Concept explainers

Basic

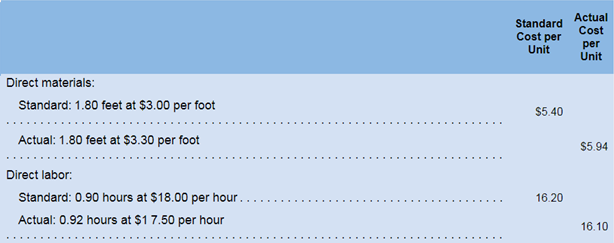

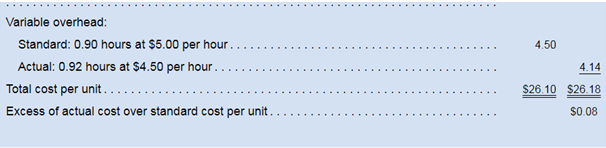

Koontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual Cost data for May.

The production superintendent was pleased when he saw this report and commented: ‘This S0.08 excess cost is well within the 2 percent limit management has set for acceptable variances. Its obious that theres not much to worry about with this product.”

Actual production for the month was 12,000 units. Variable

Required:

1. Compute the following variances for May:

a. Materials price and quantity variances.

b. Labor rate and efficiency variances.

c. Variable overhead rate and efficiency variances.

2. How much of the $0.08 excess unit cost is traceabk to each of the variances computed in (1) above.

3. How much of the $0.08 excess limit cost is traceable to apparent inefficient use of labor time?

4. Do you agree that the excess unit cost is not of concern’.

1

Variances

A variance shows the difference between actual cost incurred by a company and the budgeted cost. A variance may either be favorable or unfavorable. It will be considered as favorable if budgeted cost is higher than the cost that is actually incurred.

To calculate: Various variances related to material, labor and overhead.

Answer to Problem 20P

Material price variance is $6,480 unfavorable and material quantity variance is 0.

Labor rate variance is $5,520 favorable and labor efficiency variance is $4,320 unfavorable.

Variable overhead rate variance is $5,520 favorable and variable overhead efficiency variance is $1,200 unfavorable.

Explanation of Solution

Calculation of material price and quantity variance:

Formula to calculate material price variance is

Here, standard price is given as $3.00, actual price is $3.30 and actual quantity is 21,600 (1.8 * 12,000). So, the variance will be:

Formula to calculate material quantity variance is

Here, actual quantity is 21,600, standard quantity is 21,600 (1.8 *12,000) and standard price is $3 per foot. So, the variance will be:

Calculation of labor rate and efficiency variances:

Formula to calculate labor rate variance is

Here, standard rate is $18.00, actual rate is $17.50 and actual hours are 11,040 (0.92 *12,000). So, the variance will be:

Formula to calculate labor efficiency variance is

Here, standard rate is $18 per hour, actual hours are 11,040 and standard hours are 10,800 (0.90 *12,000). So, variance will be:

Calculation of variable overhead rate and efficiency variance

Formula to calculate variable overhead rate variance is

Here, standard rate is $5 per hour, actual rate is $4.5 per hour and actual hours are 11,040 (0.92 *12,000). So, the variance will be:

Formula to calculate variable overhead efficiency variance is:

Here, standard rate is $ per hour, actual hours are 11,040 and standard hours are 10,800 (0.90 *12,000). So, the variance will be:

2

Excess unit cost

This cost represents the additional cost incurred by a company. It is traceable to all the variances.

To calculate: Standard cost allowed for 20,000 units.

Answer to Problem 20P

Amount that will be traceable to material variances is $0.54U,

Amount that will be traceable to labor variances is $0.10F and

Amount that will be traceable to variable overhead variances is $0.36 F.

Explanation of Solution

The excess unit cost of $0.08 would be traceable to variances in the following way

| Particulars | Amount (in $) | Total (in $) |

| Materials | ||

| Efficiency variance (0/12,000) | 0 | |

| Price variance ($6,480/12,000) | 0.54 U | 0.54 U |

| Labor | ||

| Efficiency variance ($4,320/12,000) | 0.36 U | |

| Rate variance ($5,520/12,000) | 0.46 F | 0.10 F |

| Variable overheads | ||

| Efficiency variance ($1,200/12,000) | 0.10 U | |

| Rate variance ($5,520/12,000) | 0.46 F | 0.36 F |

| 0.08U |

$0.54 Unfavorable will be traceable to material variance, $0.10 favorable will be traceable to labor variance and $0.36 favorable will be traceable to variable overheads variance. Total will be $0.08 unfavorable (0.54U + 0.10 F + 0.36 F).

3

Excess unit cost

This is the cost that a company incurs in addition to budgeted or standard cost.

labor spending variance with the given figures.

Answer to Problem 20P

$0.36U is traceable to labor efficiency variance, $0.10U is traceable to overhead efficiency variance and $0.54 F would be due to other variances.

Explanation of Solution

When labor time is used inefficiently, both labor efficiency variance and overhead efficiency variance are affected. Traceability of cost to variances due to inefficient use is shown below:

| Particulars | Amount (in $) | Total (in $) |

| Excess of actual overhead cost | $0.08 U | |

| Less: Portion traceable to labor efficiency variance (shown in sub part 2) | 0.36 U | |

| Less: portion traceable to overhead efficiency variance (shown in sub part 2) | 0.10 U | 0.46 U |

| Portion due to other variances | 0.54 F |

$0.36 U will be traceable to labor efficiency variance, $0.10 U will be due to variable overhead efficiency variance and amount that would be left (0.54F) will be due to other variances.

4

Excess unit cost

Excess unit cost represents the additional cost that a company incurs, in excess of the budgeted cost. It is calculated by deducting standard cost from the actual cost incurred by a company.

To explain:Whether the excess cost is important to be considered.

Explanation of Solution

Excess unit cost represents the additional expense that a company incurs. Standard cost represents the ideal cost that should be incurred in the production process. This cost represents the amount that a company incurs in addition to standard or ideal cost. The statement that it is not of concern is false. It is important to be considered and shown by all the companies.

This cost is important to be considered as it is attributable to or traceable to all the variances. Traceability of this cost to all the variances is identified and then important decisions are taken. It increases the cost for a company and hence, reduces the profit. Therefore, it should be identified, considered and it should be minimized to the best possible level.

Want to see more full solutions like this?

Chapter 9 Solutions

Introduction To Managerial Accounting

- Refer to the information for Cinturon Corporation on the previous page. Required: 1. Break down the total variance for materials into a price variance and a usage variance using the columnar and formula approaches. 2. CONCEPTUAL CONNECTION Suppose the Boise plant manager investigates the materials variances and is told by the purchasing manager that a cheaper source of leather strips had been discovered and that this is the reason for the favorable materials price variance. Quite pleased, the purchasing manager suggests that the materials price standard be updated to reflect this new, less expensive source of leather strips. Should the plant manager update the materials price standard as suggested? Why or why not?arrow_forwardRefer to the information for Cinturon Corporation on the previous page. Required: 1. Break down the total variance for labor into a rate variance and an efficiency variance using the columnar and formula approaches. 2. CONCEPTUAL CONNECTION As part of the investigation of the unfavorable variances, the plant manager interviews the production manager. The production manager complains strongly about the quality of the leather strips. He indicates that the strips are of lower quality than usual and that workers have to be more careful to avoid a belt with cracks and more time is required. Also, even with extra care, many belts have to be discarded and new ones produced to replace the rejects. This replacement work has also produced some overtime demands. What corrective action should the plant manager take?arrow_forwardRecompute the variances from the second Acme Inc. exercise using $0.0725 as the standard cost of the material and $14 as the standard labor cost per hour. How has your explanation of the variances changed?arrow_forward

- Marten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forwardIn all of the exercises involving variances, use F and U to designate favorable and unfavorable variances, respectively. E8-1 through E8-5 use the following data: The standard operating capacity of Tecate Manufacturing Co. is 1,000 units. A detailed study of the manufacturing data relating to the standard production cost of one product revealed the following: 1. Two pounds of materials are needed to produce one unit. 2. Standard unit cost of materials is 8 per pound. 3. It takes one hour of labor to produce one unit. 4. Standard labor rate is 10 per hour. 5. Standard overhead (all variable) for this volume is 4,000. Each case in E8-1 through E8-5 requires the following: a. Set up a standard cost summary showing the standard unit cost. b. Analyze the variances for materials and labor. c. Make journal entries to record the transfer to Work in Process of: 1. Materials costs 2. Labor costs 3. Overhead costs (When making these entries, include the variances.) d. Prepare the journal entry to record the transfer of costs to the finished goods account. Standard unit cost; variance analysis; journal entries 1,000 units were started and finished. Case 1: All prices and quantities for the cost elements are standard, except for materials cost, which is 8.50 per pound. Case 2: All prices and quantities for the cost elements are standard, except that 1,900 lb of materials were used.arrow_forwardMadison Company uses the following rule to determine whether direct labor efficiency variances ought to be investigated. A direct labor efficiency variance will be investigated anytime the amount exceeds the lesser of 12,000 or 10 percent of the standard labor cost. Reports for the past five weeks provided the following information: Required: 1. Using the rule provided, identify the cases that will be investigated. 2. Suppose that investigation reveals that the cause of an unfavorable direct labor efficiency variance is the use of lower quality direct materials than are usually used. Who is responsible? What corrective action would likely be taken? 3. Suppose that investigation reveals that the cause of a significant favorable direct labor efficiency variance is attributable to a new approach to manufacturing that takes less labor time but causes more direct materials waste. Upon examining the direct materials usage variance, it is discovered to be unfavorable, and it is larger than the favorable direct labor efficiency variance. Who is responsible? What action should be taken? How would your answer change if the unfavorable variance were smaller than the favorable?arrow_forward

- The worksheet you have developed will handle most simple variance analysis problems. Try the problem below for Pscheidl, Inc.: Actual production for October was 11,500 units. Compute the direct materials and direct labor variances for Pscheidl, Inc. Be careful when entering your input because this problem presents the information in a different format from the McGrade Industries data. Save the file as PRIMEVAR4. Print the worksheet when done.arrow_forwardSommers Company uses the following rule to determine whether materials usage variances should be investigated: A materials usage variance will be investigated anytime the amount exceeds the lesser of 12,000 or 10% of the standard cost. Reports for the past 5 weeks provided the following information: Required: 1. Using the rule provided, identify the cases that will be investigated. 2. CONCEPTUAL CONNECTION Suppose investigation reveals that the cause of an unfavorable materials usage variance is the use of lower-quality materials than are normally used. Who is responsible? What corrective action would likely be taken? 3. CONCEPTUAL CONNECTION Suppose investigation reveals that the cause of a significant unfavorable materials usage variance is attributable to a new approach to manufacturing that takes less labor time but causes more material waste. Examination of the labor efficiency variance reveals that it is favorable and larger than the unfavorable materials usage variance. Who is responsible? What action should be taken?arrow_forwardCortez Manufacturing, Inc. has the following flexible budget formulas and amounts: Actual results for May for the production and sale of 5,000 units were as follows: Prepare a performance report for May that includes the identification of the favorable and unfavorable variances.arrow_forward

- Using variance analysis and interpretation Last year, Endicott Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Endicotts trial balance?arrow_forwardPerformance Report for Variable Variances Potter Company provided the following information: Required: Prepare a performance report that shows the variances for each variable overhead item (inspection and power).arrow_forwardUsing variance analysis and interpretation Last year, Wrigley Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Wrigleys trial balance?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning