Return to Figure 9.2. Suppose

Suppose a new firm with the same LRAC curve as the incumbent tries to bleak into the market by selling

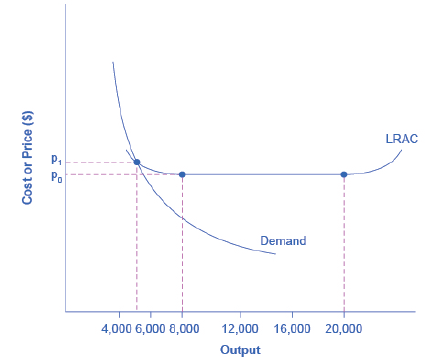

Figure 9.2 Economics of Scale and Natural Monoploy

Trending nowThis is a popular solution!

Chapter 9 Solutions

Principles of Economics 2e

Additional Business Textbook Solutions

Principles of Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Cost Accounting (15th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Managerial Accounting (5th Edition)

Horngren's Accounting (12th Edition)

- Consider a single country and a single good. The demand curve for this good is given by QD = 144 - 4P. Thereare two firms serving the market: Firm A and Firm B, where Firm A has a marginal cost of $20 and Firm B hasa marginal cost of $16. There are no fixed costs incurred by either firm. Assume that these firms compete in Cournot fashion. Part I. How many units of output each firm produces? Show your work. Part II. What is the equilibrium price in the market? Show your work.Part III. How much profit each firm makes? Show your work. Part IV. What is the consumer surplus? Show your work.arrow_forwardReturn to Figure 9.2. Suppose P0 is $10 and P1 is$11. Suppose a new firm with the same LRAC curve asthe incumbent tries to break into the market by selling4,000 units of output. Estimate from the graph what thenew firm’s average cost of producing output would be.If the incumbent continues to produce 6,000 units, howmuch output would the two firms supply to the market?Estimate what would happen to the market price as aresult of the supply of both the incumbent firm andthe new entrant. Approximately how much profit wouldeach firm earn?arrow_forwardA market consists of a dominant firm and a number of fringe firms. The followings are the information about these firms. Total market demand: QALL=300 – (2.5) P The competitive fringe supply function (total): QF=2P-12 The dominant firms marginal cost function: MC = 12 + (1⁄2) QD. a) What is the equilibrium price set by the dominant firm? b) How much will the competitive fringe supply to the market at the price found in question (a)? Show the answers graphically.arrow_forward

- When the number of competing firms is small in a market, is this market necessarily different from a perfectly competitive market in terms of market power and efficiency? Develop your in-depth analysis and argument on the basis of relevant economic theory or models. Also discuss and explain how market power can empirically and practically (from a competition policy point of view) be assessed.arrow_forwardA market consists of a dominant firm and a number of fringe firms. The followings are the information about these firms. Total market demand: QALL=300 – (2.5) P The competitive fringe supply function (total): QF=2P-12 The dominant firms marginal cost function: MC = 12 + (1⁄2) QD. a) What is the equilibrium price set by the dominant firm? b) Calculate the total market demand at the price found in question (a). c) How much will the competitive fringe supply to the market at the price found in question (a)? d) How much will the dominant firm supply to the market at the price found in question (a)? Show the answers graphically.arrow_forwardSuppose that there are two fancy hotels on the online booking platform, say W hotel and Ritz Carlton hotel. Each hotel has the capacity of 20 rooms on the New Year Eve. There are 20 families who are planning to stay at Bay Areas. Suppose that you are the manager and you set the price to maximize the hotel profit. The marginal cost of each hotel room = 500 RMB The largest valuation on the hotel room = 2000 RMB valuation decrease by 100RMS. In total, there are 20 families. Discuss with your peers how many rooms you will offer in the market.arrow_forward

- The following question pertains to dominant firm price leadership. Suppose a dominant firm has determined the price for its industry. Then suppose there is an increase in hte price of a substitute product. How will the dominant firm's price, dominant firm's quality, and the fringe firms' quality be affected?arrow_forwardRod and Todd Flanders have been working jobs in HR that pay $40,000 and $20,000 per year, respectively. They are trying to decide whether to quit their jobs and jointly open a snow cone shack, which they estimate can earn $100,000 per year. According to the Nonstrategic view of bargaining, how will the snow cone shack proceeds be split? Rod and Todd Flanders have been working jobs in HR that pay $40,000 and $20,000 per year, respectively. They are trying to decide whether to quit their jobs and jointly open a snow cone shack, which they estimate can earn $100,000 per year. According to the Nonstrategic view of bargaining, how will the snow cone shack proceeds be split? Rod gets $50,000 and Todd gets $50,000 Rod gets $66,666.67 and Todd gets $33,333.33 they won't quit their jobs. Rod gets $60,000 and Todd gets $40,000arrow_forwardConsider a single country and a single good. The demand curve for this good is given by QD = 144 - 4P. Thereare two firms serving the market: Firm A and Firm B, where Firm A has a marginal cost of $20 and Firm B hasa marginal cost of $16. There are no fixed costs incurred by either firm. Assume that these firms compete in Bertrand fashion. Part V. What is the equilibrium price in the market now? Explain your reasoning. Part VI. How many units of output each firm produces? Show your work. Part VII. How much profit each firm makes now? Show your work. Part VIII. What is the consumer surplus? Show your work. Part IX. Under which competition, Cournot vs. Bertrand, social welfare is higher? Show your work.arrow_forward

- A market consists of a dominant firm and a number of fringe firms. The followings are the information about these firms. Total market demand: QALL=300 – (2.5)P The competitive fringe supply function (total): QF=2P-12 The dominant firms marginal cost function: MC = 12 + (1⁄2)QD. What is the equilibrium price set by the dominant firm? Calculate the total market demand at the price found in question 2(a). How much will the competitive fringe supply to the market at the price found in question 2(a)? How much will the dominant firm supply to the market at the price found in question 2(a)? 5. Show the above answers graphically.arrow_forwardSuppose a firm faces the demand curve P = 100 – Q, while its costs are given by TC = 100 + 10Q, so MC = 10. Find the profit maximizing price and quantity for this firm, if it can only charge one price. Calculate the firm’s profit. Make a diagram, and illustrate consumer surplus, producer surplus, and deadweight loss, if any. Does this analysis suggest any problems with this situation from a public policy standpoint? Does the analysis suggest any unexploited business opportunities? Note:- • Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. • Answer completely. • You will get up vote for sure.arrow_forwardSuppose that there are two types of firms in a perfectly competitive market. Firms of type A have costs given by CA(q) = 30q2 + 10q. Firms of type B have costs given by CB(q) = 50q2 + 10. ( dCA dq = 60q + 10 and dCB dq = 100q). There are 60 firms of type A and 100 firms of type B. Derive the individual firm supply functions for each type of firm and What is the range of prices in which some firms produce but others do not? Are there prices at which no firms produce Why?arrow_forward

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning