Concept explainers

Comprehensive

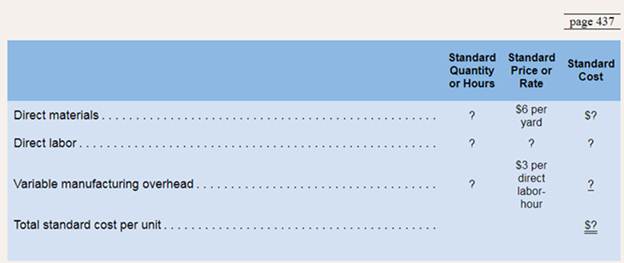

Highland Company produces a lightweight backpack that is popular with college students. Standard variable costs relating to a single backpack are given below:

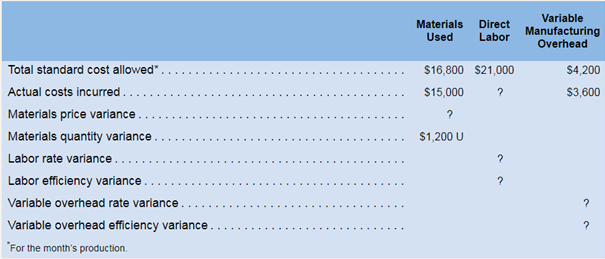

The following additional information is available for March’s production:

Required: (Hint: It may be helpful to complete a general model diagram for direct materials, direct labor, and variable manufacturing overhead before attempting to answer any of the requirements.)

1. What is the

2. What was the actual cost per backpack produced during March?

3. How many yards of material arc required at standard per backpack?

4. What was the materials price variance for March if there were no beginning or ending inventories of materials?

5. What is the standard direct labor rate per hour?

6. What was the labor rate variance for March? The labor efficiency variance?

7. What was the variable overhead rate variance for March? The variable overhead efficiency variance?

8. Prepare a standard cost card for one backpack.

1

Standard cost

It is the budgeted or estimated cost that a company plan to incur in manufacturing goods. This cost is then compared to the actual incurred cost.

To calculate: Standard cost of one backpack.

Answer to Problem 26P

Standard cost of one backpack is$42.

Explanation of Solution

Standard cost of one backpack will be calculated by dividing total standard cost by total number of backpacks.

Total standard cost is

And total 1,000 backpacks are produced by the company in the month of march. So, standard cost for one backpack will be:

Standard cost of a single backpack is $42.

2

Actual cost

This is the amount of money incurred by a company in the production of products.

To calculate: Actual cost incurred for one backpack.

Answer to Problem 26P

Actual cost for one backpack is $41.25.

Explanation of Solution

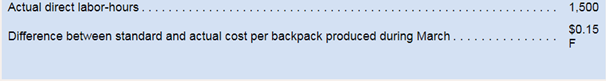

Actual cost per backpack can be calculated by deducting difference between standard and actual cost from the standard cost of one backpack. Here, difference is given as 0.15$ (favorable) and standard cost is $42 (computed in subpart 1). So, the actual cost will be:

So, the actual cost of one backpack is $41.85.

3

Materials

Materials are used by companies to make their final product. Certain processes are performed on the materials and it is then converted into a finished product.

To calculate: Yards of material required by company for each backpack.

Answer to Problem 26P

Company requires 2.8 yards for each backpack.

Explanation of Solution

Number of yards required for standard per backpack can be calculated by dividing standard material cost (per backpack) by standard material cost of one yard.

Here, standard cost of material per yard is given is $6 and standard cost of material for each backpack will be calculated as:

Now, number of yards required by the company will be calculated as:

Therefore, 2.8 yards are required for each backpack.

4

Material price variance

This variance represents the difference between actual cost incurred and standard cost of acquiring materials.

To calculate: Amount of favorable or unfavorable material price variance.

Answer to Problem 26P

Material price variance is

Explanation of Solution

Material price variance will be calculated by the following formula:

Here, material quantity variance is given as $1,200 (U) and total material variance can be calculated as:

So, amount of material price variance will be:

So, material price variance is $3,000 F.

5

Standard labor rate

These are the labor rates calculated by a company using certain standards. Standard labor hours are compared with the actual labor hours used and any difference found is minimized.

To calculate:Amount of per hour standard rate for direct labor rate.

Answer to Problem 26P

Standard labor rate per hour is $15 per direct labor hour.

Explanation of Solution

Standard rate per hour direct labor hours will be calculated by the following formula:

Here, total standard cost of direct labor is given as $21,000 and standard direct labor hours can be calculated as:

Now, calculation for standard direct labor rate per hour will be done as:

Per hour standard rate is $15 per direct labor hour.

6

Labor rate variance

This variance represents the difference between actual value incurred on labors and value that was expected to be incurred.

Labor efficiency variance

This variance represents the difference between actual hours of labor used while producing units and hours that were budgeted to be used. It shows how effectively labor hours are utilized.

To calculate:Amount of labor rate and efficiency variances.

Answer to Problem 26P

Labor rate variance is $750 unfavorable and labor efficiency variance is $1,500 unfavorable.

Explanation of Solution

Formula to calculate labor efficiency variance is

Here, actual labor hours are given as 1,500, standard hours are 1,400 (computed under sub part 5) and standard rate is $15 (computed under sub part 5).

So, the variance will be calculated as:

For calculating labor rate variance, actual direct labor cost and actual direct labor hours are needed to be calculated.

Calculation of actual direct labor cost:

| Particulars | Amount (in $) |

| Total cost of production (41.85 * 1,000) | 41,850 |

| Less: actual material cost | (15,000) |

| Less: actual variable manufacturing overhead cost | (3,600) |

| Actual direct labor cost | 23,250 |

Now, actual labor hours will be calculated as:

Now, labor rate variance will be calculated as:

So, labor rate variance is $750 unfavorable and labor efficiency variance is $1,500 unfavorable.

7

Variable overhead rate variance

This variance shows the difference between the actual amount incurred by a company on certain variable overheads and the amount that was budgeted to be incurred.

Variable overhead efficiency variance

This variance shows the difference between actual overhead production hours and hours that were budgeted using certain standards.

To calculate:Amount of variable overhead rate and efficiency variances.

Answer to Problem 26P

Variable overhead rate variance is $900 favorable and variable overhead efficiency variance is $300 unfavorable.

Explanation of Solution

Calculation of variable overhead rate variance when actual hours are given as 1,500, standard rate is $3 per hour and actual labor cost is $3,600:

Calculation of variable overhead efficiency variance:

So, variable overhead rate variance is $900 favorable and variable overhead efficiency variance is $300 unfavorable.

8

Standard cost card

A standard cost card contains helps in calculating the total standard cost of one unit by showing information about standard rate, price, quantity and hours.

To prepare:A standard cost card showing the total standard cost.

Answer to Problem 26P

Total standard cost per backpack is $42.

Explanation of Solution

Standard cost card will be prepared as follows:

| Particulars | Standard quantity or standard hours | Standard price or standard rate | Standard cost |

| Direct material | 2.8 | $6 | $16.80 |

| Direct labors (calculated below) | 1.4 | $15 | $21 |

| Variable manufacturing overheads for direct labor hours | 1.4 | $3 | $4.2 |

| Total standard cost | $42 |

Calculation of direct labor hours per backpack:

Want to see more full solutions like this?

Chapter 9 Solutions

Introduction To Managerial Accounting

- Use the following information to complete Brief Exercises 10-25 and 10-26: Tico Inc. produces plastic bottles. Each bottle has a standard labor requirement of 0.03 hour. During the month of April, 900,000 bottles were produced using 25,200 labor hours @ 15.00. The standard wage rate is 13.50 per hour. 10-26 Labor Rate and Efficiency Variances Refer to the information above for Tico Inc. on the previous page Required: Calculate the labor rate and efficiency variances using the columnar and formula approaches.arrow_forwardDirect materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardUse the following information to complete Brief Exercises 10-36 and 10-37: Ambient Inc. produces aluminum cans. Each can has a standard labor requirement of 0.03 hour. During the month of May, 500,000 cans were produced using 14,000 labor hours @ 15.00. The standard wage rate is 14.50 per hour. 10-37 Labor Rate and Efficiency Variances Refer to the information for Ambient Inc. above. Required: Calculate the labor rate and efficiency variances using the columnar and formula approaches.arrow_forward

- Calculation of materials and labor variances Fritz Corp. manufactures and sells a single product. The company uses a standard cost system. The standard cost per unit of product follows: The charges to the manufacturing department for November, when 5,000 units were produced, follow: The Purchasing department normally buys about the same quantity as is used in production during a month. In November, 5,500 lb were purchased at a price of $2.90 per pound. Required: Calculate the following from standard costs for the data given, using the formulas on pages 421–422 and 424: Materials quantity variance. Materials purchase price variance (at time of purchase). Labor efficiency variance. Labor rate variance. Give some reasons as to why both the materials quantity variance and labor efficiency variance might be unfavorable.arrow_forwardRefer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forwardControl Limits During the last 6 weeks, the actual costs of labor for Solsana Company were as follows: The standard materials cost for each week was 40,000 with an allowable deviation of 5,000. Required: Plot the actual costs over time against the upper and lower limits. Comment on whether or not there is a need to investigate any of the variances. Use the following information to complete Brief Exercises 10-34 and 10-35: Young Inc. produces plastic bottles. Production of 16-ounce bottles has a standard unit quantity of 0.45 ounce of plastic per bottle. During the month of June, 240,000 bottles were produced using 110,000 ounces of plastic. The actual cost of plastic was 0,042 per ounce, and the standard price was 0,045 per ounce. There is no beginning or ending inventories of plastic.arrow_forward

- Kavallia Company set a standard cost for one item at 328,000; allowable deviation is 14,500. Actual costs for the past six months are as follows: Required: 1. Calculate the variance from standard for each month. Which months should be investigated? 2. What if the company uses a two-part rule for investigating variances? The allowable deviation is the lesser of 4 percent of the standard amount or 14,500. Now which months should be investigated?arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forwardControl Limits During the last 6 weeks, the actual costs of materials for Brennen Company were as follows: The standard materials cost for each week was 60,000 with an allowable deviation of 6,000. Required: Plot the actual costs over time against the upper and lower limits. Comment on whether or not there is a need to investigate any of the variances. Use the following information to complete Brief Exercises 10-23 and 10-24: Krumple Inc. produces aluminum cans. Production of 12-ounce cans has a standard unit quantity of 4.7 ounces of aluminum per can. During the month of April, 450,000 cans were produced using 1,875,000 ounces of aluminum. The actual cost of aluminum was 0.10 per ounce and the standard price was 0.08 per ounce. There are no beginning or ending inventories of aluminum.arrow_forward

- Refer to the data in Problem 9.34. Vet-Pro, Inc., also uses two different types of direct labor in producing the anti-anxiety mixture: mixing and drum-filling labor (the completed product is placed into 50-gallon drums). For each batch of 20,000 gallons of direct materials input, the following standards have been developed for direct labor: The actual direct labor hours used for the output produced in March are also provided: Required: 1. Compute the direct labor mix and yield variances. (Round standard price of yield to four significant digits.) 2. Compute the total direct labor efficiency variance. Show that the total direct labor efficiency variance is equal to the sum of the direct labor mix and yield variances. Vet-Pro, Inc., produces a veterinary grade anti-anxiety mixture for pets with behavioral problems. Two chemical solutions, Aranol and Lendyl, are mixed and heated to produce a chemical that is sold to companies that produce the anti-anxiety pills. The mixture is produced in batches and has the following standards: During March, the following actual production information was provided: Required: 1. Compute the direct materials mix and yield variances. 2. Compute the total direct materials usage variance for Aranol and Lendyl. Show that the total direct materials usage variance is equal to the sum of the direct materials mix and yield variances.arrow_forwardDelano Company uses two types of direct labor for the manufacturing of its products: fabricating and assembly. Delano has developed the following standard mix for direct labor, where output is measured in number of circuit boards. During the second week in April, Delano produced the following results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. 3. Calculate the direct labor yield variance. 4. Calculate the direct labor mix variance.arrow_forwardJameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning