Fertilizer Manufacturing Division transfers the completed product to the cooperative’s Retail Sales Division at a price based on the cost of each type of fertilizer plus a markup. The Manufacturing Division is completely automated so that the only costs it incurs are the costs of the petrochemical feedstocks plus overhead that is considered fixed. The primary feedstock costs $2.00 per pound. Each 100 pounds of feedstock can produce either of the following mixtures of fertilizer. Output Schedules (in pounds) A B Greenup 50 60 Maintane…arrow_forwardAg-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into three brands of agricultural fertilizer: greenup, maintane, and winterizer. The three brands differ with respect to selling price and the proportional content of basic chemicals. Ag-Coop’s Fertilizer Manufacturing Division transfers the completed product to the cooperative’s Retail Sales Division at a price based on the cost of each type of fertilizer plus a markup. The Manufacturing Division is completely automated so that the only costs it incurs are the costs of the petrochemical feedstocks plus overhead that is considered fixed. The primary feedstock costs $1.50 per pound. Each 100 pounds of feedstock can produce either of the following mixtures of fertilizer. Output Schedules (in pounds) A B Greenup 50 60 Maintane…arrow_forward

- Cocoa Mill Chocolates manufactures specialty chocolates and sells them to fine candy stores. The company operates two divisions, cocoa and candy, as decentralized entities. The cocoa division purchases raw cacao beans and processes them into cocoa powder. The candy division purchases cocoa powder and other ingredients and uses them to produce gourmet chocolates. The cocoa division is free to sell processed cocoa to outside buyers, and the candy division is free to purchase processed cocoa from other sources. Currently, however, the cocoa division sells all of its output to the candy division, and the candy division does not purchase materials from outside suppliers. The processed cocoa is transferred from the cocoa division to the production division at 110% of full cost. The cocoa division purchases raw cacao beans for $4 per pound. The cocoa division uses 1.25 pounds of raw cacao beans to produce one pound of processed cocoa. The division’s other variable costs equal $1.25 per pound…arrow_forwardCocoa Mill Chocolates manufactures specialty chocolates and sells them to fine candy stores. The company operates two divisions, cocoa and candy, as decentralized entities. The cocoa division purchases raw cacao beans and processes them into cocoa powder. The candy division purchases cocoa powder and other ingredients and uses them to produce gourmet chocolates. The cocoa division is free to sell processed cocoa to outside buyers, and the candy division is free to purchase processed cocoa from other sources. Currently, however, the cocoa division sells all of its output to the candy division, and the candy division does not purchase materials from outside suppliers. The processed cocoa is transferred from the cocoa division to the production division at 110% of full cost. The cocoa division purchases raw cacao beans for $4 per pound. The cocoa division uses 1.25 pounds of raw cacao beans to produce one pound of processed cocoa. The division’s other variable costs equal $1.25 per pound…arrow_forwardCocoa Mill Chocolates manufactures specialty chocolates and sells them to fine candy stores. The company operates two divisions, cocoa and candy, as decentralized entities. The cocoa division purchases raw cacao beans and processes them into cocoa powder. The candy division purchases cocoa powder and other ingredients and uses them to produce gourmet chocolates. The cocoa division is free to sell processed cocoa to outside buyers, and the candy division is free to purchase processed cocoa from other sources. Currently, however, the cocoa division sells all of its output to the candy division, and the candy division does not purchase materials from outside suppliers. The processed cocoa is transferred from the cocoa division to the production division at 110% of full cost. The cocoa division purchases raw cacao beans for $4 per pound. The cocoa division uses 1.25 pounds of raw cacao beans to produce one pound of processed cocoa. The division’s other variable costs equal $1.25 per pound…arrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning